One of the more exciting things about a crash like the one the coronavirus is currently gracing us with is that while companies which the market views as somewhat speculative or unsure, based on market action, are cheap, is the other companies that become cheaper.

I’m talking companies which in the eyes of the broader, general market generally are considered to be untouchable stalwarts and havens. General Dynamics (GD) is one such company, and following Friday last week, the stock price finally broke through the barrier and became appealing.

Let me show you why I think you should invest in this business, as I have.

General Dynamics – What does the company do?

General Dynamics is a no-nonsense aerospace and defense corporation. It’s one of the largest in the world in terms of sales, and it’s a member of the Fortune 100. With over 60 years of history after its formation by the merger of Electric Boat and Canadair back in 1954, it now operates in five appealing segments of business.

(Source: General Dynamics)

These are:

- Aerospace, containing the Gulfstream and Jet Aviation businesses, which is an appealing mix of business aircraft products and business aviation services, including FBO, Maintenance, Charter, Staffing and Completion services.

- Combat Systems, developing and manufacturing wheeled and tracked vehicles, tanks and combat vehicles/ACVs as well as weapon systems such as rockets, Gatling guns, and lightweight vehicles.

- Marine systems, which contain GD’s developing and manufacture of naval vessels (Such as the Arleigh-Burke and Zumwalt-Class), submarine building and support ships such as oil tankers and dry cargo carriers. This segment is also responsible for naval vessel repair in the US.

- Information Technology is responsible for the development and creation of large-scale IT network systems and professional IT services for the defense sector, as well as government and commercial customers.

- Mission Systems focuses on the development and manufacture of secure communication, CAC (Command & Control) systems, sensors, and cyber software.

(Source: PR newswire)

General Dynamics is an active M&A’er, and its last big M&A was the services giant CSRA, which provided IT services to all levels of government sectors, as well as defense, homeland security, the army, and air force. This merger was completed in 2018, and CSRA became part of GD’s IT segment.

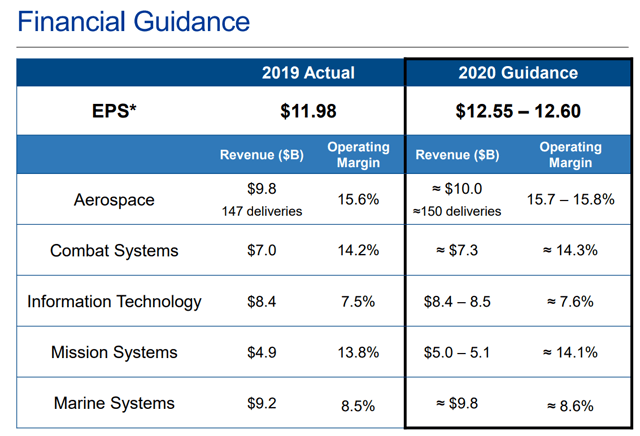

These business segments also constitute General Dynamics’ reportable segments. In terms of revenue, the segments of Marine Systems and Aerospace are the largest two contributors. Out of a near $40B FY19 revenue, these two segments came in at $9-10B each, making them about 50% of General Dynamics’ current business. The smallest segment is Mission Systems, which pull about ~$5B worth of revenue, while Information Technology and Combat Systems come in at $8.4B and $7B respectively. This makes General Dynamics an appealingly diverse company in terms of its revenue streams – though much of it remains tied to the defense industry.

(Source: USNI News)

So, the company in question is an Aerospace, Naval, IT and Defense company, delivering products to a variety of customers on governmental, defense and commercial tiers.

It makes its money by:

- Developing class-leading Aerospace, IT, Naval and defense products, and selling these to both governmental and commercial customers.

- Offering maintenance/service contracts for its products.

General Dynamics – How has the company been doing?

The last results we’ve got in are FY19 – and these results were excellent. Besides beating both in terms of revenue and EPS, we’re looking at:

- A record-high order backlog of $86.9B, marking a 28.1% increase on a YoY basis for 2019, with an FY19 book-to-bill of 1.5X.

- All five segments provided growth in operating earnings for the full year.

- Significant margin expansion during 4Q19 up to 12.3%, driven by the Aerospace segment.

Some color on the individual segments, which each provided some good items to look forward to.

Aerospace marked the first deliveries of the first G600 airplanes of the Gulfstream brand, as well as announcing the G700. The company expanded the service footprint and added nearly 1M sqft in service capacity. The G700 launch and strong demand across the portfolio also led to the best Aerospace order year in over a decade.

Combat Systems saw a 12.3% YoY revenue increase, with ramp-up of U.S Abrams and deliveries of the AJAX vehicles to the British military. Several orders were awarded as well, such as Canadian ACVS, Swiss Eagle Vehicles, and U.S. Abrams. The company also continues to see a high demand for munitions and weapon ordnance. Going forward, the FY20 appropriation bills support the U.S army modernizations which are likely to give the company continued room to grow here.

(Source: General Dynamics FY19 Presentation)

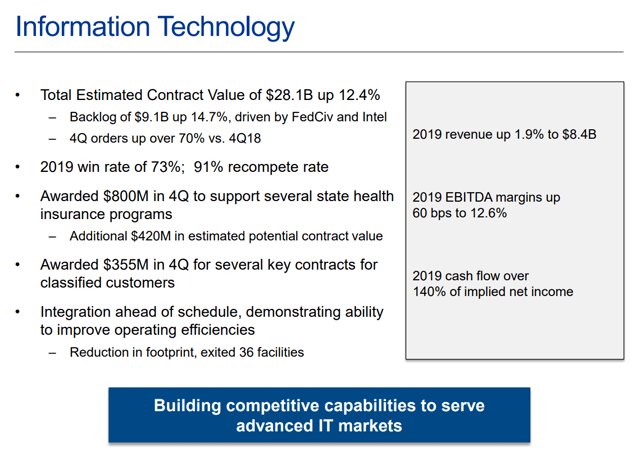

Information Technology saw, as you can see above, some impressive increases in contract values, excellent win rates, and recompete rates. New contracts are signed, and the company, like many others, are improving continuing operations and making them more efficient.

Mission systems saw a book-to-bill of 1.0X and a 4.5% revenue increase, due to contracts for the Navy’s new communication systems (satellite), new comms and computing equipment for the army, and submarine fire control systems. The company is also fielding improvements and new products for improved GPS tracking and timing.

Marine Systems saw an exciting shipbuilding contract – the largest in US Navy history, which brings new capabilities to the sub fleet, as well as a backlog of $44.2B. This makes it the highest order year – ever – for Marine systems.

So, in short, things are humming away smoothly, and given the state of the world as we look at conflict zones and tensions, it’s unlikely that the need for General Dynamics’ products – be they defensive, offensive or business/commercial – will stagnate in the near future.

All of this translates to some impressive guided improvements for 2020.

(Source: General Dynamics FY19 Results)

Other fundamentals are equally impressive. The company currently manages a 32% EPS payout ratio, it being part of why the company is ranked as a “97” out of “100” on Simplysafedividends (Source). It grows earnings steady as clockwork, and while FCF is a bit spotty (up and down), this is the character of a company with varying CapEx requirements. Debt is well in hand for a company of this type, even if the latest billion-dollar M&A did increase the Net debt/EBITDA to 3X+. It currently stands at 2.92X based on NTM EBITDA.

General Dynamics – What are the risks?

- The company is a defense company, with large amounts of revenue originating from weapons systems and defense contracts/products or infrastructure. This industry can have cyclical tendencies and is exposed to political realities which, at times, can bring the companies operating it into a tailspin.

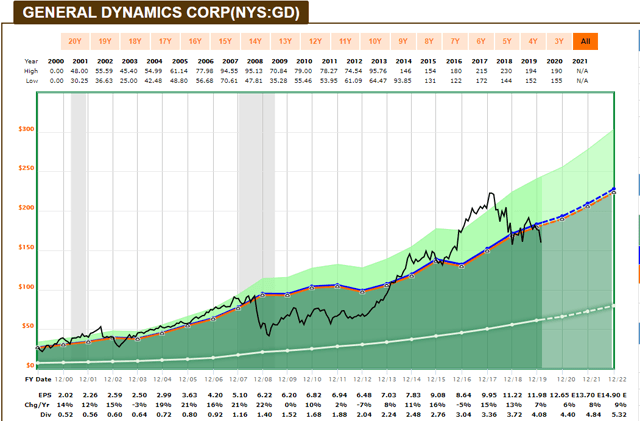

- We need only look at company history to see what a downturn does to the company. During the years following the recession, earnings growth numbers were spotty, ranging from negative 7% to 10-11% earnings growth annually. We’ll look at this more in valuation, but there are market climates where this company’s comparatively small commercial aspect, as opposed to its large government/military one, is a drawback.

- Due to the slow-growing nature of the defense industry as a whole, companies within the industry attempt to boost profitability, synergies and efficiencies through the frequent use of M&As. As we know, these can be risky and seldom do not result in the effects a company wishes.

The fact is, the qualities which make General Dynamics good, can also be an argument for why they at times go down. The heart of the matter is the defense contract revenue – about 50% of the company – which in times of conflict wind-downs can be under extreme variability. This is a fairly unique aspect to the industry here. (Source: Defence Blog)

(Source: Defence Blog)

There is also the not inconsiderable matter of the ethics of investing in a company that researches, develops and manufactures products made to, if not kill other people, at least keep them in check or be used as a deterrent in war. I am personally not bothered by investing in the industry – this is a legal, profitable and admirable business under excellent leadership – but this is a choice each investor needs to make. Arguments could be made that products by many companies ruin people’s lives – defense is just one of the more self-evident of these.

General Dynamics – What is the valuation?

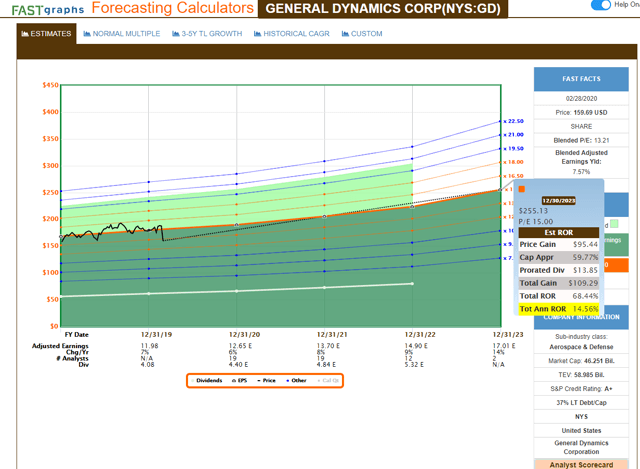

(Source: F.A.S.T graphs)

Here we can see the cadence of a company that is exposed to an interesting sector like defense. Note the rich valuation during the Afghanistan war – and how General Dynamics was essentially unaffected by the Dot-com bubble, followed by the drop during the last recession when the war was winding down and profits fell into a black hole for some years. Once again, this was followed by a resurgence, excessive overvaluation and now a drop back down due to the coronavirus.

An exciting trend, to be certain.

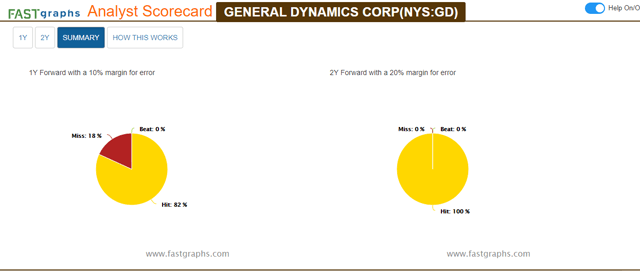

It is to be noted that GD is A+ rated and has a 37% LT Debt/Cap ratio. It’s also to be noted that analyst accuracy is quite good and that the problem forecasts were during the years following the last recession.

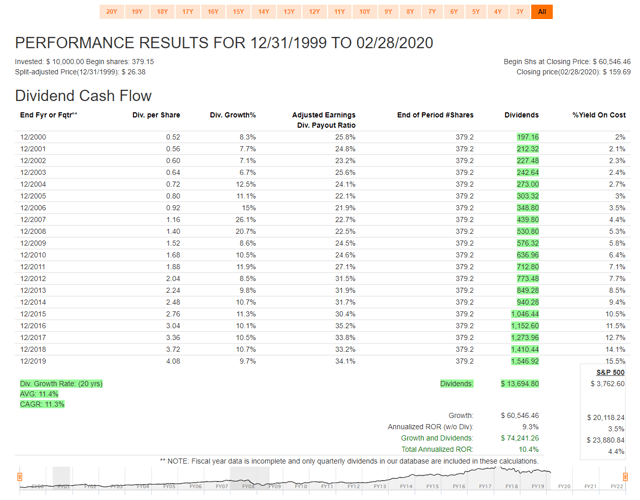

(Source: F.A.S.T graphs)

The money that’s been made long term by owning General Dynamics is quite excellent as well, more than doubling the S&P 500 in terms of total annualized returns, while also maintaining an average 11.4% dividend growth rate over a 20-year period.

More importantly, this dividend growth has been pretty constant – even during the years when earnings were spottier.

Now, current valuation has dropped to an average weighted P/E of 13.21X, despite the fact of a 10Y average earnings growth rate of nearly 9%, and an expected forward growth rate of 9-10%. The company has not been valued this cheaply since 2013, coming out of the earnings slump it was in.

(Source: F.A.S.T graphs)

The potential upside here doesn’t even come close to some of the more speculative and volatile stocks I’ve been covering during the coronavirus scare as of yet. However, the point here is this. This is starting to push down valuations even for companies the market normally considers Grade-A quality businesses. General Dynamics is, as I see it, one of the first of these.

You can currently net a yield of 2.5-2.6% investing in the company – well above its 2017-2018 average yield, which was between 1.65-2.3%. This is the beginning of General Dynamics being undervalued. Its undervaluation isn’t excessive, but the simple fact that it’s traded under 15X forward earnings should be enough to catch your eye.

Fairly valuing General Dynamics according to certain, simplistic formulas at this point isn’t hard. Given its earnings growth rate of 6-10% expected over the next 3 years, I see a 15X P/E valuation as a good marker. On the basis of 2020E earnings, we’re seeing a fair value of $189.75/share.

This means that at just south of $160/share, you could argue that General Dynamics is seeing undervaluation/upside of nearly 20% at this valuation – for one of the best aerospace/defense firms in the world.

And that should be enough to put a smile on your face.

Thesis

General Dynamics has over the course of decades proven itself to be one of the best aerospace/defense firms in the world, and certainly in the US. The very complicated and high-barrier-to-entry character of its industry means it has distinct advantages over other companies seeking to enter, and its track record is absolutely stellar, with a 28-year streak of consecutive dividend increases.

Risks are mainly related to GD’s character as a company. Its greatest strength also becomes its greatest weaknesses in times of troubles, as all of its revenue streams are exposed to either:

- The overall character/status of the global economy (commercial jets/business contracts).

- The overall character/status of governmental defense budgets.

As we can see in the past, it’s not uncommon nor unlikely that these two factors work in tandem to deliver gut punches to General Dynamics’ yearly earnings, resulting in longer periods of stagnation. Historically, however, these periods always end up picking back up again.

Outside of these factors, GD is run by a class-A management team, currently spearheaded by Chairwoman and CEO Phebe Novakovic, a former CIA intelligence officer with experience from the DoD and almost 20 years of experience working for General Dynamics. She also sits on the board of Abbott Laboratories (ABT)

Due to the conservative nature of its business management, the excellent track record of earnings and dividend growth and despite the risks which can be found in aerospace/defense, the many sources of cash flow from contracts and projects laddered across a years-long period of time at any time, makes General Dynamics a company well worth checking out.

As of Friday, I had two buys trigger due to the stock dropping below $160/share, and I’ve slowly started to build my GD position. I can only hope that this market scare continues so that I can continue picking up shares of this company at an attractive and competitive price.

I believe you should consider doing the same.

Stance

Due to recent Coronavirus-related undervaluation tendencies, General Dynamics is a “BUY” with a “Bullish” outlook.

Disclosure: I am/we are long GD. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: While this article may sound like financial advice, please observe that the author is not a CFA or in any way licensed to give financial advice. It may be structured as such, but it is not financial advice. Investors are required and expected to do their own due diligence and research prior to any investment.

I own the European/Scandinavian tickers (not the ADRs) of all European/Scandinavian companies listed in my articles.

Be the first to comment