Dragon Claws

The past 12 months have been great for the ‘Magnificent 7’ tech stocks and Al-related stocks as the market appears willing to continually chase these names to higher highs. For how much longer this rally may last, especially with Al names like Nvidia (NVDA), is anyone’s guess, and it wouldn’t be fun if and when the music stops.

That’s why a better idea for new capital deployment in this frothy market may be to allocate towards beaten down sectors that used to be market favorites, such as Consumer Staples. This strategy could provide downside protection to a portfolio should market sentiment turn negative against heavily favored growth stocks and tilt in favor of defensive names.

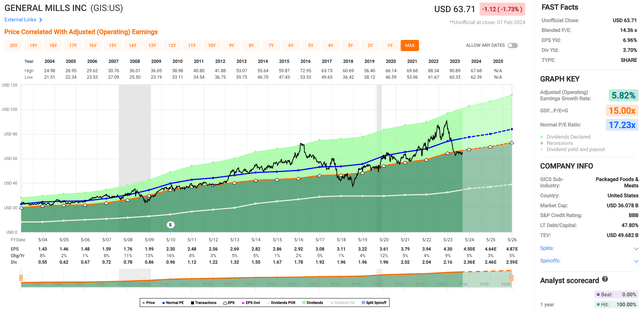

This brings me to General Mills (NYSE:GIS), which has seen its share price beaten down by 16.5% over the past 12 months. As shown below, GIS has even underperformed the SPDR Consumer Staples ETF (XLP) over the past year. In this article, I discuss why value and income may want to considering layering into GIS at the current discounted price, so let’s get started!

GIS vs. XLP 1-Yr Price Return (Seeking Alpha)

Why GIS?

General Mills is a global packaged food company that’s home to many familiar cereal, snacks, at-home meals, yogurt, baking mixes, and pet food brands, including Pillsbury, Cheerios, Betty Crocker, Nature Valley, Blue Buffalo, and Haagen-Dazs. It derives most of its businesses from the U.S. with the remaining one-fifth coming from International.

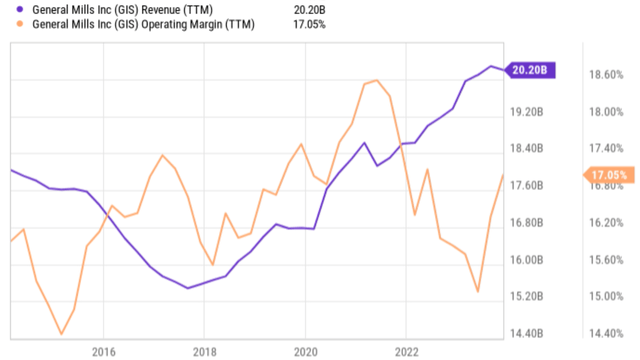

GIS has done a fairly good job of growing job of growing its revenue and while maintaining operating margin between 15% and 18% over much of the past decade, amidst changing consumer tastes and preferences. As shown below, GIS began seeing a revenue turnaround in 2018, with continued acceleration in recent years since the start of the pandemic in 2020.

GIS Revenue and Operating Margin (YCharts)

This trend has slowed down in recent quarters, however, as household shopping for certain items have reversed some gains in prior years. This is reflected by net sales being down by 2% to $5.1 billion during GIS’s last reported fiscal second quarter (ended on Nov 26th). This was driven by lower volume by the pound, partially offset by favorable net price realization and higher margin product mix. Organic net sales was also down by 2%, but it’s worth noting that this comes after double-digit growth in the prior year. Taking the prior 2 years into consideration, GIS’s organic sales were up by 4% on a 2-year compound basis.

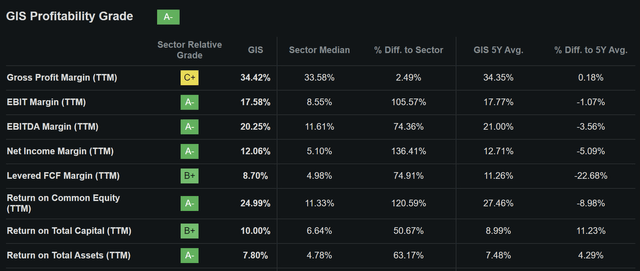

Despite GIS’s recent top-line challenges, it’s seeing favorable margin growth, with operating profit being up by 2% YoY during the fiscal second quarter, driven by favorable pricing and COGS efficiencies, as reflected by adjusted operating profit margin being up by 240 basis points YoY to 19.3%. GIS’s scale enables it to achieve margins at the high end of the Consumer Staples sector. As shown below, it achieves an A- grade for profitability with EBITDA and Net Income margins of 20% and 12%, respectively sitting at around 2x or more compared to the sector median.

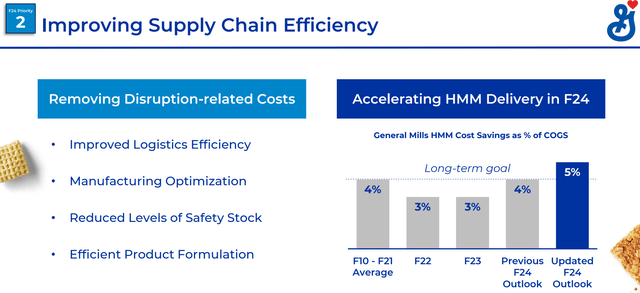

Looking forward to the rest of the fiscal year and beyond, I would look for continued margin improvements through GIS’s HMM (Holistic Margin Management) Plan, which seeks to achieve a near-term high of 5% in COGS savings this fiscal year, up from its previous goal of 4%. As shown below, this represents a marked acceleration in COGS savings in prior years. For reference, cost of goods sold is a top-line expense that gets deducted from revenue to calculate gross margin, and lower COGS result in higher gross margin.

As a result of the aforementioned cost management plan combined with anticipation of favorable product mix, management is guiding for 4-5% annual EPS growth for the full current fiscal year. This could be reasonably achieved as GIS holds top share in the dog food market through its Blue Buffalo brand and a Top 5 position in cat food and demand has proven to be inelastic to price increases in recent years. Management noted the performance in this business and its forward outlook, as noted during the last conference call:

Importantly, as we look over the five years we’ve owned the [Blue Buffalo] business, we’ve doubled the business. The Blue brand is really strong. When we execute well against it, whether it’s on Life Protection Formula, advertising or holiday treats or things like that, we see the business really respond well. And it’s very clear to us this humanization trend is going to continue, and that Blue is well paced to capture that over the course of time.

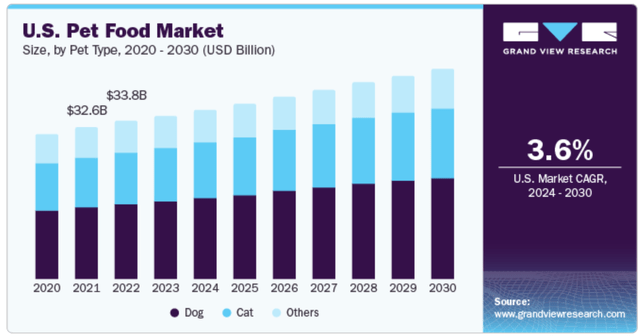

Pet food may be an underrated category at GIS, considering the robust growth in pet ownership in recent years when consumers spent more time at home during the pandemic. As shown below, this market is expected to grow at a healthy 3.6% CAGR between now and the end of the decade.

Risks to GIS in the near term include cost inflation, which may be exacerbated by the recent attacks on commercial lanes in the Red Sea. This could impact some of GIS’s ingredients such as palm oil. While some of its brands, like pet foods, have proven to be rather price inelastic, enabling GIS to pass on higher costs to consumers, there’s no telling whether if a price ceiling will be reached on higher input costs, leading consumers to down trade to cheaper store brands.

In addition, higher interest rates could result in higher interest expense for GIS, although it does maintain a BBB investment grade credit rating from S&P. Impact from higher rates is reflected by net interest expense of $118 million during fiscal Q2 compared to $92 million in the prior year period.

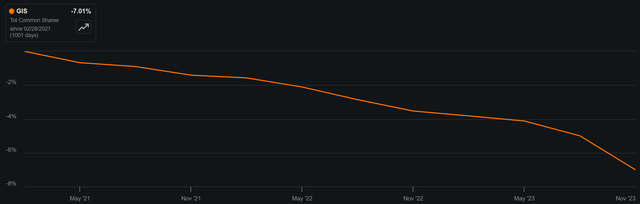

GIS has maintained a steady net debt level between $11 and $12 billion since 2020 and carries a net debt to TTM EBITDA ratio of 2.9x, sitting just below the 3.0x level generally considered to be safe by ratings agencies. Management expects to maintain a leverage ratio below 3x while maintaining its share buyback program. GIS has retired 7% of its outstanding shares over the past 3 years, and it’s getting a 7% earnings yield for every dollar spent on share buybacks, based on the current forward PE ratio of 14.2.

GIS Shares Outstanding (Seeking Alpha)

Meanwhile, GIS pays a respectable 3.7% dividend yield that’s well-covered by a 51% payout ratio, leaving plenty of retained capital for debt paydown, brand investments, and share repurchases. While the dividend 5-year CAGR is just 3.3%, growth has accelerated in recent years, including the 9.3% raise last year, which was declared in June. As such, there is potential for another raise coming in a few months.

Turning to valuation, I see value in GIS at the current price of $63.71 with a forward PE of 14.2, sitting well below its normal PE of 17.2. This is also considering the 4-5% aforementioned EPS growth estimate for the current fiscal year and sell side analysts who follow the company believe this will continue into fiscal 2026. I believe this is achievable due to cost rationalization efforts and growth in GIS’s premium brands that have demonstrated inelasticity to price increases.

Investor Takeaway

While General Mills faces near-term headwinds such as cost inflation and potential impacts from interest rates, I believe the company’s strong portfolio of well-known brands, focus on margin expansion through its HMM Plan, and solid dividend yield make it a compelling buying opportunity at current levels. Furthermore, with expectations for continued bottom-line growth and potential for share buybacks and dividend increases in the future, GIS offers the potential for long-term value and returns for investors. With a 3.7% dividend yield and a reasonable 5% long-term annual EPS growth target, GIS could produce around market-level returns all with a higher yield and less potential volatility. As such, I rate GIS as a ‘Buy’ at the current price.

Be the first to comment