Eoneren

While being short the Euro via the Invesco CurrencyShares Euro Trust (NYSEARCA:FXE) had been a winning trade in 2022, future returns are more uncertain, as monetary policies between the EU and the US reach a critical inflection point. I believe investors should step to the sidelines and see how monetary policies develop in the coming few weeks before re-engaging in either a long or a short on the FXE.

Fund Overview

The Invesco CurrencyShares Euro Trust is designed to track the price of the Euro in USD. It is one of the larger currency ETFs on the market, with approximately $350 million in assets. The FXE ETF charges a 0.40% expense ratio.

The main selling point of the FXE ETF vs. an actual investment in the Euro is that the ETF is easily accessible through a traditional brokerage account and the shares are exchange traded and marginable. The shares of the ETF are backed by the assets of the Trust, which does not hold or use derivatives. Finally, investors do not have to pay a currency conversion fee, which is typically wrapped in the bid/ask spread charged by banks.

Returns

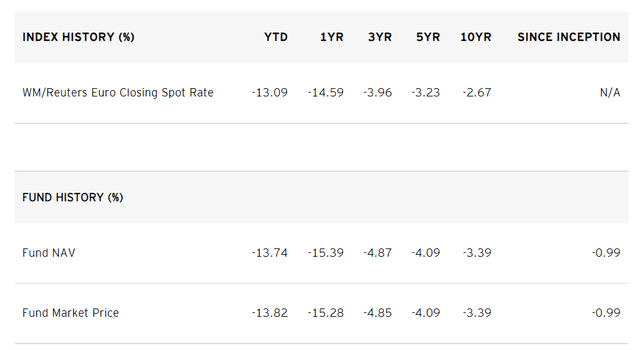

The FXE ETF has returned -13.7% YTD, inline with the decline in the Euro vs. the USD (Figure 1).

Figure 1 – FXE returns (invesco.com)

Euro Weakness Caused By Weak Economy And Interest Rate Differential

Shorting the Euro had been one of the most popular and crowded trades in 2022, as the Euro suffered from a weak economy and a widening interest rate differential compared to the USD.

Although the ECB tried to respond to soaring inflation in the EU with interest rate increases of their own, the fact that the European economy was much weaker than the American economy meant that their ability to raise rates was lower. So far, as of December 2, 2022, the Federal Reserve has raised the Fed Funds rate to 3.75%, while the equivalent ECB Deposit rate is only 1.50%.

However, in recent weeks, the Euro has rallied dramatically against the USD, erasing months of losses. What happened and is this going to continue?

Speculators Reversed Shorts And Are Now The Longest In Years

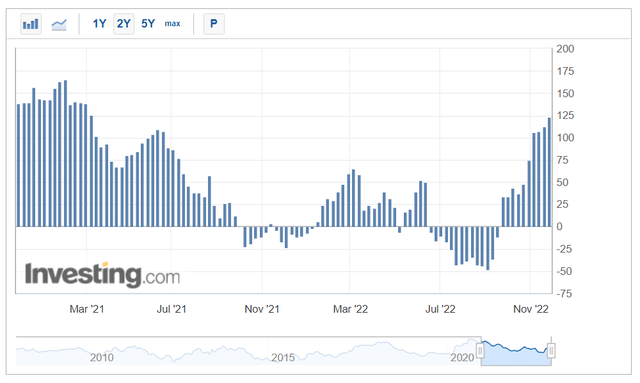

First, speculators began reversing their shorts on the Euro beginning in September, shortly after the ECB surprised markets with a 75 bps rate increase of their own (Figure 2).

Figure 2 – CFTC net speculative position in EUR (investing.com)

In recent weeks, speculators have pressed their longs to the highest levels since early 2021, helping the Euro extend gains vs. the USD.

Slowing Pace Of Fed Rate Increases Narrows Forward Interest Rate Differential

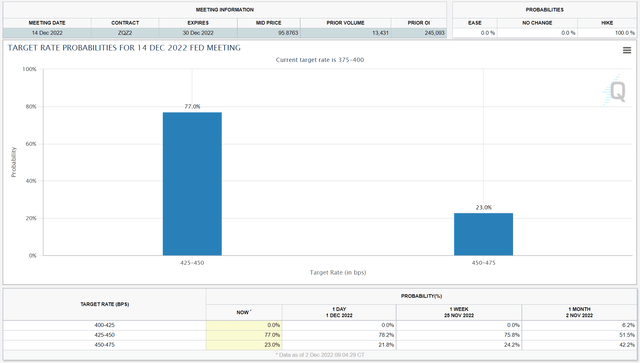

Next, although the Federal Reserve raised the Fed Funds rate by 75 bps at the November meeting, they also laid the groundwork for a slowdown in the pace of rate increases. This was practically confirmed by the Fed Chairman in his Brookings Institute speech on November 30, where he said the Fed could slow down to a 50 bps hike as soon as December.

This has led to a large repricing of the expected Fed Funds rate level for the December 14th FOMC meeting, from a 42% probability of 4.5% back in early November (before the November FOMC meeting), to now only a 23% probability (Figure 3).

Figure 3 – December Fed Funds expectations (((CME)))

With Eurozone inflation still above 10% in November vs. 7.7% in the U.S. in October, it appears the ECB needs to be more hawkish than the Fed in the short term, which will further narrow the interest rate differential.

Technicals Approaching Key Levels

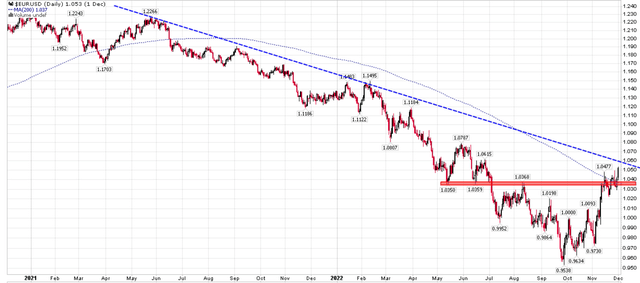

Technically, the Euro is approaching a key multi-year downtrend that could confirm a new uptrend is in place. It has already cleared a key resistance level between 1.035/1.037, as well as the 200D moving average (Figure 4).

Figure 4 – EUR approaching key downtrend (Author created with price chart from stockcharts.com)

Risks

The key downside risk to the FXE ETF is the upcoming ECB rate decision on December 15, 2022. As we can see from figure 2 above, speculators have turned quite bullish on the Euro. The risk to further Euro strength is if the ECB raises rates by 50 bps as expected, but provides a dovish outlook.

The upcoming FOMC decision on December 14 could also be a catalyst. If the Fed is more hawkish in its forward guidance, that could negatively impact the Euro versus the USD.

Conclusion

While being short the Euro via the FXE ETF had been a winning trade in 2022, future returns are more uncertain, as monetary policies between the EU and the US reach a critical inflection point. As the Euro approaches a multi-year downtrend, risk/reward for either longs or shorts at this point is unfavorable. I believe investors should step to the sidelines and see how monetary policies develop in the coming few weeks before re-engaging in either a long or a short direction.

Be the first to comment