jetcityimage/iStock Editorial via Getty Images

Article Thesis

General Electric Company (NYSE:GE) is an embattled stock that has vastly underperformed the market over the last year. Some of the company’s businesses have a good long-term outlook, but profitability issues and weak shareholder returns are headwinds going forward. Overall, it looks like other industrial companies could be better choices for the coming years.

Recent Underperformance Caused By Macro Headwinds

General Electric has dropped from a high of more than $110 per share last fall to just $70 as I write this article, which makes for a drop of close to 40%. This vastly underperformed the broad market. As an industrial company, General Electric naturally is exposed to the strength of the overall economy. And since a recession has become more likely in the recent past, the outlook for General Electric has worsened, to some degree. But that’s not all there is. The company is also negatively affected by supply chain issues caused by the current Russia-Ukraine war and by lockdown measures in China. With its different business units requiring components and materials from all around the world, disruptions to global trade or to manufacturing in specific regions hurts General Electric’s ability to produce and sell parts.

This was reflected by the fact that General Electric’s organic revenue was up by only 1% during its fiscal first quarter, which widely missed analyst estimates. This is also not at all a strong result when we consider that the previous year’s quarter, Q1 2021, was still heavily impacted by the pandemic. This made for a rather easy comparison for GE, and yet the company saw its revenue rise by just 1% at a time when inflation is running at 8% and more. On the other hand, it should also be noted that General Electric’s business performed better when it comes to generating new orders, as those were up 13% year over year on an organic basis. This was ahead of the rate of inflation and bodes well for business growth in the future, but due to the aforementioned supply chain issues, GE is not able to capitalize on the healthy demand for its products right now.

GE Stock Key Metrics

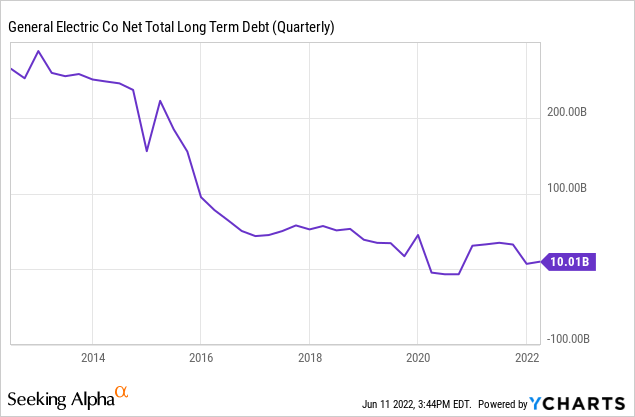

Looking into the numbers, the first very important one is GE’s debt load. The company has massively underperformed the broad market in recent years, as shares dropped by close to 70% over the last five years, while GE is also down more than 50% over the last decade. That was, to a large degree, the result of its way-too-high debt load in the past. That has hurt investors’ trust when it comes to the long-term financial health of the company, which forced management to sell business unit after business unit in order to free up cash that could be used for debt reduction. General Electric’s dividend cut also was the result of too-high debt levels in the past. General Electric has made significant progress in that regard over the years, however:

In fact, General Electric’s net long-term debt dropped from as high as $300 billion a decade ago to just $10 billion as of the end of the most recent quarter. That’s a great deleveraging success, although it is important to note that it did not come for free — the asset sales that were needed to achieve this feat have made GE’s revenue drop by half over the last decade, from around $140 billion to around $70 billion. Nevertheless, one can now say that General Electric is in a financially healthy position today, operating with debt levels that are not at all problematic, even when we account for the fact that interest rates have been rising and might continue to rise in the coming years.

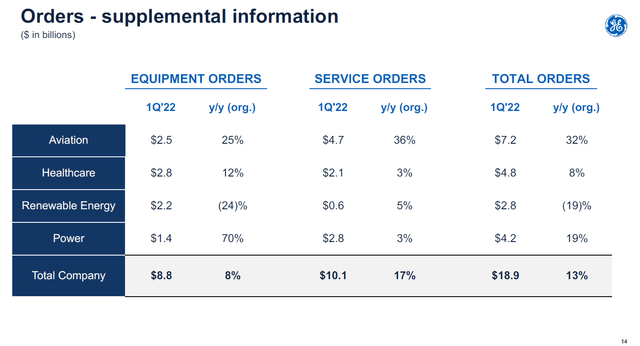

When it comes to GE’s near-term outlook, the fact that orders are trending above revenue is positive. Revenue during Q1 was $16.4 billion, while GE managed to take in new orders of $19 billion during the same period. A book-to-bill ratio of above 1.0 is generally a good sign for the company’s revenue performance in the coming quarters. As we can see in the following chart, order performance was very uneven across GE’s different business units:

GE presentation

Orders were up by a very strong 32% in the Aviation segment, which will be the future GE once Healthcare and Renewable Energy & Power have been spun off, which will happen in early 2023 and early 2024, respectively. The strong order growth in the Aviation segment can be attributed to the faster-than-expected recovery of global air travel. In late 2020 and early 2021, there were still many lockdown measures in place around the world, and air travel was very restricted. But as we have seen since then, restrictions got eased in more and more countries, and demand for air travel recovered significantly. Delta (DAL), for example, has just stated that the company sees revenue fully recovering to 2019 levels in Q2. That naturally is a positive for airlines and their demand for new equipment, which is, in turn, good for GE Aviation. The fact that high oil/kerosene prices make investments in newer, more efficient engines more attractive is another tailwind for the segment in the current environment. In the long run, many experts see air travel continuing to grow, which is why GE Aviation generally has a solid long-term growth outlook, even though the unit will likely always be cyclical to some degree.

The order performance for the Renewable Energy segment, on the other hand, was not strong at all, as numbers were down almost 20% year over year. With Chinese wind turbine makers gaining more and more market share thanks to cost advantages, and with the current energy crisis making some governments re-prioritize their energy investing goals, the market situation for the renewable energy business isn’t strong. Luckily, this wasn’t regarded as a very valuable GE unit anyway, so headwinds for this segment shouldn’t turn into overly large problems for the stock’s overall performance in the coming years.

Healthcare orders were up by 8%, which was in line with inflation. This is a non-cyclical, reliable business without an overly strong growth outlook, so the Healthcare segment order intake was fine, although not great.

GE updated its guidance that was initially given in January and foresaw earnings per share of $2.80 to $3.50 and free cash flow of $5.5 billion to $6.5 billion. As of the Q1 earnings presentation, management indicated that results were currently trending towards the lower end of the guidance range. Due to the aforementioned macro headwinds and cost inflation, this isn’t surprising. Earnings per share of around $2.90 or so and free cash flow of a little less than $6 billion are thus what investors can expect this year.

Where Will General Electric’s Stock Be In 2025?

Based on the EPS number, shares are somewhat pricy, with a mid-20s earnings multiple. Relative to free cash flows, the valuation seems reasonable though, as GE trades at around 15x this year’s expected free cash flow. For long-term investors, the outlook beyond 2022 is more important, however.

GE’s Aviation and Healthcare businesses are highly attractive, as they generate solid margins in the high-teens range (versus negative margins in the Renewable Energy segment), and since GE has favorable market positions in these markets with a positive long-term growth outlook. These two units are where most of the value of GE lies. Between these two units, GE generates around $40 billion a year annually. That amount will not explode upwards but should trend up at a solid pace over time. Mid-single-digit annual growth could make that number increase to $50 billion in 2025, which could justify a valuation of $100 billion at a 2x sales multiple. Add a little for the Energy business, and GE might be worth something like $110 four years from now. Relative to the current valuation of a little more than $80 billion, that could make for a 30% gain, which would not be a bad return. But since there is almost no dividend yield, total returns would not be great, either.

Analysts are currently predicting earnings per share of $7.80 for fiscal 2025, although there are major unknowns here of course, as we don’t know yet what the margin improvement initiatives and buybacks will result in over the next couple of years. If one were to put a 15x earnings multiple on that number, one could get to an upside of more than 50% over the next four years. But due to GE’s checkered past and its repeated underperformance relative to company goals and analyst estimates, I do believe that the EPS estimate might be too aggressive. If actual results are weaker, total returns naturally would be weaker as well.

Still, it seems pretty likely that GE will see its shares climb over the next couple of years, as the spin-offs should unlock value and since the debt reduction efforts in recent years could result in more FCF being available for shareholder returns and other measures.

Is GE Stock A Buy, Sell, Or Hold?

If someone buys GE today, I do believe that there is a high likelihood of positive returns over the next couple of years. GE Aviation and GE Healthcare are attractive businesses with a solid long-term outlook. That being said, GE is not the most attractive industrial company in the world, e.g. due to its lacking dividend yield and its unconvincing track record. I thus do believe that GE is a reasonable hold but personally do not seek to buy shares at current prices.

Be the first to comment