Andrii Yalanskyi

Bull Case

As many SA authors covered Fulgent (NASDAQ:FLGT) bull case quite extensively, I will make mine brief.

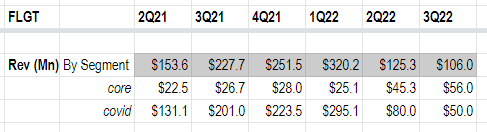

Fulgent has 2 business segments – Covid and Core. Its “covid” line of business was a high-margin, lucrative business that made a total of $1.1B in operating income since the Covid breakout. Its “core” line of business registered LTM of ~$180Mn revenue, growing at a fast pace of ~100% YoY. Here is their revenue by segment over the last 18 months.

FLGT revenue by segment (compiled by author)

At ~$35/share, 30.8Mn shares, and ~$0.9B net cash, its enterprise value is a mere $200Mn.

That values its fast-growing core business at ~1.1x EV/Sales, discarding its entire covid business. To be fair its covid business unit has been shrinking quickly and revenue trending to zero.

From Bull to Bear

While my bull case is brief, the bear case is filled with recent red flags surrounding poor corporate governance and was cemented last week by its questionable acquisition during its 3Q22 ER. Let me explain:

Red Flag 1 – Pledging Shares

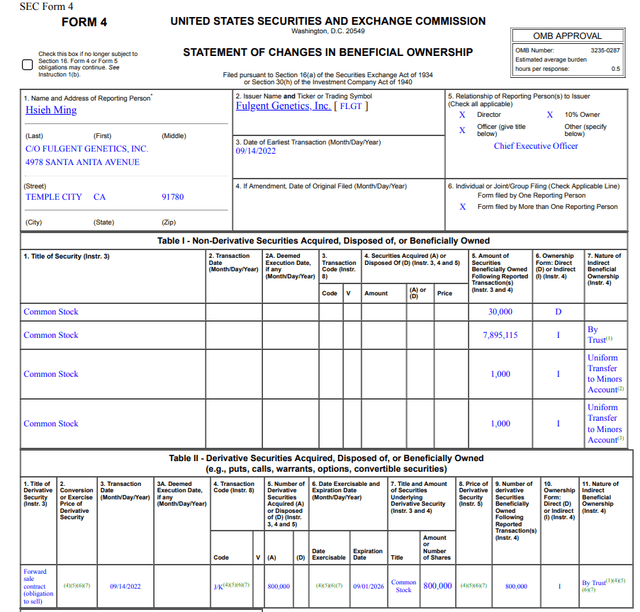

Mr. Hsieh, Fulgent’s CEO, pledged 800k shares (10% of the total shares he owns) in exchange for ~$29Mn cash in a variable forward agreement in Sep 2022.

For these unfamiliar with variable forward agreements, it is a derivative instrument that allows you to get paid upfront, and transfer equity ownership at a future date, at a variable price determined by the agreement and stock price at the time of the settlement.

Mr. Hsieh gets paid a minimum of ~$36/share. He could benefit from price appreciation (on settlement dates in Sep 2026) from $41 to $55 by delivering fewer shares, and benefits capped out at $55/share. In short, his downside risk and upside benefits are capped between $41 and $55 at the time of settlement.

For these interested in the details, here is the footnote.

4. On September 14, 2022, the Trust entered into a master confirmation in respect of a prepaid variable forward agreement (the “Agreement”) with an unaffiliated bank (the “Bank”) relating to 800,000 shares of Common Stock and obligating the Trust to deliver to the Bank up to 800,000 shares of Common Stock (or, at the Trust’s election, an equivalent amount of cash) to settle the Agreement.

5. In exchange for entering into the Agreement and assuming the obligations thereunder, the Trust received a cash payment of $28,955,274.40. The Trust pledged 800,000 shares of Common Stock (the “Pledged Shares”) to secure its obligations under the Agreement, and retained voting rights in the Pledged Shares during the term of the pledge (and thereafter if the Trust settles the Agreement in cash).

6. Under the Agreement, on each of the eight settlement dates in September 2026, the Trust will be obligated to deliver to the Bank a number of shares of Common Stock determined as follows (or, at the Trust’s election, an equivalent amount of cash): (A) if the closing price of the Common Stock on the related valuation date (the “Settlement Price”) is less than or equal to $41.0261 (the “Floor Price”), the Trust will deliver to the Bank 100,000 shares (i.e., the ratable portion of the Pledged Shares to be delivered with respect to each settlement date). 7. (continued from footnote 6) (B) if the Settlement Price is between the Floor Price and $55.1572 (the “Cap Price”), the Trust will deliver to the Bank a number of shares of Common Stock equal to 100,000 shares multiplied by a fraction, the numerator of which is the Floor Price and the denominator of which is the Settlement Price: and (C) if the Settlement Price is greater than the Cap Price, the Trust will deliver to the Bank the number of shares of Common Stock equal to the product of (i) 100,000 shares and (II) a fraction (A) the numerator of which is the sum of (X) the Floor Price and (y) the Settlement Price minus the Cap Price, and (B) the denominator of which is the Settlement Price.

As I dig further Mr. Hsieh made a similar agreement pledging 750k in Sep 2021, with floor and cap prices set at $83 and $129/share, settlement dates in September 2025.

One might ask why that’s a red flag.

With that agreement, you effectively sold that equity interest, while holding the voting power till the settlement date. It is also worth noting that while it requires sec Form 4 filing, most insider transaction monitors don’t capture them, thus it effectively reduced the negative public impression, especially when the disposition is sizeable.

Pledging shares via variable forward agreement is often associated with negative connotations. Fulgent actually went so far as to highlight it in its own proxy filing 2021 to provide justification for why the Board made an exception for Mr. Hsieh’s 750k pledge in 2021:

Hedging and Pledging: Our insider trading policy also prohibits future pledging and hedging shares of our common stock. We made a one-time exception to our hedging policy for our Chief Executive Officer to enter into a pre-paid forward contract with respect to 750,000 shares of our common stock in light of his long-term ownership of these shares and because these shares then represented less than 2.5% of our then issued and outstanding shares of common stock. We have also previously permitted exceptions to the prohibition on share pledges as noted in the section entitled “Security Ownership of Certain Beneficial Owners and Management.”

So the Board made an exception in Sep 2021, then it made another exception in September 2022. Each time Mr. Hsieh pledged ~10% of his total equities while maintaining the underlying voting rights till Y25-Y26.

Red Flag 2 – BoD Members’ Resignation

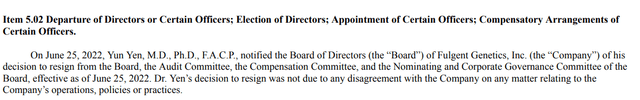

Jun 25, 2022: Yun Yen resigned from the Board after 6-year service since IPO:

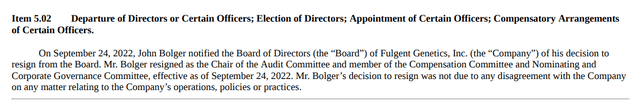

Sep 24, 2022: John Bolger resigned from the Board after 6-year service since IPO:

Oct 31, 2022: Leonard Post resigned from the Board and chair of the Corporate Governance Committee (he was nominated and became the board member in July 2022):

Leonard Post’s recent resignation is particularly concerning and curious. Mr. Post joined the Board in July 2022 (after Yun Yen resigned), and it is worth noting its 8k filing didn’t carry the standard language “decision to resign was not due to any disagreement…” that the other 2 resignation announcements have.

A thesis-changing moment in 3Q22 ER

The company announced during its 3Q22 earning release that it completed an acquisition of Fulgent Pharma for a total purchase price of approximately $100Mn.

The name was not a coincidence, In 2016, Fulgent Therapeutics split into two separate entities – Fulgent Pharma and Fulgent Genetics.

Mr. Hsieh is the Manager and controlling equity holder of Fulgent Pharma.

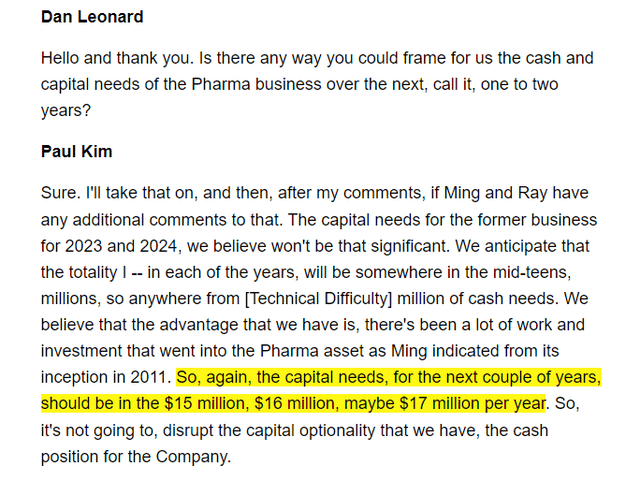

For these curious about the economics of this acquisition, here is a comment from CFO Paul Kim (3Q22 ER call). It is not accretive and is projected to have a burn rate of 15-17Mn for the next few years.

Connecting the DOTs

2 (long-tenured) Board members resigned in June and Sep this year. A recently joined one resigned a week ahead of the 3Q22 earnings.

Then the company announced it acquired a business where Mr. Hsieh is the controlling equity owner for $100Mn with no bottom line contribution in sight.

I don’t have any additional insider info, but it is not too difficult to connect the dots and question whether these 2 events are related.

Not to mention Mr. Hsieh also pledged (effectively sold) 20% of his equity ownership in 2 variable forward agreements over the last 15 months.

It started to paint a picture of the largest shareholder (and key decision maker) thinking of innovative ways to extract value from the company and his equity holdings, with little consideration given to the public shareholders.

That is not a pretty picture.

My Reflection

I call this a heartbroken bear case as I have been a long-time fan of Fulgent, Mr. Hsieh, and his management team. If you ever listened to any of their past earning conference calls, I would be hard-pressed if anyone would disagree. And I have been a shareholder for quite some time.

I must admit how difficult it was to consider exiting at $35/share, knowing how ridiculously cheap that is, and knowing all the potential it has particularly its highly efficient and battleground-tested infrastructure built throughout Covid. Imagine God forbids if there ever would be another pandemic, the edge Fulgent holds.

In the meantime, it is difficult for me to have peace with the notion that its largest shareholder and primary decision maker is in a ‘check-out’ mode, and circle around to find ‘innovative’ ways to benefit himself, with little public shareholder interest in mind.

It is even less comforting and increasingly clear that Mr. Hsieh has a dominating voice on the Board. Unless there is a strong activist voice with significant equity ownership, a bet on Fulgent today is a bet on Mr. Hsieh.

Reluctantly, that is no longer a bet I’m willing to hold given the recently emerged red flags. I sold most with a sizeable loss and intend to exit the whole position soon.

Be the first to comment