da-kuk

Thesis

The Gabelli Dividend & Income Trust (NYSE:GDV.PK) is a closed end fund focused on U.S. equities. The fund has total returns as a primary investment objective. GDV exhibits remarkably robust long-term results and has an accretive NAV which has grown at a 5% CAGR in the past decade. The CEF has a low leverage of 17%, achieved mainly via preferred equity issuance.

There are several ways for a CEF to gain leverage:

- Repo agreements

- TRS (Total Return Swap) Facilities

- Preferred Equity (auction rate, fixed rate, etc)

The best term option is the preferred equity route because it usually has no stated maturity. Preferred equity is usually issued with a five year non-call period and some market participants tend to use that date as a maturity date. Usually it does not work like clock-work, with most funds just arbitraging the market conditions – if they are able to place new preferred equity at better yields then they will do so and the retire the old ones. If that is not the case the “old” preferred will not be retired.

Repo agreements and TRS facilities do offer greater flexibility in terms of a fund leveraging up or down since they have shorter tenors (Repos) or in the case of TRS undrawn commitments (i.e. the fund does not need to utilize the entire borrowing on day 1, and can add or subtract assets within a certain net balance framework).

When an investor looks at CEF preferred equity it should be framed in the same set-up as corporate investment grade bonds. Well performing CEFs with great asset coverage ratios such as GDV will command very high investment grade ratings for their preferred shares and they will have established a very solid track record of issuing and redeeming such shares. Series K from GDV is the latest preferred issuance, and it was used to retire a more expensive slice of the capital structure, namely Series G.

With a Aa3 rating from Moody’s Series K has a 4.25% coupon and a 5.22% yield. The shares are callable starting October 2026, but we feel that due to its low coupon the shares will be outstanding longer. We are viewing this securities as a 6-year duration play. For a buy and hold retail investor looking for a steady source of income from a very highly rated security this is a good yield play. In our opinion there is no credit risk associated with Series K, only interest rate risk. Currently trading at Treasuries + 200 bps Series K is attractively priced versus for example volatile dividend paying stocks. We feel that Series K is to be bought on dips by retail investors looking to hold the security 3 years plus. As interest rates peak the price for Series K is going to bottom with significant upside potential ahead.

GDV Capital Structure

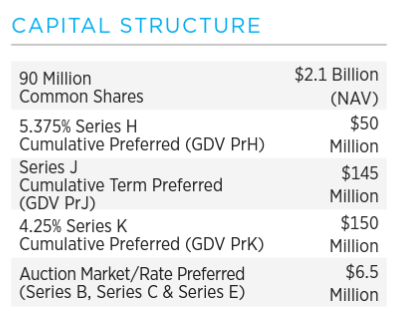

The current fund capital structure is as follows:

Capital Structure (Fact Sheet)

The more expensive Series G Preferred equity was retired upon the issuance of the Series K. We can see that the fund employs a modest leverage ratio of roughly 17%.

Series K Preferred Equity Features

The series was issued in October 2021 and was utilized to retire another tranche of preferred equity from GDV:

The Fund intends to use a portion of the net proceeds from this offering to redeem all or a portion of the Fund’s outstanding Series G Preferred Shares. The Fund intends to call all or a portion of the Series G Preferred Shares for redemption within three months of the completion of this offering

Source: Prospectus

The shares are not callable (absent force majeure) until October 2026:

The Series K Preferred Shares generally may not be called for redemption at the option of the Fund prior to October 7, 2026. The Fund reserves the right, however, to redeem the Series K Preferred Shares at any time if it is necessary, in the judgment of the Board, to maintain its status as a regulated investment company (a “RIC”) under Subchapter M of the Internal Revenue Code of 1986, as amended (the “Code”). The Fund may also be required under certain circumstances to redeem Series K Preferred Shares before or after October 7, 2026, in order to meet certain regulatory or rating agency asset coverage requirements.

Source: Prospectus

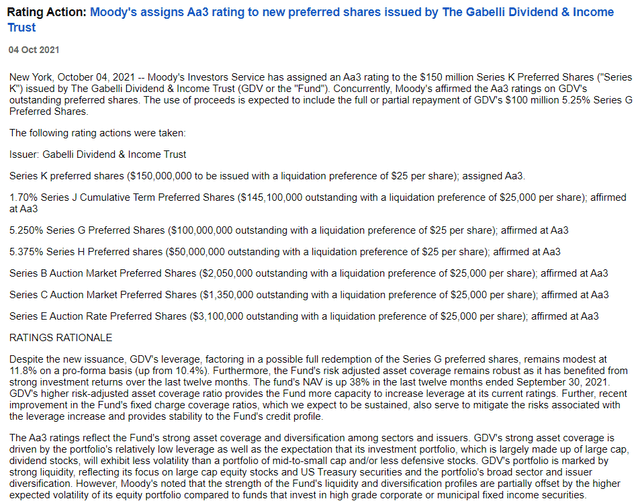

Upon issuance the coverage ratio for Series K was above 600%, which drove its very high investment grade rating from Moody’s (rated Aa3):

Pursuant to the 1940 Act, the Fund generally will not be permitted to declare any dividend, or declare any other distribution, upon any outstanding common shares, purchase any common shares or issue preferred shares, unless, in every such case, all preferred shares issued by the Fund have at the time of declaration of any such dividend or distribution or at the time of any such purchase or issuance an asset coverage of at least 200% (“1940 Act Asset Coverage Requirement”) after deducting the amount of such dividend, distribution, or purchase price, as the case may be. As of the date of this Prospectus Supplement, all of the Fund’s outstanding preferred shares are expected to have asset coverage on the date of issuance of the Series K Preferred Shares of approximately 668%

Source: Prospectus

Credit Risk

The Series K are highly rated by Moody’s:

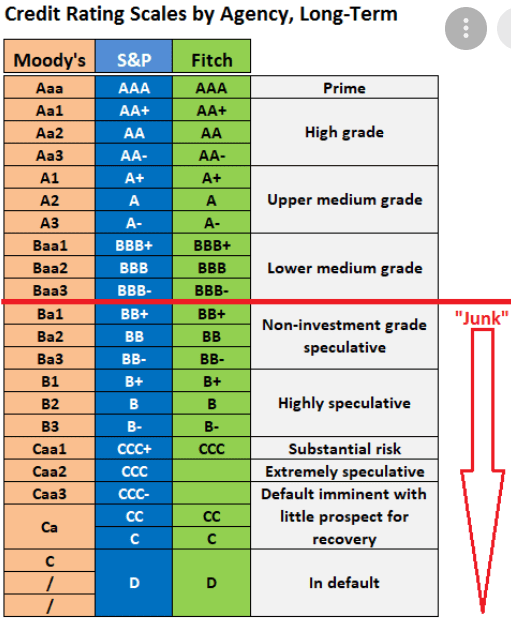

Aa3 is one of the highest investment grade ratings. As a reminder this is how the rating scale looks like:

Credit Ratings (Credit)

Given the significant asset coverage and unleveraged profile the Series K have a very low probability of default.

Interest Rate Risk

This is where all the risk associated with the preferred equity lies. Being the last issuance out of the trust and done at a very low attractive fixed rate the Series K will have a long duration. We do not anticipate the shares to be redeemed on their first call date in October 2026, unless we see another zero rates environment. This Series was placed at a very attractive yield for the trust.

The series is currently trading at a 5.22% yield, which in the current set-up represents Treasuries + roughly 200 bps:

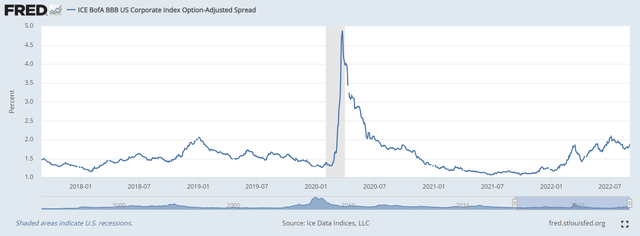

Investment Grade Bonds spreads (The Fed)

We can see that the current BBB investment grade corporate spread is close to roughly 2%, having widened out on the back of the risk sell-off. However the main component of the GDV.PRK yield is the risk free rates component, where we are using 5-year treasuries as a benchmark.

Conclusion

Series K is the latest preferred equity issuance from the GDV trust. Highly rated at Aa3 the securities are an attractive play for a buy and hold investor. The main pricing driver are interest rates and the high duration of the series (we are thinking of it as a 6-year duration bond despite the October 2026 call date). Currently priced at Treasuries + 200 bps the Series offers a compelling yield of 5.22% versus much more volatile dividend paying stocks. If you are looking to extract yields above 5% with virtually no default risk and de-minimis volatility GDV.PRK is an attractive choice.

Be the first to comment