FTX Crypto Fraud and Bankruptcy Rattles Crypto Markets

D-Keine

The Crisis Unfolds

This last week has seen a series of seminal events that have rocked the crypto world and shaken it to its foundations. Crypto bears are already announcing the death knell of all cryptocurrencies.

What happened? FTX (FTT-USD), one of the world’s largest global crypto brokerages, effectively went bankrupt over the course of a week. FTX.US, its SEC-regulated branch that had been approved by US government regulators, also declared bankruptcy, a few days later, on November 23, 2022.

In just a week, Sam Bankman-Fried, the 30-year old CEO of the company, went from a hero glossing the cover pages of Fortune Magazine to competing for the ranks of the most vilified person in the crypto finance. Fortune questioned whether the young mogul would not be “The Next Buffett?” and made him famous enough to be identified by his initials :SBF.

Just 1 year later, the same reporter was labeling SBF as the “so-called genius”, and cited scathing attacks on SBF such as the one posted in the Daily Mail by Maureen Callahan: “I never could work out what crypto is. Now a weird outfit run by an insufferable kid with a hoodie has lost billions … and it’s proof ‘smart people’ didn’t have a clue either. “

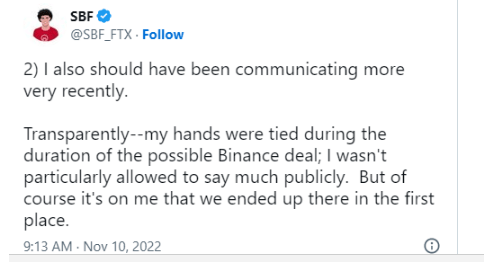

After stepping down from his position as CEO, Bankman-Fried in a series of posts to his Twitter followers, took personal responsibility: “I’m sorry” and “I [messed] up”.

SBF admits responsibility (twitter.com)

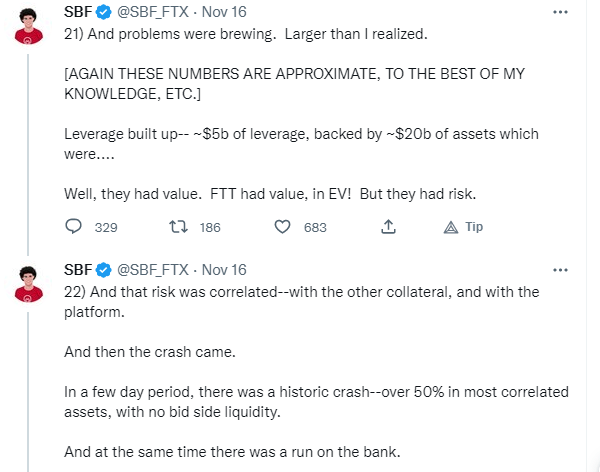

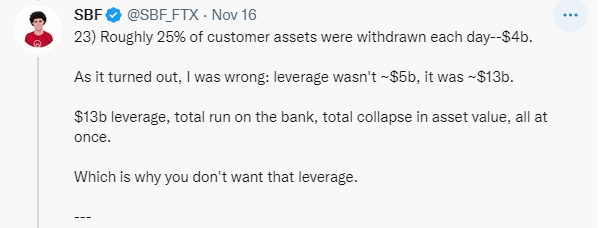

In a series of subsequent postings on November 16, 2023 , again on Twitter, SBF, painted the following picture:

sbf (twitter.com)

sbf (twitter.com)

A new CEO, John Ray III, was appointed by the bankruptcy court to oversee the US firms unwinding. Ray had previously overseen of scandal-plagued energy firm Enron following its collapse in 2001.

After even a few days of review of the FTX books and records, Ray blasted the management – or rather lack thereof – of the FTX business in his first reporting to the bankruptcy court.

“Never in my career have I seen such a complete failure of corporate controls and such a complete absence of trustworthy financial information as occurred here,” Ray wrote.

“From compromised systems integrity and faulty regulatory oversight abroad, to the concentration of control in the hands of a very small group of inexperienced, unsophisticated and potentially compromised individuals, this situation is unprecedented,” he summarized.

What’s The Damage And What Caused It?

In less than a week FTX went from an approximate market value of $40 billion to an unknown sum. It will take weeks and months to determine the extent of the damage.

A detailed analysis of all that transpired is beyond the scope of this article. Bottom line, the FTX management appears to have used customer assets to lend money to a closely related company, Alameda Research. Alameda was owned by SBF. FTX lending custodial money without customer permission was in direct violation of FTX written customer policies.

Alameda in turn risked all the money in a series of ill-conceived crypto trades, according to SBF. However, the bankruptcy documents also show that Alameda, owned by SBF, made $4.1 billion in loans to related parties, including $1 billion to SBF himself, as revealed in the recent bankruptcy filings

The money is gone, whether to poor trading or nefarious practices remains to be determined.

But the repercussions are even larger. In order to save his collapsing empire, the ambitious SBF lent money by the hundred of millions to numerous other floundering crypto businesses. Seen by the industry as its savior and compared to the likes of J.P.Morgan in saving the bank industry from collapse, SBF now appears to have been the industry’s greatest Achilles heel.

Greed and Politics? Did They Mix?

SBF was the Democrat’s party’s second largest donor in the recent elections, donating around $40 million dollars to top Democratic candidates. He contributed to both Republican and Democrat senators who were co-sponsors of a proposed bill to revamp crypto regulations. SBF was so highly reputed as a crypto genius that he became the go-to man advising Congress on how to enact new regulations to saveguard the crypto industry from scammers and bank runs.

It is critical for crypto investors to understand the political maelstrom surrounding the FTX bankruptcy, and how that is likely to impact investments in the sector going forward.

On March 23, some eight months before Bankman-Fried’s crypto empire collapsed, SEC Chairman Gensler granted what some crypto players are calling an unusual meeting to the then-billionaire SBF.

The details of that meeting are not a matter of public record. But according to Republican critics, they discussed an idea for a new SEC-approved crypto trading platform.

Prominent House member Tom Emmer (R-Minn.) tweeted recently that “@GaryGensler runs to the media while reports to my office allege he was helping SBF and FTX work on legal loopholes to obtain a regulatory monopoly.”

Republican critics also cite inappropriate close personal links to SEC Chairman Gensler, who after all was the top US official in charge of regulation of the crypto space. They claim that Gensler consulted with SBF personally in devising his plan to regulate crypto. They allege that this inappropriately aided the budding billionaire in fashioning his growing empire in such a way as to avoid the clutches of regulators and curry advantage over competitors.

Now that Republicans have won a narrow victory in the House, I expect they will exploit this explosive issue to build their case against Democrats in the upcoming 2024 presidential elections.

It’s possible that the political furor will fade into the background as time passes and these events will have little impact on investors willing to enter the risky crypto space.

But I think the opposite. Already the issue is beginning to gather steam. According to Coin Telegraph, a leading crypto blog, a recent petition for review by Congress had gathered 4000 signatures and stated:

“Evidence has emerged that proves that Gensler met with […] [FTX CEO] Sam Bankman-Fried, before the $14 billion collapse of FTX. Members of Congress have already been informed that Gensler was working with Bankman-Fried to give FTX a regulatory free pass while a massive fraud was going on right under the SEC’s nose. […] It’s time for a full Congressional investigation of Gensler’s role in one of the biggest financial frauds in American history.”

Democrats are likely to point out that SBF left the meeting empty-handed. Since then, Gensler has been the main proponent of clamping down on the crypto industry to prevent the kind of calamity that just occurred.

True to form, Sen. Elizabeth Warren (D-MA) was quick to formulate the Democrat line in a recent tweet. “The collapse of one of the largest crypto platforms shows how much of the industry appears to be smoke and mirrors. We need more aggressive enforcement, and I’m going to keep pushing to enforce the law to protect consumers and financial stability.”

Which version is right? Are Republicans right in pointing to corruption in high places, gross administrative negligence by Democrat appointees, and nepotistic policies at the highest levels of power? Or Democrats in pointing the the dangers of too loose regulations and a lack of government oversight?

Time will tell. But for the astute investor, in my opinion, one thing is certain: this issue will become a major focus of the upcoming elections, and incite more and more political acrimony.

This in turn will have an immediate effect on the crypto investment space: until the controversy surrounding FTX is hashed out politically, there will be a freezing of new crypto ventures. Thinly-capitalized ventures will find new capital impossible to raise, and will be forced to shut down.

The Domino Effect

According to the bankruptcy filings, FTX had control over a mind-bending 130 closely held entities. Moreover, FTX had investments in dozens on non-related companies (Genesis, Gemini, CoinDesk) and large stakes in important crypto currencies like Solana and Serum. Any unloading of these assets by the bankruptcy administrator could have deleterious effects on prices.

A list of major investors in FTX read like the “Who’s Who” of the crypto world: names like Binance, Multicoin, Sequoia Capital, Temasek, Paradigm, Pantera Capital.

In the tightly intertwined world of crypto, one company’s debts are inevitably another company’s assets. Due to the enormous leverage deployed within the crypto world and especially in the defi space and the offshore crypto brokerages, the impact of a $20-40 billion loss could end up causing losses many multiples of that.

Crypto investors worldwide are being barraged by a mind-numbing series of announcements that has them bewildered and shocked. The risk is that they will throw out good investments along with the bad, causing a collapse of otherwise healthy companies and a failure of promising, world-changing ventures.

For example, in the few days I’ve spent writing this article, SOL has lost another 25% of its value and I give it a big chance of going to zero. This could happen in just weeks, not months. SOL in turn, is at the anchor of many other crypto ventures.

What crypto whales, hedge funds, or other institutions have lost big on their SOL investments, which may lead them to fail or reduce their exposure elsewhere?

Less than a year ago the Crypto market had grown to just shy of $2.8 trillion in market cap by November 2021. Today, this had dropped to $833 billion.

Crypto Market Cap Nov ’22 (coinmarketcap.com)

A drop by another half again would not be surprising.

Is Crypto Dying?

If the crypto industry is not dying, it’s certainly on life support.

Following this bankruptcy, many crypto sceptics have reiterated their proclamations that all cryptos, including the original crypto, Bitcoin, would go to zero.

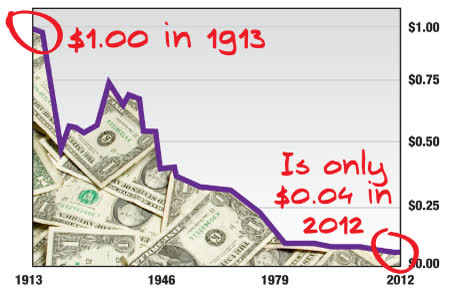

Before we address those critics, it is important and necessary to point out one fact that is the veritable “raison d’etre” behind crypto: the problems of fiat currencies. In all of human history, every single government run currency – dubbed “fiat” currency – has gone to zero value over time. There are no exceptions, given a long enough time span. The dollar is well on its way to doing the same.

The Ever Shrinking Dollar (shtfplan.com)

Nor is this trend changing. In fact, it is accelerating. With inflation at around 8% and interest rates at around 4%, the dollar is currently losing around 4% a year. At that rate, it will have lost another 50% of its value in 13 years.

That to me is a certainty, given the impossible amounts of de`bt affecting the US government today, at over $30 trillion, with unfunded obligations of over $172 trillion dollars. Those unfunded obligations are not trivial items, easily discarded, unless you don’t need Medicare or Social Security.

So to me the choice is clear. An investor can choose between losing between 3% and 10% a year to inflation for certain, or purchasing an asset that is certain to fluctuate widely in value today, but could be worth 5 to 10 times more over the next decade. Buying cryptos is like buying a very very long term deep out of the money call option with a 10 year expiry. Known downside, unlimited upside.

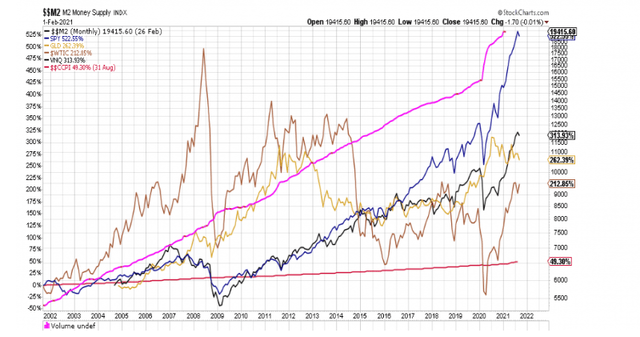

Think recent inflation is just a temporary phenomenon of money printing due to Covid? Take a good look at the chart below, showing that inflation has eclipsed the return of all other traditional investments, such as real estate, gold, stocks or treasuries over the last 20 years. The pink line leading the chase is the Consumer Price index. Right behind it in the race – far surpassing any other investments – is the blue line depicting M2. M2 is the Federal Reserve’s measure of the money supply that includes cash, checking deposits, and easily-convertible near money.

Inflation has historicall eclipsed all other investments (stockcharts.com)

Maybe you are convinced that despite the indebtedness of the US and every other major economy of the world, somehow, miraculously the central banks will permanently reverse the money printing machines. Governments will live within their means and balance all budgets.

I wish you were right. But I’d rather take the other side of that bet.

Now that I’ve explained why “cash is trash” for any kind of long term savings plan, let’s look at crypto itself. After all, if crypto itself is just another hair-brained asset bubble like the Dutch Tulip mania, then the lesser evils could be traditional investments, even if these don’t keep up with inflation.

There Are Cryptocurrencies – And Then There Is Bitcoin

You know the slogan “its not worth the paper they are printed on”? Well, cryptos are not printed. They are digital bits. They are , so to speak, in another dimension.

So are cryptos worthless, just because you can’t rub them between your fingers? Well you can’t do that with the internet either, but I’d argue the latter has enormous value. What about other intangibles, like thoughts, stories, ideas or heck, even God? All intangible, therefore worthless?

You get my point.

In order to respond to the critics of cryptocurrencies, we must make an important distinction between inflationary and non-inflationary cryptos.

Bitcoin – Different From The Rest

Bitcoin enthusiasts become downright angry when you lump Bitcoin in with other cryptocurrencies. All those other currencies, they argue are subject to the same weaknesses as fiat currencies. They are either non-deflationary – and thus subject to the same weakening of real buying power over time. Or they are deflationary, but suffer from too small market caps or too much centralization by a handful of powerful interests.

Other coins, such as Litecoin, are built similarly to Bitcoin and benefit from similar proof-of-work mechanisms and maximum emission caps. But Litecoin, and numerous other Bitcoin imitations, all suffer from the same problem. They are not the first born, benefitting from an already wide user base with a huge recognition factor.

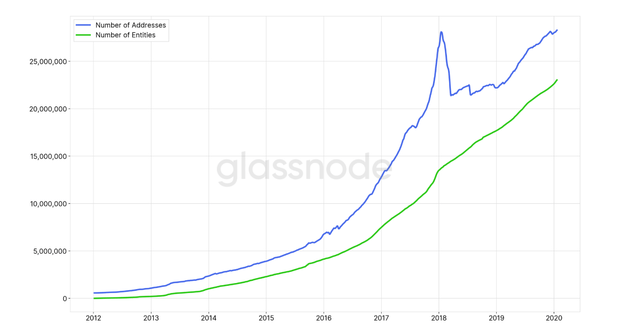

Because Bitcoin had an advantage of time, born in 2008, it reached critical size much earlier than other anti-inflationary coins. Cryptocurrencies, by their social nature, are subject to the growth metrics defined by Metcalf’s Law.

Metcalfe’s law states that the value of a telecommunications network is proportional to the square of the number of connected users of the system. So the larger a network already is, the easier it is to grow even faster.

When you are talking about something to be used as a means of exchange, like a cryptocurrency, you’d rather own one that is the most used by other people. You’d think twice about paying anything for a cryptocurrency – as brilliant as it may appear to have been conceived – if there are only 2 other using it. At 200 users, you be far more likely, and at 2 million users you’d be much more motivated.

Take a gander at Bitcoins usage numbers: it’s continued going parabolic in the last 2 years since this graph was published.

Bitcoin Unique User Statistics (glassnode)

Since Bitcoin, then, is in my view the King of Cryptos, different from all the rest, let’s consider arguments made by its most ardent critics. One of the best critiques I’ve found of cryptos is that of Nassim Taleb, who claims that Bitcoin is essentially a Ponzi scheme that will go to zero. I have tremendous respect for Taleb, an out-of-the-box thinker who is always happy to prove that the king has no clothes.

While Taleb raises a number of valid points, I disagree with his conclusions. For a detailed rebuttal, see this article. In a nutshell, here’s why I disagree: Like gold, Bitcoin only has value because many people have chosen to give it value. In both cases, that supposedly “intrinsic” value is purely based on the fact that other people cherish it. If there are enough people who do so, that value is “real”.

Nor can Bitcoin simply be copied by another named, identical protocol, as Taleb claims. This could indeed make it lose its anti-inflationary appeal. If you can only ever have 21 million Bitcoins issued, but you can issue unlimited new versions of Bitcoin, each holding 21 million coins, then you effectively have no cap, right? That would be no different than fiat money.

But that argument is false, because those other copied Bitcoins would never gain the same traction. How many Mona Lisa’s are you going to buy?

Because in the same way that no other search engine protocol could overtake Google once the latter reached a certain size, the same applies to Bitcoin. The more people adopt Bitcoin, the more vendors will want to accept it. The more people use it, the more other people will hear about it. The more vendors adopt it, the more new people will want to use it for savings and transactions. This is the nature of Metcalf’s law.

Even for those who argue that Bitcoin is not a good transactional currency, but only a means of storing value over time (like valuable artwork), this argument holds true. Where would you rather store your savings? In something valued by 10 million users, or 200 million?

Moreover, with the growth of the Lightning network, which uses Bitcoin as its base reference, Bitcoin is now quickly becoming an extremely powerful transactional currency, one in which it costs less than 1 penny to send money around the world.

Bitcoin enjoys four advantages that gold does not: 1) it is not as easily subject to forfeiture or seizure, 2) it is far more difficult to forge 3) it has far lower storage costs and 4) it has orders of magnitude lower transaction costs.

As for reaching minimum adoption, this has long since been eclipsed, as the aforementioned graph showed.

Bitcoin, in my view, has long since reached its “takeoff” network stage. If you own Bitcoin, you will always – and easily – find someone willing to buy it off of you. It may be a lot more or a lot less than what you’ve paid for it, but you’ll always find an immediate buyer.

Bitcoin, by the very nature of how its protocol was fashioned, is an anti-inflationary money. There will never be more than 21 million units printed, and we are at over 19 million units already circulating. This means that with network effects – it is extremely likely to gain enormously in value as more and more people globally become aware of its existence and how to use it.

I definitely believe there will be an enormous slowdown in adoption of Bitcoin as a result of the FTX collapse. New users will be scared off. Existing users may have lost too much money in other cryptocoins to buy more Bitcoin. But just as happened in earlier scams and crises, just like that of Mount Gox in 2013, Bitcoin will emerge from it more strong, and much more famous.

Eventually, more and more people will realize why Bitcoin’s decentralized, censorship-resistant nature makes it the perfect antidote not only for weakening central currencies and privacy-robbing CBDC’s, but also for the dangers of non-custodial solutions.

When the get-rich schemes lose their luster – and believe me they will – those cryptos that provide real value will gain renewed adherents.

Separating The Wheat from The Chaff

In January of this year, there were over 21,000 cryptocurrencies, with 1000 new ones being born each month. I’ve always believed that 98% of these would collapse to zero. But that 2% that don’t will eventually grow to become the most important sector of the global economy.

FTX’ collapse and the scandal, will kill off the majority of those cryptocurrencies, but allow the few crypto survivors to flourish. Like a forest fire. That fire, so destructive and so frightening, clears out dead and diseased trees, decaying leaves, and other unhelpful vegetation. That permits new plants to grow.

Immediate Ramifications Of The FTX Crisis

So if most of the cryptos will perish in this crisis, but some thrive, how can you as an investor cope?

Here are some of the ramifications I foresee.

- This crisis will cement the views of many private investors who were tempted to dip their toes into the crypto world to avoid the sector like the plague.

- Institutional investors will shelve any plans to get involved.

- Died-in-the-wool crypto investors will favor hodling strategies in only the strongest of cryptos (BTC, ETH) and will abandon altcoins in droves.

- Any centrally controlled crypto exchanges (CEX’s) will either submit to legislative controls or go bankrupt.

- Decentralized Exchanges protocols driven by software that are outside of government controls will ironically suffer. This should not be the case – after all the software that governs them is visible to anybody who can read the code. If the code is changed that is immediately transparent to all as it involves public discussions and acceptance by a majority of stakers or users. However, 99% of investors and their advisors cannot read code. And even the most sophisticated users find the defi protocols complex clunky, and subject to breakdowns.

- Most CEX’s will prohibit or limit margin trading. Already in the last 6 months it has become impossible to short crypto stocks on any of the major US CEX’s. Talking to Kraken yesterday, I was told I would need to have at least $10 million in my account to do so. (Sorry I’m a bit shy of that right now…)

- Until the FTX issue is completely settled, investors will throw out the baby with the bathwater. They’ll scramble to save whatever crypto assets they have left. This means a big drop in all crypto values. ,This process will take months to occur.

- Even the strongest CEX’s will suffer huge operating losses. Bigger, more regulated exchanges like Coinbase (COIN) , Binance or Kraken will be able to swallow and absorb the hundreds of smaller, lesser known, or more poorly financed competitors,. Ultimately, they will likely gain in market share.

- But even those large CEX’s will face enormous challenges just to survive. COIN derives about 90% of its income from trading. Yet bullish crypto investors have gone into full hodling, or dollar-cost-averaging mode. Those (like myself) who would profit by trading to the downside are effectively prohibited from doing so on those exchanges. And exchanges that permit this are off limits to US investors.

- Similarly, the crypto mining industry will take a big hit. Miners will face much lower asset revenues , forcing them to sell more of the the crypto they produce in order to stay in business, even if they are long term believers.

- “Not your keys, you your crypto” has gained a whole new level of awareness. Those investors not abandoning crypto altogether will learn how to deal with the complexity of hardware wallets and the virtue of self-custody.

- The last domino has not fallen. FTX allegedly had controlling interests in over 180 different entities. It was a major investor in countless other exchanges and protocols, and tokens. I expect at least 2 or 3 other huge bankruptcies before this is over. (Since I started writing this two more have fallen, Japan’s largest crypto brokerage and Gemini have both announced they are freezing customer withdrawals.)

- Solana, the 8th largest cryptocurrency by assets just a month ago, had deep links to FTX. It’s seen its asset values drop by over 67%, with a loss of value of market cap of over $5 billion at time of writing. This currency had been believed by many to be about to dethrone Ethereum (ETH) as the central currency of the Defi world. Now, it is fighting for survival.

- Central governments, spurred on by The World Economic Forum will capitalize on this crisis to advance their Central Bank Digital Currencies, at the expense of stablecoins like Tether, DAI, or USDC.

- While most institutions will flee crypto, the most savvy institutions will take quiet measures over the next year or so to buy into the most promising crypto sectors at bargain basement prices.

What Makes A Good Crypto?

For the investor, then, it is extremely important to know how to recognize the small minority of good crypto investments from the overwhelming majority of losers

We talked above about the advantages of proof of work (“POW”) cryptos like Bitcoin. These derive their value from the real cost of the electricity needed to generate new coins, the size of their network, the robustness of their security schemes, and their inflationary/deflationary nature.

But what of proof-of-stake (“POS”) cryptos that have become much more popular recently, with Ethereum leading the pack? A POS crypto is one that derives its security not from the difficulty and cost and decentralized nature of the miners involved in new coinage production. A POS crypto assures its security by locking a certain amount of capital in the crypto that those holders may not sell over a specified period of time.

These users, because they have stake in the outcome, are called stakers. If the crypto asset is hacked or data is fraudulently manipulated, those crypto stakers lose a portion of their holdings commensurate to those losses or manipulations. In exchange for taking this risk, the stakers receive a guaranteed return on their investment as well as operational and voting controls over governance of the cryptocurrency.

The advantages of POS over POW is that the former is far less expensive to run and consequently can be orders of magnitude faster. The disadvantage is that POS ultimately tend to suffer from centralization, giving too much power to a small number of individuals or institutions. There are a number of solutions – some good , some bad – for dealing with those issues.

Both POW and POS can be viable mechanisms. Whether a coin has value is ultimately, in my opinion, one one fact. Does it have a utility that is linked to something of value in the real world, like the growth in goods and services? Does the crypto serve a need that cannot be better addressed by existing web2 technologies and centralized industries? Is the crypto asset managed by a group or team of highly-motivated and highly qualified individuals with a demonstrated ability to manage the project? If you find a crypto asset that responds positively to those three questions, you’ve got a winner.

For Bitcoin – The Utility is Long Term Value Growth

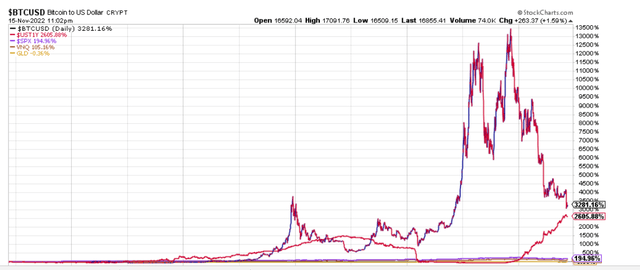

Bitcoin serves the purpose of a long term anti-inflationary instrument. Yes its volatile, though that volatility is projected to go down over time. But at least the volatility is rewarded with enormous growth. Unlike savings accounts.

For those who don’t like the volatility, just mix and match: It is one asset class, among others, and should best be mixed with other asset classes to produce desired results.

Bitcoin vs main asset classes (stockcharts.com)

For example, if you really want to play it safe, put 90% of your assets in short term government bonds (no duration risk), and the balance split evenly between Bitcoin, Gold, real estate, stocks and commodities. You’ll be amazed at how well you sleep at night, and how much you outperform a savings account.

Form more on similar strategies, see a recent posting of mine.

But in the crypto world, it’s not just Bitcoin that will thrive. Nor is Bitcoin the best solution for matching other real-world needs.

Real-World Practicality Vs Ill-Conceived Utopias

As mentioned, 98% of the cryptos I’ve looked at fail the test of real world practicality. Here’s how they work. Crypto entrepreneurs essentially create a token out of thin air. They trade it avidly among a group of friends and insiders to build up interest in the token, bidding the price up artificially. This is their intent. When they’ve reached a critical mass of price, volume and attention, they sell it to the masses, allocating themselves a healthy number of free shares for their efforts.

But wait, isn’t that what stocks also do in an IPO? You’re right. The difference is, in almost all cases the stocks are tied to an existing business with a proven track record, or to a new business idea that is carefully drafted so that investors understand how the idea could make money in the real world.

Check out the majority of cryptos. They are self-referential. Here’s how the John Sindreu of the WSJ summed it up in a Nov 17,2022 commentary : “All of crypto is a deeply interconnected ecosystem in which assets are created without relation to real-world wealth and then used as collateral to further inflate what boils down to a single, enormous credit risk – crypto itself.”

That’s a scathing indictment of the crypto industry. Unfortunately, its true of 98% of the companies involved. But not all of them. It reminds me of the things I used to hear about web technologies after the 2000 dot-com crash.

Some crypto tokens perform a real world purpose unmatched by traditional technologies. File sharing is one of them, I would propose. Yes Google and AWS do this brilliantly, but at an enormous cost to our privacy and ultimately our independence from governments and powerful interests.

Social networking is another. The recent political and social upheaval surrounding Meta’s Facebook, Twitter, Apple’s I-Store and TikTok, just to name a few, are indicative of the problems and perils of centralization in the web2 world we’ve constructed in the last 20 years.

There are many others where the benefits of the blockchain. The financial democratizing incentives of cryptos can create a powerful new force creating unimaginable new efficiencies that benefit humanity. Crypto can enable this process to occur in a manner that is more equitable to the common man, more diversified across geographies, and more efficient in its outcomes.

The trick is to separate the wheat from the chaff. It’s not an easy task. It takes research, time and a lot of hard thinking. Seeking Alpha pages are a great place to do that.

Crypto Tamed Or Defi Discovered?

It will take at least a year or two for the political dust to settle out and all of the revelations from this crisis to become clear. Once that occurs, there are two ways this could play out in the longer run, for the crypto industry.

On the one hand, it could strengthen the hands of centrally-managed, strictly regulated central crypto exchanges.

These organizations could have to closely follow US policies of Know Your Customer (KYC) and Anti Money Laundering (AML) regulations. They will be placed under intense financial scrutiny and subject to expensive, tedious reporting that favors only the largest institutions.

International companies like Binance – the world’s largest crypto brokerage – would have to bow to political pressures and succumb to US regulatory scrutiny.

If this occurs, I expect you will find little difference between these companies and traditional stock brokerages, large public companies like Schwab (SCHW) or Interactive Brokers (IBKR). In fact, I believe you will see an absorption of crypto brokerages by big brokerage companies, and smaller traditional brokerages by big crypto brokerages.

On the other hand, the critics of government regulation could win out. They could convince the US and global electorates that the FTX fiasco was caused or enabled by government ineffective controls.

They argue that the calamities of the FTX disaster reveal the dangers of centralized control. Government controls, they argue, give you the appearance of safety, without the ability to enforce such safety. Moreover, government regulations prove to be so stifling that they prevent truly novel ideas and newer, more efficient modern technologies to flourish.

There are elements of truth to both sides, I believe. The stronger political force will be the one for calling for more government regulations and rules and more centralized controls.

Eventually, the pendulum will swing back to more decentralization, but this will take years, not months. Attempted regulations will prove ineffective or counterproductive. Innovation will dry up.

Meanwhile, true believers among the crypto-engineers will devolve better solutions to enhance transparency, improve privacy, and remove the complexity from defi protocols. With better understanding of defi code functionality, and independent third party controls of protocols, investors will be better placed to judge the risks and rewards of each crypto investment.

One thing is certain. SBF will have left a permanent mark on the world of crypto. We don’t know how he would have liked to have left his legacy, but undoubtedly, the world of crypto will never be the same.

Be the first to comment