plastic_buddha/E+ via Getty Images

Published on the Value Lab 28/6/22

Galane Gold (OTCQB:GGGOF) is a microcap gold mining stock that offers a strong case for value investors and gold speculators. As a gold miner, it has operating leverage to the commodity, which we believe is in a reasonably good environment that will resist the down-cycle better than most commodities despite rate increases reducing relative gold return. Moreover, it trades extremely cheaply on expected mining earnings, and even cheaper considering properties that they develop. With management having a great track record of restoring old mines and making them profitable again, we look at Galane as an interesting gold oriented PE-esque investment vehicle that investors should consider in today’s market.

Update for Q1

The big event in our last coverage was that they were disposing of the Mupane property which was on its last legs. Despite that, some consideration was paid for its disposition despite cleanup provisions that allowed for a moderate deleveraging of gross debt and obligations from about $5 million to $4 million.

Currently, the only asset producing any cash flow is the Galaxy mine, which is being expanded to almost double its production of payable gold in a phase 2 CAPEXing plan. This is still under execution.

In other news there is the Summit mine which was acquired recently, and is a restart effort. Currently it is out of commission, but Galane management are working on an economic assessment of the mine this June in order to be able to report next steps. We have some idea of the possible daily tonnage already, which allows us to produce a model later. How long it will take for this asset to be up and running we’re not sure, but some CAPEX will have to go into it in order to furnish it with machines and equipment to bring it out of disrepair. Summit will produce silver in addition to gold.

October 2021 was when the Galaxy mines first came into action, and more or less when the Mupane mine was no longer a contributor. Current operating results show us the effect of the mine being up and running still in its phase 1.

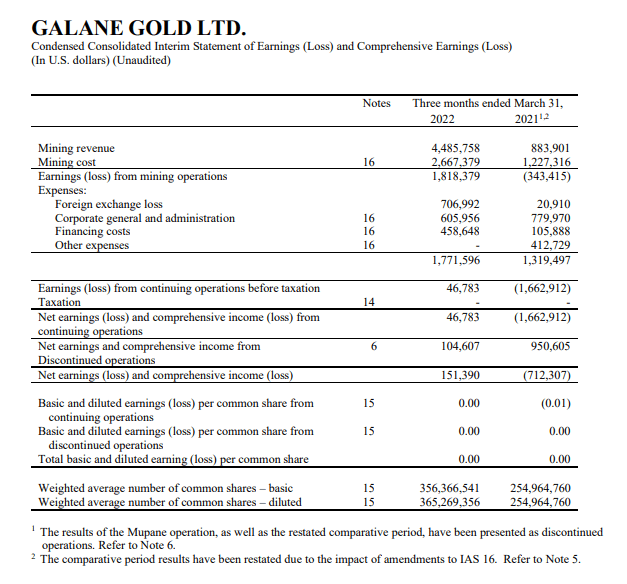

Income Statement Galane (Q1 2022 PR)

Forex losses have decimated results, but we are looking at about $1.2 million in EBIT this quarter, and about $2 million in EBITDA, which annualises to about $8 million in EBITDA annually, which is still below our estimates based on the per ounce mining costs assumed in our model. Based on guided production figures, it seems like the culprit might be the topline in this case, so we expect that Galaxy will mature into a fuller run-rate this year.

Model and Conclusions

Currently the Galaxy mine is the only one in operation, so let’s build a model using its cash costs.

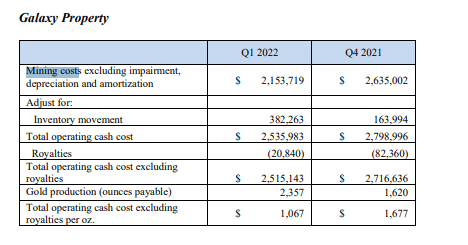

Cash Costs Galaxy (Management Discussion 2022 Q1)

A nice thing to notice is the minimal royalties. Using the current price of gold, we can build the model for EBITDA, skipping to when phase 2 will be in action.

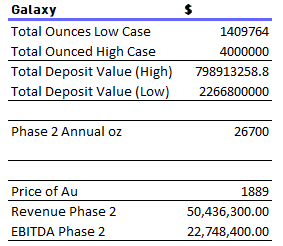

Galaxy Valuation (VTS)

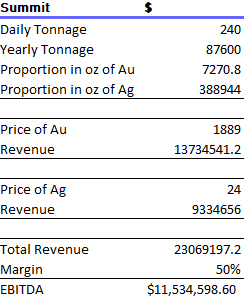

We can do the same with the Summit mine, instead making some estimation of EBITDA margin at 30%, where cash costs per ounce cannot yet be determined.

Summit Valuation (VTS)

Notice that cost per ounce fell massively for the Galaxy mine. Further improvement with phase 2 scale have not therefore been incorporated into our model, where we are using current run rate costs per ounce for Galaxy.

In total that gives us a $33 million in EBITDA. With the EV around $37 million, that puts the EBITDA at just slightly above 1x.

There are risks here. First of all, CAPEXing is going to be required in order to restart Summit in particular. Secondly, Forex is an issue because the Galaxy property is in South Africa, and the strengthening of the Rand against the dollar, in which gold is traded, has meant much less earnings in terms of Rand and ultimately CA$ as it gets repatriated and presented in Canada. A strong Rand is not great for Galane, and unfortunately, a strong Rand could persist because of positive exposures to Palladium, a highly Russian focused resource in terms of reserves, but also generally for commodities. The Rand is likely to weaken as higher rates push down industrial commodity prices, but it will probably not fall to previously normalised levels due to the Russia impact. Finally there is the risk of operating leverage to gold. Gold could fall as rates rise and the return on fixed income increases relative to just holding a commodity. Also, speculators are generally dumping commodities in the market right now, which will hopefully unwind some inflation courtesy of the rate hikes, but also signals that gold might get the same treatment as people begin to more confidently appraise the economic situation and reduce the desire for gold as a safe haven asset.

Nonetheless, trading at a low valuation like it does makes it an attractive way to ride the current market jitters with hard assets on safe commodities. Gold reserves are falling quickly, and there are supply forces that support the commodity. Moreover, gold has certain utility flows from being used in jewelry, means there are certain call option elements to it where downside is limited on the basis of that when the speculative value falls out. Overall, a 1x multiple is attractive and warrants consideration.

Be the first to comment