Eugene Gologursky/Getty Images Entertainment

Introduction

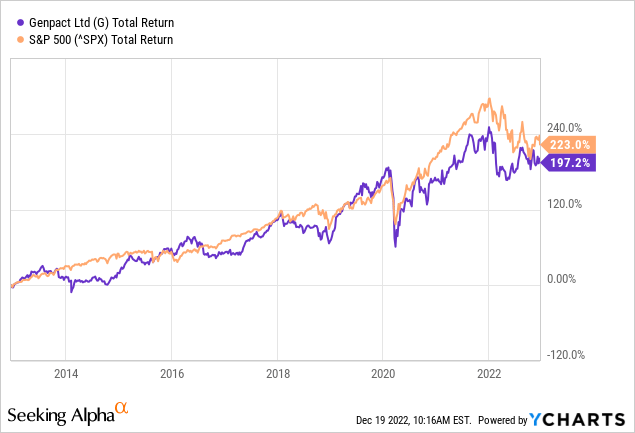

Genpact (NYSE:G) has achieved fantastic returns over the past 10 years, as it manages to keep up well with the S&P500. Annual returns over 10 years have averaged 11.5%. The company is based in Bermuda, so investors should note that they are indirectly buying shares in the company through the holding structure in Bermuda.

Genpact provides business process outsourcing and IT services in India, Asia, the Americas and Europe. Overall, the company offers CFO advisory services, ESG services and reporting, financial and accounting services, supply chain advisory services and IT services.

The company operates in three business segments:

- Banking, Capital Markets and Insurance

- Consumer Goods, Retail, Life Sciences and Healthcare

- High Tech, Manufacturing and Services

In 2020, General Electric (GE) is their largest customer, which generated about 12% of total revenue. Furthermore, the company serves about 1/4th of the Fortune Global 500 companies, including Aon (AON), AstraZeneca (AZN), AXA (OTCQX:AXAHY), Bayer (OTCPK:BAYZF), Dentsu (OTCPK:DNTUF), Heineken (OTCQX:HEINY), Hitachi (OTCPK:HTHIY) and others.

The large and strong customer base makes Genpact a strong player in business process outsourcing and IT services.

Revenue And Earnings Grew Strongly

Results for the third quarter of 2022 were strong, with the company’s revenues up 9% year-on-year, which were driven primarily by continued growth in cloud-based data and analytics solutions for supply chain processes, sales and trading, and risk services. The financial services business segment grew strongly with 18% revenue growth, largely due to continued strong demand for risk management services. Consumer and healthcare grew 6%, due to strong growth in Data-Tech-AI, sales and commerce and supply chain engagements. The High Tech, Manufacturing and Services business segment grew 16%, driven by sales and commercial, supply chain and financial solutions.

Cash flow from operating activities was 8% higher than the same period last year, mainly due to higher adjusted operating income. The balance sheet looks solid, as nearly 80% of total debt is fixed income. With the Fed aiming to raise interest rates to 5%, Genpact should continue to perform strongly.

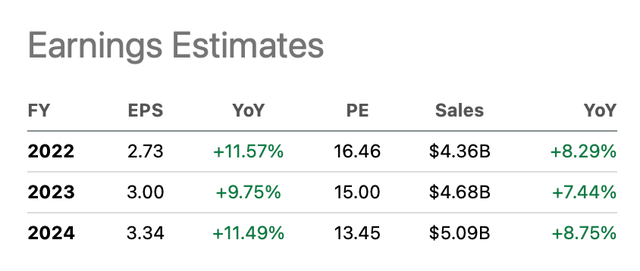

Looking ahead, the company expects full-year sales to increase 7.5% to 8.5% over last year. The strong dollar has a major impact on earnings. At constant currency, the company expects sales to increase between 10% and 11%. Margins on operating income are expected to be near the upper end of the company’s previous forecast of 16% to 16.5%. Adjusted earnings per share is expected to be between $2.69 and $2.74 (compared with the company’s previous forecast of $2.68 to $2.74).

Growing Dividends And Share Repurchases

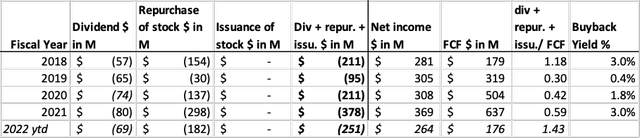

The company increased its dividend by an average of 12.7% per year over the past 3 years. The dividend rate is $0.50, representing a dividend yield of 1.1%.

In addition to dividend distribution, the company also repurchases shares. In 2021, the company repurchased $298 million worth of shares, representing a 3% buyback yield. Repurchasing shares will increase the dividend per share, but it should also increase the stock price as demand increases while supply decreases. Share repurchases have caused the share price to rise sharply in recent years.

Dividend payments plus share repurchases do not comprise more than 60% of free cash flow in 2021. To date, this ratio is much higher due to their negative free cash flow in the first quarter of the year. The free cash flow margin of 16% provides plenty of cash to return to investors or to grow the business.

Genpact’s cash flow highlights (SEC and author’s own calculation)

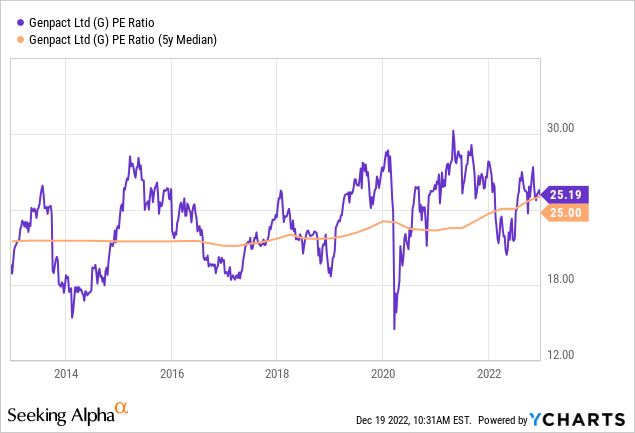

Valuation In Line With 5-Year Average

The PE ratio is a common metric to gain insight in the stock’s valuation. Earnings per share should increase as the company repurchases shares, making the PE ratio favorable after share repurchases. Currently, the GAAP PE ratio is 25.2, which is slightly higher than the S&P500’s PE ratio of 21, but in line with the company’s historical average.

Earnings estimates are strong, as 7 analysts on the Seeking Alpha Genpact ticker page have revised earnings upward. Revenue is expected to increase 8% year over year and earnings per share by 10% year over year. One caveat is that earnings per share here are non-GAAP, while the chart above is based on GAAP earnings. Nevertheless, the company is growing strongly and its valuation is in line with its historical average. That makes the stock worth buying.

Genpact’s earnings estimates (Seeking Alpha Genpact ticker page)

Conclusion

Genpact is a strong growth player, as the company has strongly increased revenue and earnings per share in recent years. Their strong growth has resulted in a total return nearly equal to that of the S&P500. In 2020, General Electric was their largest customer, accounting for about 12% of total sales. Genpact has a large customer base, as the company serves about 1/4th of the Fortune Global 500 companies. Notable clients include Aon, AstraZeneca, AXA, and others. The strong customer base makes Genpact a leading company in business process outsourcing and IT services.

Third-quarter results were strong, with revenues up 9% year-on-year, driven primarily by strong growth in the financial services segment. Operating cash flow was 8% higher than in the same period last year. The balance sheet looks solid, as almost 80% of total debt is fixed income. Full-year revenue is expected to be 7.5% to 8.5% higher than last year, and earnings per share will be between $2.69 and $2.74.

The company repurchases shares and increases its dividend per share. The dividend per share has increased an average of 13% per year in recent years. The share valuation is in line with the historical average. The high free cash flow margin, growing revenue and earnings per share and dividend, and favorable valuation make this stock worth buying.

Be the first to comment