Shawn Williams/iStock Editorial via Getty Images

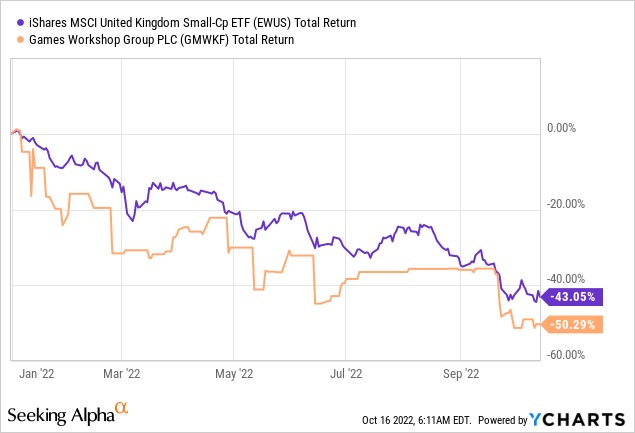

Shares of Games Workshop Group PLC (OTCPK:GMWKF) have fallen sharply this year, with the UK-based retailer of fantasy miniatures seeing the market’s aggressive growth expectations crash up against an increasingly tough environment for both the business and its stock. As a result, these shares are now off around 40% year-to-date, underperforming the broader iShares MSCI United Kingdom Small-Cap ETF (EWUS) in the process.

Games Workshop has been one of the biggest success stories in the U.K. small-cap space, with a large growth spurt following current CEO Kevin Rountree’s appointment back in the mid-2010s bucking the general downward trend of other British high street retailers. That, in turn, has led to an avalanche of earnings and free cash flow growth, with investor interest and shareholder returns understandably following suit.

Shareholders would be forgiven for feeling hard done by recently. Financial figures released year-to-date haven’t exactly been catastrophic, but such is the tightrope that needs to be walked when your stock is trading above 30x earnings that it doesn’t take much to be blown right off the track.

While the firm hasn’t actually done anything wrong, conditions have been ripe for a big correction in previously high-flying growth stocks. Trading conditions are getting bleaker for discretionary retailers, particularly in the U.K. and Europe, while the impact of rising interest rates and bond yields is probably having a similar effect on equity valuations, certainly at the frothier end of the market.

What Went Right

Games Workshop owns tabletop fantasy franchises Warhammer 40,000 and Warhammer Age of Sigmar. In short, it created and owns the intellectual property and sells miniatures which folks can assemble, paint and then either play or simply collect. The company sells its goods through three channels: its own network of physical retail outlets (23% of sales), which currently number around 520; select independent outlets (55% of sales); and its own online store (22% of sales).

Owning the intellectual property is obviously a big deal, and is an important part of its success, but the company was actually pretty sleepy for many years. I collected some Warhammer 40,000 as a kid twenty years ago, and the company’s stock price was the same in 2015 as it was back then. Annual sales and pre-tax profit were typically in the £120m and £15m areas respectively for many years.

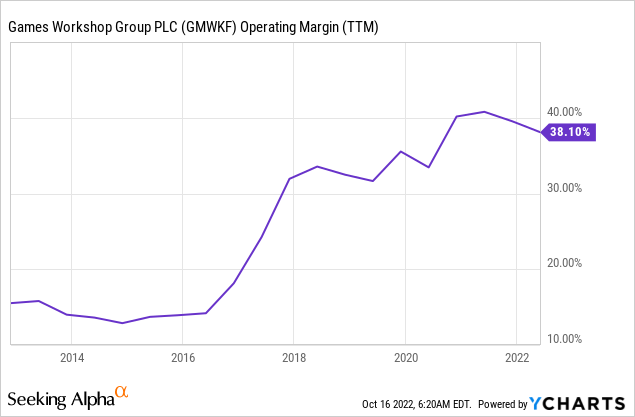

That changed during its growth spurt, which began in the middle part of the last decade. As is common with retailers, Games Workshop exhibits a high degree of fixed cost leverage. That is to say, changes in revenue go on to produce much larger swings in profit. So while revenue is up by a (very impressive) factor of around 3.5 since 2016, pre-tax profit is up nearly tenfold over the same period as margins exploded. As a result, investors were happy enough to bid up the stock, helped by accommodative monetary policies. An earnings yield of 3% looks fine when those earnings are growing at a double-digit annualized clip and the risk-free rate was stuck at practically zero.

Conditions Starting To Toughen

The risk now is that those trends basically go into reverse gear. The stock is already down 40% YTD and 50% from its 2021 peak, not because earnings have collapsed, but because at circa £62 in London trading the stock’s P/E has derated from circa 32 to 16 – not all that surprising given where bond yields are at.

More importantly, the company is perhaps facing some of the toughest trading conditions in years. Input cost inflation has obviously been a problem for one, with Brexit related costs, freight issues emanating from COVID, energy prices rocketing due to the war in Ukraine all weighing on margins. Pre-tax profit was duly lower in Q1 2022/23, coming in at around £39m versus £45m in the year-ago period.

The revenue side may also be about to come under significant pressure as well. So far the top line has held up very well – revenue was up to £109m from £103m in the year-ago period in Q1 – but it looks like the worst is yet to come for consumers. Inflation is obviously threatening disposable income, as is the very real prospect of a recession and higher levels of unemployment. This looks like more of an issue in the U.K. and Europe due to their energy price situation, and despite strong growth in North America and Asia, these regions still account for around 50% of the company’s revenue.

Shares Could Be Interesting Long-Term

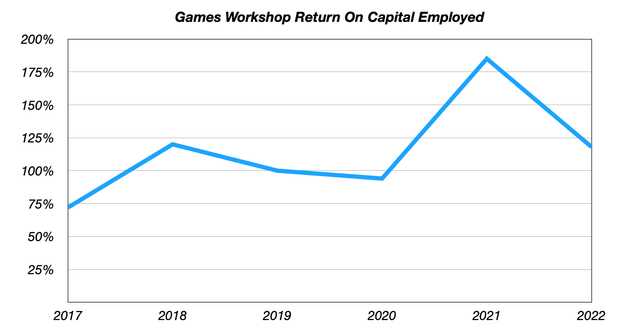

With the above in mind, the selloff here might not look as extreme as it appears at first glance. Sure, 16x earnings look a steal for a business throwing down 100%-plus returns on capital employed and with a recent history of very strong earnings growth – but that valuation could easily blow out on the back of a relatively modest decline in revenue.

Data Source: Figures Taken Directly From Games Workshop Annual Reports

That’s not to say these shares don’t look interesting, though, especially for longer-term orientated folks, with mid-single-digit long-term free cash flow growth more than enough to justify the current share price. The balance sheet is also in strong condition: cash stood at over £20m at last count net of lease liabilities, with zero financial debt. Still, with interest rates marching higher and the coming quarters set to throw up the toughest trading environment for discretionary retailers in recent memory, prospective investors here can afford to wait and see how things develop. Hold.

Be the first to comment