teekid/E+ via Getty Images

Shares of Genmab (GMAB) rallied nearly 40% since my late June article, making the stock less attractive considering the lack of significant changes to the long-term outlook, but the company did make steady progress and still looks well-positioned for long-term growth.

Darzalex continues to impress and Genmab raised the full-year net sales guidance as a result, and the FDA accepted the BLA submission for epcoritamab and the submission was also granted Priority Review, which both speeds up the potential market arrival and increases the probability of approval.

Genmab’s partners made progress as well with the approval of J&J’s (JNJ) Tecvayli (teclistamab) adding another source of royalties going forward.

Darzalex’s outperformance prompts increased full-year revenue guidance

Global net sales of Darzalex grew 30% Y/Y to $2.05 billion in the third quarter, driven by increased market share and strong uptake of the subcutaneous version of the product (Darzalex Faspro). This resulted in strong royalty revenue growth, but I should note that the reported numbers overstate the growth rates due to the strength of the U.S. dollar as Genmab reports results in Danish Krone.

Total revenue and royalty revenue grew 77% and 65% Y/Y in local currency in the third quarter and 50% and 40% when converted to dollars.

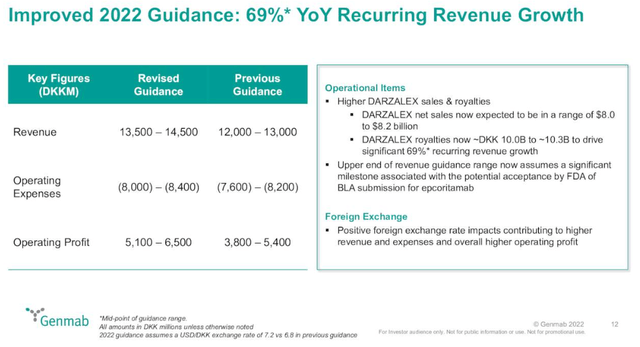

The company increased the full-year net sales guidance for Darzalex from $7.8-$8.0 billion to $8.0-$8.2 billion, and it increased the full-year revenue and operating earnings guidance due to better-than-expected growth of Darzalex and due to the above-mentioned currency tailwinds.

Darzalex should continue to deliver healthy growth in the following years as it still has plenty of room to grow in earlier lines of multiple myeloma.

However, the revenue base is going to be far more diversified going forward. The royalties from Kesimpta and Tepezza have grown rapidly in the last few quarters, and I continue to see their potential peak annual contribution in the $450 million to $700 million range.

Kesimpta continues to do well, and while Tepezza had some difficulties in the last two quarters I continue to see it as well-positioned to grow significantly in the following years, and I covered this at length in my August article on Horizon Therapeutics (HZNP). But even if it does not, it will not make a big difference to Genmab as the royalty rate on Tepezza is the lowest of the three products at mid-single digits.

The launch of Tivdak is progressing nicely, but until Genmab and partner Seagen (SGEN) expand the label, its contribution to topline growth will be rather limited.

Partner J&J secured FDA approval for another multiple myeloma drug – Tecvayli (teclistamab). It will probably be a modest contributor in the next few years since the label is limited to fourth-line-plus multiple myeloma, but Tecvayli could represent another decent royalty stream for Genmab later this decade.

Overall, Genmab looks well positioned to grow revenues in the following years, and we could see another important product on the market in 2023 – epcoritamab.

BLA submission for epcoritamab accepted and granted Priority Review

Genmab and partner AbbVie (ABBV) announced last week that the BLA submission for epcoritamab for the treatment of relapsed/refractory large B-cell lymphoma (‘LBCL’) was accepted by the FDA and that the application was granted Priority Review which shortens the review to six months. The PDUFA date is May 21, 2023, and I believe that Priority Review increases the probability of approval (but it does not guarantee it).

One of the issues lately for accelerated approval of oncology drugs was the status of confirmatory trials. The FDA may request that the confirmatory trial is fully enrolled at the time of approval, and while Genmab has not provided enrollment updates, the confirmatory study was initiated in late 2020, and it is possible that enrollment is completed by the time of the FDA’s decision, or at least sufficiently so for the FDA to have confidence that it will be completed in a timely manner. And while the FDA has asked this from other sponsors, it is not an actual rule, and management seems confident either way.

EMA validated for review the marketing authorization application for epcoritamab in October, and epcoritamab could be approved in Europe in the second half of 2023.

Relapsed/refractory LBCL is not a big population, but it represents the first step for epcoritamab on the path to becoming a blockbuster. Epcoritamab should become a major player in B-cell malignancies, as monotherapy and in combination with other products or candidates. I wrote about the data it generated in my previous article and will only repeat that the efficacy looks strong and durable and that it should further improve in earlier lines of therapy and in combinations with other agents.

I will also add that there is one ASH abstract comparing the results of epcoritamab to chemoimmunotherapy. This is a cross-trial comparison and has limitations, but shows that epcoritamab has significantly improved overall response rate (74% vs 34%), complete response rate (52% vs 12%), and overall survival (not reached after a median follow-up of 10.7 months versus 5.4 months) compared to chemoimmunotherapy.

Pipeline updates at ASH

Genmab will present a lot of clinical data at ASH next month, and the company will host an R&D day to discuss the data. Epcoritamab is the main asset of interest, with 10 of 19 abstracts focused on it. The presentations include initial data of epcoritamab in patients with Richter’s Syndrome, data from the EPCORE NHL-2 trial, updated data from the trial in patients with relapsed/refractory follicular lymphoma or diffuse large B-cell lymphoma, and the initial results in first-line follicular lymphoma.

There will also be some data presentations from early-stage trials of other candidates. The most interesting early-stage asset is GEN3014 (HexaBody-CD38). This is a candidate that was shown to be more potent than Darzalex in preclinical trials, and while it is still too early, the ASH abstract showed some early but unimpressive activity. There were 19 response evaluable patients, of which five were naïve to anti-CD38 antibody and 14 were refractory, two of five naïve patients achieved a very good partial response, and one achieved a minimal response. Of the 14 patients refractory to anti-CD38 antibody, two achieved a minimal response. We will see updated data from this trial at ASH next month.

In addition to the preliminary monotherapy data in relapsed/refractory multiple myeloma patients that we will see at ASH next month, Genmab is conducting a proof of concept head-to-head trial of GEN3014 against Darzalex. This will be the more interesting part, but we are not going to see the data until probably late 2023 or early 2024. Partner J&J has an option on GEN3014 and if it exercises it, Genmab is entitled to a flat royalty rate of 20% until 2031, followed by a tiered royalty rate starting at 13% and peaking at 20%.

Conclusion

While the stock is now less attractive after a nearly 40% rally in the last five months, Genmab’s commercial momentum should remain strong in the following years. And the growth will be decreasingly driven by Darzalex. That is not due to Darzalex’s lack of growth, but due to the company’s expanding commercial portfolio. Epcoritamab could become one of the main growth drivers in the following years and with significantly improved economics compared to existing marketed products because of the 50:50 profit/loss split with AbbVie in the U.S. and Japan and 22-26% royalty rates in other territories. This compares very favorably to mid-double-digit royalties on Darzalex and 10% or less on other products that its partners are currently selling.

Be the first to comment