gustavofrazao/iStock via Getty Images

Investment Thesis

Investing in financially distressed stocks is like investing in call options. The worst case of both is you lose all your money, option premiums or investment principal you paid. When a financially distressed company goes bankrupt, its equity investors comprise the thinnest and lowest-level floor in the capital structure, so they will have nothing to gain. However, as with options, you can expect large returns due to the leverage effect if a company performs better than expected, and the greater the volatility, the better.

I am confident that GEO Group (NYSE:GEO) has a significant upside potential. First, the company has a strong position in a larger criminal justice market, an alternative prison industry, while its legacy prison business has become stable after a political shock. Second, its competitive advantages such as a high barrier to entry, leading market position, and business qualities that contribute to incremental return on capital will enable it to capture the growth opportunities. Last, although its financial condition, which had adversely affected its share price, has improved, the share price remains still low, providing an attractive investment opportunity.

Business Analysis

Growth: Opportunities in a larger criminal justice market

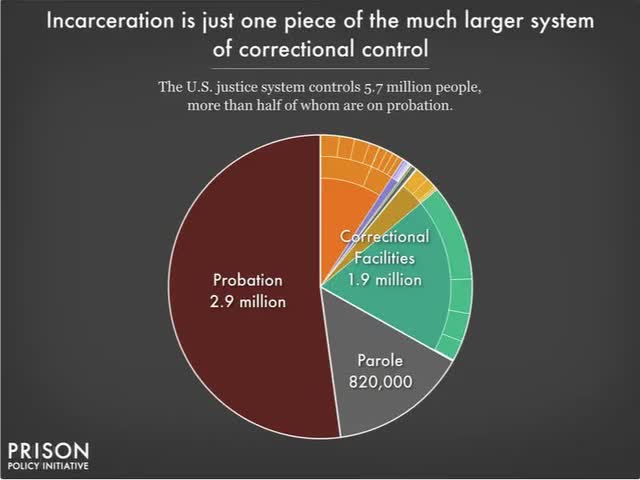

Incarceration is just one piece of the much larger system of correctional control (prisonpolicy)

The company’s primary businesses are prisons and community corrections. Although, the private prison industry faces challenges like decreasing population of inmates, the prospects for community corrections, are much brighter.

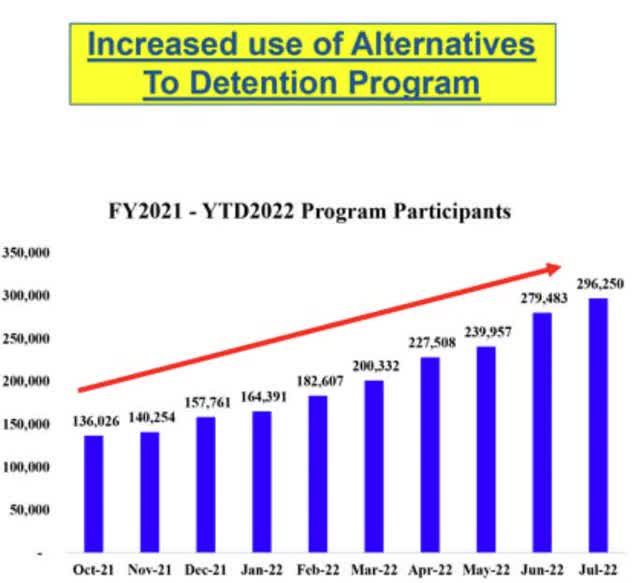

First, it is a larger system than prisons. The number of people managed by probation and parole is about 2 times bigger than that of prisons. Second, it is expected to increase further. The U.S. is well known for mass incarceration. So, to fix it, the country is trying hard to decrease the prison population and it has trended downward since 2010. Therefore, as an alternative to the prison, community corrections are being widely used. Electronic monitoring, one of the company’s main businesses, is one of the means to represent a new form of prison. It is being used to manage not only criminals but also immigrants on the southern border, so the company has a solid foothold for growth.

I strongly believe that the company is in a great position in the alternative prison market, and it can seize future growth opportunities.

Private Prison: Challenging but manageable

Although the prison industry is on a downward trajectory, its problem can be dealt with, and opportunities still exist. The company’s prison business serves the federal and state governments. The federal government is working hard to reduce the number of inmates, and its demand for prisons has declined significantly. In addition, President Biden’s executive order made it difficult for the company to extend its contract with the federal government agencies, and the market took it very seriously, which caused a huge negative impact on its stock price.

On the other hand, the state governments face a different situation. The company provides managed-only services to the state government. Occupancy rates of the managed-only service remain high according to the company’s supplemental disclosure.

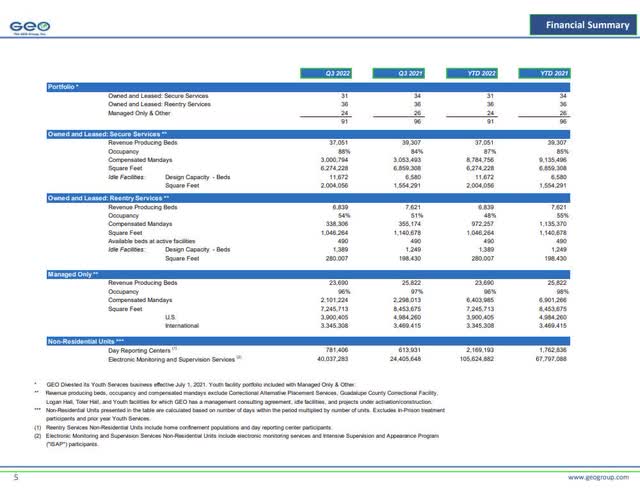

Managed only occupancy rates remain high compared to owned and leased (GEO 3Q22 Supplemental Disclosure)

As shown in the figure, the occupancy rate of managed only service is in the high 90% range, but that of owned and leased service is in the mid 80% range. This clearly shows that the state and federal governments have different demands for the company’s service.

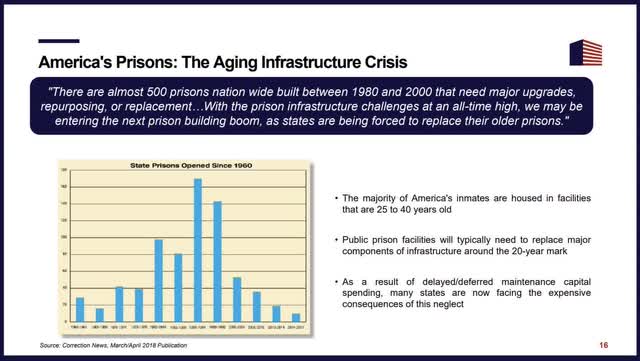

America’s Prisons: The Aging Infrastructure Crisis (CoreCivic)

In addition, according to CoreCivic (CXW), another publicly traded private prison company, there is a high demand for reconstruction of aging prisons for the state governments. This is because the existing prisons are aging and quite old-fashioned in terms of hygiene, security, and space. The demand to replace older prisons will help fill the void the federal government has made.

The industry is difficult or reluctant to enter

Since the early 1980s, when the demand for private prisons exploded, GEO and CXW have maintained a dominant position in the industry. This trend will continue in the future. Because the reputation risk of operating facilities like prisons is too great for a strong competitor to enter the industry. Furthermore, it will be difficult to keep up with the long track records of these two dominant companies because the prison industry requires special operating know-how and skills.

Business qualities that are expected to improve ROIC

The company has rapidly adapted to the changing environment in the prison industry. It offers through its wholly owned subsidiary, BI Incorporated, electronic monitoring technologies which help supervise parolees, probationers, pretrial defendants, and individuals involved in the immigration process. The company has other alternative prison businesses besides electronic monitoring, but I want to focus on electronic monitoring because it has a distinct characteristic.

First, it is not a real estate-based business. Real estate businesses show high capital intensity, making it difficult to generate free cash flows. On the other hand, a key component of electronic monitoring is GPS tracking units, so it does not require a large amount of capital investment as much as real estate businesses.

Furthermore, it can deliver a great unit economics and a high profitability. While the operating margin of the secure services, which operate private prisons, has been around 20% from 2017 to the third quarter of 2022, GEO Care segment, which includes electronic monitoring, has shown excellent profitability from the mid-20% to the mid-30% for the same period. The higher profitability results from the fact that it is mostly funded by the people subjected to it. According to Worth Rises, the costs include setup fees of up to $200, and daily monitoring fees that can reach $40. If a device is damaged, the wearer can be charged as much as $1,200 to replace the device. If they fail to pay, they may end up in a situation where there is no choice but to go back to jail.

On the immigration system side, detained immigrants can often be freed while awaiting their deportation proceedings, which typically last more than two years. During the time, they wear an electronic monitor. The costs include $460 activation fee, $50 device deliver fee, and $420 in monthly device lease charges. If they fail to pay, they may end up with deportation.

According to the 2021 annual report, the company monitors approximately 260,000 individuals through its monitoring technology. Net operating income for three quarters of 2022 is about $184 million, up 64% from the same period of 2021. I strongly believe that this trend will continue.

Stronger balance sheets

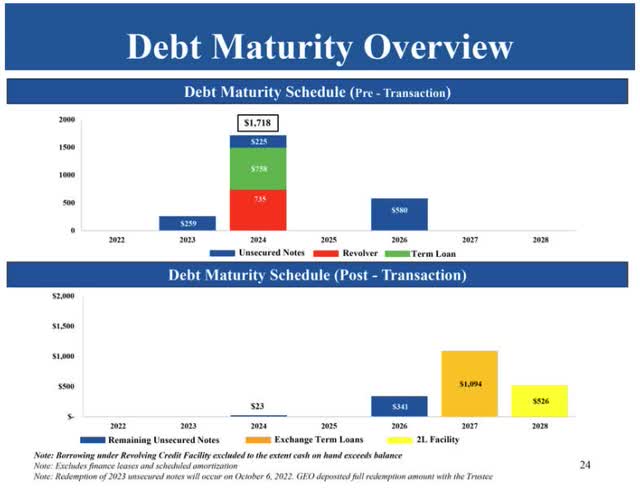

The company announced that it had completed transactions to address substantial majority of debt maturities. Although it is still excessive compared to cash flows, a significant debt reduction is positive. The company’s total borrowings decreased from about 2,900 million at the end of 2021 to about 2,000 million as of now. The debt amount of about 1,800 million which was expected to be matured in 2024 was successfully refinanced and the refinanced debt maturities are spread to 26, 27, and 28 years.

Debt Maturity (before & after transaction) (Investor presentation)

Newly issued debt interest rates were set in the 8-9% range. Given the recent spike in interest rates, I don’t think they are outrageously high. The company’s ability to address refinanced debt maturity is still robust. Its cash flow comes from the U.S. federal and state governments, which have the highest credit profiles. And the company’s business is a mission-critical business, so even when the US government shut down, the operation never stopped. In addition, contractual provisions such as minimum payment and ability to obtain additional funding to provide wage increases for its employees from government agencies make it protected from inflationary economic environment.

Valuation

The GEO Care segment, which operates electronic monitoring and other alternative prisons, will be the key to company’s value creation. Its business characteristics include ample growth opportunities, a higher profitability, and a low capital intensity.

My key valuation assumptions are as follows: First, U.S. Secure Services will grow at 2.0% to 1.0% to reflect the decline in the industry. On the other hand, I expect GEO Care to grow at 15.0% to 5.0%, considering that it can secure demand as a substitute for prison, and a complement to the immigrant processing.

Second, Operating margins of U.S. Secure Services are expected to maintain a historical margin of 20%. As a mission-critical business, it is likely to be stable. GEO Care is expected to show an operating profitability of around 33%.

Third, the company’s capex burden is expected to decrease as it shifts from a real estate-oriented business to a tech equipment-oriented business. Accordingly, the capital turnover ratio will rise from 0.5x to 1x.

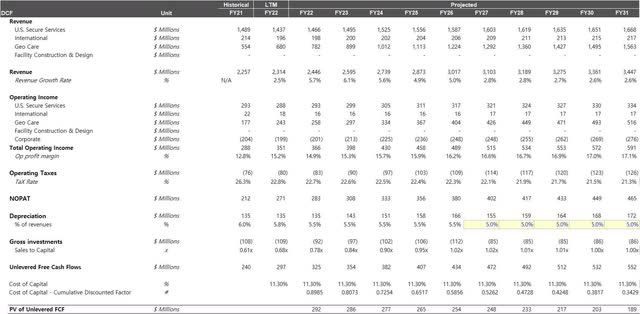

Lastly, the discount rate obtained using the CAPM model is about 11.0%, reflecting the interest rate on the recently refinanced borrowings. Using these assumptions, I estimate the company’s future free cash flows as shown below.

GEO 10 year cash flow forecast (Created by the author)

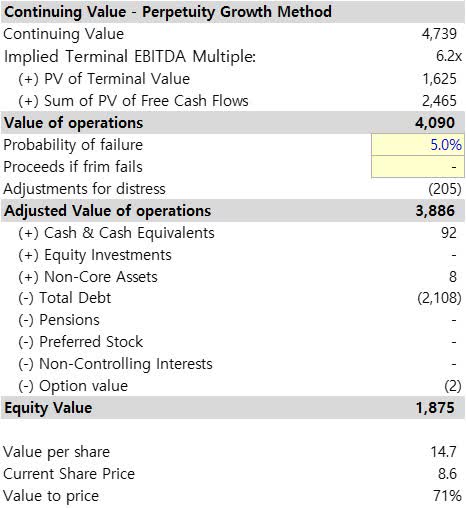

My valuation indicates that the company’s terminal EV/EBITDA multiple at about 6.2x. The calculated value per share is about $14 after considering terminal growth rates of 2.0% and probability of failure of 5.0%. It implies that the current share price is still undervalued and there is about 70% upside potential.

Value per share (Created by the author)

Risks

It is difficult to predict, but I think the political risk has been reduced. Most of the businesses affected by the Biden administration’s presidential executive order were stabilized. BOP, the Federal Bureau of Prisons, was one of the big customers, but now it has no relations with the company. Nevertheless, the company’s financial performance is improving.

ICE, Immigration and Customs Enforcement, is a big customer, and it is also a government agency. But I don’t think there will be a big political risk here because its dependence on private companies is more than that of private prisons.

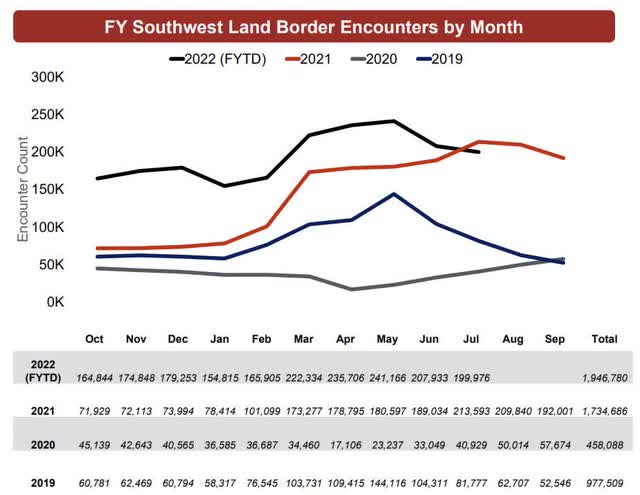

Southwest Land Border Encounters by Month (CXW Second Quarter 2022 Investor Presentation)

As you can see, the number of encounters on the southwest border is hitting 21-year highs and remains elevated. Moreover, as the pandemic is now almost over, it appears that Title 42, which restricts movement on the southern border, is soon to be repealed.

Growing Dependence on private prison companies (GEO Investor Presentation)

As a result of increased activities on the southern border, the agency is increasingly dependent on the company to deal with immigrants. So, I see less political risks here as opposed to prisons.

Conclusions

The operational and financial conditions of the company have improved compared to when I authored the article in April 2021. Despite this, the stock is still underperforming compared to its upside potential. I am still expecting a higher upside and maintained strong buy recommendation.

Be the first to comment