Goldman Sachs shares seem to have gotten ahead of themselves, so we took profits. Chris Hondros

We have previously discussed how we like the big banks (See Morgan Stanley (MS) here and here as well as a pair trade idea for Bank of America (BAC) and Wells Fargo (WFC), which was an Editor’s Pick located here). We especially like those with fee income generating segments and large trading desks in this environment due to their ability to generate earnings moving forward.

While assets under management, or AUM, could be volatile due to the markets, the fee income from the advisory business adds a good baseline for those banks with exposure and the trading desks provide the potential to significantly profit off of the volatility in the markets. Yes, it is true that the trading desks do take less risk than they used to, but that is why we like the potential set-up here – rather than risking capital to trade for profit, the Wall Street banks are able to collect a nice little spread on each trade by connecting institutional buyers and sellers. So periods of volatility increase trading (and can also increase the spreads that can be realized), which increases trading revenue as it becomes a volume-based business.

While we have discussed trading the other bank names mentioned earlier, to date we have never before discussed The Goldman Sachs Group, Inc. (NYSE:GS), which fits into our overall thesis on banks with Wall Street exposure via trading desks and advisory services.

We Used To Own Goldman…

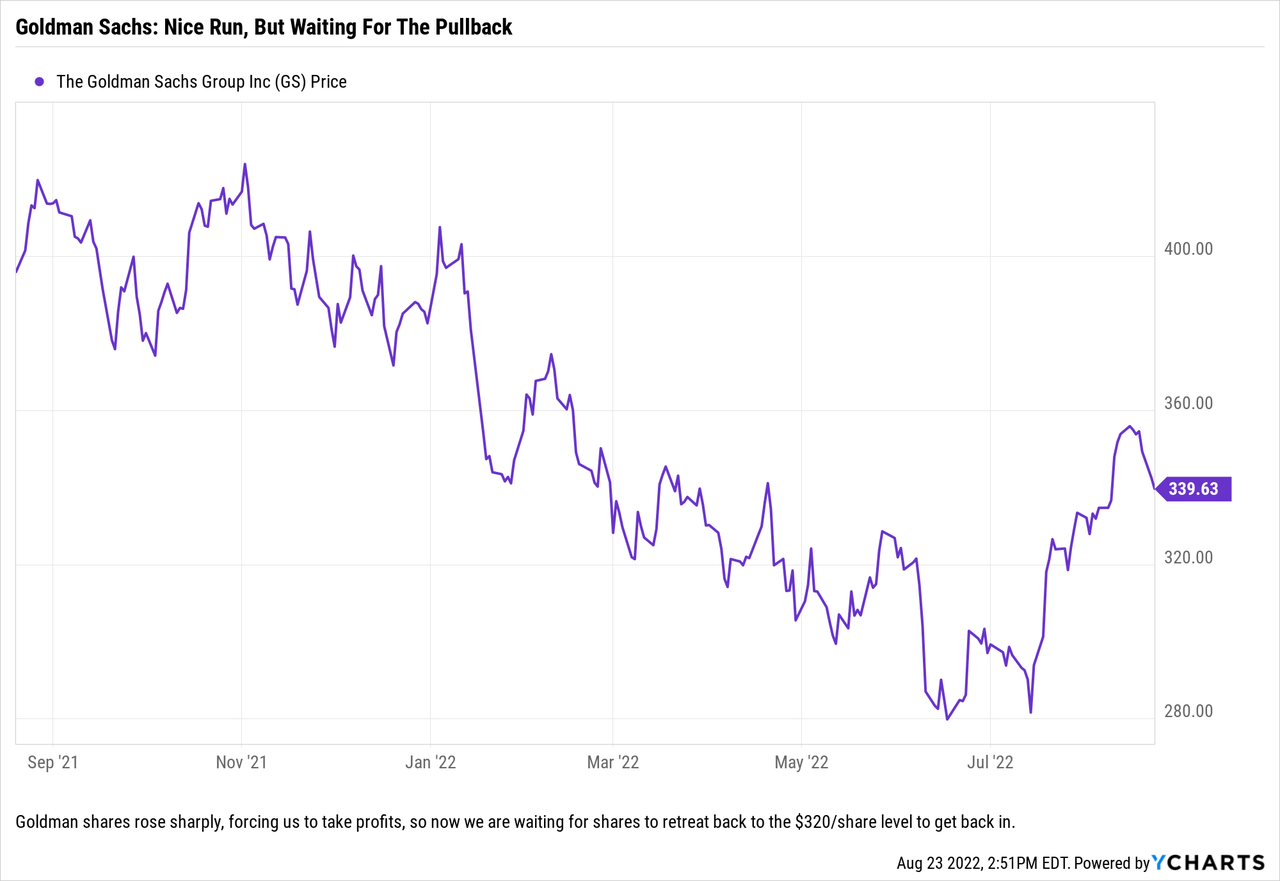

Last week, specifically on Monday, August 15th, we decided to take profits in certain accounts holding Goldman Sachs shares and were able to exit at $356.31/share. Our reason for exiting was that we felt that the market had risen sharply, and our holdings were up over 20% in just a few weeks.

Goldman shares themselves rose from a closing price of $281.59/ share on July 14th to our selling price in the span of a month – which was a 26.54% move higher. We still do not have a handle on what type of bear market we are in, or exactly where the economy stands, so a move that fast requires one to throw the investment plan out the window and embrace trading strategies. We had this position marked as a possible short-term trade from the beginning, although we were prepared to hold for long-term gains, so selling was not a difficult exercise.

We have done the due diligence, so a decent pullback will give us the opportunity to once again get back into the stock – which is another reason we did not mind selling the shares last week…we knew this was going right back on the watchlist for a re-entry trade, which brings us to today, when we saw shares at one point were down 5% from where we sold. We generally do not exit a position for a 5% move, instead, we look for 10-20% pullbacks before getting back in.

And We Would Like To Own It Again…

Since we try to refrain from trading in 5% swings, we think that the trade for our portfolios is to put money to work by being on call. We are not making too much having the funds sit around in cash, so we think that utilizing the cash to write cash secured puts at a predetermined re-entry point could generate some additional cash flows and potential alpha for the portfolios. A 10% pullback, where we get interested in owning shares again, from where we sold shares last week, $356.31/share, would take us to roughly the $320.70/share level.

One of the items we looked at when we sold was the ex-dividend date, which is August 31, 2022, and how that $2.50/share quarterly dividend would impact our thinking. It was not enough to entice us to hold our shares, which was the correct call it now appears, and it is not enough to draw us back into this trade by owning the equity outright. However, after checking the options chains, we think that we have come up with an acceptable trade that replaces the dividend and can help us potentially get back into the shares while avoiding another 5% to the downside.

So What Is The Trade?

We are targeting the September 9, 2022 Puts with a strike price of $320/share that are currently trading at a bid/ask of $2.52/$2.72 per share. This trade should generate $2.62/share before fees, or $262 per contract, using the midpoint between the bid/ask spread. This generates a cash flow about 5% larger than the $2.50/share dividend, and if the shares are put to us will allow us to book around $35.63/share in outperformance on the capital depreciation on Goldman Sachs since the start of our holding period (since we sold at the higher price of $356.31/share). That is active management outperformance which was achieved by following our trading rules and holding firm in selling at a price we had predetermined would be acceptable.

Should the shares not get put to us, we still have the option to repurchase shares if the market has firmed up and/or the economy is looking stronger.

Be the first to comment