koto_feja G1

Such a study indicates that the greatest investment reward comes to those who by good luck or good sense find the occasional company that over the years can grow in sales and profits far more than industry as a whole. – Phillip Fisher (Warren Buffett’s mentor)

In biotech investing, you want to pick a company that has multiple catalysts like a data release stacked in close sessions. After all, if one data release flops there would be additional clinical reporting to galvanize the shares price. Despite that its marketing partner Boehringer left, I still like G1 Therapeutics (NASDAQ:GTHX) because of the substantial unlocked value in Cosela. Going into yearend and next year, there is a flurry of catalysts that can substantially improve the investment prospects of this company. In this research, I’ll feature a fundamental analysis of G1 and share with you my expectation of this intriguing equity.

Figure 1: G1 Therapeutic Chart

About The Company

As usual, I’ll present a brief corporate overview for new investors. If you’re familiar with the firm, I suggest that you skip to the next section. Operating out of the Research Triangle Park, North Carolina, G1 Therapeutics is a commercial-stage company focusing on the innovation and commercialization of next-generation medicines to fulfill the unmet needs in cancers.

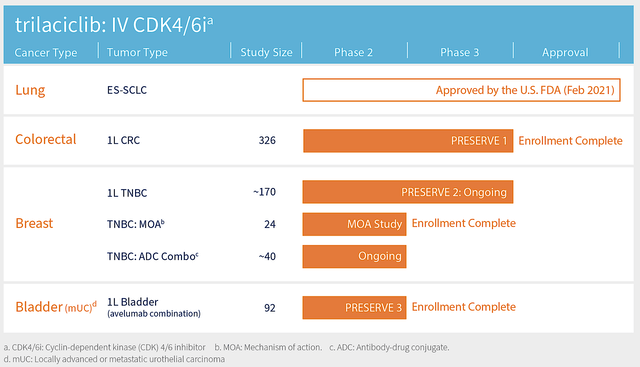

As the “crown jewel” of this pipeline, Cosela is already FDA-approved for the treatment of chemotherapy-induced myelosuppression in adult patients with metastatic small-cell lung cancer (mSCLC). In expanding its label, G1 is investigating Cosela as monotherapy and in combination with other drugs for various solid tumors, including colorectal, breast, lung, and bladder cancers.

Figure 2: G1 Therapeutics chart

Mechanism Of Action (MOA) Of Cosela

Shifting gears, let us walk through the various fundamental developments pertaining to Cosela/G1. Whenever appropriate, I’d present to you the research format that illustrates the MOA, Disease Context (i.e., DC), and supporting data. That way, you can better appreciate your data forecasting. More importantly, it’ll give you more context in “reading the tea leaves” to stay ahead of the market.

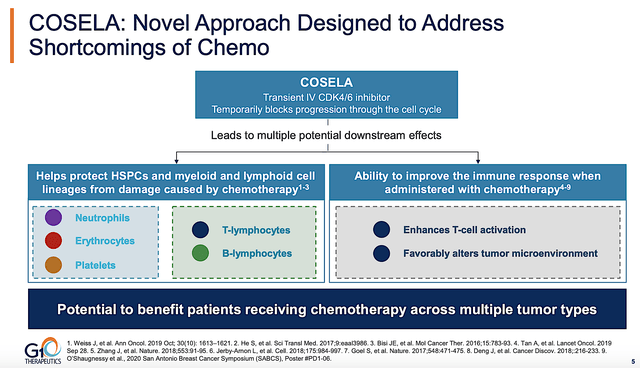

On this front, you can see that Cosela’s MOA is crucial in the treatment of a vast number of cancer indications. Notably, chemotherapy kills both the cancer cells as well as normal cells (including cells of the immune system like the T-cells). But in order for chemotherapy to kill these cells, the cell has to be able to move forward in its “cell cycle.” That is to say, those cells have to advance from immature precursors to their matured forms.

As a transient CDK46 inhibitor, Cosela “temporarily” halts the cell cycle of key cells needed to combat cancers. Consequently, Cosela can theoretically protect various (i.e., myeloid and lymphoid) cells from damage caused by chemotherapy. With the aforesaid key cells being protected, Cosela ultimately boosts immune system functioning. Notably, this MOA is logical to me, but there is still some “gray area” in my thinking. Simply put, it’s not as clear-cut as other MOAs.

Figure 3: Cosela mechanism of action

Disease Context For Various Cancers

As you can imagine, the MOA of Cosela (i.e., boosting immune cells) is very important for the treatment of cancers. After all, tumor cells exert “suppressive effects” on the immune system. As you can appreciate, the MOA of Cosela – in protecting immune/blood cells and strengthening the immune function – “more or less fits” into the cancer Disease Context like puzzle pieces. As such, it explicates and foretells upcoming strong clinical data results.

The solid proof in the pudding of Cosela’s efficacy is that it is already approved and launched for the treatment of myelosuppression associated with chemotherapy treatment for lung cancer.

Upcoming Catalysts In 4Q2022

As catalysts can move the needle on your stock, you want to check up on the vast number of upcoming data reports. Beyond the potential share price appreciation, those catalysts can also ramp up Cosela’s sales.

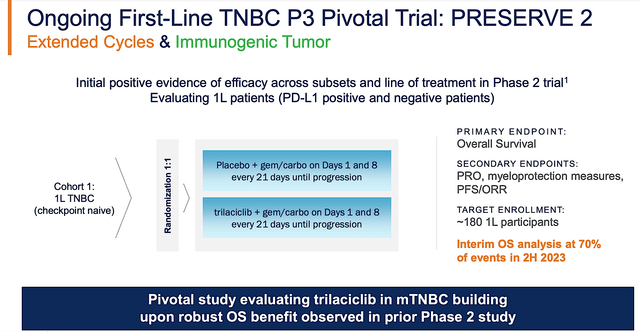

Toward year-end, there is an upcoming data release for the Phase 2 trial that assesses Cosela in 24 patients suffering from early-stage triple-negative breast cancer (i.e., TNBC). This study further explores the MOA of Cosela. The study’s primary endpoint is the immune-based MOA. That includes Cosela’s impact on CD8+ T-cells (i.e., killer T-cells) and regulatory T cells (i.e, T-regs) in the tumor’s environment. A key secondary endpoint is the pathological complete response rate (i.e., PCR).

That aside, there are two Phase 2 combo investigations poised to release their data soon. The first is a combo study with an antibody-drug conjugate (i.e, ADC) known as Trodelvy for advanced TNBC. Here is where it gets interesting with the second study, i.e., the Phase 2 (PRESERVE 3) trial. Notably, PRESERVE 3 assesses Cosela with chemotherapy and an immune checkpoint inhibitor dubbed Avelumab in 92 patients with bladder cancer.

With Enrollment already completed, G1 would release the initial data by yearend. Next year, there are more data releases (i.e., progression-free survival) for PRESERVE 3. Now, PRESERVE 3 is very important because it can position Cosela+Trodelvy to become the first line (i.e, 1L) treatment for bladder cancer. Over the decades, I have noticed that 1L therapeutics have the best chances of becoming blockbusters.

Figure 4: PRESERVE 2 trial

Commercialization Progress

In the latest earnings report, G1 reported $8.7M in Cosela sales. While that isn’t much, it’s significant for a small company like G1. Had Boehringer still been on board, you can bet that sales would have been much higher. Interestingly, G1 noted in the earnings conference call that Cosela is now approved in China.

In connection with the milestone achieved, the China partner (Simcere) will pay G1 $13M as part of the total $156M to be earned. I like that development because G1 can leverage a partner like Simcere who knows the China market. With Simcere, you can expect a stronger revenue ramp-up. Commenting on the recent development, the CEO (Jack Bailey) remarked:

The second quarter of 2022 was a period of continued momentum across the G1 organization toward our mission of improving the lives of those impacted with cancer. For the first time, our sales team was in full control of Cosela, interacting with prescribers and driving usage and uptake. Thanks to the quality of these engagements, we experienced nearly 60 percent vial volume growth quarter over quarter – our highest quarterly growth rate since the initial launch period. In addition, our clinical team continued to execute on each of our ongoing clinical trials, including achieving important enrollment milestones in our Phase 3 trial of trilaciclib in patients with colorectal cancer and in our Phase 2 bladder cancer and mechanism of action trials.

Financial Assessment

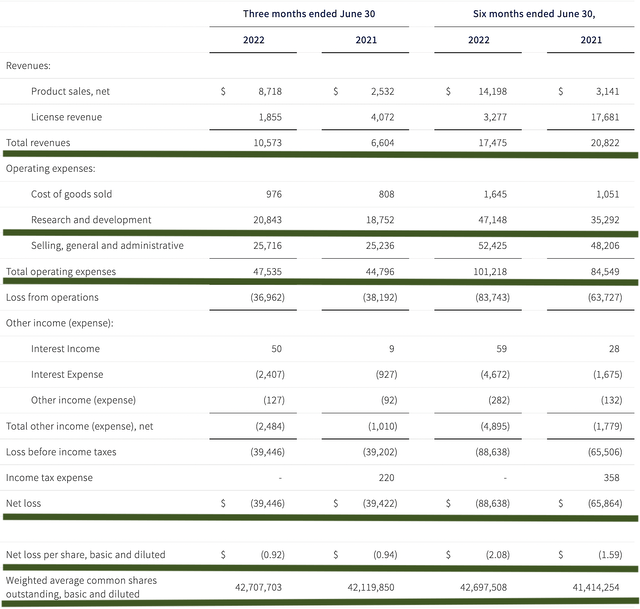

Just as you would get an annual physical for your well-being, it’s important to check the financial health of your stock. For instance, your health is affected by “blood flow” as your stock’s viability is dependent on the “cash flow.” With that in mind, you should assess the 2Q2022 earnings report for the period that ended on June 30.

As follows, G1 procured $10.5M in total revenues, compared to only $6.6M for the same period a year prior. Of the revenues, Cosela’s sales for the respective periods registered at $8.7M and $2.5M. Therefore, product sales increased by 248% year-over-year (YOY).

That aside, the research and development (i.e., R&D) tallied at $20.8M and $18.7M for the same comparison. I viewed the 11.2% R&D increase positively because the money invested today can turn into blockbuster profits tomorrow. After all, you have to plant a tree to enjoy its fruits.

Additionally, there were $39.44M ($0.92 per share) net losses compared to $39.42M ($0.94 per share) declines for the same comparison. The bottom line essentially remains the same.

Figure 5: Key financial metrics

About the balance sheet, there were $144.0M in cash and equivalents. On top of the $10.5M quarterly revenue and against the $47.5M quarterly OpEx, there should be adequate capital to fund operations into 2Q2023 prior to the need for additional financing. Simply put, the cash position is adequate relative to the burn rate.

Potential Risks

Since investment research is an imperfect science, there are always risks associated with your stock, regardless of its fundamental strengths. More importantly, the risks are “growth-cycle dependent.” At this point in its life cycle, the main concern for G1 is whether Cosela can post positive data for its two registration trials (i.e., PRESERVE 1 and 3).

In case of a negative clinical binary, you can expect your stock to tumble by 50% and vice versa. That aside, there is a significant risk that something is wrong with Cosela which caused Boehringer to drop the launch partnership.

Conclusion

In all, I recommend G1 Therapeutics as a speculative buy with a 4.7/5 stars rating. G1 Therapeutics is an interesting play with tremendous potential. The lead medicine Cosela is already approved for lung cancers. Early sales results have been modest because the company lost its robust launch partner, Boehringer. Nevertheless, G1 picked up another launch partner (though less well-known), Simcere.

Despite modest sales thus far, those results are significant. Now, the biggest value for Cosela is in its label expansions into the first-line treatment for bladder cancer and mCRC. In the case of positive data release and ultimate approval/launch with a big partner, that can position Cosela to become a mega-blockbuster drug.

Be the first to comment