Aleksandr Potashev/iStock via Getty Images

One niche automotive supplier that many investors aren’t aware of but likely have a product of, is Gentex Corporation (NASDAQ:GNTX). This firm, which focuses on producing and selling digital vision, connected car, dimmable glass, as well as fire protection products, is an intriguing enterprise that, prior to the pandemic, generally had posted positive and improving performance year after year. The pandemic hurt the company, but sales have started to rebound. Having said that, and despite a favorable start to the 2021 fiscal year, performance most recently has been a bit mixed. As a result of this weakness, shares of the company have suffered some. But for the entirety of the company’s 2022 fiscal year, management has high expectations.

This comes in spite of weak performance in the most recent quarter for which data is available and it comes leading up to the first quarter of the company’s 2022 fiscal year, a quarter in which analysts anticipate that weakness to continue. Should management be right, and the company performs well, this could result in a nice bit of upside before too long. While if analysts are correct, and if management has to reduce expectations as a result, some downside could be warranted. This pivotal moment could make all the difference between strong returns and poor returns for investors who decide to own the company during this time. So because of that, investors should keep a careful eye on what the current expectations are and the degree to which management can deliver.

Gentex’s recent performance has been weak

The last time I wrote an article about Gentex was in November of last year. At that time, I mentioned that the company was a quality operator in its space. Generally speaking, I liked the firm, but I also mentioned that shares were just too pricey to make sense to me. At the end of the day, this led me to rate the company a ‘hold’ prospect, but it seems as though I was being a bit generous here. Following the publication of the article, shares generated a loss for investors of 25.5%. That compares to the 6.7% loss achieved by the S&P 500 over the same window of time.

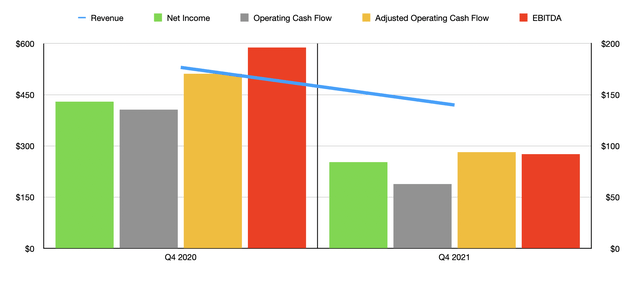

Author – SEC EDGAR Data

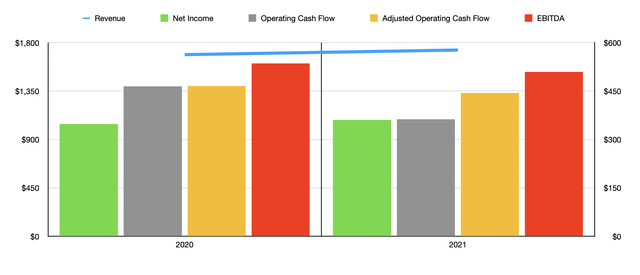

The good news that I can rely on is that this performance was rather unexpected. You see, at that time, performance for the company had been generally impressive for the year. Although the performance the company achieved in the third quarter that year was weaker year-over-year compared to what the business generated in 2020, overall performance was encouraging for the first nine months of the 2021 fiscal year. As an example, revenue during that timeframe was up 13.2% year-over-year, while net income was up 35.5%. Unfortunately, the weakness experienced in the third quarter that year extended into the final quarter. Revenue came in at $419.8 million. That compared to the $529.9 million generated one year earlier, for a year-over-year drop of 20.8%. Much of this weakness came as a result of an 18% decline in auto-dimming mirror units sold year over year. The greatest weakness was in the interior mirror market, which saw a decline year over year of 25%. Even so, total revenue for the year came in at $1.73 billion. That was up 2.5% compared to the $1.69 billion generated in 2020.

Author – SEC EDGAR Data

When it came to profitability, the picture for Gentex also suffered. In the final quarter of the year, net income totaled $84.2 million. That compared to the $143.3 million generated just one year earlier. Operating cash flow dropped from $135.5 million to $62.8 million, while the adjusted equivalent (operating cash flow but without the changes in working capital) plunged from $170.5 million to $93.8 million. Meanwhile, EBITDA for the company also declined, dropping from $196.2 million to $91.9 million. Even though the company did experience weakness to end out the year, total performance for 2021 was mixed. Net profits of $360.8 million beat out the $347.6 million generated in 2020. B operating cash flow did fall, declining from $464.5 million to $362.2 million, while the adjusted equivalent declined from $465.4 million to $444.3 million. And EBITDA for the company dropped from $535.1 million to $508.9 million.

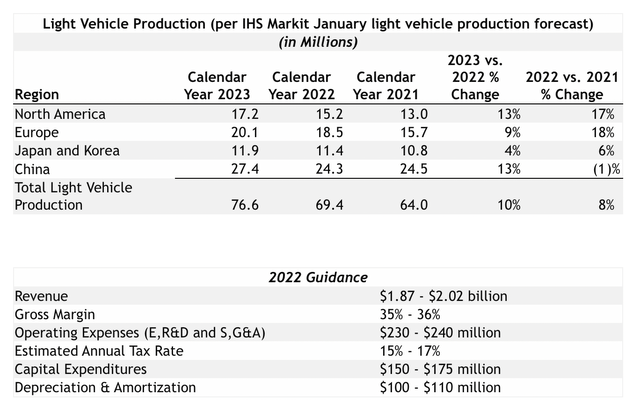

Despite these bleak results, management remains hopeful for the 2022 fiscal year. They anticipate light vehicle production across North America, Europe, Japan, Korea, and China, to total 69.4 million in 2022. That would represent an 8.4% increase over the 64 million generated in 2021. And in 2023, management anticipates light vehicle production climbing a further 10.4% to 76.6 million. As a result of this, the company anticipates revenue for 2022 of between $1.87 billion and $2.02 billion. They also see revenue growing a further 15% to 20% in 2023. No guidance was given when it came to profitability. But the firm did give guidance on gross margin, operating expenses, taxes, and more. Using these, we get a rough approximation for net income of $401 million. If we assume that other profitability metrics will grow at the same rate, we should anticipate adjusted operating cash flow of about $493.8 million and EBITDA of around $565.6 million.

Gentex

It will be interesting to see how things play out for the first quarter of the company’s 2022 fiscal year. On April 22nd, before the market opens, management is due to report data for that time frame. The current expectation is for revenue of $435.3 million. That compares to the $483.7 million generated one year earlier. Earnings per share, meanwhile, should be around $0.33 if analysts are correct. That would translate to net income of $78 million. That stacks up against the $113.5 million the company reported for the first quarter of its 2021 fiscal year.

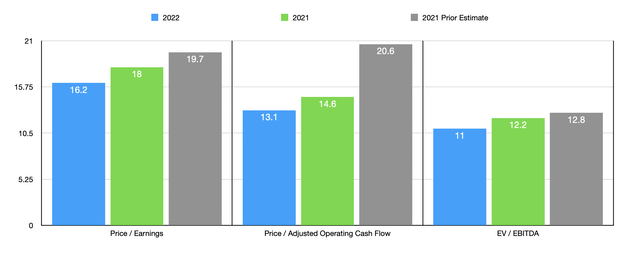

Author – SEC EDGAR Data

In the event that analysts are correct and the company sees a worsening in its financial condition, it is possible management might have to revise their expectations lower for the year. But then again, it’s also possible that a single quarter of pain will not sink the year entirely. In the event that management reiterates performance, and especially if data comes in stronger than what analysts anticipate, investors could be due for some nice upside. I say this because, using the company’s 2021 results, shares don’t look all that bad. At present, the price to earnings multiple of the company stands at 18. This compares to the 19.7 I calculated when I last wrote about the firm. The price to adjusted operating cash flow multiple is 14.6. That compares to the 20.6 I previously calculated. And the EV to EBITDA multiple of the company should be 12.2. That’s down from the 12.8 I calculated in my last article. In the event that management achieves its guidance for the 2022 fiscal year, then these multiples would be 16.2, 13.1, and 11, respectively.

To put the pricing of the company into perspective, I decided to compare it to five similar firms. On a price-to-earnings basis, these companies ranged from a low of 9.3 to a high of 66. On a price to operating cash flow basis, the range was from 6.5 to 127.4. In both of these cases, Gentex was cheaper than all but two of the companies. Meanwhile, using the EV to EBITDA approach, the range was from 5.2 to 15.2. In this scenario, three of the five companies were cheaper than our prospect.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| Gentex Corporation | 18.0 | 14.6 | 12.2 |

| Standard Motor Products (SMP) | 10.6 | 11.3 | 6.5 |

| Tenneco (TEN) | 43.1 | 6.5 | 5.2 |

| LCI Industries (LCII) | 9.3 | 127.4 | 7.6 |

| Visteon (VC) | 66.0 | 46.5 | 13.3 |

| Dorman Products (DORM) | 22.9 | 30.0 | 15.2 |

Takeaway

All things considered, recent results for Gentex have been painful. However, management has high hopes for the near future and shares don’t look all that bad from a pricing perspective. Relative to peers, the stock seems to be more or less fairly valued. And on an absolute basis, I would say that they tilt in the direction of being underpriced only marginally. This is far from being a home run. But given the decline in share price and the higher expectations moving forward, I cannot help but think that this may now be a decent ‘buy’ prospect to consider. Of course, this could change in a few days when management reports financial results for the latest quarter, as well as discusses any guidance updates. But for investors who believe in management’s ability to deliver, now might be a good time to consider buying in if you are already drawn to the company in that manner.

Be the first to comment