Matthias Tunger/DigitalVision via Getty Images

Online Gambling Will Hold Up Strongly in the Event of a Recession

With inflation likely to remain far from the 2% target, central banks in the Americas and Europe appear poised to continue raising the cost of money aggressively to send recession signals to consumers.

They are therefore being urged to tighten their consumption restraints as energy costs – the main component of the current runaway inflation – are poised to absorb more of their income, which now has less purchasing power than in the recent past.

Inevitably, then, the coming weeks will see a slowdown in the consumption of certain products and services, while others that meet basic needs will be much more resilient.

Surprisingly, even in a highly possible recession scenario, the demand for gambling and lotteries, as well as sports betting and others, which can now be done online with the proliferation of internet technology and the increasing adoption of mobile phones, will suffer much less than other services.

This trend of people gambling even during an economic recession could be because these individuals may see their activity as an opportunity to generate significant income. Another reason for being resilient during tough economic times could be that online gambling is usually very addictive for its players.

So, online gambling will not falter when the next economic slowdown hits.

The global market for this activity is expected to grow nearly 14% annually over the next six years to about $145 billion in 2028.

From a business standpoint, even in the darkest of economic times, online gambling won’t bend. Indeed, during the severe crisis caused by the pandemic spread of the COVID-19 virus, gambling found a strong ally in lockdowns and restrictions to gain momentum.

Therefore, the companies that generate and sell these services saw their sales surge during the pandemic, when many other services took a heavy toll.

Gambling Stocks Also Fell Due to Heightened Recession Risk

From a stock market perspective, however, many of these US-listed online gambling companies have not demonstrated the same resilience.

Influenced by fears of an economic recession or slowdown, investors have treated online gambling stocks as discretionary stocks, forgetting that gambling services are sold even during downturns in the economic cycle.

Thus, roughly in line with stock market performance, they have also fallen due to headwinds from the prevailing bearish sentiment.

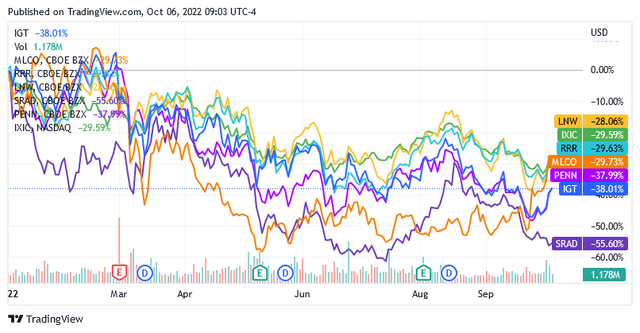

The chart below shows well-known online gambling stocks that are down significantly year-to-date, with decline rates roughly in line with the NASDAQ Composite (^IXIC)’s 29.59% drop. The NASDAQ Composite is considered the benchmark index for this purpose because these stocks are typically traded on the stock exchange for tech stocks.

In some cases, the loss has been even larger, such as for Sportradar Group AG (SRAD) stock, which has really suffered from the bearish sentiment, falling more than 55%.

However, the possibility to take advantage of significantly lower stock prices creates the following investment opportunity. Once in bullish mode, a solid shareholder return could occur among online gambling stocks if the stock market valuation reflects the expected strong 14% annual growth in the global online market, as mentioned before. This should happen because when the market is generally bullish, online gambling stocks are very popular.

GAN Limited Looks Well Prepared for When the Bullish Market is Back

Among the US-listed equities in online gambling companies, GAN Limited (NASDAQ:GAN) stock appears well-positioned to benefit from a return to bullish sentiment.

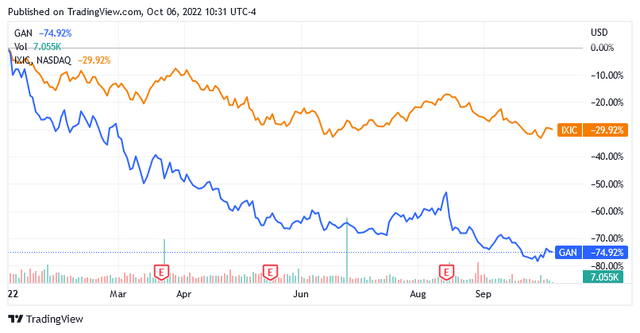

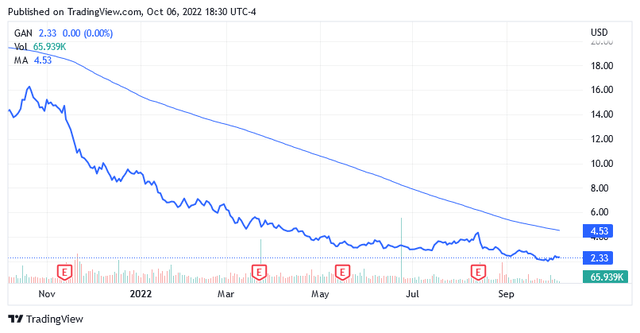

But as long as the market focuses on energy stocks to take advantage of record oil and gas prices, while risk aversion is generally high among US-listed stocks, shares of GAN Limited are likely to remain under pressure for a while. The downtrend, as shown in the chart below, has been going on for months.

Based on a comparison to the benchmark index for the market, GAN Limited stock literally plummeted, underperforming a bearish NASDAQ Composite (^IXIC) by about 45%.

Aside from this negative price action that irks shareholders, there is no further impediment to not assuming a brighter future for the stock price, knowing that this trend has little to do with the company’s fundamentals.

Despite the share price, the business is characterized by very positive and increasing trends in the business-to-business segment, as well as traffic generated by the business-to-consumer segment on the platform and the success of marketing strategies in attracting new players to the platform.

Relevant Trends in GAN Limited’s Business

Based in Irvine, California, GAN Ltd operates the business-to-business [B2B] segment and the business-to-consumer segment [B2C].

For the B2B segment, GAN acts as a leading provider of software-as-a-service solutions for Internet gambling, which are now primarily used in the US casino industry.

In this segment, GAN has developed a proprietary enterprise software system for internet gambling called GameSTACK. The company licenses GameSTACK to US-based casino operators.

The technology is a turnkey solution suitable for regulated real-money internet gaming, which includes not only internet gambling and internet sports betting, but also social casino games, referred to as simulated gaming.

This segment, which alone accounts for about 40% of total revenue [nearly $35 million for Q2 2022], continues to see significant year-over-year and quarter-over-quarter improvements.

The segment grew 36.5% year-on-year and 8.3% sequentially in the second quarter of 2022.

Organic growth in US real-money gaming is increasingly proving to be the real driving force of the segment.

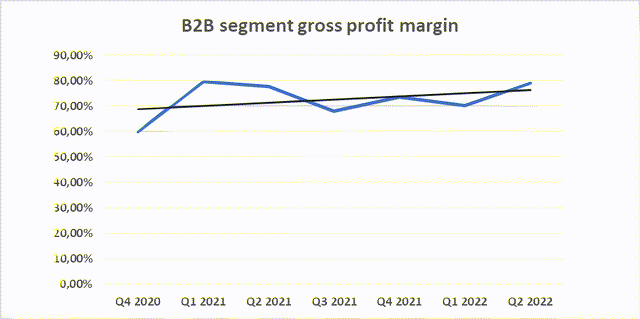

In the second quarter of 2022, the segment reported the second-best quarterly gross profit margin of 79.2% in 7 quarters. It reflected a sharp increase of 150 basis points compared to the same quarter of 2021 and an increase of a whopping 910 basis points compared to the previous quarter.

The chart below shows the upward trend in quarterly gross profit margin from the B2B segment over the last 7 quarters.

figures are from company’s quarterly reports

The B2B take rate, which roughly measures the percentage the company gets to keep for every $1 that corporate clients generate on the platform, is up both year-over-year [30 basis points] and quarter-over-quarter [to 60 basis points] to 5% in the second quarter of 2022.

In terms of the B2C segment, GAN Ltd operates proprietary technology enabling online sports betting in select overseas markets while holding leading positions in Europe and South America.

The B2C segment, which accounts for about 60% of GAN Ltd’s total revenue [nearly $35 million], hasn’t fared very well lately. Revenue for the second quarter of 2022 fell nearly 15% sequentially. However, it remained almost 2% above the corresponding quarter of the previous year.

As for gross profit margin, it declined 420 basis points quarter-on-quarter and 250 basis points year-on-year to nearly 64% in Q2 2022.

However, these negative trends in the B2C space should not be too much of a concern. These are influenced by seasonal factors that only have a temporary effect. Sports betting margins tend to be lower towards the end of the second quarter, which typically corresponds to the end of the sports season for many sporting events. The B2C segment was also impacted by the strength of the US dollar relative to other currencies, resulting in lower sales revenue in US dollars from overseas markets.

Europe and South America together account for the entire B2C segment and more than 65% of the company’s total revenue.

Stronger US dollar and aggressive U.S. Federal Reserve Largely Explain Certain Downward Trends

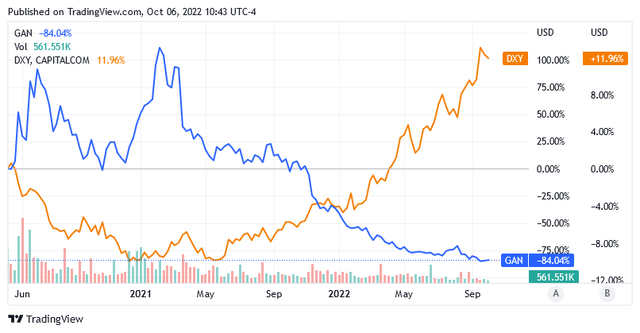

The effect of the U.S. Dollar appreciation is reflected in the stock as can be seen in the chart below which compares GAN’s share price to the US Dollar Index (DXY). The DXY is a measure of the value of the US dollar against a specific basket of currencies of countries that are the main trading partners of the US.

As can be seen from the chart, the stock’s downward trend corresponds to an appreciation of the US dollar against other currencies in Europe and Latin America.

However, the stronger US dollar was the result of the US Federal Reserve’s hawkish stance on interest rates.

But, following the US Federal Reserve’s rate hike, investors have become more aware of the risk of investing in the stock market, as the Fed’s goal is to signal a recession in hopes of easing inflationary pressures.

A cautious stance on the stock market amid macroeconomic and geopolitical challenges has impacted GAN Limited shares as well.

But There is Something Very Positive about B2C

However, some good trends have emerged in the B2C space, including the number of active customers, which is a measure of traffic on the platform, and the marketing expense ratio, which reflects how successful the company is at attracting customers.

The number of active B2C customers increased from 187,000 in Q2 2021 to 230,000 in Q1 2022 and from there to 260,000 in Q2 2022.

The B2C marketing expense ratio increased from 12% in Q2 2021 to 19% in Q1 2022 and from there to 22% in Q2 2022 due to the execution of the company’s growth strategy to expand into Latin American markets.

In particular, the company intends to take advantage of the next event of the 2022 FIFA World Cup, scheduled to be held in Qatar from November 20 to December 18, 2022, to attract more Latin American customers.

The goal is to promote brand awareness by leveraging the reach of the world’s major sports events through ad hoc sponsorship agreements.

2022 Revenue and EBITDA Forecast

In the near term, the company estimates that revenue will increase by 14.7% to 22.8% from 2021 to $142.5 million-$152.5 million in 2022.

While pro forma EBITDA is expected to increase from a net loss of $500,000 in 2021 to $10 million-$15 million in 2022.

The company appears to have what it takes to do well once the stock market turns bullish again. For this to happen, the US Federal Reserve will have to abandon its hawkish stance on interest rates. The Federal Reserve’s policy change may come earlier than expected so as not to weaken the economy too much. The slowdown in consumption and investment probably would have followed high energy costs anyway, but now it threatens to become even more severe due to aggressive interest rates.

As the US Federal Reserve eases monetary tightening, a return of the flame should follow for stocks like GAN, which would also benefit from interesting trends and strategies that point to an acceleration in future growth.

The Stock Price Valuation

After a significant decline over the past year, the stock is trading at low levels, but that doesn’t mean it won’t fall further.

The stock price of $2.33 [at the time of writing] is significantly below its long-term trend of the 200-day moving average of $4.53.

Furthermore, the share price trades well below the middle point of $9.25 of the 52-Week Range of $2 to $16.50. Despite the sharp drop, GAN Ltd stock is far from the oversold level as shown by the 14-day relative strength indicator of 44.99. Therefore, the stock price could still fall under the blows of the current market headwinds.

The stock appears to have interesting catalysts implying the potential for a good recovery, but the market needs to change sentiment. Meanwhile, a cheaper stock may result due to possible additional downsides.

Conclusion – The Stock Has Good Rebound Potential, but The Market Must Be Different

GAN stock has taken a hit amid bearish sentiment sparked by recession signals from the US Federal Reserve. Also, higher interest rates caused the dollar to appreciate, which did not benefit sales outside the United States. The possibility of a stock price recovery depends on the Federal Reserve’s next steps. Meanwhile, GAN’s operations appear to be well-positioned to capitalize on tailwinds from the anticipated expansion of global online gambling activity.

Be the first to comment