bfk92/E+ via Getty Images

Overview:

Interest rates are going up, war exists in Europe, world trade is in jeopardy, and Europe is headed for a cold winter. What should an investor do to protect his or her investments?

How about investing in U.S. defense stocks like General Dynamics Corporation (NYSE:GD) and/or Raytheon Technologies Corporation (NYSE:RTX)?

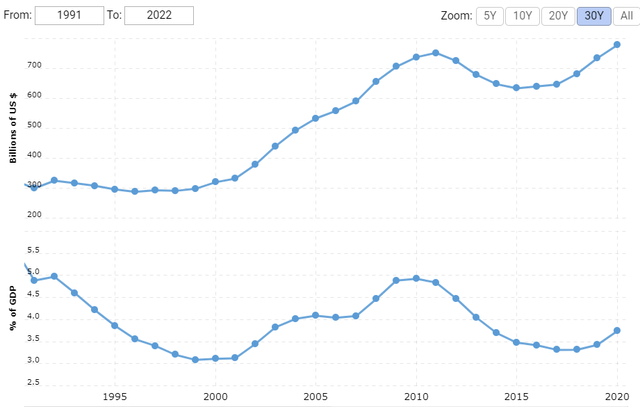

One of the advantages of the U.S. defense business is that defense budget tends to go up every year, except for a few years under the Obama administration. In addition, the amount of defense spending as a percentage of the GDP is 25% lower than it was 30 years ago. Over the last five years, it has gone up every year to a record level in 2022.

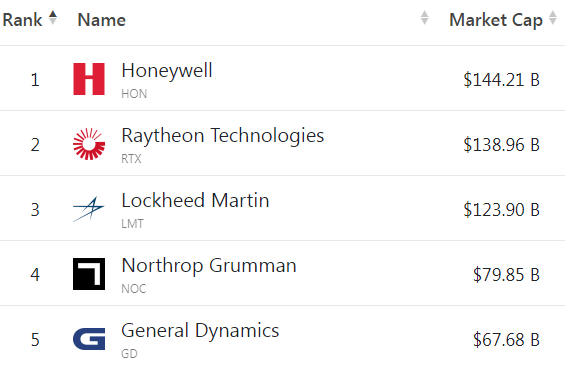

Two of the best choices in defense stocks are General Dynamics and Raytheon Corp. They are both in the top 5 defense contractors by market value.

companiesmarketcap.com

In this article, I will analyze these two defense contractors to see if either or both may be a good defense against a volatile stock market.

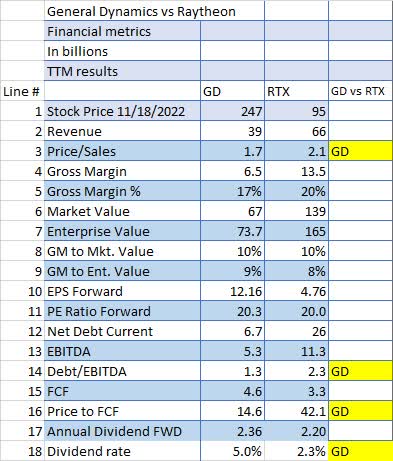

Financial metrics

When we look at the financial metrics comparing the two companies on a TTM (Trailing Twelve Month) basis, several metrics jump out. One of these is that Raytheon’s Revenue (Line 2) is 70% more than General Dynamics’s.

Gross Margin % (Line 5) is 20% for RTX vs. General Dynamics’s 17%. But based on GM to Market Value Percentage (Line 8), Raytheon’s margin is exactly the same as General Dynamics’ at 10%. And GM to Enterprise % (Line 9) is virtually the same. This would indicate that neither Raytheon nor General Dynamics have any real advantage based on margins.

Looking at the P/E Ratio (Line11), both companies look virtually the same with a ratio of about 20.

When it comes to Debt/EBITDA (Line 14), General Dynamics looks much better with a ratio of 1.3 versus RTX’s 2.3, but both ratios are good and show a solid financial basis for both companies.

Seeking Alpha and author

Price to free cash flow (“FCF”) (Line 16) also shows a huge advantage to General Dynamics at 14.6x versus RTX’s rather high 42.1x.

And finally, the dividend rate (line 18) is much higher for GD at 5% compared to Raytheon’s 2.3%.

Based on financial metrics, General Dynamics is the winner.

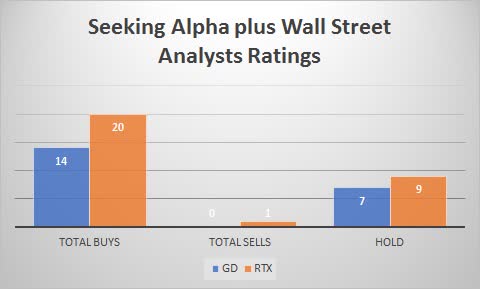

Wall Street analyst ratings show General Dynamics is well-liked, but the quant community likes Raytheon better

Wall Street analysts appear to have strong feelings for General Dynamics, with Wall Street plus Seeking Alpha analysts combined showing 14 Buys and zero Sells. Raytheon is almost as good, with 20 Buy recommendations and only 1 Sell.

Seeking Alpha and author

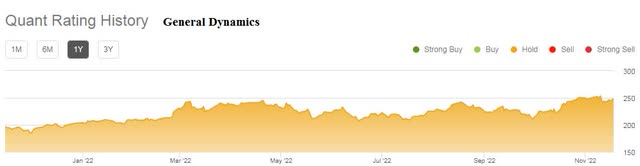

Quant ratings over the last year are different, showing nothing but Hold ratings for General Dynamics and nothing but Buy ratings for Raytheon over the entire time period.

So quants seem to really like Raytheon but are less enthusiastic about General Dynamics.

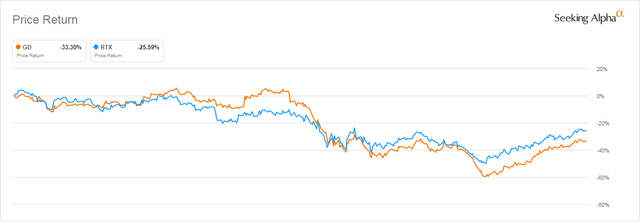

Neither General Dynamics nor Raytheon did well in the last recession

If you’re concerned, as I am, of a looming recession in the next year or 18 months, knowing how a company did in the last recession can provide some investment insight.

December 2007 through June 2009 is the last recognized recession period, and neither General Dynamics nor Raytheon did well. Raytheon fell by 25% and General Dynamics fell by 33% over that particular recessionary period.

So, no real advantage to holding either of these two stocks during a recession.

Dividends and share buybacks.

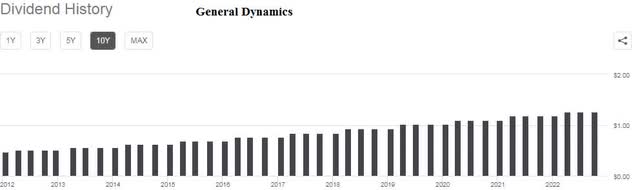

General Dynamics has raised its dividend for 28 years in a row, a commendable record.

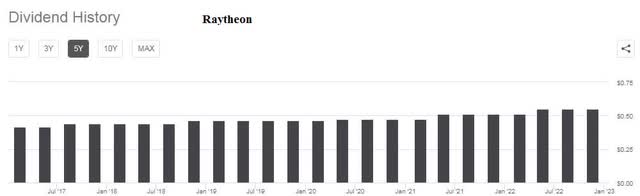

On the other hand, Raytheon has done even better, raising its dividend for 29 years in a row.

So, if you’re looking for a steady, consistently increasing dividend, either company is an excellent choice.

However, keep in mind that General Dynamics’ current dividend rate is 5% compared to RTX’s 2.3%.

As for share buybacks, General Dynamics recently announced a 10 million share buyback plan, or approximately 4% of its market value.

Since 2012, GD has share repurchases worth more than $12 billion.

stockbuybackhistory.com

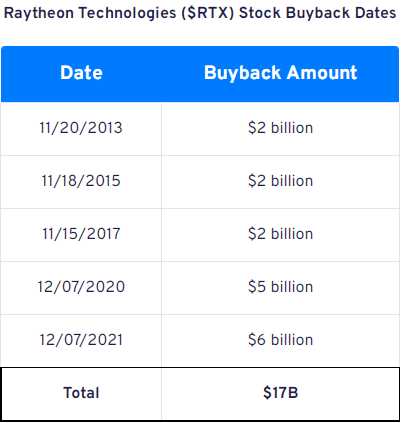

Raytheon currently has a $6 billion share buyback plan in force (about 4% of shares outstanding) and is on its way to purchasing more than $17 billion since 2013.

stockbuybackhistory.com

Both companies are increasing their dividend and buying back shares, but General Dynamics’ dividend rate is a healthy 5%.

Dividend and share repurchase advantage goes to General Dynamics.

Risks

One problem with any defense-related business is the annual political wrangling over the budget. In recent years and in most years for the last 30, the budget has gone up but nothing is guaranteed in politics. Policy can change in a moment and on a political whim.

In a volatile environment like we’re facing now, cash is always a viable alternative. CD rates are now in excess of 4% a number we haven’t seen literally in years.

In addition, there could be a recession coming or even a depression according to several economists. That may make profits elusive at best and provide losses at worst.

So please, do your own due diligence on every investment option.

Conclusion:

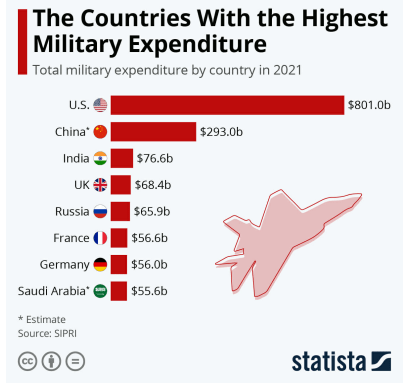

The United States spends more on defense than any other country in the world by a factor of more than 2 to 1. Therefore, it makes investment sense to buy into that bounty if a reasonable price can be achieved.

Statista

Comparing General Dynamics and Raytheon over the last five years on the basis of Total Return (including dividends) shows not much difference in returns, with GD up 41% and RTX up 48%.

However, comparing only the last year, General Dynamics has outperformed RTX by 29% to 14%.

Looking at these two companies, I see General Dynamics as being better on the financial metrics, mainly because of a lower P/E ratio, lower Debt/EBITDA ratio, and higher dividend. It has also been performing better over the last year.

Based upon the above analysis, General Dynamics is a Buy, and Raytheon is a Hold.

Be the first to comment