Spencer Platt/Getty Images News

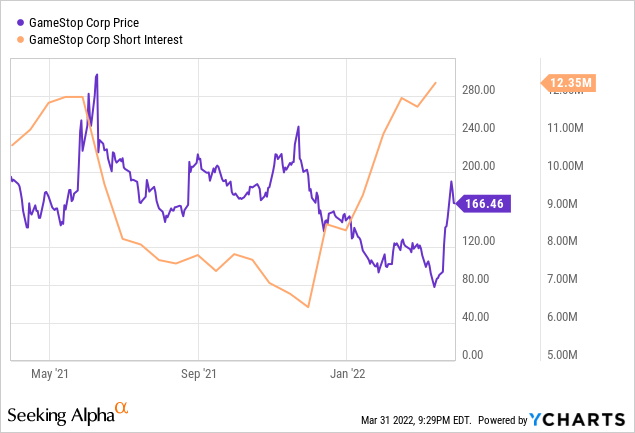

Shares of GameStop (NYSE:GME) are trading at $165 per share as a result of management’s decision to provide a stock dividend to shareholders of the company (pending shareholder approval). There has been a series of events that have created significant upside momentum and created paper losses for recent short-sellers of the company. First, Chairman Ryan Cohen purchased shares of the company. Then, as momentum was turning GameStop announced a bullish stock split which pushed shares as high as $203 after-hours. This key $203 short-term top is a very attractive entry point to start a short position.

With the current short interest, it’s entirely possible to see additional momentum in the next couple of days as shorts continue to get squeezed out of their positions. It’s impossible to time the exact top – additional positive headlines could continue to create stop losses for new or older shorts – but hopefully shares retest the $203 short-term top.

When the dust settles fundamentals will come again into play and I believe investors will realize that GameStop’s performance is very likely to resemble that of Chewy (CHWY) which is another company where GameStop’s Chairman Ryan Cohen is involved. In fact, he was the co-founder of the firm.

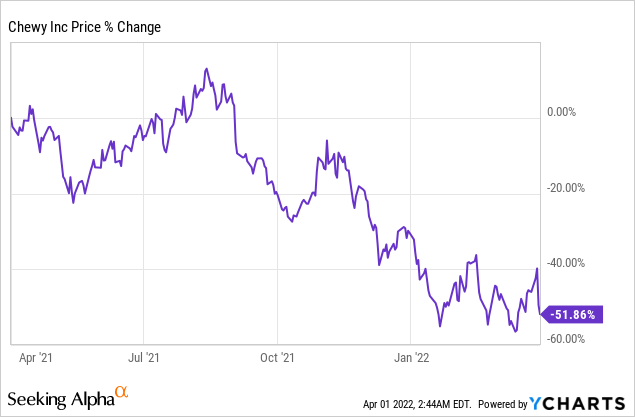

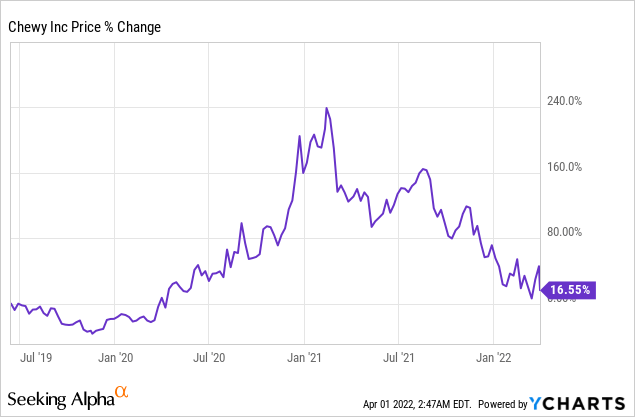

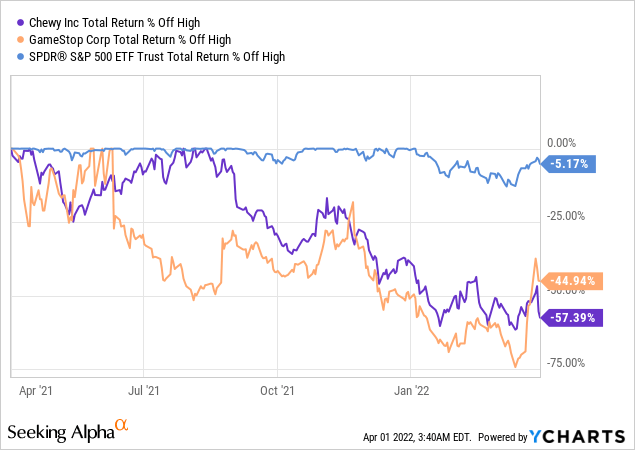

At some point, I believe investors in GameStop will realize that as much value as Mr. Cohen can provide to the company, even his startup Chewy has been unable to produce outsized returns as a public company. In fact, his company has only returned 16% over a 3 year period.

Chewy also experienced a massive surge around the meme months but since then it’s 65% off from its top and is now lagging behind the S&P performance. It seems that investors are putting way too much confidence in Mr. Cohen and his ability to turn around this company or to create something new that he hasn’t been able to create at Chewy.

This article isn’t a smear campaign against Mr. Cohen as most of us would only dream of being as successful as he has been. Also, without his intervention and those of the meme mania – GameStop most likely would have already gone bankrupt. Melvin Capital under normal circumstances would have successfully deprived GameStop of accessing the financial markets to raise equity forcing the company into bankruptcy.

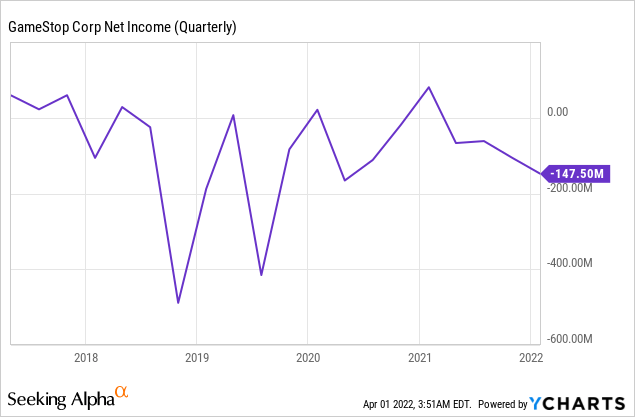

However, the other extreme that shareholders of GameStop and every other meme company always tend to forget – is that fundamentals do matter indeed over the long-term. For the last 5 years, GameStop has lost in excess of $1 billion dollars. In the last quarter, the company lost $147.5 million dollars. At this rate, the company will be completely out of cash by 2025. Even if the company were to be able to turn around the company to earn $100 million per quarter the company would still be trading at 30x earnings which is an extremely generous valuation given the uncertainty in the business future.

Future Corporate Needs & Compensatory Equity Issuances

For this reason, I believe management used language that implied future equity issuance on its latest 8-K. Management also needs shareholders to approve a new incentive plan to continue using significant equity awards to retain talent and preserve cash.

On March 31, 2022, GameStop Corp. (the “Company” or “GameStop”) announced its plan to request stockholder approval at the upcoming 2022 Annual Meeting of Stockholders (the “Annual Meeting”) for an increase in the number of authorized shares of Class A common stock from 300,000,000 to 1,000,000,000 through an amendment to the Company’s Third Amended and Restated Certificate of Incorporation (the “Charter Amendment”) in order to implement a stock split of the Company’s Class A common stock in the form of a stock dividend and provide flexibility for future corporate needs. GameStop also intends to request stockholder approval at the Annual Meeting for a new incentive plan (the “2022 Equity Plan”) to support future compensatory equity issuances.

Losses aren’t likely to go away anytime soon and are likely to accelerate as management invests in new areas of growth or the NFT marketplace, etc. Sure, the company is likely to innovate and explore new areas of growth just as AMC Entertainment (AMC) started its popcorn side business. I will let you be the judge of how much additional revenue such endeavors can generate for both GameStop and AMC. But GameStop has to worry about Microsoft (MSFT) and about its all-in push into video games with its pending purchase of Activision (ATVI). Ryan Cohen has shown he’s able to compete with Amazon with its online Chewy pet store. However, as shown earlier his company has capped growth expectations as there’s only so much you can grow in a niche market before big tech sees an opportunity in your market.

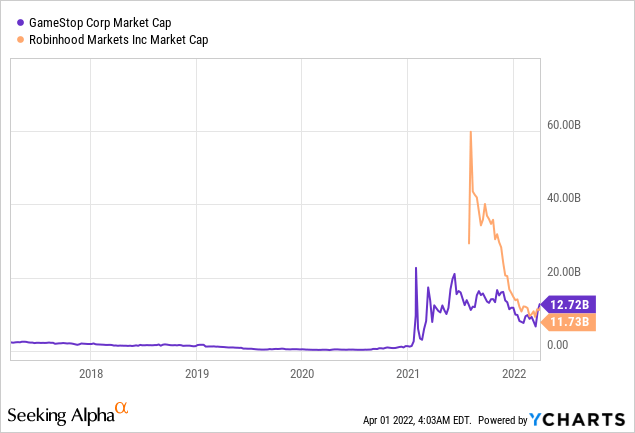

If you look at Robinhood’s valuation you will notice that as interest rates rise, investors are being less patient with how many losses they are willing to finance. Robinhood is the definition of disruption in the brokerage industry and even so its market cap is comparable to that of GameStop which isn’t a disruptor in its industry. I do see a future for Robinhood’s business model as customers love their app and free trading structure. However, I don’t see a future as it is for GameStop, and in my opinion, that warrants a discount to valuation rather than a premium.

How GameStop can be trading higher than Robinhood which is a true disruptor of our generation is beyond my understanding. But higher interest rates will soon permeate the valuations of meme stocks and a whole new generation of retail investors will soon learn a hard lesson that valuations don’t matter until they do. Just a few weeks ago most of them were significantly underwater when GameStop was trading at $75.

Significant Downside Ahead

I am confident that GameStop will go back to the $75 price mark it had a couple of days ago based on its quarterly cash burn alone. However, there’s always a risk of being squeezed out. As such, I have opened $300 naked calls with enough cash to cover losses all the way to $500 without having to sell any other investments and with enough value on my account to sustain theoretical losses until $1200. If your account doesn’t support options trading my recommendation is to enter a straight short position anywhere between $185 and $250 with enough cash set aside for the stock to potentially double in a short period of time and with enough investments to potentially cover a margin call.

Risks to Shorting GameStop

The most significant risk on top of unlimited potential losses involved with any short trading strategy is special margin requirements for GameStop. TD Ameritrade for example requires a 300% margin requirement in GameStop. I contacted a customer service representative for the information before placing the trade as sometimes there’s just generic language on their website that warns you of special margin requirements without disclosing them in detail. The 300% special margin trading requirement means at all times you need to have the cash necessary for a theoretical tripling of the stock in a nanosecond. As the stock moves up the amount of cash you need to have in your account grows exponentially and could put you in a margin call. Consider the following scenario for being short 1 single share of GameStop.

| Price of GameStop | Margin Requirement at Td Ameritrade | Expected Maximum Upside |

| $160 | $320 | $480 |

| $250 | $500 | $750 |

| $300 | $600 | $900 |

| $400 | $800 | $1200 |

| $500 | $1000 |

$1500 |

| $600 | $1200 |

$1800 |

Source: Created by Author

As such, never enter into a large short position in any stock no matter how compelling the case could be but especially so if they have a special margin requirement. The stock you short might never go up enough to wipe your account but the margin requirements necessary to keep the short position open could literally wipe your whole account. Your broker can exercise at any time its right to liquidate your positions in a margin call if its special margin requirements are violated. One possible solution is to hedge your position with an out-of-the-money call. It’s important to understand all the risks involved before starting a short position.

On top of that, it’s important to understand that GameStop can defy any logic for much longer than you can stay solvent. Increased share price can lead to future equity raises that in turn provide more cash for management to invest in new business ideas that in turn provide additional momentum to the stock. Tesla was a perfect example of a company that squeezed out all its legacy shorts while continually raising capital. Make sure that you have an exit plan in place in case the turnaround story begins to change for good.

Psychology of Meme Stocks

Hedge fund managers and even high profile pension managers like Calpers are becoming more and more involved in meme stocks. They have consistently shorted the tops and bought the bottoms. They know there’s money to be made off retail hands. Learn to follow the lead and make money on both sides.

Investors constantly point to short interest and they fail to understand that shorts are continuously rotating money in and out of these stocks just as bulls do. Assume the short float is 20% and a short-seller who shorted GameStop at $75 might have covered at $100 where another short takes the position to cover at $130 where another short takes the position to cover at $160 where finally another short takes the position and at $200 rather than covering decides to double down or triple down. The amount of shorted shares in such an example might remain about the same at 20% of the float. Retail investors could assume that shorts are stuck with a position at $75 when in reality the short might have started its position at $150 and is hardly being squeezed. The short is just patiently waiting for the tide to turn with enough capital and time to wait for the squeeze confident the stock will significantly drop below $150. Longs therefore could be playing a game of chicken continuing to bid up the stock just to suddenly realize they are all trying to exit at the same time with no bidders left.

Summary

It’s important to turn off the noise and play the momentum on both sides. I made a fortune shorting both GameStop and AMC last year not because I am good timing the market but rather because I am a fundamentalist. I know that fundamentals don’t matter until they do but that the market can stay irrational for longer than you can stay solvent. As such it’s important to take calculated risks where the skew is in your favor. For example, buying long-dated calls around $40 on GameStop with a 45% short interest could make sense for a potential rally, and when GameStop is trading around its 52-week high of $250 it might make more sense to start a short position. The stock could significantly drop below $40 or above $250 but on each, the risk is tilted to a different degree. Don’t fall in love with your position. Just trade smart and as professionals do!

Be the first to comment