British Pound (GBP) Price Outlook – GBP/USD Chart and Analysis

- UK Budget on Wednesday will guide Sterling this week.

- GBP/USD battling with 1.4000 again.

Recommended by Nick Cawley

Download our Q1 Sterling Forecast

The UK Chancellor Rishi Sunak will present his Budget on Wednesday (12:30 GMT) saying that he will ‘level’ with the population over the enormous costs of countering the covid-19 pandemic. The Chancellor is expected to extend various payments, including the furlough scheme, until June in order to boost the economy ahead of the scheduled re-opening. According to media sources, Mr. Sunak will warn of future tax hikes, both personal and corporate, in an effort to start to cover some of the estimated pandemic cost of GBP300 billion.

The UK vaccination program continues at full speed with in excess of 20 million people vaccinated with at least one dose. The UK government’s next ambitious plan is to offer vaccinations to all over-50s by mid-April. In the last seven days, just over 2.5 million first doses were administered and just over 180,000 second doses.

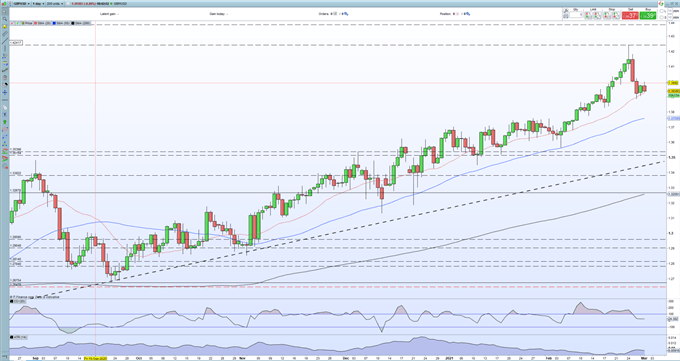

Sterling is backing off again this week against the US dollar after printing the first negative weekly candle last week in nearly two months, despite making a fresh near-three-year high of 1.4242. The sell-off occurred as US Treasury bond yields jumped, boosting the greenback, as investors continued to worry about inflationary pressures further down the line. Cable is currently trading around 1.3935 and looks likely to re-test 1.3900 soon, although support off the 20-day simple moving average at 1.3930 and last week’s low at 1.3888 should stem any further sell-off.

GBP/USD Daily Price Chart (August 2020 – March 1, 2021)

| Change in | Longs | Shorts | OI |

| Daily | 13% | 12% | 13% |

| Weekly | 31% | -35% | -13% |

Retail trader data show 49.35% of traders are net-long with the ratio of traders short to long at 1.03 to 1. We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests GBP/USD prices may continue to rise.Yet traders are less net-short than yesterday and compared with last week. Recent changes in sentiment warn that the current GBP/USD price trend may soon reverse lower despite the fact traders remain net-short.

Traders of all levels and abilities will find something to help them make more informed decisions in the new and improved DailyFX Trading Education Centre

What is your view on Sterling – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author via Twitter @nickcawley1.

Be the first to comment