Birdlkportfolio/iStock via Getty Images

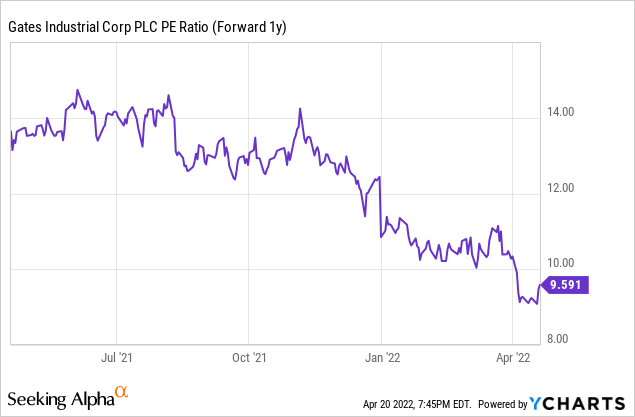

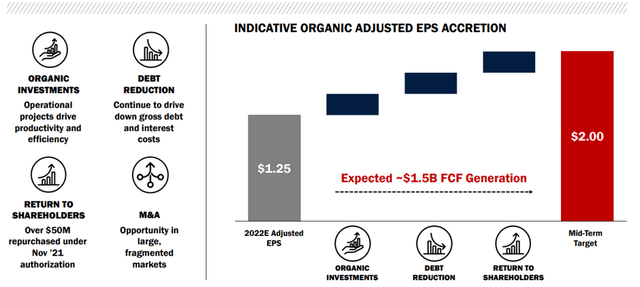

Gates Industrial Corporation (NYSE:GTES) is the global leader in Power Transmission and Fluid Power equipment products, components, and solutions. While industrial production weakness has dragged down GTES’s end market performance in the last year or two, signs of a recovery are emerging – recent manufacturing data from the Fed, for instance, points to further expansion ahead. GTES is a natural beneficiary of this short-cycle industrial demand pickup, and thus, the updated mid-term EPS guidance of $2.00/share (almost double the $1.25/share in 2022) certainly checks out, in my view. Coupled with the massive long-term growth and margin opportunities in fast-growing areas like EVs, as well as the capital deployment optionality, GTES’s upside potential seems under-appreciated at the current ~10x fwd P/E (or ~7x mid-term EPS guidance).

Ample Growth Opportunities Support the Mid-Single-Digit Growth Outlook

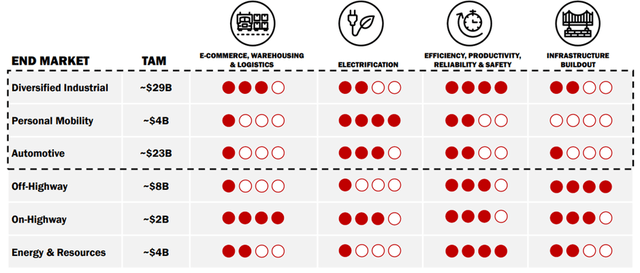

GTES has ample room for long-term growth – of its total addressable market (TAM) opportunity of ~$70bn, it only holds an overall market share of ~5% as of 2021. By vertical, Diversified Industrial offers the largest TAM at ~$29bn and presents the clearest runway for market share growth within the GTES portfolio, given the company only commands a ~2.5% share. By contrast, the company commands the leading share within the $14bn On-Highway, Off-Highway, and Energy & Resources vertical at ~9%. Assuming it holds share here and drives above-market growth rates through its leading positions in other verticals such as Power Transmission and Fluid Power, GTES should deliver on its mid-single-digit organic growth target. Industrial end-markets can be cyclical, though, and thus, GTES’s high levels of new product vitality and investments into Digital Tools are positive steps as it looks to build out a growth runway for the long-term. Plus, I wouldn’t rule out new TAM opportunities down the line – innovation has been a key part of the company’s DNA, as shown by its consistent new product family/platform launches (around six per year on average).

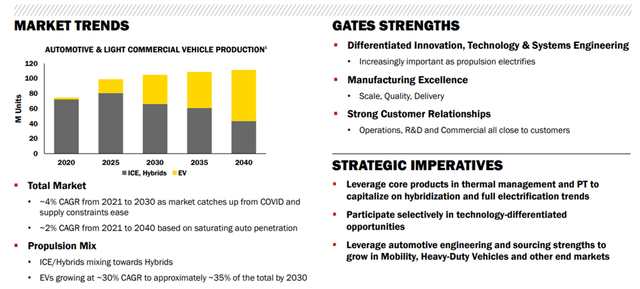

Uniquely Positioned to Capitalize on Electrification Tailwinds

Among the key highlights from GTES’s investor update was the introduction of a ~75% new energy vehicle mix target for 2030 (up from ~10% of 2021 revenue). The move shows intent, having already shrunk its commoditized, lower-margin ICE business. In the meantime, GTES is coming to market with newer applications and products that can generate higher-quality revenues and margins. Its SKU expansion efforts allow it to tap into a bigger addressable market over the long term – GTES will be able to serve >95% of the North American EV market over the mid-term (vs. ~85% prior). With EV production set to grow at a 30% CAGR, reaching ~35% of total vehicle sales through 2030 (and ~60% through 2040), GTES is uniquely positioned to benefit.

Gates Corporation Investor Day 2022 Deck

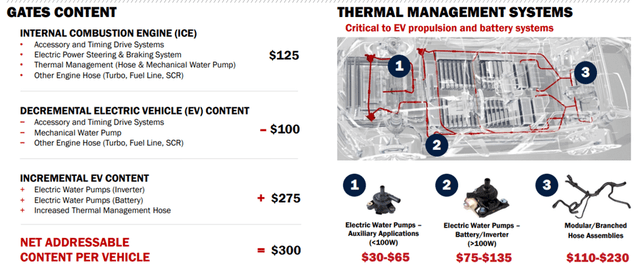

The shift to electric vehicles won’t be smooth, as ~$100 in content is guided to be lost per vehicle, mainly from the Power Transmission segment. However, EVs also have more complex thermal management systems, and thus, Gates will more than offset the loss with an additional ~$275 of Fluid Power content. Net, this means an incremental $175 worth of content per vehicle (a ~2.4x average content uplift) when shifting from ICEs to EVs. Assuming hybrids also play a role in the transition, GTES could gain even larger benefits – management guided to an additional ~$325 in content per hybrid unit (a ~2.6x average content uplift relative to ICEs). Beyond passenger vehicles, GTES also stands to gain from near-term opportunities in personal mobility, including e-bikes, e-scooters, and e-motorcycles, all of which are seeing electrification occur at a faster pace. Given that the dollar content per unit is not only higher on mobility applications, but there are also twice as many personal mobility units (vs. ICE vehicles), I suspect electrification tailwinds could drive meaningful upside to the long-term GTES growth trajectory.

Gates Corporation Investor Day 2022 Deck

Accelerated Deleveraging Target Creates Capital Deployment Optionality

GTES’s net leverage target has been updated to “less than 1.5x,” which seems aggressive at first blush, given the emphasis on M&A opportunities as well. Still, management has been adept at executing the deleveraging playbook, with net leverage now at 2.6x – well within the prior 2.0x-3.0x long-term net leverage target and significantly below the 4.3x net leverage in 2020. Plus, the accelerated debt paydown schedule is supported by a base case outlook for increased cash generation and adj EBITDA growth, so any incremental M&A contribution would add upside to its targets. Beyond acquisitions, ongoing initiatives to improve net leverage levels also provide added optionality for capital deployment in the form of buybacks and reinvestments into the core business. The latter could prove particularly accretive given GTES’s new product platforms have driven a robust>25% CAGR in vitality revenues and generate strong ROICs. On balance, I feel comfortable underwriting the mid-term EPS target of $2.00/share (ex-M&A) as the base case, with any potential M&A accretion likely to drive incremental upside to the earnings power.

Gates Corporation Investor Day 2022 Deck

Blackstone Continues to Pare Ownership, but it’s Not All Bad News

GTES’s key financial sponsor, Blackstone (BX), remains the key technical overhang. Having announced another secondary offering of up to 5m shares (with an additional 750K greenshoe) last month, BX might be looking for a gradual exit. In response, GTES has entered into a share repurchase contract to purchase up to 8m shares from BX. Even including the underwriter’s option, however, the latest share sale would only reduce BX’s ownership to ~61% (from ~66% before), so the selling pressure is likely far from over. On the other hand, the stream of secondary offerings by BX will improve liquidity, while share repurchases by GTES (backed by a reinforced balance sheet) should help minimize the impact of BX paring down its ownership and are likely accretive given the depressed multiple. Assuming future reductions in the sponsor overhang will continue at a gradual pace (BX previously executed secondary offerings in February and August 2021), I think GTES’s ability to unlock its mid-term earnings power will be the more important factor to the stock.

Underappreciated Earnings Power

Since its PE ownership and subsequent IPO in 2018, GTES has struggled to shed its over-leveraged balance sheet. Things are changing for GTES, however, as the company is on track to bring net leverage down to ~1.5x, creating capital deployment optionality. Plus, GTES should benefit from a near-term industrial rebound and continued outgrowth across its main end-markets, driving a $2/share mid-term EPS scenario. Given the current guidance does not incorporate inorganic benefits, the GTES earnings growth algorithm could accelerate if management successfully executes a bolt-on M&A strategy. Clearly GTES cannot control a potential sell-down by its sponsor or the direction of input costs, but the ~10x fwd P/E valuation should provide sufficient buffer against much of the downside.

Be the first to comment