Mario Tama/Getty Images News

Price Action Thesis

We were confident in General Motors (NYSE:GM) stock from August last year until we decided to cut all exposure in March and rotated. No doubt, the company is one of the leading automakers in the US, with an illustrious history. It has an ambitious EV transformation roadmap under the leadership of CEO Mary Barra. It also aims to challenge Tesla (TSLA) and Ford (F) for global EV leadership over the next decade.

Yet the stock has lost nearly 48% from its January highs. Hence, we asked ourselves what we did get wrong that the market knew and we didn’t. We noted that GM stock traded at an NTM normalized earnings of 10.6x even at its peak in January. Therefore, it was still well below the market’s P/E. However, it didn’t prevent the stock from reaching levels last seen in late 2020, digesting all its gains from 2021.

Therefore, it was a humbling experience for us. More so because we had the necessary price action analysis skills but did not use them effectively. Instead, we had focused more on its story, and analysts’ ratings, to our peril. Therefore, our GM ratings performed below par, and we are keen not to repeat our previous mistakes.

We discuss why utilizing appropriate price action analysis can help investors recognize the market’s intentions and avoid such pains in the future. We also present critical levels that investors should consider moving forward.

As we have not observed a noteworthy bear trap price action, coupled with another bull trap after its double top, we revise our rating on GM stock from Buy to Hold.

We Should Have Paid Attention To Those Double Top Bull Traps

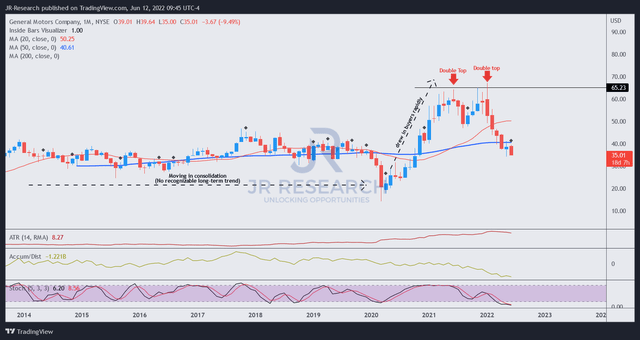

GM price chart (monthly) (TradingView)

Investors can corral from the monthly chart above and observe the double top bull traps in June 2021 and January 2022. These traps were formed, coming off a surge of optimism in GM stock. In June 2021, the company telegraphed the first of its $35B electrification plan, which saw GM stock surge into its first double top bull trap.

Notably, the market’s ability to price in critical events ahead of time is incredible. Investors can easily discern the surge from its COVID bottom that helped GM stock break into new highs in 2021, in contrast to its tepid consolidation pattern previously. Therefore, we urge investors to watch price action closely and not simply buy into hype/news/analysts’ upgrades. Investors must do their due diligence and independent analysis.

The second bull trap formed after the “final flush,” drawing in buyers who bought into GM’s Investor Day, as it highlighted its platform innovator ambitions (see our previous article). As investors cheered the company’s plans, the market drew in the final round of buyers before setting the second double top bull trap in January 2022.

Having one double top bull trap is already bearish enough. Having to deal with two double tops at the same resistance level clearly shows buying momentum failure. What happened after the second double top bull trap was a steep sell-off as the market digested those massive gains from 2020-21.

Near-Term Bottom Is Tenuous

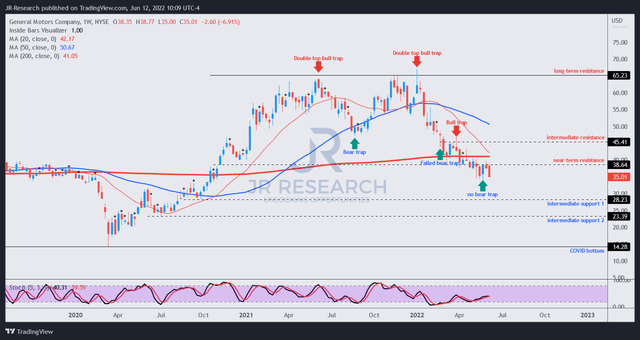

GM price chart (weekly) (TradingView)

GM stock’s weekly chart fills in the necessary details from our broader monthly chart framework.

As seen above, the price action from double top bull traps is ominous, as they indicate a higher probability of sustained trend reversals. Notably, the deep retracement after its first double top (June 2021) did not suffer a sustained trend reversal. Notably, GM stock was also supported by a bear trap price action signal. However, we usually accord a lower significance to a bear trap that occurs after a double top.

However, the second double top bull trap (January 2022) broke the camel’s back, sending GM stock into negative flow (decisive bearish momentum). Note the failed bear trap after its second double top. As mentioned, the initial bear trap price action after a potent double top is usually unreliable. Subsequently, GM stock also had another bull trap in late March, setting up its intermediate resistance.

GM stock is at a near-term bottom, as it had attempted to consolidate over the past four weeks. However, we noticed that the buying momentum has faced stiff resistance and has been overpowered so far. Furthermore, we have not observed a double bottom bear trap price action that could help reverse its bearish momentum.

Given its negative flow and prior double top price action, we prefer to observe a double bottom bear trap before we are confident of a higher probability setup for a potential reversal in trend.

Is GM Stock A Buy, Sell, Or Hold?

GM investors have contended that the stock is relatively cheap, priced at a discount against the market, and at a steep discount against Tesla. But that has not prevented the market from digesting its massive 2021 gains entirely.

Therefore, we believe investors should watch price action closely to monitor for clues that the market is telling us about its forward intentions. We have learned from our mistakes and will not repeat them.

We revise our rating on GM stock from Buy to Hold and await a clear price action signal. We will reassess our rating if a significant price action signal develops moving forward.

Be the first to comment