Scharfsinn86

Investment thesis: Fusion Fuel Green PLC (NASDAQ:HTOO) is a hydrogen startup, based in the EU. It is focused on producing green hydrogen through solar-powered hydrolysis, as well as providing its proprietary equipment to other companies, looking to produce green hydrogen from solar power. It is mostly focused on projects in the Mediterranean area and it is currently in various stages of ramping up production at a number of its projects, while also providing equipment to other hydrogen producers.

With the EU energy crisis becoming more severe and taking on a permanent feel, as its relations with its largest energy provider keep deteriorating, there is increasingly no alternative but to embrace non-hydrocarbon solutions. The EU was already committed to a green transition, even before the energy crisis, but the economic divorce with Russia removes any opportunity to hesitate or turn the clock back, even as the economic pain will most likely intensify. In other words, with the Russia-EU economic divorce, the EU burned its bridges and there is no turning back. It has to attempt to build an economy dominated by green energy.

Within the context of a still-evolving energy crisis in Europe, the timing of Fusion Fuel’s ramping up of its operations seems to be coincidentally perfect. It can take advantage of Europe’s scramble to speed up its energy transformation, which should see more grants coming its way, as well as the rising costs of grey hydrogen production, which makes green hydrogen production far more competitive. Assuming that its ongoing projects will be successfully implemented, Fusion Fuel should see a significant jump in customer interest for its solar-powered hydrolysis systems as well as for the hydrogen production that it is ramping up.

Fusion Fuel’s timing for launching and starting to ramp up its hydrogen production and solar-powered hydrolysis equipment, could not have been any better

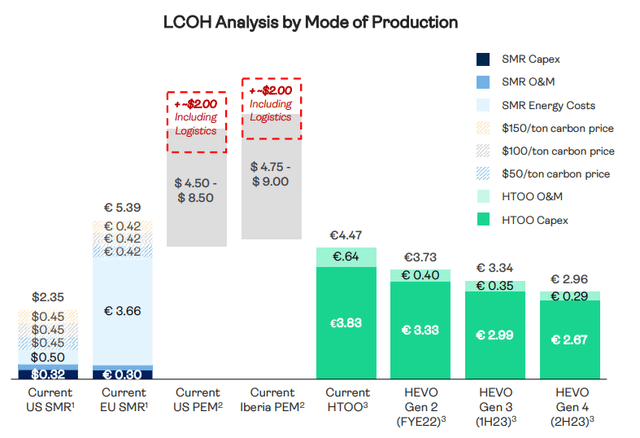

Before I address the very important issue of the EU’s growing need to urgently adopt a hydrogen-powered economy model, in order to deal with its increasingly bleak energy security and pricing outlook, I want to briefly introduce Fusion Fuel’s financial situation and business model & profile. It is a startup with a market cap of about $100 million, based in Europe. It specializes in designing and producing solar-powered hydrolysis units meant for green hydrogen production. Just a year ago green hydrogen production costs were not competitive compared with hydrogen production derived from natural gas.

Hydrogen production costs (Fusion Fuel)

Because natural gas prices in Europe rose so dramatically in the past year, Fusion Fuel is now able to actually compete in terms of cost of production with grey hydrogen producers in the EU market. It may be argued that the current natural gas price environment in Europe is only a temporary situation, with the market returning to some form of normal in the coming months or within the next few years at most. I personally do not see it happening, given the worsening relations between the EU and Russia. Natural gas prices will be high for the foreseeable future and it is affecting the competitiveness of all industries that use it for some form of energy generation or as a feed material.

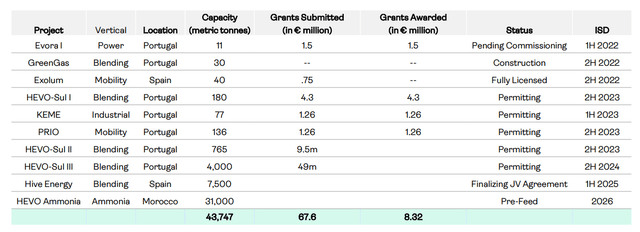

As of the first quarter of this year, Fusion Fuel does not have a great deal of financial performance history for us to draw conclusions in regards to profitability, and other measures. It took a loss of 3.84 million euros. Operating expenses were 3.04 million euros. For the fourth quarter of last year, it recorded a net profit of 11.11 million euros, which tells us very little about the company. Of note, the number of shares outstanding has been steady for the first quarter of the year. Revenues are currently flowing into its coffers in the form of grant programs that the company is accessing in support of a number of projects it is currently undertaking and are in various stages of development.

The total employee headcount of the company is likely to be about 150 by the end of the year. As the list of projects and the capacities involved will suggest, this company is not set to see very meaningful revenue flows until after the middle of the decade. It should be noted however that the current situation in the EU may lead to an acceleration of its projects, with the flow of grants also potentially set to increase.

About a third of the total estimated CAPEX needed for the implementation of its projects is currently covered by potential grants, assuming that all of the grants requested will be granted and absorbed. Within the current context, I doubt that it will be a problem, given that the EU is in a bind in regard to its energy situation. In fact, Fusion Fuel may become eligible for additional grants as the EU will most likely scramble to greatly increase the pace of its energy transition. For investors, this means that their shares are less likely to be overly diluted in the future through massive share issuance, while Fusion Fuel will be less likely to accumulate massive, potentially unsustainable or profitability-eroding debt in the future.

The EU cannot run its economy on wind & solar, without hydrogen being used as an energy storage medium.

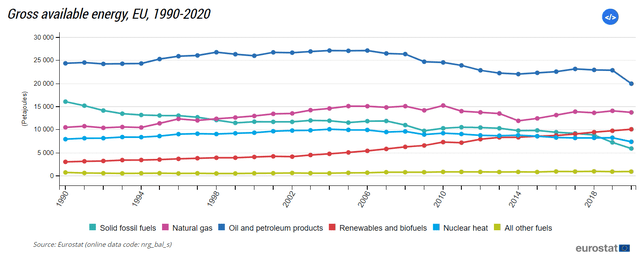

As the energy price spike in Europe that started in late 2021 has shown, renewable sources of energy can be as unpredictable as the weather. While most green energy storage and backup plans tend to focus on smoothing out the great output variation from one day to another, or at most from one week to another, wind power output in places like Germany and elsewhere saw a double-digit percentage decline in 2021 compared with the previous year, which led to an EU energy crisis months before Russia’s invasion of Ukraine. The price pressures came as a result of extra demand from idled power generation facilities that run on natural gas, that had to come back online in order to make up for the large shortfall in wind and hydropower generation.

Ordinarily, it is assumed that with a diverse supply of renewables, dominated by wind, solar and hydro, and with regional grid integration adding to regional weather pattern diversity, renewable power can provide a more or less steady, dependable flow of energy. The massive renewable energy shortfall of 2021, which has been largely downplayed by public officials as well as most of the media suggests otherwise. Wind power generation shortfalls were widespread throughout the continent. Solar power was stagnant, while hydro power generation in Scandinavia was also hit by a drought, leading to a decline in exports of electricity from countries like Sweden.

The fact that there can be such a massive gap in green power generation from one year to another suggests that running a power grid mostly on renewable energy sources that are dependent on the weather will require long-term storage of energy generated by those sources. Lithium batteries as well as other solutions can provide for gaps in power generation that may last hours, days, or at most a few weeks. Transforming solar & wind power into hydrogen is the only viable option as far as I can tell for solving the problem of longer-term shortfalls in renewable power generation.

As for the magnitude of the need, based on the 2021 shortfall, an EU economy that is set to supposedly run mostly on renewable sources of energy within perhaps three decades will probably need to be prepared to cover about 20% of its yearly energy needs with hydrogen stored at any given point in time.

Based on data available, the EU needs about 60,000 Petajoules per year in total energy. 20% of that is about 12,000 Petajoules. One Petajoule converted into hydrogen equivalent comes out to about 10,000 tonnes of hydrogen. For reference, the EC hydrogen strategy released in 2020 envisaged a million tonnes of hydrogen to be produced from renewable energy sources by 2024. So, it will be enough to meet about .12% of its total hydrogen needs by 2050, which I estimate will be necessary in order to ensure energy security within the context of the envisaged renewables-driven economy that it wants to build in the next three decades. I should note that the EC sees green hydrogen making up 13-15% of the total energy mix of the EU by 2050, which is less than the 20% I estimate is needed, given what we learned in 2021 about renewable energy reliability issues. Regardless of whether I am right, or whether the EC is right, it is a huge potential market that Fusion Fuel is tapping into with its solar hydrolysis systems.

Investment implications:

Just recently Norsk Hydro ASA (OTCQX:NHYDY, OTCQX:NHYKF) announced that it is shutting down an aluminum smelter in Slovakia. It may be a sign that the prolonged period of high energy costs, which started about a year ago is starting to lead to permanent shutdowns of industrial activities, whereas up until now industrial shutdowns in response to the crisis have been mostly temporary in nature. The need to address the situation has therefore become very urgent in the EU. The timeline for ramping up the production of green hydrogen that the EU planned for just two years ago will most likely be accelerated.

The obvious implication for Fusion Fuel is that this could mean far more financial as well as institutional support for its efforts to ramp up its hydrogen production, as well as the production of its solar-powered hydrolysis systems that it intends to sell to other companies. EU and national permitting rules may be relaxed for such particular projects, while the EU, as well as national grants, are likely to increase.

It used to be that the argument in favor of such companies centered around the above-mentioned government support the industry is benefiting from. In the particular case of Europe, with energy prices set to remain high for the foreseeable future, green hydrogen is no longer an emerging industry set to benefit from constant government welfare and also become wholly dependent on it. It is likely to compete with other sources of hydrogen, as well as other sources of energy. There is always the risk that somehow, Europe’s energy security situation will revert back to a pre-2020 normal, in which case Fusion Fuel may get caught out. The odds of that happening are declining with every day that passes, as the EU-Russia economic relationship continues to deteriorate. While there are some risks involved, ranging from Fusion Fuel’s own ability to execute successfully all its proposed projects, to geopolitical trends that are currently favoring its business model, turning against it, the current situation most certainly warrants a bullish outlook for its stock. I first bought some stock in this company a few months ago, and I recently added some more. The potential gains seem to outweigh the potential risks in magnitude as well as in terms of odds.

Just a few months ago there was still much doubt in regards to whether the EU will fully commit to its green energy transition, given how painful it is set to be for its economy. After months of economic conflict with Russia, the relationship between the two seems to have become irretrievably broken, while the EU is waking up to the reality of worldwide scarcity, which makes it very difficult to fully replace Russian energy. At this point, for better or worse, the EU is now fully committed to the green new deal, no longer by choice, but by circumstance. This means that a lot of hydrogen will be needed, and Fusion Fuel came along just at the right time.

Be the first to comment