CloudVisual/iStock via Getty Images

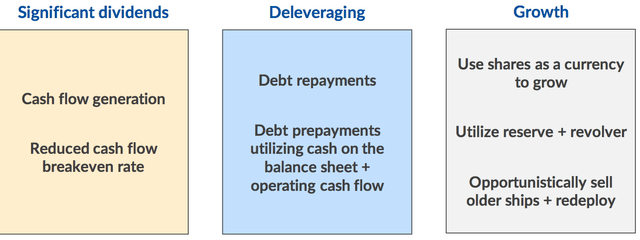

If you’re looking for value in a high yield investment, take a look at Genco Shipping & Trading Ltd. (NYSE:GNK). Genco’s management has adopted a new Value strategy over the past ~year, focusing on 3 elements – dividends, deleveraging, and growth.

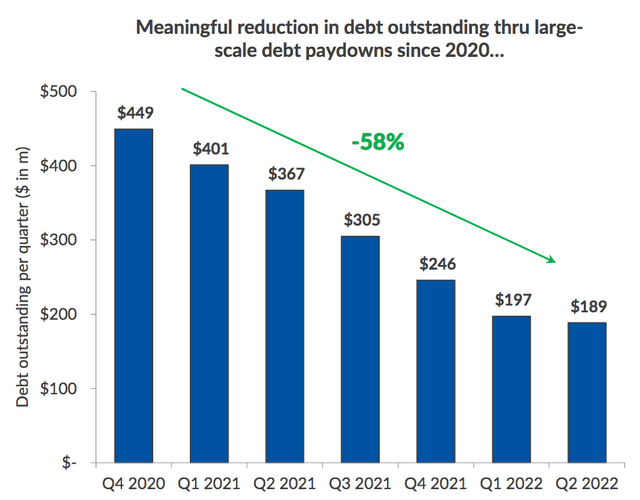

They paid down $203M in debt in 2021, and are paying down $8.75M/quarter in 2022 on a voluntary basis, with a medium-term target of reaching no debt.

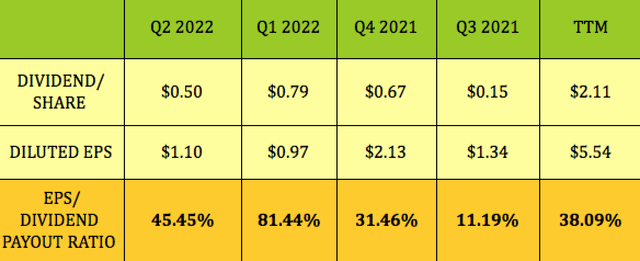

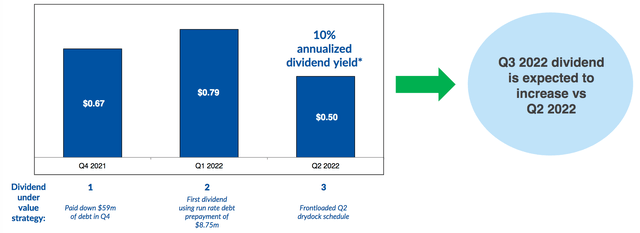

During the most recent 3 quarters, (Q4 ’21-Q2 ’22), we’ve seen the quarterly dividend rise to a range of $.50 to $.79, vs. $.02 to $.10 a year ago; and they’ve been able to achieve a trailing 12-month EPS/Dividend Payout ratio of 38.09%. The payout ratio was a strong 45% in Q2 ’22:

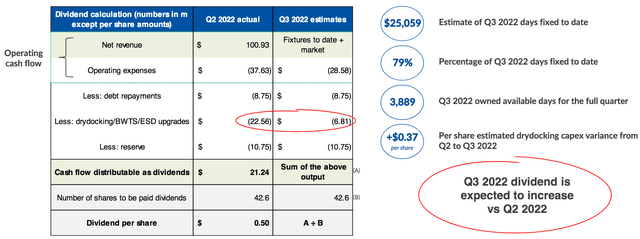

Looking forward to Q3 ’22, management expects the dividend to increase, due to lower drydocking expenses. They front-loaded those expenses into Q2 ’22, and were still able to declare a $.50 dividend.

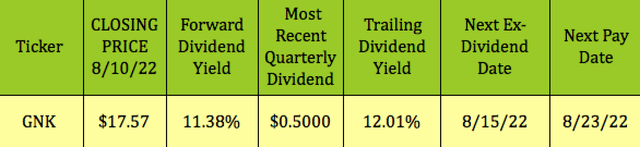

At its 8/10/22 $17.57 closing price, GNK had a forward yield of 11.38%. It goes ex-dividend on 8/15/22, with an 8/23/22 pay date.

GNK’s new dividend policy deducts Debt Repayments, Maintenance Capex, and a reserve from Operating Cash Flow to calculate Distributable Cash Flow for dividends. That figure is then divided by number of shares that are due dividends, in order to calculate each quarter’s dividend/share, which is $.50 for Q2 ’22.

Looking ahead to Q3 ’22, GNK already has 79% of its fleet booked at $25,059 per day, and drydocking expenses are expected to decline by $6.8M. Net Revenue will determine the final figure available for Q3 ’22 dividend distributions.

Profile:

Genco Shipping & Trading Limited is an international ship owning company. We transport iron ore, coal, grain, steel products and other drybulk cargoes along worldwide shipping routes. Its wholly owned modern fleet of dry cargo vessels consists of Capesize, Ultramax and Supramax vessels that provide an essential link in international trade. (source: company resources)

Fleet:

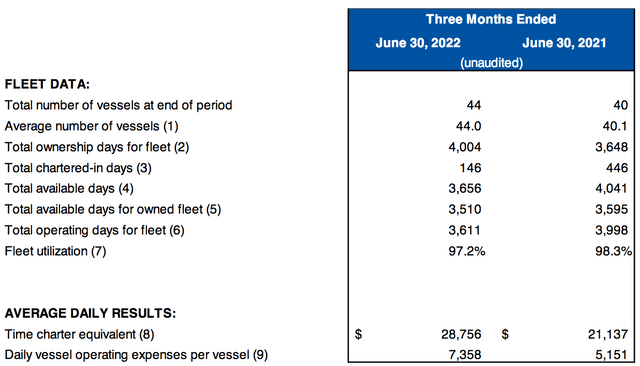

GNK’s fleet consisted of 44 vessels, as of 6/30/22, with the delivery of the Genco Mary and the Genco Laddey, two high quality, fuel-efficient Ultramax vessels built in 2022 at Dalian Cosco KHI Ship Engineering.

Q2 ’22 fleet utilization was slightly lower, at 97.2%, vs. 98.3% in Q2 ’21, but that was overcome by much higher time charter equivalent, TCE, rates of $28,756.00, up 36% vs. $21,137.00 Q2 ’21. Meanwhile, daily vessel operating expenses only rose $2,207.00, lower than the $7,619.00 TCE rate increase:

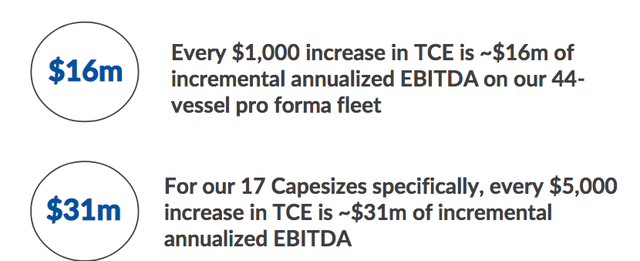

Management estimates that a $1K TCE increase would bring an additional $16M in EBITDA/year from its fleet. They estimate that GNK’s Capesize vessels earn an additional $31M/year in EBITDA per $5K TCE increase:

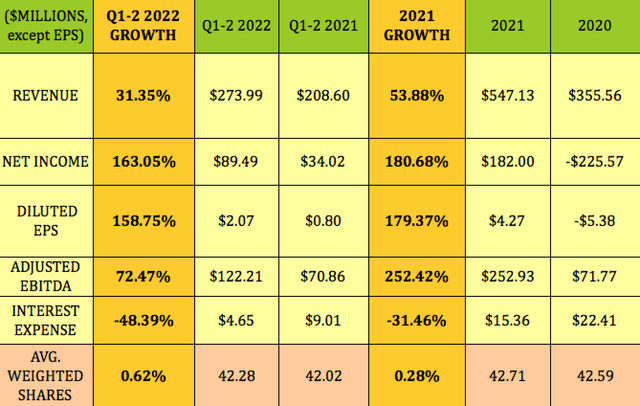

Earnings:

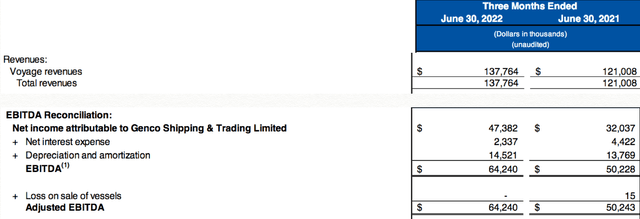

Q2 ’22 earnings were strong, as revenue rose ~14% vs. Q2 ’21, with Net Income rising 48%, and Adjusted EBITDA up 28%.

Q1-2 2022 continued the strong growth pattern of full year 2021, due to much higher shipping rates, with Revenue up 31%, Net Income up 163%, EPS up 159%, and Adjusted EBITDA up 72%.

As in 2021, Interest Expense decreased significantly, down -48%, after decreasing -31% in full year 2021:

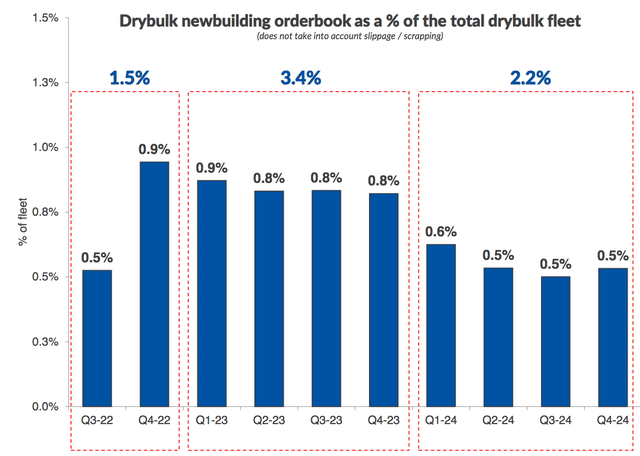

In addition to supply chain and geopolitical issues, the lower rate of newly built vessels has helped to raise shipping rates. More newbuilds are expected in 2023, but will only be 3.4% of the drybulk fleet, while 2024 newbuilds will only be 2.2%, not an excessive addition to the fleet.

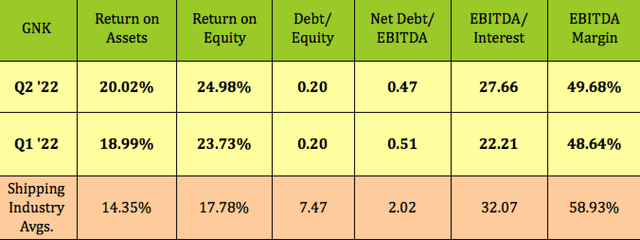

Profitability & Leverage:

GNK’s ROA, ROE and EBITDA Margin all increased sequentially in Q2 ’21, vs. Q1 ’22. Debt/Equity was roughly flat, while EBITDA/Interest coverage improved from 22.21X to 27.66X.

GNK’s ROA and ROE are much higher than shipping industry averages, and its Debt leverage ratios are significantly lower.

Debt & Liquidity:

Management has paid down $260.7m of debt since Jan 2021 or 58% of the previous debt load. GNK has no quarterly debt paydown obligations until 2026, but management has continued to pay down $8.75M per quarter.

Performance:

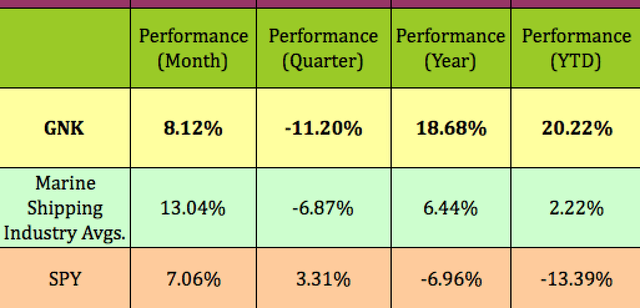

With the success of management’s new dividend and debt paydown policies, GNK has outperformed over the past year, and so far in 2022. However, it did lag its industry and the S&P over the past trading quarter, falling -11%.

It’s up 8% in the past trading month, lagging its industry, but slightly outperforming the S&P:

Valuations:

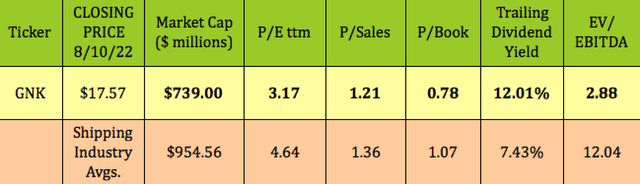

At its lower price level, GNK is selling at 22% discount to Book Value, vs. a 7% average premium to Book Value for the shipping industry. It also looks cheaper on a trailing P/E, P/Sales, and EV/EBITDA basis, in addition to having a much higher dividend yield.

Analysts’ Upgrades & Price Targets:

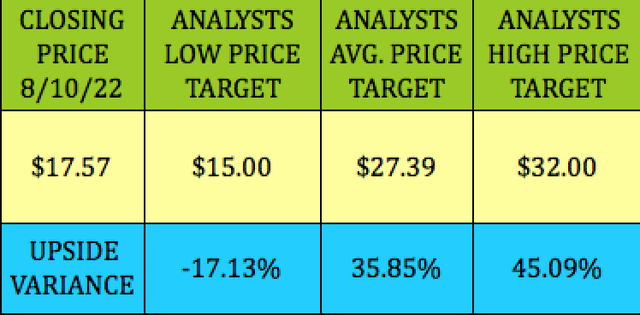

GNK has received Initiation/Buy ratings from 2 analysts in July/August, with Jefferies rating it a Buy, with a $25 price target; and Alliance Global rating it a Buy, with a $29.00 price target.

At its 8/10/22 closing price of $17.57, GNK was ~36% below the $27.39 average price target, and was 45% below the $32.00 highest target:

Parting Thoughts:

GNK looks undervalued; its management is committed to bringing debt down to $0.00, and its dividend policy is offering a very attractive yield. We rate it a speculative BUY, speculative only because the shipping industry is notorious for its ups and downs.

If you get seasick easily, tread lightly, maybe sell some puts below GNK’s price, in order to lower your breakeven. Just don’t bet the ranch, or the yacht.

If you’re interested in other high yield vehicles, we cover them every Friday and Sunday in our articles.

All tables furnished by Hidden Dividend Stocks Plus, unless otherwise noted.

Be the first to comment