Miro Nenchev/iStock via Getty Images

Investment Thesis

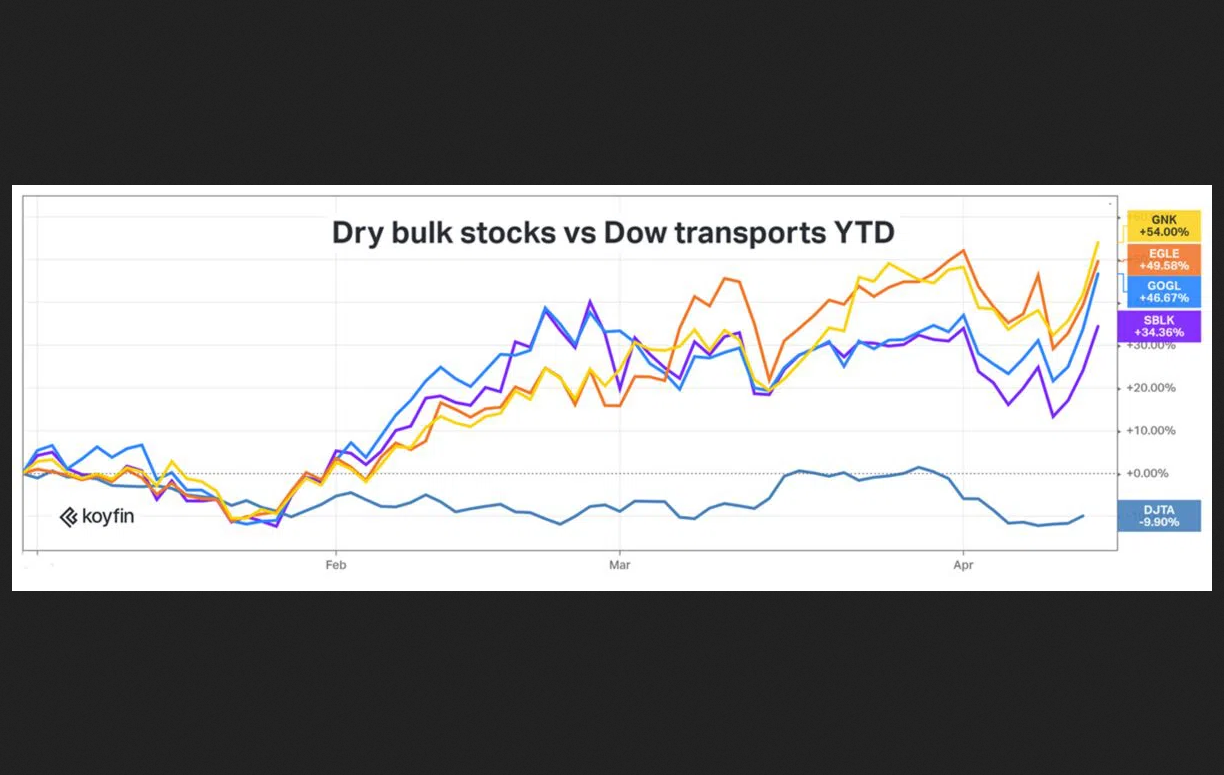

The recovery of the global economy and a strong performance by China is expected to sustain robust global commodity markets and continue fueling the surge in demand for dry-bulk commodities such as coal, iron ore, grains, and other dry-bulk products over the next few years. This is at a time when the availability of shipping capacity is constricted by slow net fleet growth due to the historically low order-book for new ships. These market dynamics and dry-bulk fundamentals should help sustain charter rates at favorable levels.

Genco Shipping & Trading Limited (NYSE:GNK), the largest U.S.-based ship-owning and operating company, is well placed to gainfully exploit arising opportunities.

Supply of Dry-Bulk Shipping Capacity

The market for dry-bulk shipping services is highly competitive with approximately 2,300 independent dry-bulk carrier owners. Shipping capacity supply is mainly shaped by a matrix of factors including the number, size, age, condition, and specifications of vessels.

Recently, availability of shipping capacity has been constricted by higher port congestion (Covid-19 measures and poor weather slowed down port operations) and slow net fleet growth due to the historically low order-book for new ships. New shipbuilding deliveries were down 22% in 2021 YOY. For 2022-2024, there are 308 units of the 25,000 – 68,000 dwt range slated for delivery, a drop of 34% compared with the 2019-2021 period. New bulker orders are being blocked out by those for new container ships and gas carriers, with most slots in yards booked until 2025.

Further, uncertainty surrounding fuel technology options and environmental regulations implementation is making it difficult for owners to confidently place orders for new ships, leading to lower new building orders, and could result in increased scrapping and or slower vessel speeds, thus reducing ship supply. The world fleet is projected to grow by a 1.25% compound annual growth rate until the start of 2026, a slowdown from a 1.44% CAGR for the previous five years.

Demand for Dry-Bulk Commodities Shipping Services

Dry-bulk shipping rates and therefore revenues are largely driven by global economic activity levels. Global volumes of seaborne dry-bulk trade are comprised of 30% iron ore, 17% coal, 14% grains, and 39% others. World trade in dry-bulk commodities has grown considerably over the years. For example, world steel production increased from 129 million tons in 2010 to 1065 million tons in 2020. The Asia Pacific is the fastest-growing regional market due to an increase in iron ore and coal imports to China.

Following the gradual easing of Covid-19-related measures, the global economic activity rebounded in 2021 and is projected to remain fairly firm in the coming few years. The World Bank estimates that the world economy will expand by 4.1% in 2022 and by 3.2% in 2023. United States economy is projected to grow by 3.7% and 2.6% in 2022 and 2023 respectively. For China, estimates are 5.1% in 2022 and 5.3% in 2023. After expanding by 9.5% in 2021, global trade is expected to slow down to 5.8% in 2022 and to 4.7% in 2023, as demand moderates.

Around 1.25 billion tons of coal was loaded on dry-bulk ships in 2021, up from 1.195 billion tons in 2020. The main recipient of this incremental coal was China which imported 285.8 million tons of coal in 2021, some 36.7 million tons higher year-on-year. China’s appetite for seaborne coal surged by 16% in 2021. China, the largest importer of dry-bulk commodities globally, drives demand for iron ore, coal, and other cargoes that Genco carries and on which its business is substantially dependent.

China’s import ban on Australian coal in late 2020 resulted in China importing more from other coal-exporting countries mainly from Indonesia, Russia, and the United States, while other coal-importing countries switched to importing more from Australia.

With the ongoing war in Ukraine, grain shipments from Ukraine have effectively stopped. Several countries have imposed sanctions on Russia with traders, particularly in coal and grain having to find alternative sources such as the U.S., Australia, and South America to help fill the supply gap. This has led to a re-direction of cargo flows, lengthening ton-miles.

Shipping Freight Rates

The rebound in world economies in 2021 and resultant surge in demand for dry-bulk commodities, coupled with rampant port congestion and slowed fleet growth reducing effective ship supply, contributed to a boom in dry-bulk freight rates peaking in October 2021. For Genco, the average Time Charter Equivalent (TCE) rates obtained by the overall fleet increased by 138.7% from $10,221 per day for the twelve months ended December 31, 2020, to $24,402 per day for the twelve months ended December 31, 2021, representing the company’s highest annual TCE since 2010.

TCE rates obtained by the Company’s fleet were $35,200 per day for Q4 2021 as compared to $13,167 per day for Q4 2020. Markets historically exhibit seasonal fluctuation in freight and charter rates which are typically stronger in the fall and winter months in anticipation of increased consumption of coal and raw materials during the winter months. As a result, revenues could be weaker during Q2 and Q3 and conversely, revenues could be stronger during Q4 and Q1.

FreightWaves.com

Although freight rates have retreated from the high levels of Q4 2021, the earnings environment has remained robust with freight rates sustained at quite profitable levels from a historical perspective. Genco’s average daily fleet-wide TCE for Q1 2022 was $24,093, 98% higher YOY and the company’s highest first-quarter TCE since 2010. Based on the current period and spot fixtures, the company estimates Q2 2022 will yield a reasonable TCE of $27,596 for 68% of its owned fleet available days.

Genco had a remarkably strong year in 2021. In spite of a reduction in the average number of vessels from 51.8 in 2020 to 41.6 in 2021, and an accompanying drop in total fleet operating days from 19,204 in 2020 to 16,165 in 2021, the company recorded a$191.6 million or 53.9% jump in revenues from $355 million in 2020 to$547 million in 2021, primarily due to higher freight rates. The decrease in vessels was primarily due to the sale of nine vessels during 2020 and eleven vessels during 2021, partially offset by the delivery of seven vessels during 2020/2021. Revenues for Q1 2022 were $136.2 million compared to $87.6 million in Q1 2021 or a 55% improvement.

Net cash provided by operating activities for the years ended December 31, 2021, and 2020 was $231.1 million and $36.9 million, respectively. Net cash for Q1, 2022 was $52.6 million, a significant improvement from the $13.5 million achieved in Q1 2021.

Value Enhancement

Genco is executing a number of strategies – improving the quality of its fleet, building a cash reserve, reducing debt, lowering its cash flow breakeven levels, and strengthening management – to achieve a competitive advantage in terms of securing charters, better operating-efficiencies, improved financial performance and strengthening of its balance sheet.

The company has since 2020 divested 20 older, less fuel-efficient vessels and boosted the quality of its fleet through the acquisition of nine modern, high specifications, fuel-efficient vessels. The average age of its fleet is 10.2 years compared to the global average of 14 years for dry-bulk carrier vessels. Genco has been fitting its vessels with energy-saving devices and with exhaust-gas scrubbers enabling them to burn cheaper 3.5% sulfur fuel as opposed to expensive 0.5% sulfur fuel.

In September 2021, Genco formed a specialized joint venture company tasked with providing services in technical management, which company is expected to improve Genco’s vessel operations and enhance efficiency. The utilization rate for Genco’s diversified fleet of 44 wholly-owned dry cargo vessels remained high, increasing marginally from 97.1% in 2020 to 97.9% in2021.

Even after spending $66.2 million net on vessel acquisitions and disposals in the year 2021, and $203.2 million on debt repayments or approximately 45% of the beginning of the year debt balance, the company maintained a strong liquidity position with $120.5 million of cash while lowering net loan-to-value (LTV) to 15% as of December 31, 2021.

Consequently, net interest expense decreased by $6.2 million in 2021. Genco paid down an additional $48.75 million of debt during the first quarter of 2022, reducing debt to $197.3 million and bringing the net LTV to 12% as of May 3, 2022. The company says it has lowered its cash flow breakeven levels to among the lowest in the industry. As of March 31, 2022, the company had $49.1 million of cash on the balance sheet. The company is setting aside $10.75 million quarterly towards building a cash reserve to fund vessel acquisitions, debt repayments, and general corporate purposes.

The company recorded a net income of $182.0 million or $4.27 diluted net earnings per share for the twelve months ended December 31, 2021. This compares to a net loss of $225.6 million or $5.38 diluted net loss per share for the twelve months ended December 31, 2020. Net loss for the year 2020 included $208.9 million in non-cash vessel impairment charges. Excluding these items, adjusted EBITDA would have amounted to $252.9 million and $71.8 million for 2021 and 2020 respectively. EBITDA was $58.0 million during Q1 2022.

Riding on improved earnings, the company declared a $0.67 per share dividend for Q4 2021, a nearly 350% increase from the $0.15 per share dividend paid during Q3 2021, representing an annualized yield of 14% on Genco’s closing share price as of February 23, 2022. It declared a $0.79 per share dividend for the Q1 2022, an increase of 18% compared to the previous quarter and representing an annualized yield of over 16% on Genco’s recent closing share price.

The economic recovery and the newfound sector profitability have led to a sharp increase in steel and ship prices. For example, a 10-year-old Capesize vessel was worth about $33 million at end of the year 2021, i.e. 65 – 74% more than at the end of 2020 when values ranged between $19 – 20 million. The value of a new Capesize posted an increase of 18 – 20%, ending 2021 at around $59 – 60 million. Ship scrap prices rose by about 50%.

It is therefore likely that Genco may record significant asset value appreciation based on earnings potential, residual value, and scrap prices.

Conclusion

The recovery of the global economy and a strong performance by China is expected to sustain robust global commodity markets and dry-bulk products demand. Europe’s need to replace Russian coal with coal from further afield is positive for ton-miles and particularly for the larger Capesize vessels.

While factors such as bad weather, Covid-19-related port congestion, and commodity prices that contributed to the huge spike in freight rates in 2022 are likely to be temporary and may wane in the coming periods, in the short to medium term, freight and charter rates and ship valuations continue to have a positive outlook on account of the favorable dry-bulk supply and demand balance, underpinned by the historically low fleet growth, amid an increasingly carbon-conscious environment.

The Baltic Dry Index which provides a benchmark for the price of moving bulk materials by sea was up 45.25% for the year as of May 13, 2022, after rising 178% year-on-year in 2021. Forward freight agreements pricing, time-charter rates, and ship valuations all point to continued strength.

Genco is well-positioned to gain from these favorable market dynamics and dry-bulk fundamentals. The company is already demonstrating its potential with the majority of available ship-days booked at over $27,500 per day for the second quarter of 2022, locking in attractive profit margins and securing cash flows. With every $1000 increase in TCE translating to about $16m of incremental annualized EBITDA or $0.37/share, the company is anticipating a strong financial performance for 2022 and 2033.

As the company’s strategies pay off in terms of reducing loan exposure and the attendant reduction in interest and principal payments, attaining higher asset values and reduced chances of incurring impairment charges, and with no mandatory debt amortization payments due until 2026, the company can in the short to medium term expect to generate significant net cash flows to fund operations, build value and strengthen its dividend-paying ability.

In the long haul, however, the company can expect to incur significant capital expenditure on renewal and scaling up of its fleet as it seeks to dive deep for profit in the volatile sector.

Be the first to comment