Allison Dinner/Getty Images News

The Gap, Inc. (NYSE:GPS) operates as an apparel retail company. The company offers apparel, accessories, and personal care products for men, women, and children under the Old Navy, Gap, Banana Republic, and Athleta brands. Its products include denim, tees, fleece, and khakis; eyewear, jewelry, shoes, handbags, and fragrances; and fitness and lifestyle products for use in yoga, training, sports, travel, and everyday activities for women and girls.

We have published an article on Seeking Alpha in June 2022, titled: “Mind the Gap”. In that article, we have rated Gap’s stock as “sell”, due to the poor first quarter financial performance, the inventory management issues and the unsustainably high dividends. We have also highlighted some of the macroeconomic factors, which are creating headwinds for the firm, including consumer confidence and rising energy prices.

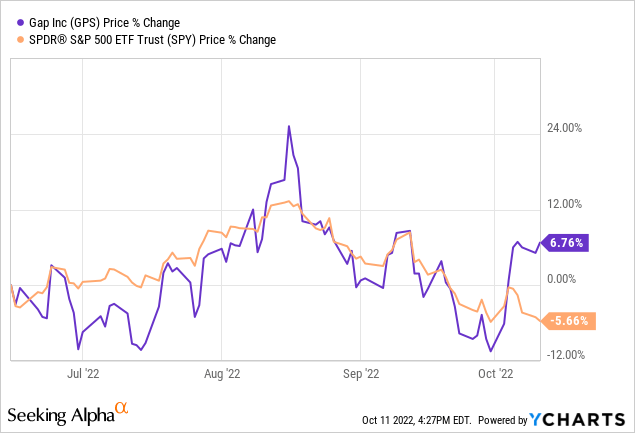

Since our last article, Gap’s stock price has increased by 7%, outperforming the broader market, which has declined by 6%.

Today we are revisiting Gap, and providing an updated view on the firm, taking the latest news, developments and earnings release into account.

Let us start with the latest earnings figures.

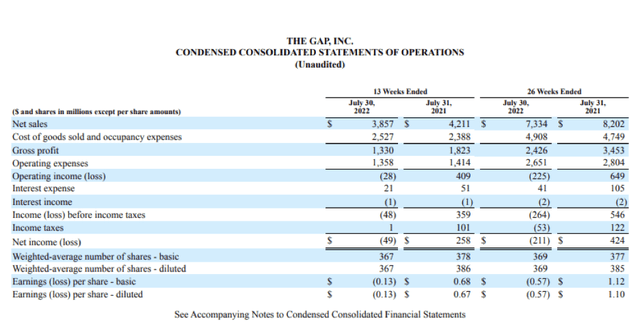

Q2 financial results

Despite the firm beating on analyst estimates, the financial performance in the second quarter, just like in Q1, has been poor.

Sales have declined, gross profit declined, margins have contracted and as a result the firm’s net loss has been $49 million, compared to the $258 million profit in the year ago quarter.

As highlighted by the management, the poor sales results were attributable to the inventory delays related to continued global supply chain disruptions, the continued size and assortment imbalances, and the strategic store closures, as well as an unfavorable impact of foreign exchange.

On the other hand, the main causes for the cost increases were: increased average unit costs, a result of higher air freight expenses and commodity price increases, together with higher promotional activity and inventory impairment.

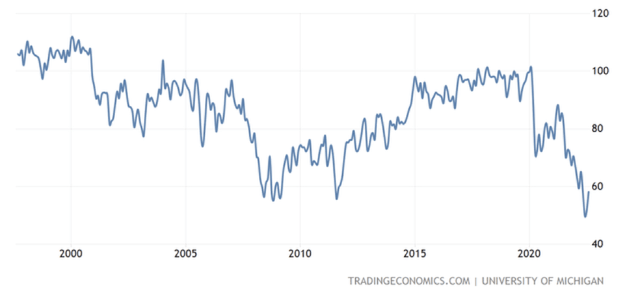

As we have expected earlier, macroeconomic headwinds and inventory management issues continued to negatively impact Gap’s financial performance, contributing significantly to the poor results in the second quarter. If we take a look at the previously mentioned macroeconomic factors, we can see that no dramatic improvement has happened during the past months.

Consumer confidence in the United States has remained at extremely low levels, potentially leading to further negative impact on the financial performance.

U.S. Consumer confidence (Tradingeconomics.com)

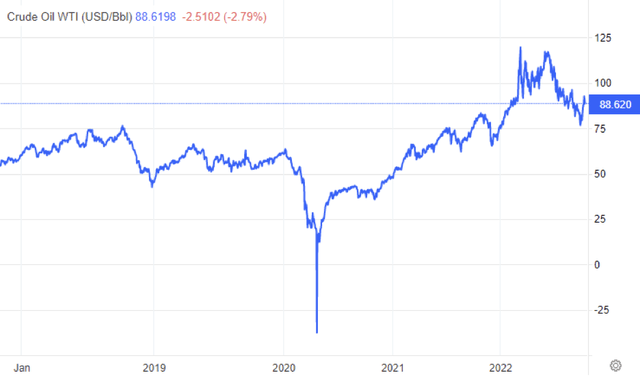

While oil prices have come off of their peaks, they remain elevated. Further, the recent announcement by OPEC+, with regards to production cuts, makes the uncertainty around energy prices even higher.

WTI prices (Tradingeconomics.com)

We believe that the poor consumer confidence is likely to lead to further decrease in the demand for Gap’s products, while the elevated energy prices are likely to drive costs further up.

The firm has also withdrawn its annual guidance, which can be linked to the high uncertainty in the near term, which we believe is quite troubling for shareholders and potential investors.

For these reasons, we do not see any justification to change our bearish view on the stock.

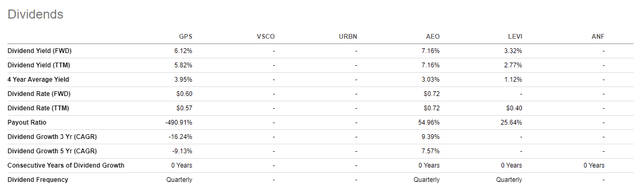

Dividend

In August, the firm has declared a $0.15 per share dividend. We believe that this is not the best allocation of capital in the current environment, especially when considering the poor financial performance and the net loss in Q2. We have already mentioned that the dividends are likely unsustainable in the near future, therefore we interpret these news as negative.

If you consider investing in Gap’s stock for the dividend, keep in mind that the unsustainability may lead to dividend cut in the coming quarters, which could also have a negative impact on the stock price.

We can also see that many of GPS competitors and peers are not paying dividends, or the ones that pay, have substantially lower payout ratios. It also signals us that a dividend cut may be on the horizon for GPS.

Departure of CEO

In July 2022, the CEO of the firm has unexpectedly stepped down. Such events are often a signal that the firm is not moving in the right direction. In our opinion, it may be a warning sign and should not be ignored by investors, when making an investment decision.

Cutting jobs

In September, the firm has announced its plans of cutting 500 corporate jobs in cost-cutting measure. While job cuts can be an effective measure to reduce costs, it is likely an additional warning sign that the firm is in financial trouble.

Financial ratios

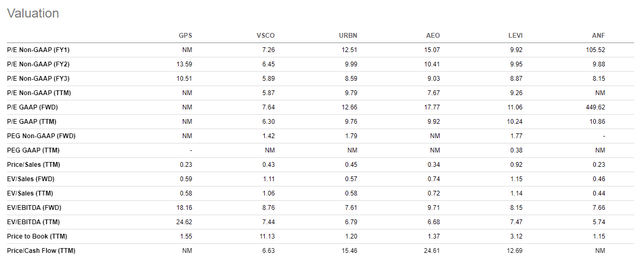

Valuation

The following table compares some of the key valuation ratios of Gap, with its peers.

We can see that both in terms of P/E and P/CF, GPS is trading at a significant premium compared to its peers. We believe that such an overvaluation is not justified, especially in the current market environment. For this reason, in our view, there is substantial downside risk at the current price levels.

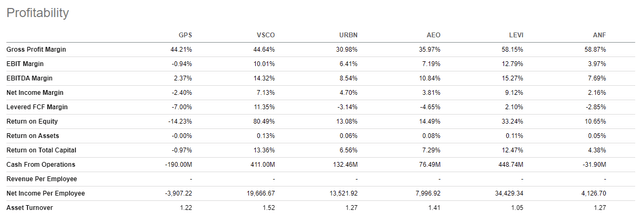

Profitability

Also the profitability ratios indicate that GPS is relatively unattractive compared to its peers.

Both the EBIT, EBITDA and net income margins are far worse than those if its peers. These all show that the company is much less successful than its competitors in terms of converting their sales into profits. Another reason, why the valuation is not justified, in our opinion.

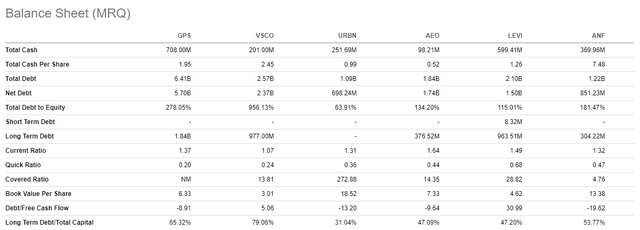

Balance sheet ratios

Balance sheet (MRQ) (Seeking Alpha)

The current- and quick ratios give an indication of the firm’s financial flexibility and its ability to meet short term financial obligations. We prefer firms that have current- and quick ratios above one, meaning they have more current assets than current liabilities. As we can see, GPS is far below 1, in terms of the quick ratio, and also compares poorly to its peers. This could mean that GPS may have troubles in the near future, especially if the above mentioned headwinds continue in the upcoming quarters.

To sum up

In our opinion, the firm’s financial performance remains poor. Both net sales and earnings have been declining, while costs have been increasing. The macroeconomic environment remains challenging, which is likely to have further negative impact on the Gap’s performance in the near term.

The declaration of the dividend, while reporting a net loss, is an unattractive and unsustainable way of allocating capital.

The unexpected departure of the CEO, could be a further warning sign that the firm is in trouble.

The firm compares poorly to its peers and competitors, in terms of valuation, profitability and balance sheet ratios, which makes Gap an even more unattractive investment option.

For these reasons, we maintain our “sell” rating.

Be the first to comment