Sky_Blue

Note: A preliminary version of this report was previously shared on Value Investor’s Edge in early-October and GasLog Partners (NYSE:GLOP) was added to our Speculative Model at $5.60.

The LNG Shipping Sector is Surging

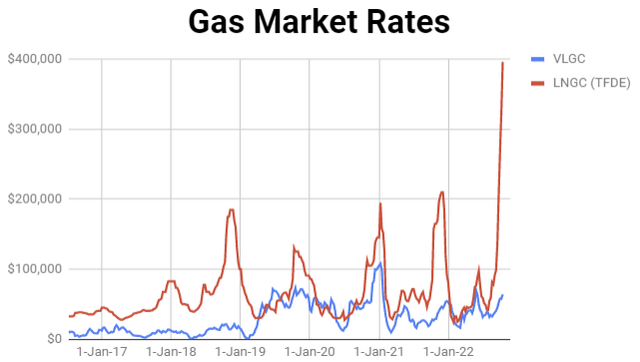

The LNG shipping sector is buoyed by an extreme shortage of ships available on the spot market at a time when the EU is panicking about potential gas shortages and Asia is filling up reserves ahead of the winter season. The LNG shipping sector is highly seasonal, but rates typically ramp from October-January; this year, rates are spiking nearly two months ahead of schedule, with a slew of strong charters in August-September. $300kpd rates in September have quickly given way to $400kpd, and natural gas arbitrage between the U.S. and Europe could support rates up to nearly $1M/day.

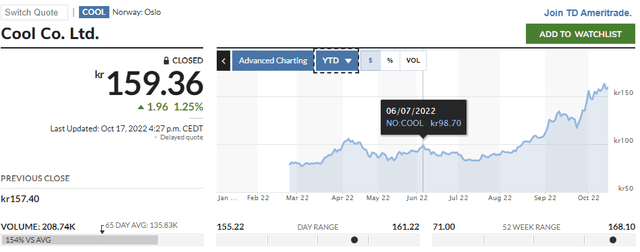

The LNG sector has been a fairly obvious trade since the invasion of Ukraine and subsequent sanctions; however, one firm with excellent upcoming spot exposure has not moved a muscle: GasLog Partners, which is trading barely flat y/y, and is still down(!) from yearly highs set back in June 2022.

Source: Google Finance, GLOP 1y Chart

Meanwhile, top market favorites, such as Flex LNG (FLNG) have returned 54% on a y/y basis and that is before dividends; including outsized dividends, FLNG has provided investors with a y/y total return of 68%, which compares to GLOP with a total return of just 20% from last November. Flex has a more modern fleet; however, that is a meaningless statistic since the entirety of their fleet is fixed on charters with minimal exposure to rising rates. The closest true comp to GLOP is Oslo-listed CoolCo (Oslo: COOL), which has surged by 61% since June 2022 highs. If GLOP had performed similarly to its closest comp, then the units would trade at nearly $11.50 today.

Source: MarketWatch, COOL YYD Chart

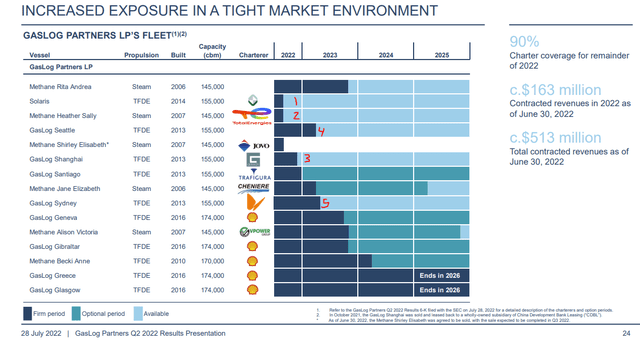

COOL company is an exciting firm because they have 1 ship currently open, 2 more into-early 2023, and a 4th opening mid-2022 (50% of the fleet). Meanwhile GLOP has a total of five vessels available between now and mid-2023 (6th open in fall 2023) and the rest of their fleet is fixed on strong legacy charters.

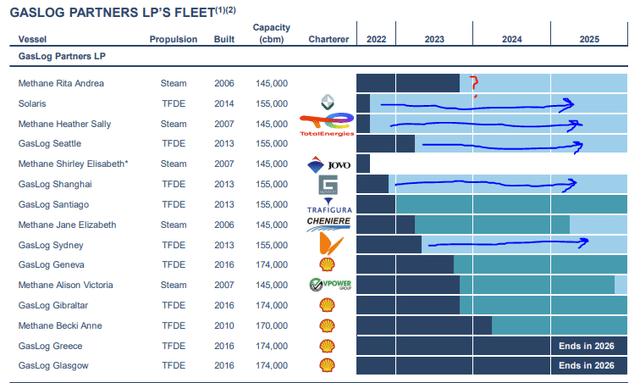

Source: GasLog Partners, Q2-22 Presentation, Slide 24

Furthermore, GLOP has very high financial leverage, including a thick stack of preferred equity (all-in leverage of 71%), which means incremental free cash flow will rapidly accrue to common equity valuations. Although investors typically prefer a lower- to moderate-leveraged company, in a market boom, you want the highest (within reason) financial leverage possible.

Remember Danaos Corp. (DAC), from $5 to $100+? Those sorts of returns were only possible due to the combination of massive rate surges combined with extreme leverage. GLOP is not going to be a 20x, but there is a very clear pathway to yearly gains of 3x or more if LNG rates remain strong.

Our current GLOP ‘fair value estimate’ at Value Investor’s Edge is $7.50/unit; however, this is more of a ‘floor valuation’ as it already includes a heavy discount for subpar governance structure (Limited Partnership) and the riskier balance sheet. NAV is already around $10/unit, and that is before including any of the cash flow generated during July, August, September, or October. Q4-22E NAV (i.e. what we can expect by January 2023) has already blown past $12/sh and is likely to land around $15.00 by January.

GasLog Partners Overview

GasLog Partners LP is a limited partnership controlled by (formerly public) general partner GasLog Ltd. GLOP owns a fleet of 14 LNG carriers (2006-2016 built). GLOP was originally designed as a funding vehicle for parent GLOG and carried super-premium valuations (200-300% NAV) due to its hefty distribution payments. This structure was clearly unsustainable, and the stock eventually collapsed as GLOP slashed their payout from $0.561 all the way down to $0.01/qtr across a series of cuts back in 2019-2020.

GLOP has fallen by around 70% over the past three years and they have burned a lot of previously unsuspecting income investors; however, the core fleet and most of the underlying equity value remains intact. What was once a grossly overvalued and overleveraged company with a rickety fleet is now emerging as a near-perfectly positioned firm to benefit from the cycle uptick.

Source: Google Finance, GLOP 5y chart

Although GLOP owns the oldest fleet in the LNGC sector with an average age of 10 years, this is the type of market where the age of the vessel makes little difference. GLOP’s TFDE ships (4 of the 5 openings) match perfectly to the TFDE benchmark index, which just recently hit all-time highs of about $400kpd. They have one modern steamer vessel, which will likely be fixed at a discount of $30-$40kpd to prevailing market rates (still an adjusted quote of over $300kpd today). This compares to normalized rates of close to $50kpd.

Source: Value Investor’s Edge, based on Clarkson’s Shipping Intel

This is a seasonal market, and the time to strike is normally limited; however, if the conflict in Ukraine continues to escalate, this could be a multi-year phenomenon until much needed export capacity and new ships arrive between 2024-2026.

Share Capitalization & Balance Sheet

GLOP currently has about 52.4M units outstanding for a market capitalization of about $365M. GLOP also has $322M outstanding in preferred equity (GLOP-A, GLOP-B, and GLOP-C). The preferred equity caps at $25/sh (all three instruments already trade right around $25), and all incremental equity gains will flow directly to common equity value.

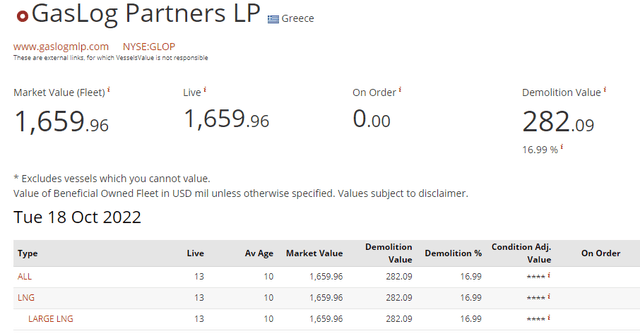

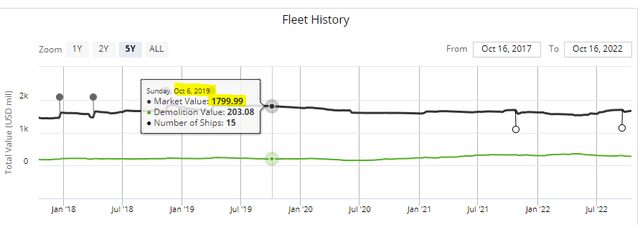

Following the sale of one of their oldest assets this summer, the remaining total net bank debt, as of 30 June, was $876M. This compares to a total current fleet value of nearly $1.8B per the latest numbers from VesselsValue (note: the chart below does not include the “GasLog Shanghai,” which is controlled via a 5-year bareboat lease and last valued at $135M).

Source: VesselsValue, GasLog Partners Fleet Summary

Even though we have highlighted GLOP’s high overall leverage, the actual net bank debt is just 49% debt-to-assets (“D/A”), which is easily manageable in a surging market environment. The rest of the leverage is contained via the aforementioned $322M of preferred equity.

EPS Potential: Over $1.00 by Q1-23, $5-$8 in FY23

GLOP recently reported Q2-22 adjusted earnings of $0.37 per unit, which was prior to fixing any of their upcoming openings at higher rates. If we assume they can fix three of their near-term openings at rates which are just $125kpd above previous levels (the current spread is over $300kpd), then GLOP could potentially produce quarterly earnings of over $1.00 by Q1-23. Annual earnings in 2023 could range from $4.00 to nearly $8.00 depending on contract results across the five upcoming openings (i.e. will GLOP pursue multi-year charters at closer to $150kpd, or lock mega spot rates earlier?).

If GLOP aims for longer-duration at lower rates, FY23 could be closer to $4-$5/sh in earnings, but we would also see very strong and similar returns in 2024-2025 as those contracts produce huge FCF alongside legacy charters. All of the other optional periods are heavily in-the-money for legacy customers, so these are almost certainly to be extended to 2024-2025+. The “Methane Rita Andrea” is the 6th ship to open up in late-2023 and I believe it could be sold for up to $100M for use as an FSRU conversion candidate.

Source: GasLog Partners, Q2-22 Presentation, Slide 24, marks added

Asset Valuations Haven’t Moved (Yet)!

The most remarkable thing about GLOP and its underlying NAV ($10.01/unit as of 30 June financials) is that the underlying asset values themselves haven’t even budged upwards yet, with roughly the same values seen in fall 2019 ($1.8B fleet valuation).

Meanwhile, LNG newbuilds have surged from $180M to recent quotes of nearly $250M (+39%), and many of these new ships won’t even hit the water until 2025-2026. If we assume just a moderate increase of 25% to GLOP’s current fleet value, this adds another $450M in value ($8.50/unit), and would result in a pro forma NAV of roughly $18.50/unit. If we include the next few quarters of strong free cash flows along with a 25% asset appreciation, then GLOP could reach a NAV into the $20s by mid-2023.

Source: VesselsValue, GLOP Fleet Valuation History

Risk Factors

The biggest risk factors to an investment in GLOP primarily mostly revolve around lower quality governance and uncertainty on market execution:

- Disappointing Charters: LNG shipping rates could be a ‘flash-in-the-pan’ and GLOP might not be able to secure meaningful charter upside from their upcoming openings. Management might also have poorly timed some of their openings and the two upcoming ships might have already been contracted at below-market rates. Either of these outcomes would mean that GLOP might otherwise end up earning closer to $3.00/sh per year for the next 2-3 years as opposed to peaking closer to $8.00.

- Lower Governance & Takeunder Bid: The governance quality is lower due to an LP structure, which means privately-held GasLog (in partnership with BlackRock (BLK)) could attempt to squeeze value out of the thinly-traded limited partner by keeping distributions tiny and then sneaking in a ‘take-under’ deal at a ripoff price. For instance, GasLog could try to take GLOP private at $10-$15 in coming months, and the bombed out investors in the equity market might be ‘dumb’ enough to sell $20.00 worth of equity for closer to $12.00. We have seen these sorts of deals accomplished already four times in just the past two years via GasLog, Hoegh LNG, Teekay LNG Partners, and most recently with Hoegh LNG Partners. If GasLog wants to sneak out a take-private, expect another tiny $0.01/qtr dividend in November followed by a takeunder bid shortly thereafter (perhaps as soon as December) as short-sighted retailers might throw a fit over the “tiny distribution” and blindly sell off their units.

- Heavy Focus on Deleveraging: Although GLOP’s balance sheet is otherwise in decent shape, management might decide to be ultra-conservative and plow most of the excess 2023-2024 free cash flow into reducing debt. Retail investors are typically shorter-term focused and also tend to favor companies with higher dividend yields. If GLOP pushes into deleveraging as opposed to raising the dividend or repurchasing units, valuations could languish at a large discount to NAV.

- Pivot to Growth Spending: With GLOP about to be flush with excess cash, management might decide to spend cash buying heavily-priced ‘dropdown’ assets from the private GasLog parent company. While these deals would not necessarily destroy value, it could blunt near-term returns and lead to a lower valuation closer to $10-$15 as opposed to $20-$25.

These are all legitimate risk factors to an investment in GLOP and are all reasons why terminal valuations could be closer to the $10ish range as opposed to potential bullish valuations into the $20s.

Since we lack visibility on near-term charter progress (the last public update was shared on 28 July) and we are not sure what the upcoming capital allocation decisions will look like, our official ‘fair value estimate’ at Value Investor’s Edge (which is more like a ‘floor valuation’ as this point since it assumes virtually the worst outcomes on everything) is just $7.50/unit as opposed to current NAV around $10.00, pro forma (January 2023) NAV around $15.00, and potential mid-2023 valuations into the $20s.

Once GLOP reports updates and management shares their plans, I will adjust our ‘fair value estimates’ accordingly. I expect GLOP will report their Q3-22 results between the last week of October and early-November 2022 and precedent suggests we could see results as soon as Thursday, 27 October!

Conclusion: Buy GLOP, Best Risk/Reward in LNG

I believe GasLog Partners offers the best risk/reward setup in the current LNG shipping environment. We have already set our ‘fair value estimate’ at a significant discount to account for the riskier balance sheet, subpar governance structure, and uncertain near- and mid-term spot and charter market outcomes. I believe a reasonable floor/worst-case valuation is $7.50/unit and we could reasonably see valuations of $15+ within a few months.

We added GLOP to our Speculative Model portfolios at Value Investor’s Edge in early-October at an effective price of $5.60/unit. I will re-evaluate the prospects of GLOP based upon the upcoming Q3-22 report and update our ‘fair value estimate’ based upon charter fixture success and capital allocation guidance. If GLOP management handles this transition well and plays fair with investors, we could see units trade closer to a pro forma NAV of $15/unit by January and potentially closer to the $20s by the middle of next year.

Be the first to comment