sarawuth702

Aside from the supply shortage, one of the biggest buzzwords in the commercial vehicle industry over the past few years has revolved around electric vehicles (EVs). Everyone has an opinion on whether EVs are a fad or here to stay but what does the data say specifically about EVs in the commercial industry? Even through the supply issues of the past few years, there were more EVs registered commercially through August 2022 than all of 2021.

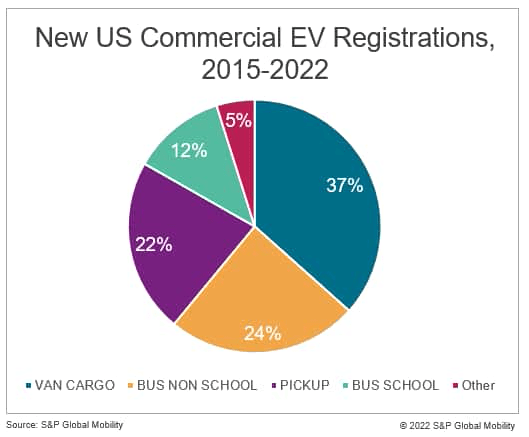

Since 2015, 53% of new US EV registrations have been Tesla (TSLA). However, when we remove Tesla and specifically look at fleets, cargo vans make up 37% of EV registrations and are being registered to companies such as Amazon (AMZN), Walmart (WMT), and FedEx (FDX). All these companies have developed partnerships with Rivian (RIVN), Ford (F), and BrightDrop, respectively, with investment or order commitments. Last-mile delivery is a great fit for EVs owing to the hub and spoke nature of delivery. These vehicles are not traveling long distances and can go back to the same hub to charge every night. These registrations are happening largely in states such as Florida, California, Arkansas, and Illinois. California is leading the way for EV growth through availability of more subsidies and a better charging ecosystem. Illinois is also offering additional incentives. In states such as Florida and Arkansas, a large concentration of vehicles have been registered by Amazon and Walmart.

Another segment of the commercial vehicle population that is benefiting from EVs is buses. Buses are nipping at the heels of cargo vans, currently making up 36% of EV registrations. Similar to cargo vans, buses can go back to the same hub every night to charge and are traveling distances that fit in the current EV battery range. School buses in particular travel a known route in the morning, have hours of downtime that can be used to recharge, then known routes in the afternoon. Recently, Canada announced 100% zero-emission trucks and buses by 2040 and USD550 million was earmarked for those incentives. These incentives offer up to USD200,000 off of the purchase of certain trucks and buses. In the United States, the Infrastructure Investments & Jobs Act (IIJA) increases tenfold the funds available to transit buses and charging infrastructure to USD5.5 billion. Washington DC, California, and New York are becoming hot spots for both school buses and non-school buses. In this category, Lion Electric, New Flyer, Blue Bird, Proterra, and Freightliner are introducing new EV models.

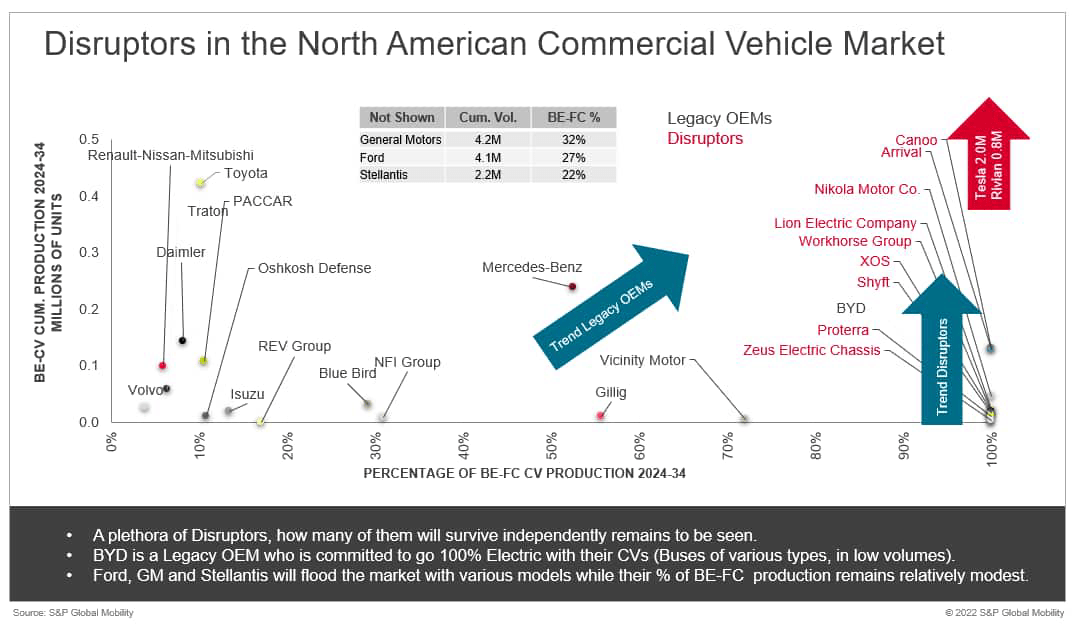

In addition to cargo vans and buses, there is also news related to Class 8 electric trucks. Tesla stated that in December it would deliver to PepsiCo (PEP) the first of a 100-unit order of the Tesla Semi. These BEV trucks will likely qualify for a USD40,000 incentive through the Inflation Reduction Act recently signed into law. Tesla joins more traditional Class 8 truck builders such as Daimler, Volvo, and Traton in offering EV semis. Tesla is not the only newcomer to electrification. Though Tesla and Rivian are the two most recognizable disruptors in the commercial vehicle market, they are not alone. EV startup companies have focused on the commercial vehicle segment as a launching pad for new electrified products. Cargo vans, buses, and Class 8 semis are the products of choice, followed by pickups and incomplete chassis. The driving factor behind these product choices is undoubtedly the significant growth in e-commerce that began before the COVID-19 pandemic and accelerated to even faster growth during and following the pandemic. Online ordering of goods has dramatically increased the demand for cargo vehicles for last-mile delivery, as well as interstate transport.

Alongside delivery vans and buses, the commercial vehicle industry also includes Class 4-8 medium and heavy trucks. Used for hauling goods, in their own right, or for pulling trailers, these vehicles are generally above the gross vehicle weight rating (GVWR) of most production vans. Although registrations of zero-emission vehicles (ZEVs) in this part of the market are still extremely low, the pace of adoption in the current decade is set to accelerate. By 2030, as much as 17% of the new truck market is expected to be ZEVs. Four primary reasons for the expected ramp-up are product availability, OEM strategies, regulation, and the expected evolution of the price-cost relationship.

The definition of a ZEV may vary and is anchored in local regulation. Generally, ZEVs include pure battery-electric trucks, as well as fuel-cell electric vehicles (FCEVs). Some jurisdictions may also group some hybrid electric vehicles (HEVs) with these primary ZEV types. Some ZEVs are produced each year by converters, which start with an existing OE chassis. More recently, the OEMs themselves have begun to offer dedicated ZEVs to the market directly. Whereas new registrations of Class 4-8 OEM-installed systems in the US finished at fewer than 100 units in 2021, new registrations of OEM-produced ZEV trucks in 2022 approached double that in the first eight months alone. Compared with four brands with ZEV products tracked by S&P Global Mobility’s new registrations statistics in 2021, seven brands recorded new registrations of ZEV trucks in year-to-date (YTD) 2022.

In the United States, all the top OEMs are publicly traded. The evident broadening in the ZEV truck product rollout is by design and aimed to help the OEMs reach their climate goals, as communicated to investors. Diverse solutions are available where ZEV solutions make the most relative sense. These range from stepvans at the bottom end of the weight range to larger, two-axle box vans in the middle and daycab tractor trucks at the upper end.

Manufacturer climate ambitions coincide with encouragement by regulators and improvements in technical solutions. For their part, regulators in the US have been particularly active at the individual state level, where California leads the way in setting ZEV adoption mandates and plans for public-sector support. However, California is not alone, and 15 other states and jurisdictions have announced plans to mimic California’s goals and approach. Manufacturers are to meet goals stepwise, with gradual progress to the end goal each year. Together, these jurisdictions have the potential to promote critical mass in US ZEV volume by the early part of the next decade.

ZEV offerings in the market today are, in many cases, well above the purchase prices of comparable diesel- or gasoline-powered vehicles. Improvements in manufacturing, vehicle design, and adoption will help reduce costs incrementally over time. Financial support for producers and truck users may help to further grow ZEV demand. How much support in the form of public money and other resources required will depend, in part, on the state of the ZEV technologies themselves and, in particular, their cost and suitability in different trucking vocations. While some vocations, such as long-haul trucking, may be very challenging for ZEV trucks even in the long term, others could see cost of ownership parity approach more quickly, for example, stepvans used for parcel delivery. S&P Global Mobility looks at these and related issues in our forthcoming report Reinventing the Truck 2022, produced in conjunction with our Commodity Insights team.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment