sandsun/iStock Editorial via Getty Images

Garmin (NYSE:GRMN) designs, develops, manufactures, markets, and distributes a range of wireless devices in the Americas, the Asia Pacific, Australian Continent, Europe, the Middle East, and Africa. Its operations can be categorized into five main segments: fitness, outdoor, aviation, marine and auto. The firm markets its products through independent retailers, online retailers, dealers, distributors, installation and repair shops, and original equipment manufacturers, as well as an online webshop, garmin.com.

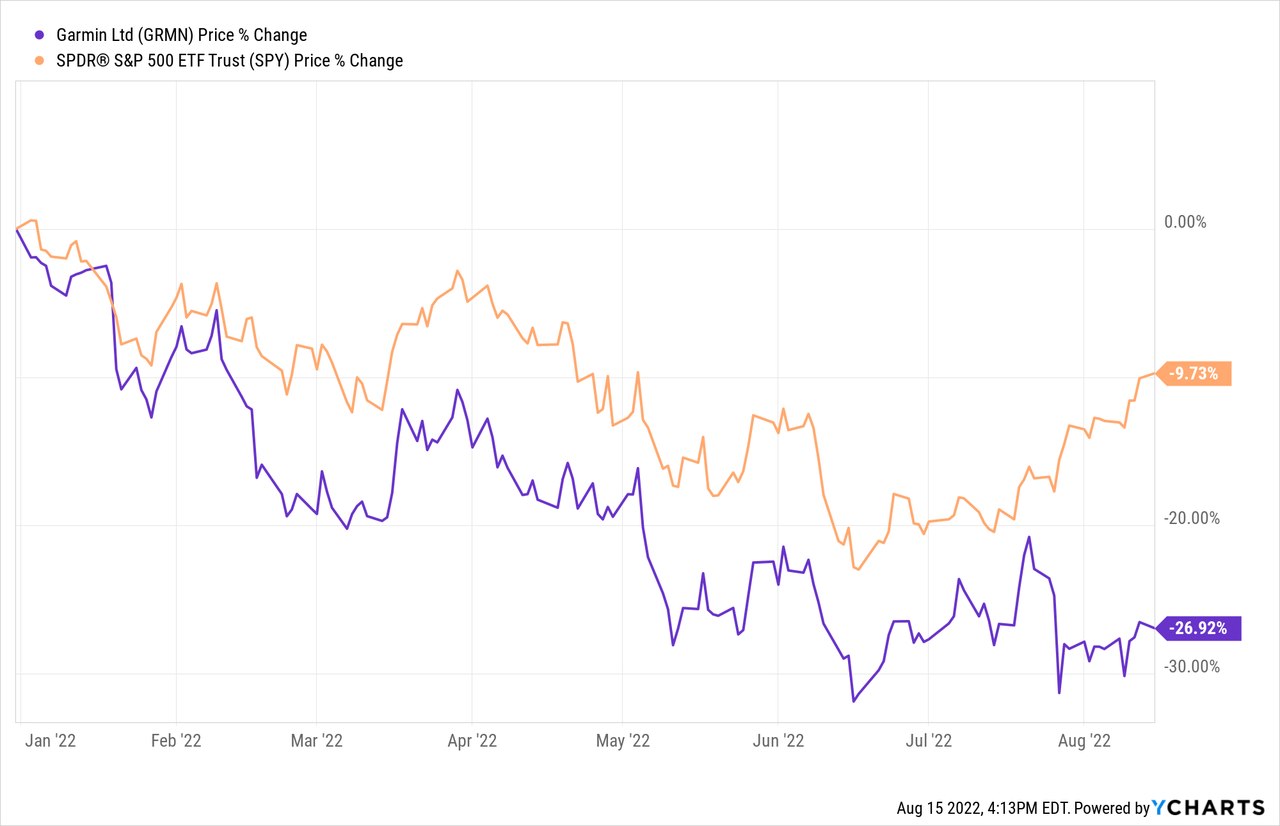

Year to date, Garmin and its stock have been substantially underperforming the broader market. The firm has lost more than 25% of its market value, while the S&P 500 (SPY) has only declined by about 10%.

In this article, we will take a look at the firm’s second quarter financial results, and some of the macroeconomic factors that could impact Garmin’s financial performance in the near term and also its stock price movement.

Financial Results

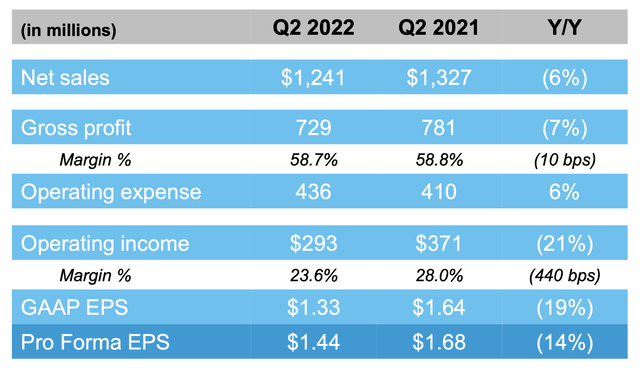

Garmin’s Q2 revenue has totaled $1.24 billion, down about 6%, compared to the year-ago quarter. Not only revenue was hit, operating income has declined by as much as 21%, totaling in $293 million for the quarter. Both operating and gross margins have contracted compared to Q2 2021.

The firm has highlighted the key drivers of the decline:

-

strong pandemic-driven comparable of 2021

-

Strengthening of the USD versus other major currencies

-

Supply chain constraints

Let us take a look at the results by segments to better understand, what products are actually driving the decline.

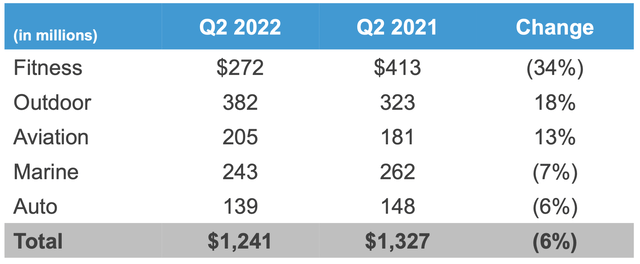

Revenue by segment

The revenue generated by the fitness segment has declined by as much as 34%. While the revenue from all product categories has declined, it was primarily led by advanced wearables and cycling. For 2022 revenue in this segment is expected to decrease by 25% compared to the prior year.

While the marine segment has also declined in the second quarter, it was not primarily driven by decreasing demand for the products. Supply chain constraints created limitation for the firm. Revenue growth for 2022 is expected to be 5%.

The auto segment (the smallest segment of the firm) has declined in both consumer and OEM, but a revenue growth of 5% is expected for 2022 compared to the prior year.

Revenue by region

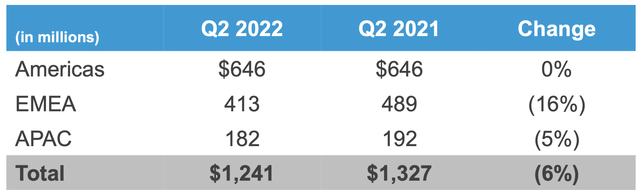

A significant portion of GRMN’s revenue is generated outside of the United States.

As the USD has been strengthening since the beginning of 2022 versus other major currencies, it has created major headwinds for Garmin. The firm estimates this headwind to be as much as $57 million.

While revenue in the Americas has not declined, both in EMEA and APAC it has substantially fallen, driven by both declining demand and the strong USD.

Macroeconomic Factors Impacting the Results

There are a set of macroeconomic factors that can have the future (or already had) material impact on the firm’s financial performance.

1) Consumer sentiment

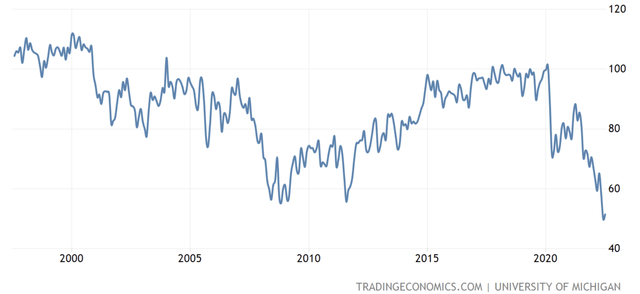

Consumer confidence is normally defined as a leading economic indicator, which can be used to predict major changes in the consumer spending trends in the near future. Consumer confidence is driven by a number of different factors, ranging from inflation, energy and fuel prices, the geopolitical situation.

Inflation has been steadily rising in 2022, along with energy and fuel prices. At the same time, the geopolitical tension between Russia and Ukraine has also escalated, while the U.S. – China relationship seems to be deteriorating as well.

As a result, consumer confidence has been steadily falling in 2022, even declining below levels that were observed during the financial crisis in 2008-2009.

U.S. Consumer confidence (tradingeconomics.com)

A low or declining consumer confidence can signal that people are becoming more uncertain about their financial future, which tends to lead to lower spending and higher savings. The demand for durable, discretionary, non-essential products can drastically decline in such periods. As Garmin’s products are discretionary consumer electronics, the demand is expected to decline.

Also, important to note here that the increasing competition in the market, especially in the fitness segment allows consumers to choose lower cost, more affordable products in times of low confidence.

In fact, from the Q2 financial results, it becomes obvious that the demand for their consumer electronic devices has significantly declined. Only two segments have seen an increase in revenue, aviation, which is unrelated to consumer confidence and outdoor, which is fuelled by the increased interest in travelling after the pandemic.

All in all, we believe that as long as consumer sentiment does not improve, the demand for Garmin’s products is likely to remain low. For the rest of 2022, we do not expect a significant improvement.

2) Inflation

Rising inflation has made both materials and labour more costly. While it is thought to have peaked earlier this year, it is likely to remain elevated compared to the 2021 levels. For these reasons, we expect a further downward pressure on the firm’s margins.

Valuation

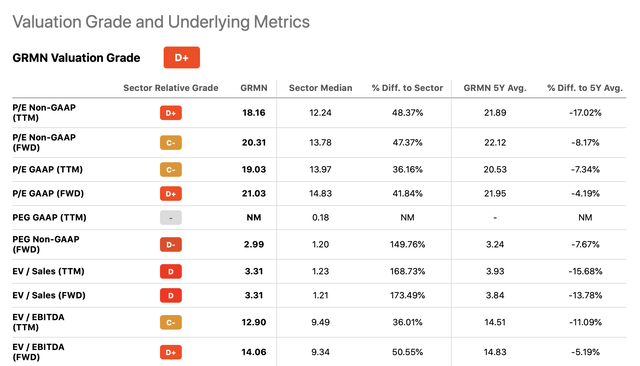

Despite the significant sell-off this year, we believe that GRMN’s stock is still overvalued. According to a set of traditional price multiples, GRMN is trading at a significant premium compared to its respective sector median.

GRMN valuation (seekingalpha.com)

While the company has been also historically trading at a premium compared to the consumer discretionary median, we believe in the current market environment this premium is not justified.

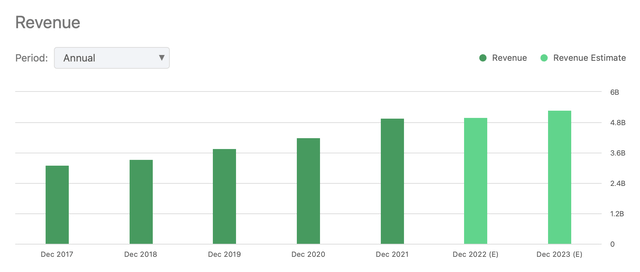

Further, analysts expect revenue to be flat for 2022 and increase only slightly in 2023.

Revenue forecast (seekingalpha.com)

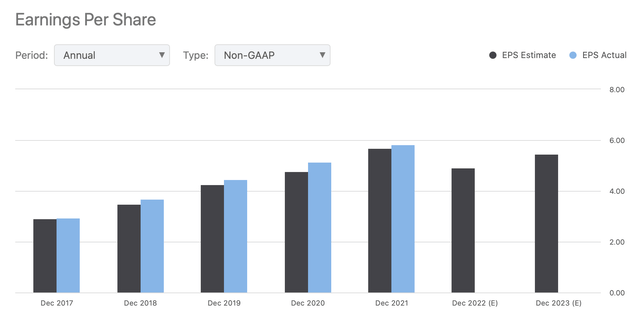

Earnings forecast looks even less appealing.

EPS forecast (seekingalpha.com)

In 2022, earnings are expected to decline to 2020 levels. While 2023 is forecasted to be slightly better, EPS is likely to remain below the 2021 results.

For these reasons, we believe that GRMN’s stock at the current valuation is a sell.

Key Takeaways

The sell-off in the first half of the year is justified, in our opinion, as revenue has substantially declined compared to 2021 figures, while both gross and operating margins have contracted.

Macroeconomic headwinds, including low consumer confidence and elevated inflation are likely to negatively impact GRMN for the rest of 2022.

Despite the sell-off, the stock still appears to be trading at a significant premium compared to its peers, which we believe is not justified due to the relatively weak revenue and earnings outlook.

Due to these reasons, we currently rate Garmin as “sell”.

Be the first to comment