British Pound (GBP) Price Outlook

- Strong local election results, vaccination data, boost interest in UK plc.

- GBPUSD takes out multi-week resistance.

- FTSE 100 pushing ever higher.

UK PM Boris Johnson is expected to outline further plans to re-open the UK economy later today, in a further boost to UK assets. The government made further gains in last week’s local elections, buoying the faith in PM Johnson, while Labour leader Sir Keir Starmer re-shuffled his team over the weekend as dark clouds loom over the leader of the opposition. In Scotland, the SNP kept hold of power, as expected, but just missed out on winning a majority. The First Minister of Scotland, Nicola Sturgeon, has already said that a new independence referendum is a case of ‘when not if’ but the SNP is unlikely to set out further plans until next year.

The latest UK covid-19 and vaccination data show the government’s program continuing to forge ahead with over 67% of the population having had at least of jab, while 33.5% have received two jabs.

For all market-moving economic data and events see the real-time DailyFX calendar.

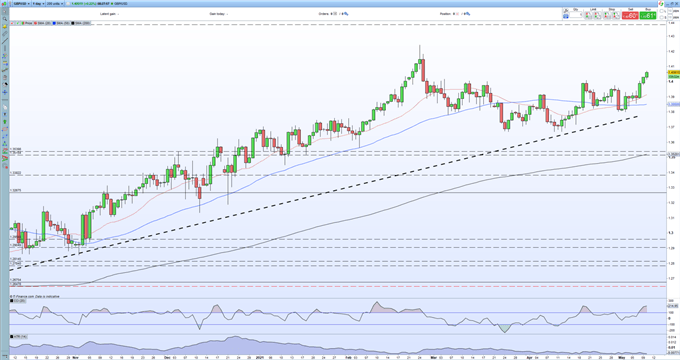

GBP/USD currently trades at its best level in two-and-a-half months, driven higher by a combination of positive Sterling sentiment and a weak, post-NFP, US dollar. Friday’s US Jobs Report missed expectations of one million new jobs by a wide margin, while last month’s number was also revised sharply lower. The greenback fell on the release as traders pushed back expectations of taper talk to the backend of the year. The daily chart shows little in the way of strong resistance before the February 24 high at 1.4242. This level will need further positive data readings and sentiment flows before it comes under pressure. The CCI warns that GBP/USD is heavily overbought.

GBP/USD Daily Price Chart (October 2020 – May 10, 2021)

Retail trader data show 40.67% of traders are net-long with the ratio of traders short to long at 1.46 to 1. The number of traders net-long is 1.99% higher than yesterday and 37.68% lower from last week, while the number of traders net-short is 2.69% higher than yesterday and 51.79% higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests GBP/USD prices may continue to rise.Traders are further net-short than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger GBP/USD-bullish contrarian trading bias.

The FTSE 100 has seemingly broken its inverse relationship with Sterling and is also pushing higher. The UK big board continues to make a fresh 14-month high and is now testing the bullish channel that has dictated price action since late-January. Again, the market looks overbought and may need a period of consolidation before further gains are made.

FTSE 100 Daily Price Chart (September 2020 – May 10, 2021)

Traders of all levels and abilities will find something to help them make more informed decisions in the new and improved DailyFX Trading Education Centre

What is your view on Sterling and the FTSE 100 – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author via Twitter @nickcawley1.

Be the first to comment