Spencer Platt/Getty Images News

Brazilian long steel producer, Gerdau S.A. (NYSE:GGB) is Brazil’s largest steelmaker, and one of the largest in the world. Despite growing profitability over the last decade, the company has underperformed the B3 SA and Russell 3,000. Nevertheless, given inflation, and the risk of weakening demand for steel, Gerdau is well placed to take advantage of weaknesses in other steelmakers, and to thrive under these conditions. With free cash flows trading at a yield of some 29.89%, the company is a very attractive proposition.

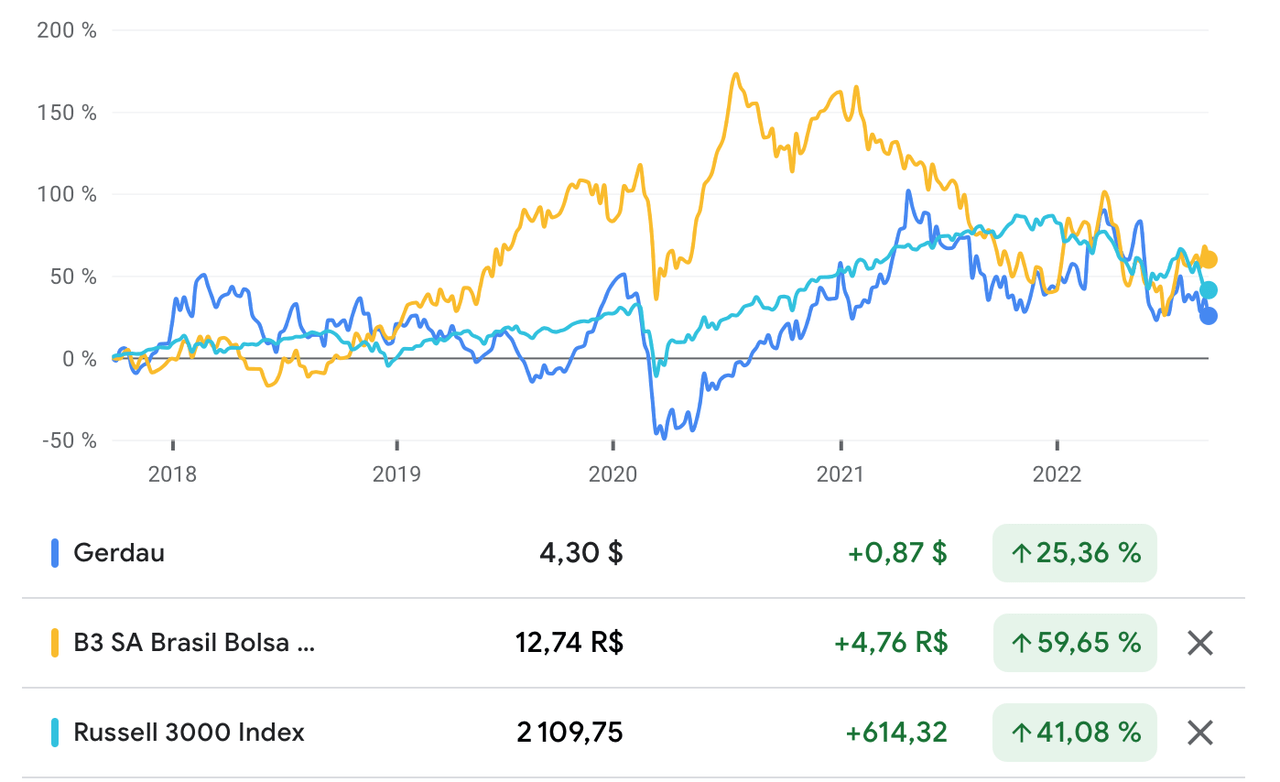

Gerdau is a tale of underperformance. In the last 5-years, the Brazilian steelmaker has gained just 25.36% at the time of writing, compared to 59.65% for the B3 S.A and 41.08% for the Russell 3000.

Google Finance

In the year-to-date, Gerdau is down 10.79%, while the B3 S.A. is up 18.84%, and the Russell 3000 is down 24.78%. While the company’s dividend yield of 12.72% will go a long way toward healing some of the hurt of this year’s performance, that depends largely on how low the company’s share price will go in the last four months of the year. Barring a spectacular last few months of the year, investors are likely to experience pain in holding the company’s stock. However, there is a case to be made that the company will be a long-term stock market winner and that the share price decline has made Gerdau more attractive.

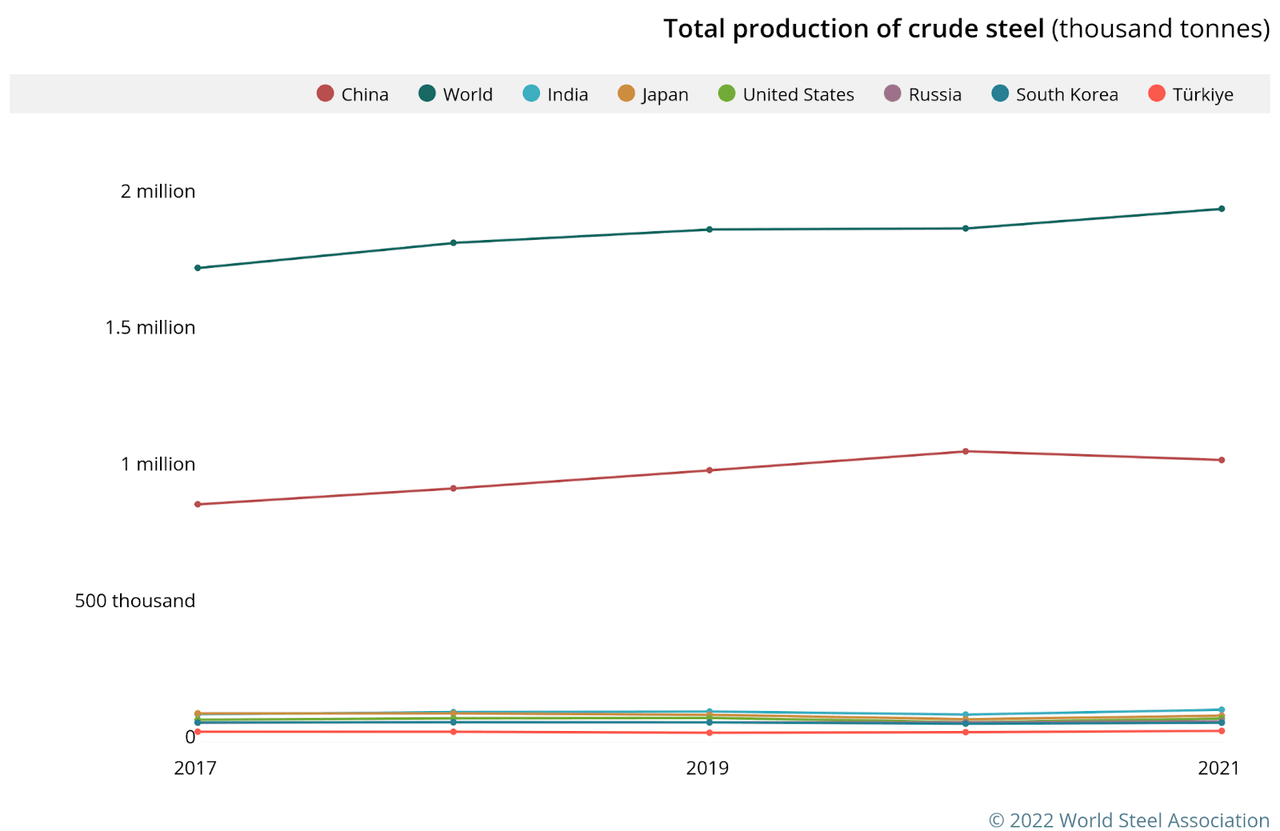

Steel firms should be analyzed as part of the industry, because they are price-takers in a market that follows the Kaldorian cobweb model, in which there is a large time lag between production decisions and price responses. This leads to a highly cyclical industry in which businesses expand production in response to rising prices, often overshooting their estimates of demand, leading to a glut in supply, a popping of the bubble, and an exit of capital until profitability returns to the market. Price volatility and inventory write-downs are common to the business.

In an environment of rising inflation, there is an argument to be made that demand for steel will decline, and this will impact the company’s profitability. Indeed, the World Steel Association forecasts demand will grow by just 0.4% in 2022, rising to 2.2% in 2023. That is a real risk, but it also presents an opportunity: steelmakers will be less inclined to expand production needlessly, out of fear that they will not be able to shift all their products. With greater capital restraint, future returns are likely to be greater. Firms that are not in good financial health will be forced out of the business, because they won’t have the alibi of rising prices to keep on going. So we are likely to see capital exiting, through consolidations and perhaps even bankruptcies. Given the inverse relationship between asset growth and future returns, a decline in output for the industry may not be a bad thing. The decade of growth since 2010 that has helped steelmakers such as Gerdau, has come to an end. The winners will be firms like Gerdau who have found a way to grow profitability in that era.

Gerdau’s Business

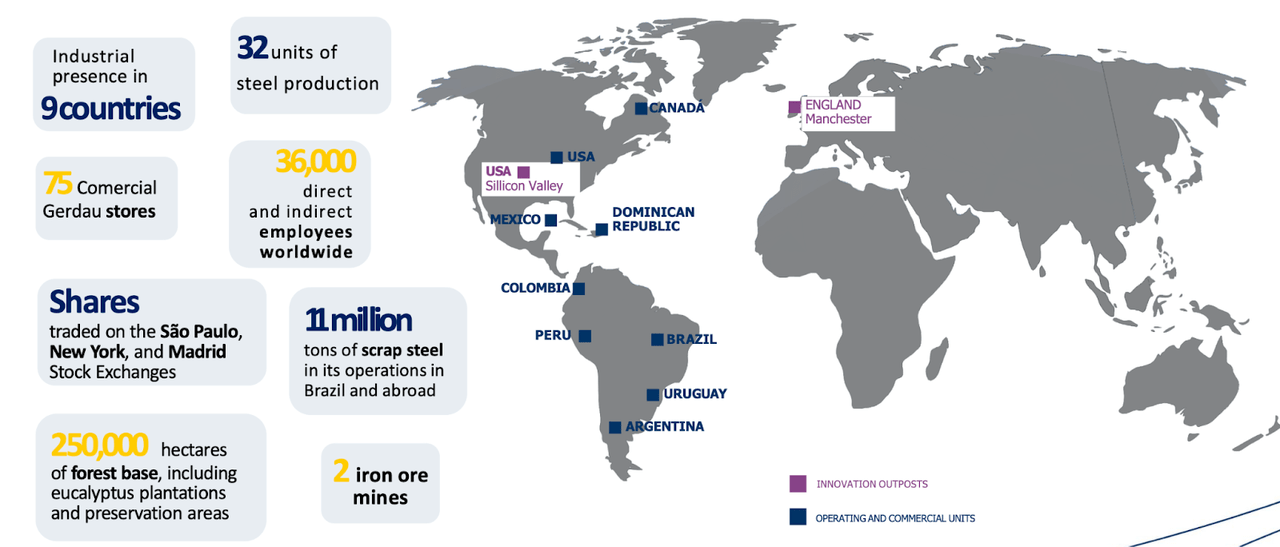

Founded in 1901 by João Gerdau, Gerdau is now the 30th largest steelmaker in the world. The firm has steel mills in Brazil, Argentina, Canada, Colombia, the Dominican Republic, Mexico, Peru, the United States, and Uruguay. The company operates 32 units of steel production, and produces 11 million tons of scrap steel from its Brazilian operations and abroad.

Investor Presentation, September 2022

Gerdau’s Strong, Decade-Long Financial Performance

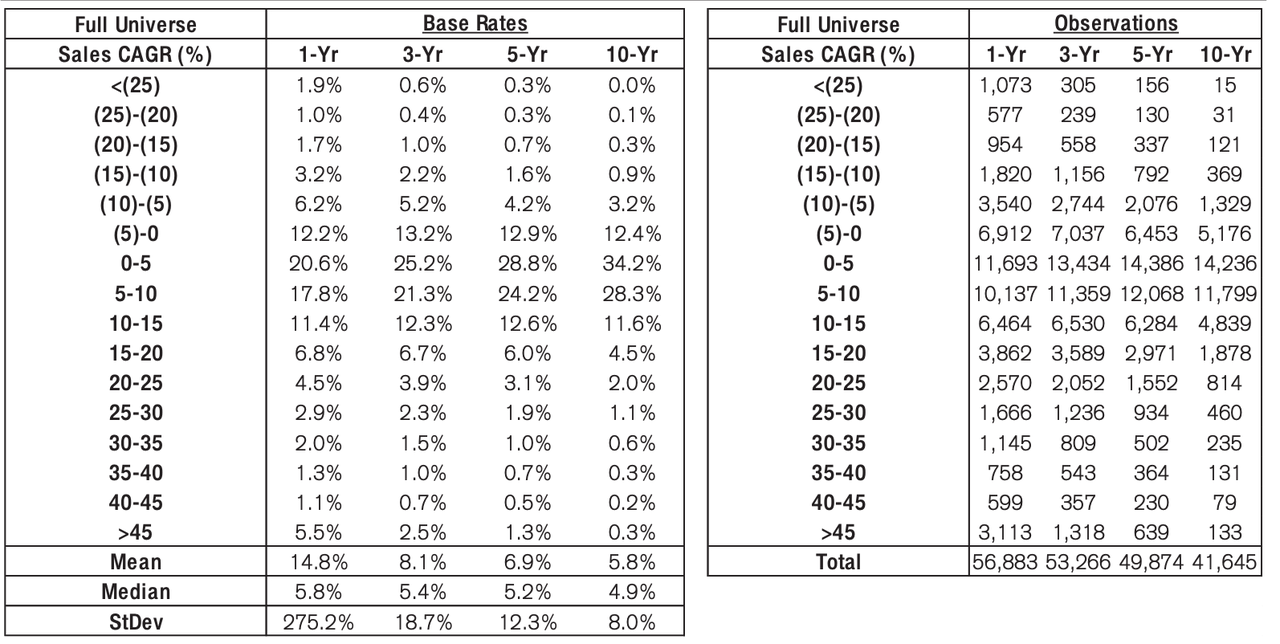

Gerdau’s poor market performance has been despite its profitable growth in the last decade. Gerdau has grown revenues from R$37.98 billion in 2012, to nearly R$78.35 billion in 2021, at a compound annual growth rate (CAGR) of just over 7.5%. (Filing currency is Brazilian real, for example, in the 2021 annual report). According to Credit Suisse’s The Base Rate Book, this puts it in line with the 10-year revenue CAGR of 28.3% of firms.

Credit Suisse

The company’s gross profitability has risen from an anemic 0.089 in 2012, to more than 0.28 in 2021. This is still below the 0.33 threshold that Robert Novy-Marx’s research says indicates an attractive company. Gross profitability for industrial firms tends to be around 0.3.

Operating profit margin has risen from 6.2% in 2012 to 24.5% in 2021. The median operating profit margin for industrials is 9%. Aswath Damodaran’s data shows that the steel industry has an operating profit margin of 13.98%. Gross margins have risen from 12.5% in 2012 to 26.6% in 2021. According to Damodaran’s data, the steel industry has a gross margin of 23.6%.

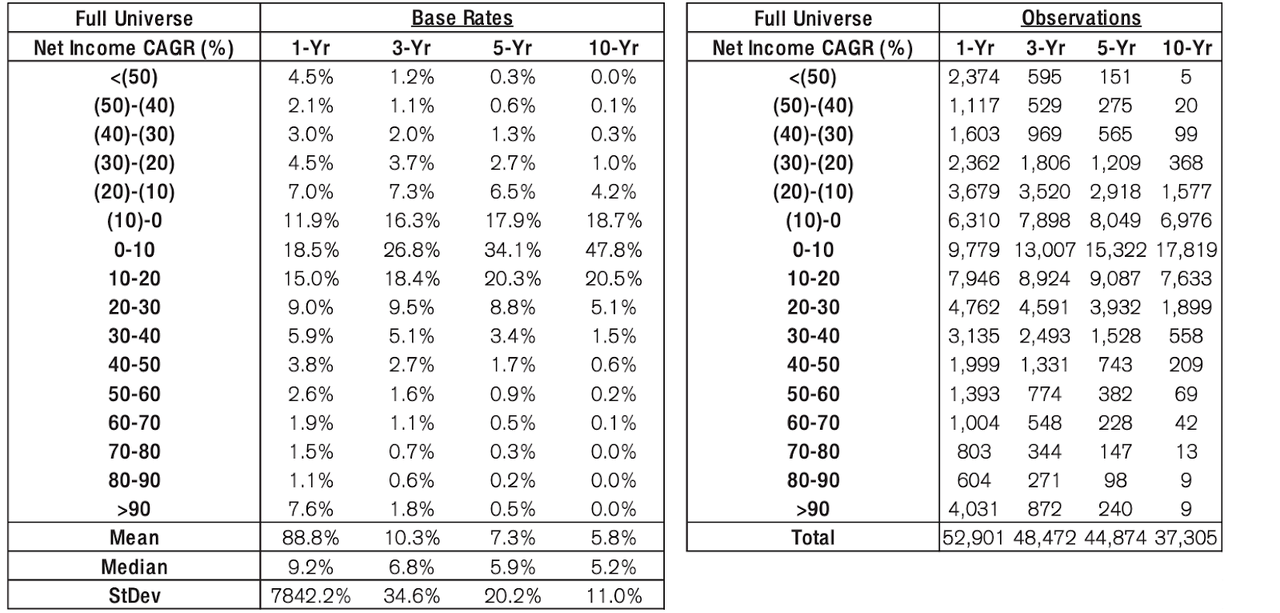

Net income has risen from nearly R$1.43 billion in 2012 to nearly R$15.5 billion in 2021, compounding at 26.95% over that decade. Just 5.1% of firms achieved similar results between 1950 and 2015.

Credit Suisse

Gerdau’s growing profitability is reflected in its return on invested capital (ROIC), which has risen from 5.3% in 2012 to 39.2% in 2021. As the economics of steel has grown to favor the company, it has generated rising amounts of free cash flow (FCF), with FCF growing from nearly R$2.29 billion in 2012, to nearly R$13.64 billion in 2021, at a 10-year FCF CAGR of 19.56%.

Gerdau Could Play a Key Role in the New Era

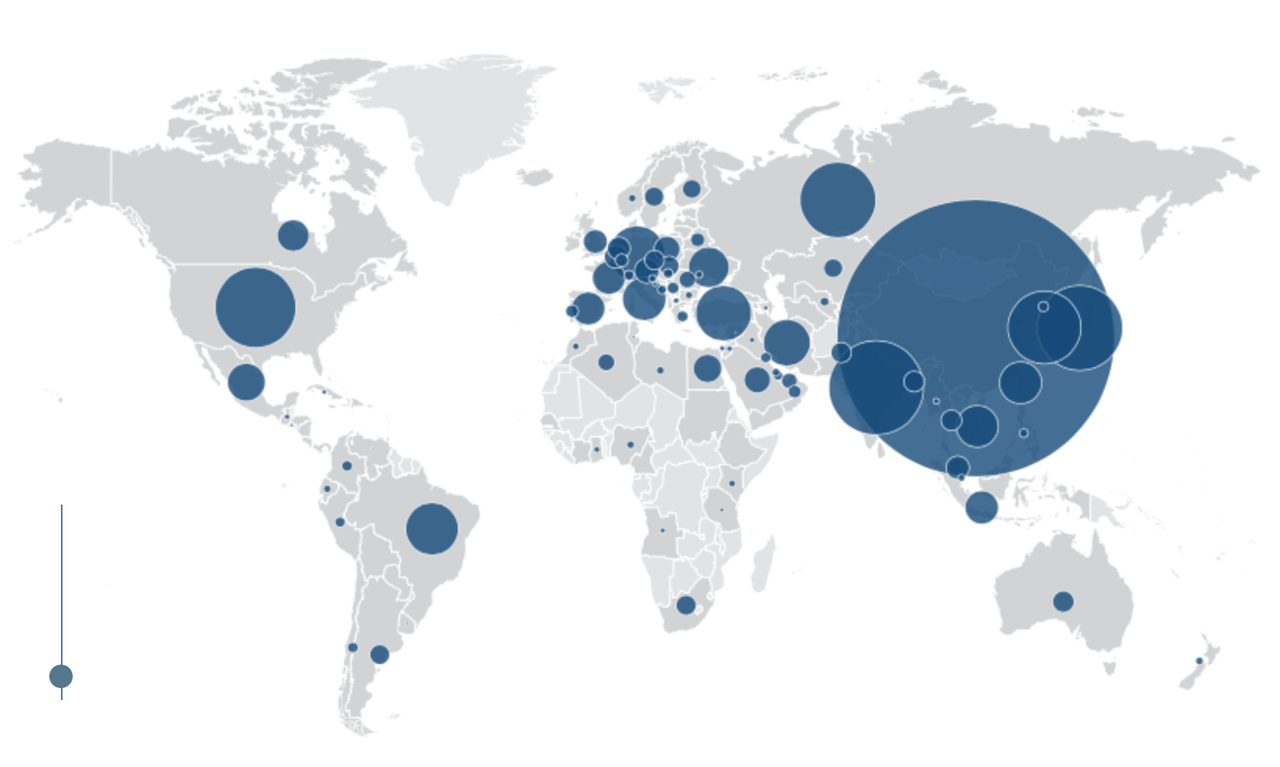

China and India are two of the largest steel producers in the world. While in the past, China was seen as a purely virtuous source of cheap inputs, in the age of looming conflict between the United States and China, relying on Chinese steel comes with a silent risk.

World Steel Association

Investors have too often been caught off guard by broader geopolitical moves. Investors and managers who bet heavily on Russia, are finding that those bets were largely misguided. We have entered an era in which we have to take geopolitical considerations into account when making capital allocation decisions. In Europe, businesses are starting to factor in geopolitical risk as part of their supply due diligence. This is important in the context of the United States’ deteriorating relationship with China, and the rising possibility of a Sino-American War over Taiwan.

As China prepares for war over Taiwan, Admiral Philip S. Davidson, Former Commander, U.S. Indo-Pacific Command has warned that China will invade Taiwan within the next decade. That will dramatically change the supply chains of the United States and the European Union, who will be forced to look within, environmental laws notwithstanding, and to friendly countries, to meet their steel needs.

World Steel Association

Given the dominance of China within the steel industry, the shift in demand to friendlier countries will be very large. Although Canada is the United States’ biggest steel supplier, China is a meaningful trade partner to the United States. As Brazil’s largest steelmaker, Gerdau could be a beneficiary of any reconfiguration of supply chains.

Valuation

With an FCF of R$13.64 billion and an enterprise value of R$45.63 billion, Gerdau has an FCF yield of over 29.89%. Compare this with the FCF yield of the 2,000 largest firms in the United States, which New Constructs calculates as being 1.5%.

Conclusion

Gerdau is one of the world’s largest steelmakers. Operating in a highly volatile business, the company has used the last decade of growth to expand revenues and to fatten profits. The company is well-placed to take advantage of any opportunities that will arise as a result of a global slowdown. In addition, the silent risk of a Sino-American War will make it a valuable supplier if supply chains have to be realigned. The company’s FCF is trading at a very attractive yield.

Be the first to comment