baona

After an 18-month bull trend in the dollar, the FX outlook has become less clear. Further position adjustment could prompt a little more short-term dollar weakness, but we do not believe the conditions are in place for a major dollar bear trend just yet. Instead, we expect FX markets in 2023 to be characterised by less trend and more volatility.

G10: Less trend, more volatility

The final quarter of 2022 has seen a breakdown in the otherwise orderly dollar bull trend – a trend which had been worth 5% per quarter over the first nine months of the year. That dollar rally had largely been driven by a Federal Reserve wanting to take policy into restrictive territory – a trend only exacerbated by the war in Ukraine.

For all the current discussions about peak dollar and peak macro pessimism, we think it is still worth examining whether the conditions will be in place to deliver an orderly dollar bear trend in 2023. We think not and here are three reasons why:

- Driving the dollar bull trend since summer 2021 has been a Fed at first abandoning Average Inflation Targeting and then trying to get ahead of the inflation surge. A call on a benign dollar decline in 2023 requires the Fed to be taking a back seat. That seems unlikely. The stark message from both the Fed’s Jackson Hole symposium and the IMF autumn meetings was that central banks should avoid relaxing too early in their inflation battle – a move which would deliver the pain of recession without any of the sustained gains on inflation. We suspect it will be too early for the Fed to sound relaxed at its 14 December meeting and March 2023 may be the first opportunity for a decisive turn in Fed rhetoric.

- While a softer Fed profile may be a necessary condition for a turn in the dollar, a sufficient condition requires a global economic environment attractive enough to draw funds out of the dollar. 2023 global growth forecasts are still being cut – dragged lower especially by recession in Europe. ING forecasts merchandise world trade growth below 2% in 2023 – not a particularly attractive story for the trade-sensitive currencies in Europe and emerging markets.

- A liquidity premium will be required of non-dollar currencies. 2023 will be a year when central banks are initially still hiking into a recession and shrinking balance sheets. The Fed will reduce its balance sheet by a further $1.1tn in 2023 and the European Central Bank will be looking at quantitative tightening, too. Lower excess reserves will tighten liquidity conditions still further and raise FX volatility levels. Again, the bar not to invest in dollar deposits remains high – especially when those dollar deposits start to pay 5% and the dollar retains its crown as the most liquid currency on the planet.

What do these trends mean for G10 FX markets? This probably means that the dollar can bounce around near the highs rather than embark on a clean bear trend in 2023. If the dollar is to turn substantially lower, we would favour the defensive currencies such as the Japanese yen and Swiss franc outperforming. Here, the positive correlation between bonds and equity markets may well break down via the bond market rallying on the back of a US recession and easier Fed policy. ING forecasts US 10-year Treasury yields ending 2023 at 2.75% – USD/JPY could be trading at 130 under that scenario.

Recession in Europe means that EUR/USD could be trading in a 0.95-1.05 range for most of the year, where fears of another energy crisis in the winter of 2023 and uncertainty in Ukraine will hold the euro back. Sterling should also stay fragile as the new government attempts to restore fiscal credibility with Austerity 2.0. We cannot see sterling being rewarded much more on austerity and suspect that GBP/USD struggles to hold gains over 1.20.

Elsewhere in Europe, some differentiation could emerge between the Scandinavian currencies. The Swedish krona may struggle to enter a sustained uptrend next year, given its elevated exposure to the eurozone’s growth story, while the Norwegian krone could benefit from its attractive commodity exposure. However, NOK is an illiquid and more volatile currency, and would therefore face a bigger downside in a risk-off scenario.

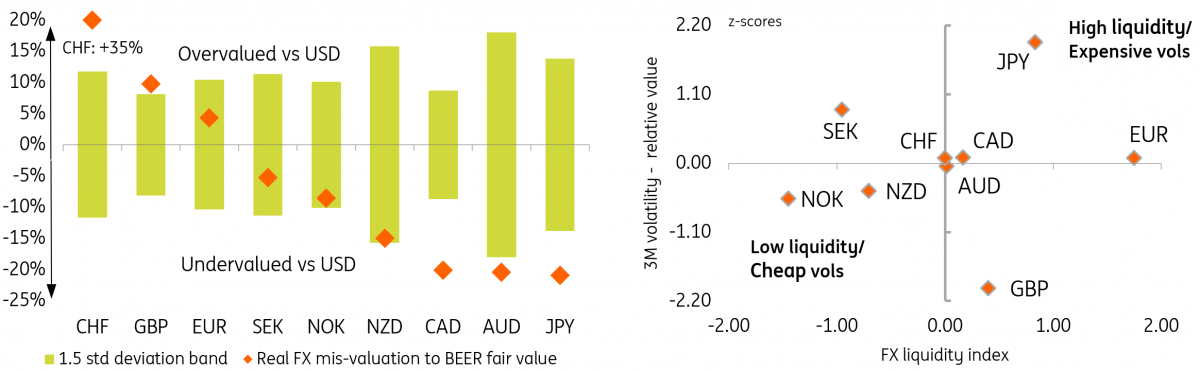

As shown in the chart below, commodity currencies look undervalued versus the dollar on a fundamental basis. However, a stabilisation in risk sentiment is a necessary condition to close the misvaluation gap. For the Australian and New Zealand dollars, an improvement in China’s medium-term outlook is also essential, so the Canadian dollar may emerge as a more attractive pro-cyclical bet given low exposure to the economic woes of Europe and China.

Another factor to consider is the depth of the forthcoming house price contraction. We think central banks will increasingly take this into consideration and will try to avert an uncontrolled fall in the housing sector. However, this is potentially a very sizeable downside risk, especially for the currencies of commodity-exporting countries, which generally display the most overvalued property markets in the G10.

To conclude, we think FX trends will become less clear in 2023 and volatility will continue to rise. FX option volatility may seem expensive relative to historical levels, but not at all when compared to the volatility FX pairs are actually delivering. We suspect risk management through FX options may become even more popular in 2023.

Valuation, volatility and liquidity in G10

Source: ING, Refinitiv

EUR/USD: Dollar bromance will take some breaking

|

Spot |

Year ahead bias | 4Q22 | 1Q23 | 2Q23 | 3Q23 | 4Q23 |

|---|---|---|---|---|---|---|

|

EUR/USD 1.035 |

Bearish | 0.98 | 0.95 | 0.98 | 1.00 | 1.00 |

Bullish leap of faith is too dangerous: We are bearish on EUR/USD into the end of the first quarter of 2023. Key factors which have driven EUR/USD lower this year will remain largely in place. The softish US October CPI print may give the Fed some pause for thought, but should not be enough to derail it from some further tightening – taking the policy rate close to 5.00% in the first quarter of 2023. Another key factor for EUR/USD this year has been energy. Here, our team sees prices for both natural gas and oil rising from current levels through 2023. A difficult 2023 European winter for energy may well restrain the EUR/USD recovery later in the year, continuing to depress the eurozone’s traditionally large current account surplus.

Necessary but not sufficient: Tighter Fed policy has been at the forefront of this year’s dollar rally and a shift in the Fed tone (more likely in March 2023 than December 2022) will be necessary to see the short end of the US yield curve soften appreciably and the dollar weaken. But the sufficient condition for a EUR/USD turnaround is the state of affairs amongst trading partners. Are they attractive enough to draw funds away from USD cash deposits potentially paying 5%? That is a high bar and why we would favour the EUR/USD 2023 recovery being very modest, rather than the ‘V’ shape some are talking about.

ECB will blink first: The case for a central bank pivot is stronger for the ECB than the Fed. The German economy looks set to contract 1.5% next year and at its 15 December meeting, the ECB may well use its 2025 forecast round to show inflation back on target. We see the ECB tightening cycle stalling at 2.25% in February versus the near 3% currently priced by the market for 2023. This all assumes a seamless ECB introduction of quantitative tightening and one that does not upset peripheral bond markets. Add in global merchandise trade barely growing above 1% next year (recall how the 2017-19 trade wars weighed on the euro) plus the risk of tighter liquidity spilling into financial stability – all suggest the market’s bromance with the dollar will continue for a while yet.

USD/JPY: 1Q23 will be a crucial quarter

|

Spot |

Year ahead bias | 4Q22 | 1Q23 | 2Q23 | 3Q23 | 4Q23 |

|---|---|---|---|---|---|---|

|

USD/JPY 140.00 |

Bearish | 145.00 | 145.00 | 140.00 | 135.00 | 130.00 |

Clash of the titans: The stark divergence in monetary policy between the Fed and the Bank of Japan has been the primary driver of this year’s 15%+ rally in USD/JPY. In 2023, investors may question whether the BoJ is ready to tighten. The default view is that the perma-dovish BoJ Governor, Haruhiko Kuroda, will not be moved. However, the end of Governor Kuroda’s term on 8 April 2023 will no doubt lead to frenzied speculation on his replacement and whether a less dovish candidate emerges. Interest rate markets are starting to price a change – e.g. the BoJ’s 10-year target sovereign yield of 0.25% is priced at 0.50% in six months’ time.

March 2023 will be especially volatile: The first quarter of 2023 will also see huge focus on the Japanese wage round, where a rise in wages is a prerequisite for the BoJ to tighten policy. Japanese politicians have been encouraging business leaders to raise wages, while at the same time, the government has been quite aggressive with fiscal stimulus to offset the cost-of-living shock. This period will also see the Fed release its dot plots (22 March), which may be the first real chance for the Fed to acknowledge a turn in the inflation profile. As such, this period (March/April) could see a big reversal lower in USD/JPY.

FX Intervention slows the move: Most agree that USD/JPY is higher for good reasons (including the energy crisis) and that Japanese FX intervention can only slow, not reverse the move. The Japanese have already spent around $70bn in FX intervention between the 146 and 151 region in USD/JPY and will likely be called into further action based on our view of a stronger dollar over coming months. FX reserves are not limitless, of course, but Japan’s large stockpile of $1.1tn means that this campaign can continue for several more months. The purpose here is to buy time before the Fed cycle turns. Unless we end up with 6%+ policy rates in the US next year, we would expect USD/JPY to be ending 2023 nearer 130.

GBP/USD: Running repairs

|

Spot |

Year ahead bias | 4Q22 | 1Q23 | 2Q23 | 3Q23 | 4Q23 |

|---|---|---|---|---|---|---|

|

GBP/USD 1.19 |

Mildly Bearish | 1.10 | 1.07 | 1.11 | 1.14 | 1.14 |

Fiscal rescue plan: After September’s government-inflicted flash crash, GBP/USD is now recovering on the expectation of more credible UK fiscal plans and the softer dollar. As above, we doubt 2023 will prove the year of a benign dollar decline. And the risk is that the Fed keeps rates at elevated levels for longer. Given sterling’s large current account deficit and its transition to high beta on the external environment, we think it is too early to be expecting a sustained recovery here. Instead, we favour a return to the 1.10 area into year-end as the government introduces Austerity 2.0 and the Bank of England cycle is repriced lower.

Tighter fiscal/looser monetary mix: At its meeting in early November, the BoE pushed back against the market pricing of the rate cycle – arguing that hikes close to 5% would see the UK economy contract 5%. Our call is that the BoE terminal rate will be closer to the 3.75% area than the 4.50% that the market prices today. As the BoE assesses the degree of tightening needed to curtail inflation, the government is discussing ways to fill around a £60bn hole in the budget. The plan will be revealed on 17 November, probably in a roughly 50:50 split between tax hikes and real terms spending cuts. We look for the UK economy to contract every quarter in 2023 – making it a very difficult environment for sterling.

Sterling suffers from liquidity outages: This year’s BIS triennial FX survey saw sterling retain its position as the fourth most traded currency pair. Despite this, sterling does occasionally suffer from flash crashes. We think liquidity will be at a premium in 2023 and that a Fed taking real rates even higher as economies head into recession is a dangerous combination for sterling – where financial services make up a large section of the economy. GBP/USD realised volatility is now back to levels seen during Brexit and our market call for 2023 is that these types of levels will become more, not less, common.

EUR/JPY: A turn in the cycle

|

Spot |

Year ahead bias | 4Q22 | 1Q23 | 2Q23 | 3Q23 | 4Q23 |

|---|---|---|---|---|---|---|

|

EUR/JPY 144.50 |

Bearish | 142.00 | 138.00 | 137.00 | 135.00 | 130.00 |

Downside risks into 1Q23: EUR/JPY has defied typical relationships with risk assets by gently rallying all year even as both bond and equity benchmarks sold off 20%. Driving that JPY underperformance has probably been BoJ policy and USD/JPY’s strong relationship with US 10-year yields. Both the eurozone and Japan have been hit by the energy shock, where external surpluses have quickly dwindled. As above, we tend to think there are downside risks to EUR/JPY in the first quarter of 2023 as speculation mounts over BoJ Kuroda’s successor as well as the ECB potentially calling time on their tightening cycle at the February meeting.

US10yr can drag EUR/JPY to 130 in 2H23: A large part of the JPY underperformance during 2022 has been driven by developments in the US bond market. USD/JPY consistently shows the most positive correlation to US 10-year Treasury yields of any of the G10 FX pairs – and far higher than EUR/USD. Consistent with ING’s view on the Fed cutting rates in the third quarter of 2023, our debt strategy team sees US 10-year yields starting to edge lower in the second quarter of 2023, and then falling 100bp in the second half of 2023. In theory, this should heavily pressure EUR/JPY into the end of the year.

Financial stability risks increase: Lower growth and tighter liquidity conditions – at least through the early part of 2023 – increase the prospect of financial stability risks. Recall the Fed will be shrinking its balance sheet by $1.1tn in 2023 even as liquidity and bid-offer spreads continue to create difficult market conditions. The yen lost its shine as a safe-haven currency in 2022, but we suspect relative to the euro, some of that shine can be regained in a softer US rate environment. The EUR/JPY cycle should also turn if the ECB calls time on its tightening cycle at the 2 February meeting.

EUR/GBP: Listless in London

|

Spot |

Year ahead bias | 4Q22 | 1Q23 | 2Q23 | 3Q23 | 4Q23 |

|---|---|---|---|---|---|---|

|

EUR/GBP 0.87 |

Neutral | 0.89 | 0.89 | 0.88 | 0.88 | 0.88 |

In the same macro boat: Both the eurozone and UK economies have been hit hard by the war in Ukraine and the surge in energy prices. Both saw sharp terms of trade declines into August and then a sharp reversal as natural gas prices dipped into the warm winter. There is not a substantial amount of difference between our German and UK quarterly growth profiles for 2023 – both contracting every quarter of the year. Perhaps one could argue that the UK is more exposed to higher mortgage rates given the shorter duration of fixed-rate mortgages in the UK. This could all make for a trendless EUR/GBP environment.

Energy price guarantees could differentiate: One important determinant for UK growth in 2023 will be how the new government handles the Energy Price Guarantee. Former UK Prime Minister, Liz Truss, offered a two-year programme – subsequently cut back to six months after the UK fiscal crisis. How the UK consumer copes with having to pay market prices for energy will be key to the UK story in 2023 as well as how the EU as a whole copes with similar challenges. Currently, it seems that the ECB is concerned that the fiscal programmes in Europe are too generous and not particularly targeted – adding to the inflation challenge.

Political wild cards: To pick out a few political wild cards, the first is a re-run of the Scottish independence referendum. The Scottish National Party (SNP) has picked 19 October 2023 as the date – although such an exercise would likely have to be approved by the UK parliament. Currently, the SNP is pursuing an action through the Supreme Court to see whether London can indeed still veto the referendum. In Europe, the focus will probably be on the fiscal path taken by the new right-wing Meloni government and also the reform of the Stability and Growth Pact. Budgets submitted in late 2023 could become an issue were the rules to be tightened again.

EUR/CHF: Swiss National Bank to guide it lower

|

Spot |

Year ahead bias | 4Q22 | 1Q23 | 2Q23 | 3Q23 | 4Q23 |

|---|---|---|---|---|---|---|

|

EUR/CHF 0.98 |

Bearish | 0.95 | 0.93 | 0.90 | 0.90 | 0.92 |

Does the SNB want a stronger Swiss franc?: The Swiss National Bank this year said it made a conscious decision to allow nominal Swiss franc appreciation in light of the inflation environment. The three-month policy rate has been raised 125bp to 0.50% and the SNB says it wants to keep the real exchange rate stable. With inflation running at 3% in Switzerland versus 10% in its largest trading partner, the eurozone, the SNB in theory should be happy with something like 5-7% per annum nominal appreciation in the Swiss franc. That certainly was the story into the end of September but does not quite explain the Swiss franc’s weakness over the last six weeks.

Two-sided intervention: When hiking rates earlier this year the SNB also said it would be engaging in two-sided FX intervention. Ever since the start of the financial crisis in 2008, the SNB has been more familiar as a seller of the Swiss franc – including its 1.20 floor in 2011-2015. Now its strategy is changing and we read that as an objective to potentially manage the Swiss franc stronger in line with its ambitions to tighten monetary conditions. Earlier this year, we estimated that the SNB could possibly drive EUR/CHF to the 0.90 area in summer 2023 based on expected inflation differentials and the need for a stable real exchange rate.

The risk environment should favour the franc: Central banks are communicating that they need to tighten rates into recession and remove the excess liquidity poured out during a series of monetary bailouts. Tighter monetary and financial conditions typically spell stormy waters for risk assets. With its still sizable current account surplus (worth 8% of GDP in the second quarter of 2022) the Swiss franc should perform well during this stage of the global economic cycle. Closer to home, the European economic cycle and the ECB discussing quantitative tightening into early 2023 will prove a challenge to peripheral eurozone debt markets and likely reinforce the franc as a eurozone hedge.

EUR/NOK: Not for the faint of heart

|

Spot |

Year ahead bias | 4Q22 | 1Q23 | 2Q23 | 3Q23 | 4Q23 |

|---|---|---|---|---|---|---|

|

EUR/NOK 10.33 |

Bearish | 10.30 | 10.15 | 9.95 | 9.70 | 9.60 |

Risk sentiment remains key: The krone is not a currency for the faint of heart. It is the least liquid currency in the G10 space, making it considerably exposed to negative shifts in global risk sentiment and equity market turmoil. It is, at this stage, way too early to call for a turn in equities, and a hawkish Fed into the new year may actually mean more pain for risk assets, at least in the near term. A recovery in global sentiment should offer support to NOK in the second half of next year, but restoring market confidence in a very high-beta currency is no easy feat.

Norges Bank policy: The krone’s underperformance in 2022 was exacerbated by Norges Bank effectively sterilising oil and gas profits via a large increase in daily NOK sales. In November, FX daily sales have been scaled back from NOK4.3bn to NOK3.7bn, and we think there could be some interest by NB to further ease the pressure on the currency via smaller FX sales. With recent dovish hints suggesting that the NB hiking cycle may peak at 3.0% (with most of the country on variable mortgage rates, many more rate hikes could be difficult to tolerate), allowing a stronger currency to do some inflation-fighting sounds reasonable.

Energy prices: If indeed markets enjoy a calmer environment in 2023 and NB favours a stronger currency, then NOK is left with considerable room to benefit from a still strong energy market picture for Norway. There is probably an optimal range for oil and – above all – gas prices to trade at elevated levels but not such high levels that would significantly hit risk sentiment. For TTF, this could be somewhere around 150-200 €/MWh. This a plausible forecast for next year, but the margin for error can be very large. We see EUR/NOK at 10.50 in the fourth quarter of 2023, but NOK hiccups along the way are highly likely.

EUR/SEK: Eurozone exposure a drag on SEK

|

Spot |

Year ahead bias | 4Q22 | 1Q23 | 2Q23 | 3Q23 | 4Q23 |

|---|---|---|---|---|---|---|

|

EUR/SEK 10.80 |

Neutral | 10.85 | 10.70 | 10.60 | 10.40 | 10.50 |

Riksbank’s policy: The Riksbank delivered more than one hawkish surprise in 2022, including a 100bp rate hike. This appeared to be part of a front-loading operation where lifting the krona was seen as a welcome side effect. In practice, and like in many other instances in the G10, the high volatility environment meant that short-term rate differentials played a negligible role in FX. So, despite a wide EUR-SEK negative rate differential throughout 2022, SEK was unable to draw any real benefit. That differential has now evaporated, but we expect 125bp of tightening (rates at 3.0%) in Sweden versus 75bp in the eurozone, which could suggest some EUR/SEK downside room in a more stable market environment. Also, a slowdown in FX purchases by the RB, now that reserves are back to the 1H19 levels, should remove some of the pressure on SEK.

European picture: Sweden is a very open economy with more than half of its exports heading to other EU countries. Our expectations are that 2023 will see a rather pronounced eurozone recession and that the energy crisis will extend into the end of next year. Barring a prolonged period of low energy prices (and essentially an improvement in the geopolitical picture) in Europe, we doubt SEK will be able to enter a sustainable appreciation trend in 2023 as sentiment in the eurozone should remain depressed.

Valuation: We are not fans of the euro in 2023, which means that our EUR-crosses forecasts reflect the weaker EUR profile. We see some room for EUR/SEK to move lower throughout the year – also considering that we estimate the pair to be around 9.0% overvalued. However, the high risk of a prolonged energy crisis in the eurozone means that SEK is significantly less attractive than other pro-cyclical currencies next year. Incidentally, SEK is highly correlated to the US tech stock market, which looks particularly vulnerable at the moment. A return to 10.00 or below would likely require a significant improvement in European sentiment.

USD/CAD: Loonie is an attractive pro-cyclical bet

|

Spot |

Year ahead bias | 4Q22 | 1Q23 | 2Q23 | 3Q23 | 4Q23 |

|---|---|---|---|---|---|---|

|

USD/CAD 1.33 |

Bearish | 1.34 | 1.32 | 1.30 | 1.26 | 1.24 |

Commodities and external factors: Our commodities team expects Brent to average slightly above $100/bbl next year, and Western Canadian Select around $85/bbl. Along with our expectations for higher gas prices, the overall commodity picture should prove rather supportive for the Canadian dollar in 2023. In our base-case scenario, where global risk sentiment gradually recovers but two major risk-off forces – Ukraine/Europe and China – remain, CAD would be in an advantageous position, since Canada has much more limited direct exposure to China and Europe compared to other commodity-exporting economies.

Domestic economy: If the US proves to be a relative ‘safe-haven’ in the global recession, therefore withstanding the downturn better than other major economies like the eurozone, this should offer a shield to Canada’s economy, which is heavily reliant on exports to the US. There is probably one major concern for the domestic economy: house prices. Canada is among the most vulnerable housing markets in the world, with price-to-income ratios around 9x in many cities (compared to 5-6x in the US). Whether we’ll see a sizeable but controlled descent or a fully-fledged housing crash will depend on the Bank of Canada and the depth of the recession.

Monetary policy and valuation: It does appear that the BoC has started to consider domestic warning signals (probably, also house prices), and recently shifted to a more moderate pace of tightening. Markets are currently expecting rates to peak around 4.25/4.50% in Canada, and we tend to agree. Barring a rapid acceleration in the unemployment rate, a housing crash should be averted. It is also likely that the BoC will start cutting before the Fed in 2023. All in all, accepting the downside risks stemming from the housing market and/or a further deterioration in risk sentiment, we see room for a descent in USD/CAD to the 1.25 level towards the end of 2023. In our BEER model, CAD is around 20% undervalued in real terms.

AUD/USD: Riding Beijing’s roller coaster

|

Spot |

Year ahead bias | 4Q22 | 1Q23 | 2Q23 | 3Q23 | 4Q23 |

|---|---|---|---|---|---|---|

|

AUD/USD 0.68 |

Mildly Bullish | 0.66 | 0.66 | 0.68 | 0.69 | 0.70 |

Exposure to China: The Australian dollar is a high-beta currency, and the direction of global risk sentiment will be the key driver next year. We think that a gradual recovery in sentiment will be accompanied by a still challenging energy picture, which may force investors to choose which pro-cyclical currencies to bet on. When it comes to AUD, the China factor will remain very central, as Australia has the most China-dependent export machine in the G10. Our economics team’s baseline scenario is that the real estate crisis will be the main drag on growth in China and while retail should recover on looser Covid rules, slowing global demand should hit exports. One positive development: the new Australian government is seeking a more friendly relationship with Beijing, paving the way for the removal of export curbs next year.

Commodities and growth: Iron ore remains Australia’s main export (estimated at $130bn in 2022), and it is a very sensitive commodity to China’s real estate sector. Our commodities team thinks a return to $100+ levels is unlikely given the worsening Chinese demand picture, but still forecasts prices to average $90/t in 2023. The second and third largest exports are oil and natural gas ($100bn combined). Here, we see clearly more upside room for prices, especially on the natural gas side. On balance, we expect the commodity picture for Australia to be rather constructive next year, which could offer a buffer to the Australian economy during the downturn. Growth in 2022 should have topped the 4% mark, but that will be much harder to achieve in 2023. The combination of higher rates, reset mortgages, a slowing housing market and possibly softening labour market should bring growth back closer to 3%. This would still be an extremely strong outcome against the backdrop of global weakness.

Monetary policy and valuation: The Reserve Bank of Australia has been one of the ‘pioneers’ of the dovish pivot, and a return to 50bp increases seems unlikely, as the Bank is probably monitoring the rather overvalued housing market, and the inflation picture is less concerning than in the US or in Europe. Most Australian households have short-term fixed mortgage rates, and we could see a deterioration in disposable income (especially at the start of the year). We think the RBA will be careful to avert an excessively sharp housing contraction, and we expect rates to peak at 3.60% (well below the Fed and the Reserve Bank of New Zealand) and cuts from 3Q23. This would mean a less attractive carry – and less upside risk in an optimistic scenario for global sentiment; but also less damage to the economy, which may play in AUD’s favour in our baseline scenario. Valuation highly favours AUD, as the positive terms of trade shock means that AUD/USD is 20% undervalued in real terms, according to our behavioural equilibrium exchange rate (BEER) model. We have a moderately upward-sloping profile for the pair in 2023, but high sensitivity to risk sentiment and China suggests downside risks remain high.

NZD/USD: Dodging the housing bullet

|

Spot |

Year ahead bias | 4Q22 | 1Q23 | 2Q23 | 3Q23 | 4Q23 |

|---|---|---|---|---|---|---|

|

NZD/USD 0.62 |

Mildly Bullish | 0.60 | 0.60 | 0.62 | 0.63 | 0.64 |

Monetary policy: The Reserve Bank of New Zealand has given very few reasons to believe it is approaching a dovish pivot. Markets are currently expecting the Bank to hike well into 2023, and take rates to around 5.0%. While inflation (7.2% year-on-year) and job market tightness (unemployment at 3.3%) both remained elevated in the third quarter, there are growing concerns about the rapid downturn in the New Zealand property market, which in our view will trigger either an earlier-than-expected end to the tightening cycle or a faster pace of rate cuts in 2023.

Housing troubles: The RBNZ recently published its financial stability report, where it showed relatively limited concern about households’ ability to withstand the forthcoming downturn in house prices. In its August 2022 forecasts, the RBNZ estimated that the YoY contraction in house prices will reach 11.6% in the first quarter of 2023. However, that implied an Official Cash Rate at 4.0%, so only 50bp of extra tightening from now, which seems too conservative now. House prices have fallen 7.5% from their first quarter 2022 peak so far, but the trend may well accelerate, especially given a hawkish RBNZ and the risk of slowing global demand hitting the very open New Zealand economy.

External drivers and valuation: Even assuming a constructive domestic picture in the housing market and an attractive yield for the currency in 2023, external factors will determine how much NZD can draw any benefit. As for AUD, risk sentiment and China are the two central themes. The New Zealand dollar is more exposed to risk sentiment (as it is less liquid and higher-yielding) than AUD, but probably less exposed to China’s story. In particular, the real estate troubles in China may well hit Australia via the iron ore channel, while NZ exports (primarily dairy products) are much more linked to China’s Covid restrictions, which look likely to be gradually scaled back. In our base case, the two currencies should largely move in tandem next year. The real NZD/USD rate is 15% undervalued, according to our BEER model.

EUR/DKK: Tricky mix of intervention and rates

|

Spot |

Year ahead bias | 4Q22 | 1Q23 | 2Q23 | 3Q23 | 4Q23 |

|---|---|---|---|---|---|---|

|

EUR/DKK 7.44 |

Neutral | 7.44 | 7.44 | 7.44 | 7.44 | 7.45 |

Central bank policy: Danmarks Nationalbank delivered FX intervention worth DKK45bn in September and October to defend the EUR/DKK peg. On 27 October, it opted for a smaller rate hike (60bp) compared to the ECB (75bp), which briefly sent EUR/DKK close to the 7.4460 February highs before rapidly falling back to 7.4380/90. We think it will be a busy year ahead for the central bank, as we expect very limited idiosyncratic EUR strength and potentially more pressure on EUR/DKK. Having now exited negative rate territory, DN has much more room to adjust the policy rate for a wider rate differential with the ECB if needed. However, with inflation running above 10% in Denmark, DN may prefer FX intervention over dovish monetary policy to support the peg. We have recently revised our EUR/DKK forecast, and expect a return to 7.4600 only in 2024.

Content Disclaimer

This publication has been prepared by ING solely for information purposes irrespective of a particular user’s means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment