jetcityimage

Investment Thesis

General Electric, as a major manufacturer of aircraft engines, it looks attractive due to large-scale investment cycle of the aircraft industry. Despite the difficulties in the renewable energy segment, we expect investors to start opening positions in the stock. According to our valuation, the company’s shares already have good upside, but we are willing to wait for further decline in stock and indices.

Underinvestment in aviation industry is a strong driver for General Electric

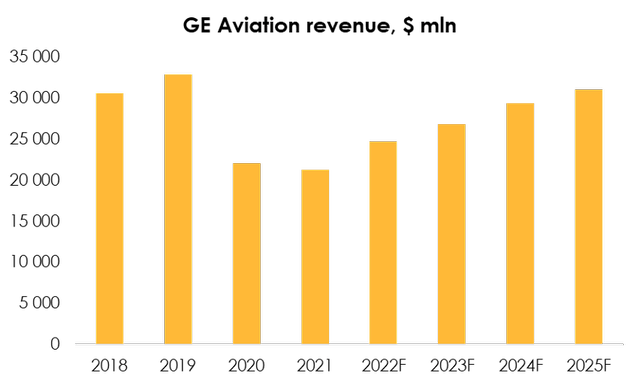

The General Aviation division remains the most successful business segment, both in terms of revenue growth and profitability. It is highly likely to show similar dynamics, at least in the next few years.

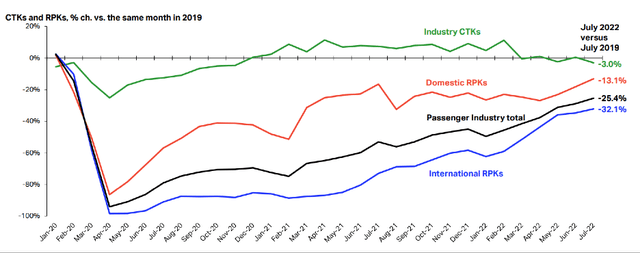

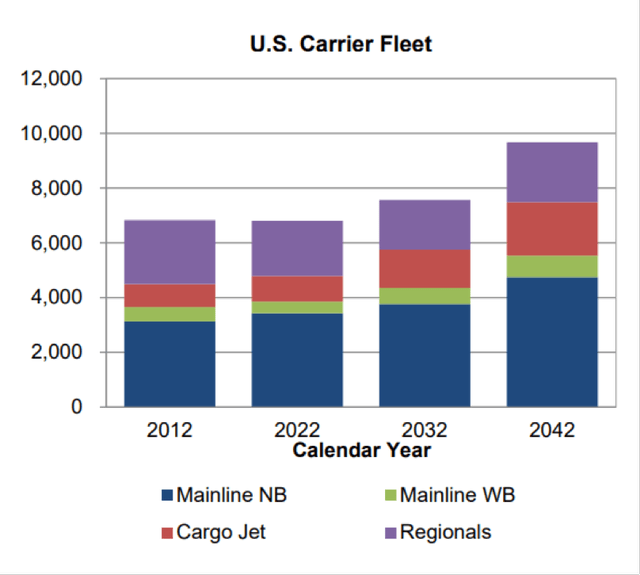

The 2020 pandemic caused significant damage to the industry as a whole and forced most major airlines to shrink their fleets. Despite recovering aircraft deliveries, according to IATA, total capacity was down by 28% in June vs. the same month in 2019.

Fleet reduction and halting of deliveries in 2020-2021 resulted in the major carriers’ fleet becoming obsolete today, and the companies themselves cannot fully meet the recovered demand even for domestic transportation. With the subsequent recovery of international tourism, carriers will need even more aircraft, according to Airfleets.

Airfleets

Boeing and Airbus have already started to elevate production rates, in particular, Boeing has increased the pace of production of the most popular B-737 model family up to 31 planes per month vs. 16 planes/ month a year earlier). Airbus is expected to produce 75 similar aircraft of A320 family by 2025, which implies a 50% increase in the current production rate.

In addition, other aircraft models with General Electric engines will be available for operation in the foreseeable future. For example, Boeing 787 with GEnx engines is likely to be delivered since Q3 2022. Meanwhile, the deliveries of A321NLX have been postponed until 2024, and this model will have CFM Leap engines made by General Electric and French Safran Aircraft Engines.

General Electric has an almost monopolistic position in civil aviation, providing engines for the largest aircraft manufacturers. Due to underinvestment, and retirement of aircraft in 2020, the total number of planes has not changed much in 10 years, according to FAA. Therefore, we expect the observed trend of strong revenue growth and high profitability to be long-lasting.

The airline industry is heading for a long investment cycle in which General Electric will become the main supplier of engines for aircraft.

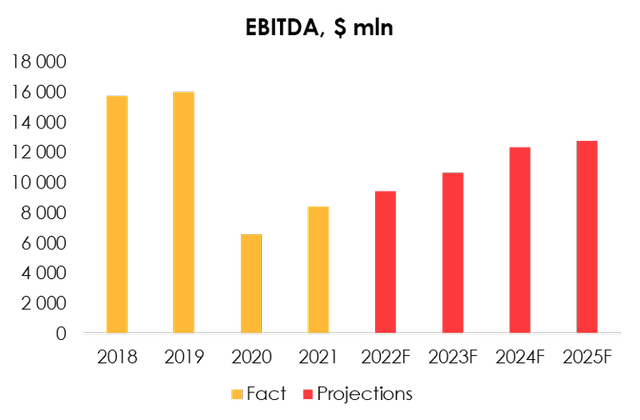

According to our estimates, General Electric Aviation revenue will grow at an average rate of 9.8% y/y over the next four years. Meanwhile, the company is expected to improve its profitability to 20.6% by 2025 via mitigating inflationary pressure and updating contract prices.

Renewable energy sector looks weak, even with the latest Congress check

Despite bright prospects of the aviation sector, Renewable Energy division of General Electrics is experiencing difficulties, and we do not expect significant improvements in the medium term.

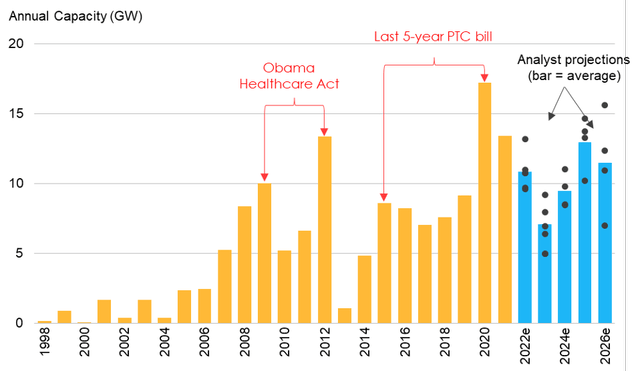

As for the renewable energy sector, General Electric is focused on production and maintenance of wind turbines and related infrastructure. The company experienced problems with orders in 1H 2022, largely due to uncertainties in U.S. law and delay in the extension of PTC and ITC benefits. Although in August the benefits were prolonged till 2025 and he market started to bet on renewable energy producers, we don’t believe it will have strong effect on financial results of General Electric in the next 2-3 years.

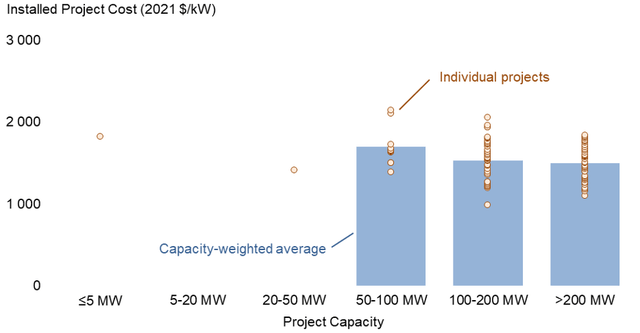

Firstly, wind power is severely limited in terms of consumer base. Due to high cost and scale of wind turbines, according to Energy Efficiency & Renewables Energy, using them in individual projects is very expensive and almost always makes no sense. Orders for generators come from large companies that can afford big projects – the bulk is for projects >200 MW, which is equivalent to installing >80 turbines.

Energy Efficiency & Renewables Energy

Owing to high concentration of customers in the corporate segment, the correlation between orders and tax benefits of Congress is less linear than when a large share of buyers is in the private sector. Since construction takes place under long-term contracts and buyers have the option to postpone delivery to later dates, the main goal is to start construction before the deadline. Under the previous tax benefits, the bulk of the capacity increase always occurred during the last year of validity period of the law. Therefore, we expect a similar pattern in the new cycle and an increase in deliveries in 2025, according to Energy Efficiency & Renewables Energy.

Energy Efficiency & Renewables Energy

General Electric, though a major supplier of wind turbines in the U.S., is cutting turbine production rates to ~2 000 per year (about a half of the company’s actual capacity) to reduce costs. We expect the company to recover production capacity by 2024.

The rest of General Electric’s segments, Gas & Power, and Healthcare, remain stable, and we see no strong catalysts for notable improvement in financial results over the medium term.

GE Stock Valuation

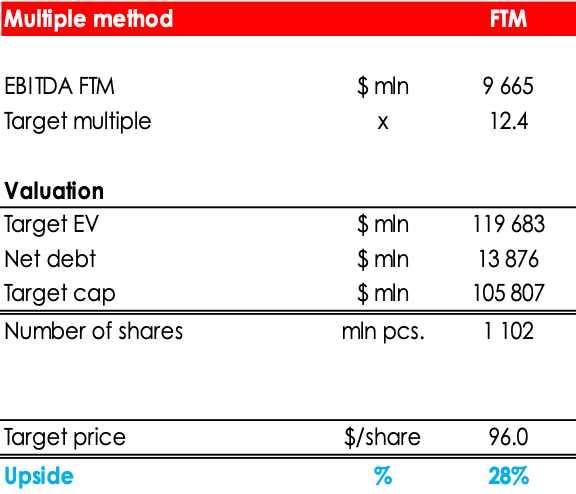

According to our forecast, in the next four years, the company’s EBITDA will increase at an average rate of 11%, overtaking the rate of revenue growth. It will be supported by correction of commodity prices and new pricing policy, which is already being implemented by the company’s management in all business segments.

According to our valuation, the instruct value of GE stock is $96.0/share, and we maintain HOLD status. Upside-28%.

Invest Heroes

Although General Electric shares already has attractive upside, we are waiting for the major indices to decline, so we are not yet ready to open this position and believe that it is better to wait for a more attractive price.

Conclusion

We are very close to upgrade the status of General Electric to BUY. The aviation segment is growing at a very fast pace, and there are all the prerequisites for the trend to continue over the next few years. Despite the challenges in the renewable energy segment, we believe that the aviation division offers too attractive return to overlook it.

Now we are not ready to open buy General Electric because of expectations of declining indices due to the withdrawal of liquidity from the market and expected recession. However, if a more significant upside emerges, General Electric will be at the top of our list to buy.

To manage the position, we recommend monitoring financial statements of General Electric, key economic indicators, and industry surveys (e.g., IATA and EIA).

Be the first to comment