FotoDuets/iStock via Getty Images

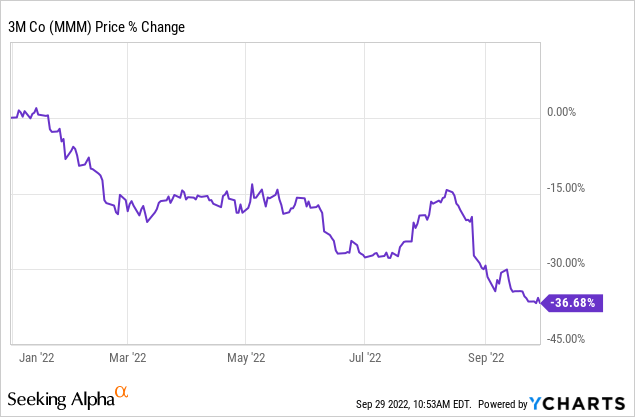

In May 2022, we have published an article on 3M (NYSE:MMM), titled ”3M: Not as safe as you first think”. In that article, we have presented several reasons that made our outlook bearish for the near- and mid-term. These reasons included, but were not limited to the macroeconomic environment (primarily related to increasing raw material prices and decreasing manufacturing productivity), potential costs associated with pending legal claims and the downward trending margins.

While the stock price has fallen substantially since our last article, we have to understand how these risks have developed since then, to decide whether 3M could be a better investment now than it appeared to be in May.

In this article, we are going to take a look at these risk factors once again and provide an updated view, based on the latest news, events and economic indicator readings.

Macroeconomic environment

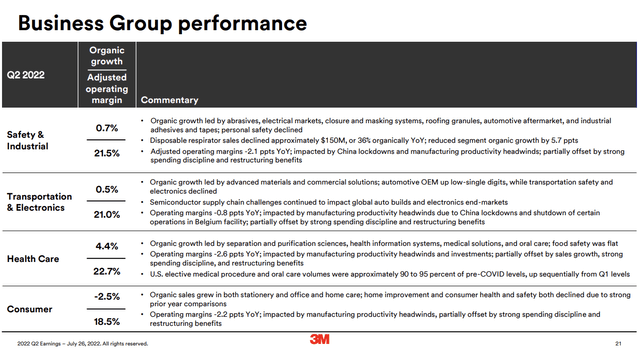

The challenging macroeconomic environment still keeps creating headwinds for 3M and is negatively influencing the firm’s financial performance. In the latest earnings release, the firm has highlighted some of these challenges:

- A larger than expected negative impact on sales from foreign currency translation due to strength of U.S. dollar

- Headwinds from the combined impact of China COVID-related lockdowns and decline in disposable respirator demand

- Manufacturing headwinds from global supply chain challenges, including geopolitical impacts

- Raw material and logistics cost inflation

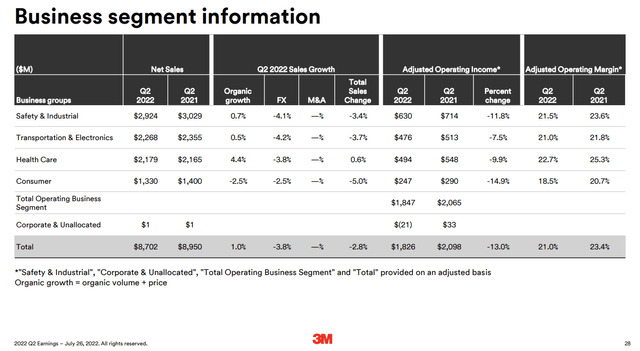

The firm has also provided a detailed commentary on the tailwinds and headwinds for the individual business segments. This is summarized in the following tables:

Business group performance (3M)

Business segment information (3M)

These headwinds are now also taken into account for the firm’s full year 2022 guidance, which has been adjusted downwards, significantly:

- Total sales growth: -2.5 to -0.5 percent vs. 1 to 4 percent prior

- Organic sales growth: 1.5 to 3.5 percent vs. 2 to 5 percent prior

- Foreign currency translation: -4 percent vs. -1 percent prior

- GAAP earnings per share: $7.32 to $7.82 vs. $9.89 to 10.39 prior

- Adjusted earnings per share: $10.30 to $10.80 vs. $10.75 to $11.25 prior

- Operating cash flow of $6.6 to $7.2 billion contributing to 90% to 100% adjusted free cash flow conversion

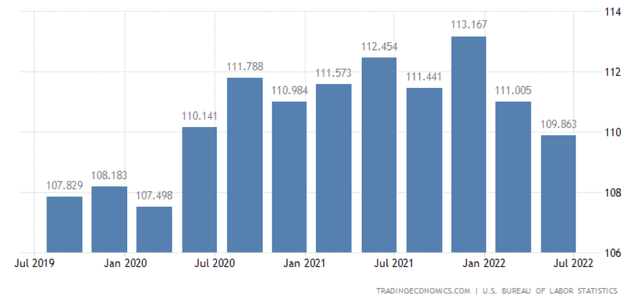

Additionally, the economic indicators that we have presented in our previous article, also have not been showing any meaningful improvement that could signal any positive impact on the financial performance for the rest of the year.

Non farm labour productivity

In the United States, the productivity of nonfarm workers is measured as the output of goods and services per hour worked. Labor productivity is calculated by dividing an index of real output by an index of hours worked of all persons, including employees, proprietors, and unpaid family workers.

Earlier this year, the firm has highlighted the decreasing labour productivity as a cause for the contracting margins. Since our last writing, we have seen further deterioration of the labour productivity.

Non farm payroll productivity (Tradingeconomics.com)

Non-farm labor productivity in the US fell an annualized 4.1 percent in the second quarter of 2022, slightly less than initial estimates of a 4.6 percent drop. Output decreased 1.4 percent and hours worked 2.7 percent. Compared to the second quarter of 2021, productivity decreased 2.4 percent, the largest decline since the first quarter of 1948.

Based on this indicator, we do not expect a meaningful improvement of the margins in the near term.

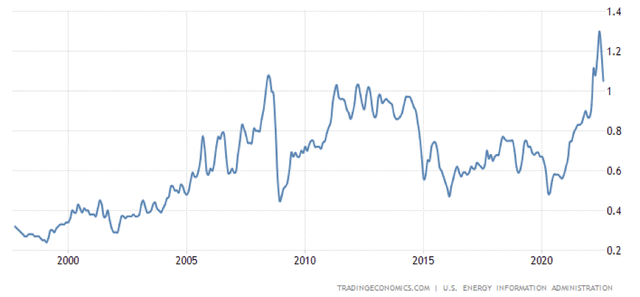

Gasoline prices

While the prices of raw materials, including gasoline prices, have come down substantially from their peaks, reached earlier this year, they remain elevated compared to pre-pandemic levels. In our opinion these elevated levels are likely to keep negatively impacting the firm in the near future.

Gasoline prices (USD/L) (Tradingeconomics.com)

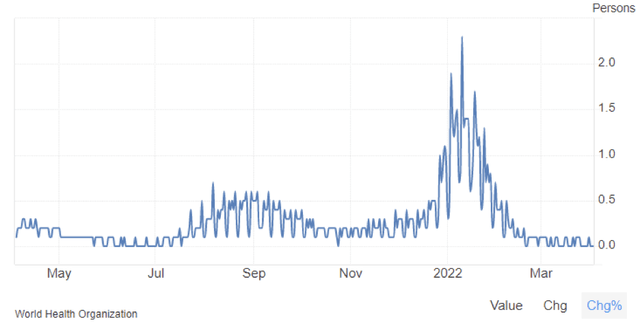

COVID-19 cases

COVID-19 effects are twofold for 3M’s business.

As mentioned, the declining COVID-19 cases are leading to a slowing demand for pandemic related products, which eventually are resulting in lower sales figures for the firm. On the other hand, COVID-19 related restrictions in China caused manufacturing productivity to decline, causing a negative impact on the margins.

Covid-19 cases (Tradingeconomics.com)

To sum up, based on the economic indicators and the firm’s updated full year guidance, we believe that there is no justification at the moment to update our previously issued “sell” rating.

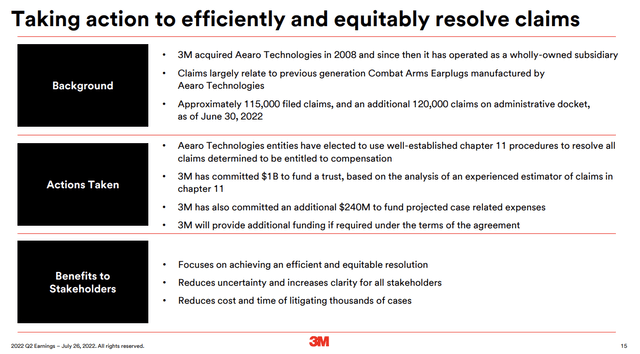

Legal actions

In our opinion, the uncertainty around legal actions has been somewhat decreased since our last writing. Although significant risks remain, the firm has taken certain actions to efficiently and equitably resolve the litigation related to the combat arms earplug version 2.

The following table summarizes 3M’s actions:

Actions taken to resolve claims (3M)

The question is now, how effectively this strategy can be executed. So far, there have been hurdles. End of August 2022, U.S. Bankruptcy judge Jeffrey J. Graham ruled against a temporary stay of suits. This decision substantially disrupts 3M’s plan to settle the lawsuit by their previously outlined strategy. The firm, however, disagreed with the judgment and planned to appeal.

Further, a new earplug lawsuit could also block 3M’s health care spinoff, which creates an additional, new layer of uncertainty.

All in all, we can say that there have been more questions raised than answered in the last months with regards to the legal actions against 3M. For this reason, we do not see any improvements in the risk-reward profile and any reasons that could justify upgrading the stock from our previous “sell” rating.

To sum up

Share price has substantially fallen since our last writing, which we believe is justified, due to the downward adjustment of the full year 2022 guidance and the challenging macroeconomic environment.

Many of the indicators that we have presented earlier are showing no improvement of the macroeconomic conditions.

Additionally, the relative strength of the USD compared to other currencies has a larger negative impact on the financial performance than it was first expected.

While there have been substantial developments related to the legal claims, we believe that these developments are rather disadvantageous for 3M.

For these reasons we maintain our “sell” rating.

Be the first to comment