winhorse

Investment thesis

FUJIFILM (OTCPK:FUJIF) experienced a disappointing outcome with Novavax for vaccine supply as this was expected to be a game-changer. Despite this, recent trading has been strong and FY3/2023 company guidance has been revised upward. We believe the share price correction YTD is an opportunity to buy the shares.

Quick primer

Established in 1934, FUJIFILM is a fine chemical manufacturer spun out of Daicel (OTCPK:DACHF) producing photography film. It has been expanding into healthcare, focusing on expansion as a contract development and manufacturing organization, and as a manufacturer of diagnostic imaging systems which include endoscopes, CT, MRI, and X-ray scanners.

The company also provides materials such as photoresists and optical film for the semiconductor industry, business process outsourcing (digitizing print and content management as a replacement for office equipment), and pharmaceutical drugs. At first glance, the company seems to have a diverse and disparate business model but the core theme is FUJIFILM’s technological expertise in imaging and transferring skills in manufacturing (e.g. high-quality control and improving production yield) to relevant new markets.

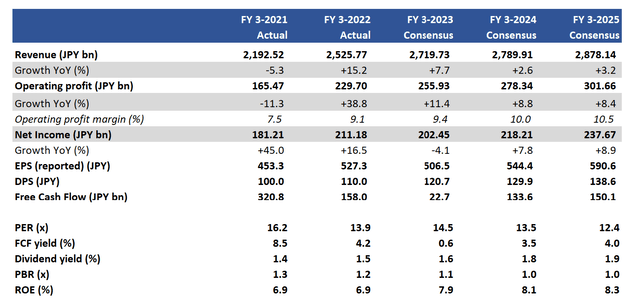

Key financials with consensus forecasts

Key financials with consensus forecasts (Company, Refinitiv)

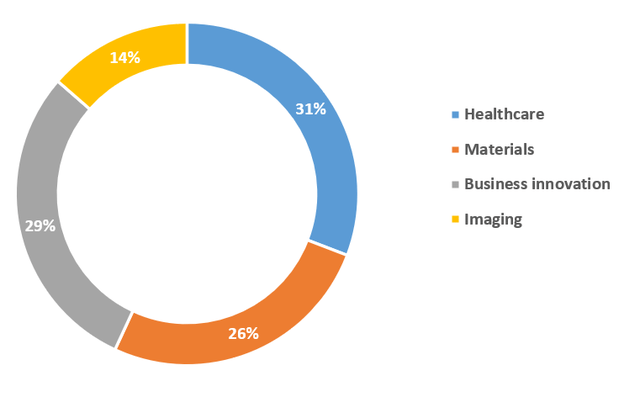

Q1-2 FY3/2023 sales split by business segment

Q1-2 FY3/2023 sales split by business segment (Company)

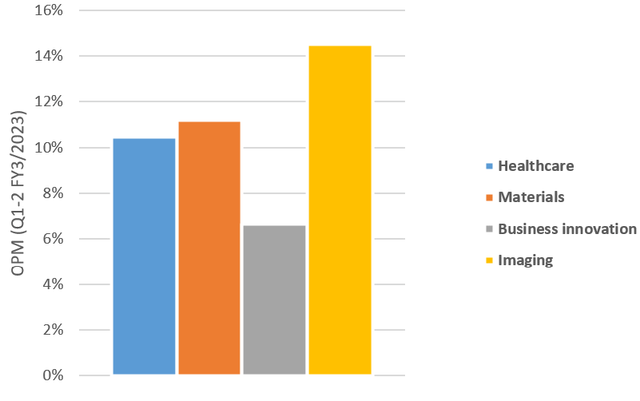

Q1-2 FY3/2023 OP margin by business segment

Q1-2 FY3/2023 OP margin by business segment (Company)

Our objectives

We want to revisit our initial view from a bullish stance in March 2021, where prospects for the healthcare business appeared positive, particularly for the CDMO business. Unfortunately, low demand for Novavax’s (NVAX) COVID-19 vaccine has resulted in a termination of the supply agreement with FUJIFILM; Novavax has agreed to pay up to USD185 million in a settlement.

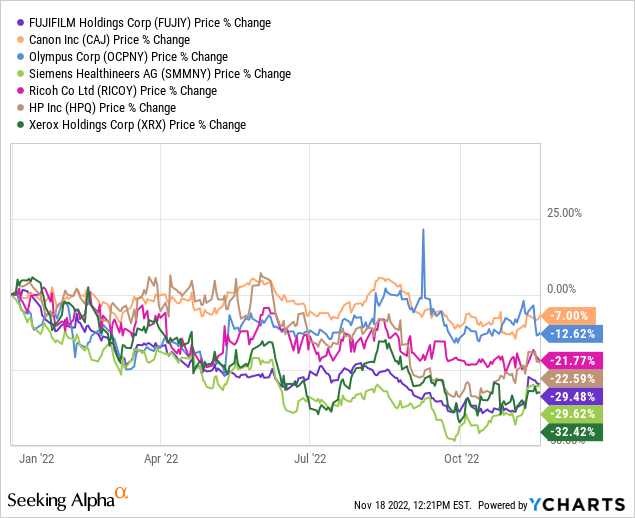

FUJIFILM shares have underperformed the majority of its imaging and office services peers YTD, with Canon (CAJ) and Olympus (OTCPK:OCPNY) holding up well, benefitting significantly from a depreciating Japanese yen.

Novavax issue was expected

It is disappointing that the company could not capitalize on its relationship with Novavax. Since the initial announcement back in July 2020, there was a distinct lack of any positive newsflow, and it was becoming more evident that uptake for the COVID-19 drug in the US was delayed and ultimately too low. Thankfully, the company has begun to receive the settlement payments from Q2 FY3/2023.

Despite this setback, the company’s Q1-2 FY3/2023 results were robust with both sales and operating profit growing 12% YoY. Q2 FY3/2023 operating profit reached a record high, and the company raised FY operating profit guidance to another record high of JPY260 billion/USD1.8 billion. This was a positive surprise, as the company was in a position to meet its medium-term financial targets a year ahead of schedule.

The current earnings drivers are twofold. The largest contributor is Imaging, driven by both consumer and professional product demand. FUJIFILM has been an innovative player in the smartphone printer market with products such as the Instax Mini Link 2 proving to be another hit. For the professional space, the new HS2 mirrorless camera which was launched in July 2022 has had a strong reception. The other smaller driver was from Business Innovation, comprised of demand for multi-function devices and printers as office workers returned, as well as business process outsourcing services. Overall, Imaging is expected to be the core driver of growth YoY for FY3/2023.

Longer term outlook

Despite the Novavax experience, the company is continuing to invest in increasing capacity for the contract development and manufacturing organization business with a new facility in Japan. Strategically, we believe that there will be growing demand for biopharmaceuticals and vaccines in Japan and Asia, to become less reliant on overseas suppliers. This new site in Toyama is scheduled to start operations in FY3/2027 which is some time away, but we believe scaling this business will be positive for the longer term.

Other strategic initiatives include investment in a new CMP (chemical mechanical polishing) slurry plant in Kumamoto in Japan, planned to start operating in January 2024. FUJIFILM is aiming to develop a one-stop-shop service for the semiconductor industry, providing other related products such as post-CMP cleaners and photoresist material.

Whilst there is no guarantee that these investments will deliver high returns, the company’s recent trend in ROIC is encouraging, rising from a lowly 3.5% in FY3/2013 to 7.0% in FY3/2022. Although the absolute level remains relatively low, it does indicate that the company is improving its capital allocation to more profitable investments.

Valuation

On consensus forecasts (see Key financials table above), the shares are trading on PER FY3/2024 13.5x and a free cash flow yield of 3.5%. These metrics do look attractive, especially given the company’s growing medical exposure that generally places a high valuation premium.

Risks

Upside risk comes from a seasonal surge in demand for Imaging products in H2 FY3/2023, driving stronger earnings than expected resulting in a major overshoot to revised guidance. Lockdowns in China being loosened will be beneficial to medical system sales as well as office equipment, helping to recover earnings in this region.

Downside risk comes from a strengthening Japanese yen, with the current USDJPY assumption for FY3/2023 being set at JPY135. A significant rise in the silver price will be negative for the profitability of photographic films.

Conclusion

FUJIFILM is making gradual progress in remodeling its business portfolio towards higher return activities. Although the company is unlikely to demonstrate a high growth profile, it is showing signs of an attractive compounding business. The Novavax episode is unfortunate, but the company has been able to grow its earnings to record levels in the last quarter. With the share correction YTD, we believe it is a buying opportunity.

Be the first to comment