everythingpossible

A Quick Take On CI&T

CI&T Inc (NYSE:CINT) went public in November 2021, raising approximately $195 million in gross proceeds for the company and selling shareholders from an IPO that was priced at $15.00 per share.

The firm provides digital transformation software consulting services to clients worldwide.

Perhaps as the strong U.S. dollar begins to wane, CINT will face slower Forex headwinds and reduced labor cost growth, but for the time-being, I’m on Hold for CINT in the near term.

CI&T Overview

Campinas, Brazil-based CI&T was founded to develop a range of software services to assist businesses in their digital transformation efforts.

Management is headed by co-founder and Chief Executive Officer, Cesar Nivaldo Gon, who has been with the firm since inception and previously earned a master’s degree in computer science from UNICAMP.

The company’s primary offerings include:

-

Strategy

-

Design

-

Engineering

The firm pursues clients across all industry verticals and currently operates in eight countries.

The company has distributed teams in Brazil, the U.S. UK, Canada, Japan, China, Portugal, and Australia.

CI&T’s Market & Competition

According to a 2021 market research report by 360 Market Updates, the global market for digital transformation strategy consulting was an estimated $58.2 billion in 2019 and is forecast to reach $143 billion by 2025.

This represents a forecast CAGR of 16.2% from 2020 to 2025.

The main drivers for this expected growth are a large transition from on-premises, legacy systems to cloud-based environments with complex architectures.

Also, the COVID-19 pandemic has likely pulled forward significant demand to modernize enterprise systems resulting in increased growth prospects for digital transformation consultancies.

Major competitive or other industry participants include:

-

Endava

-

Globant

-

EPAM Systems

-

Accenture

-

Capgemini

-

Cognizant Technology Solutions

-

Tata Consultancy

-

Ideo

-

McKinsey & Company

-

The Omnicom Group

-

Sapient

-

WPP

-

Others

CI&T’s Recent Financial Performance

-

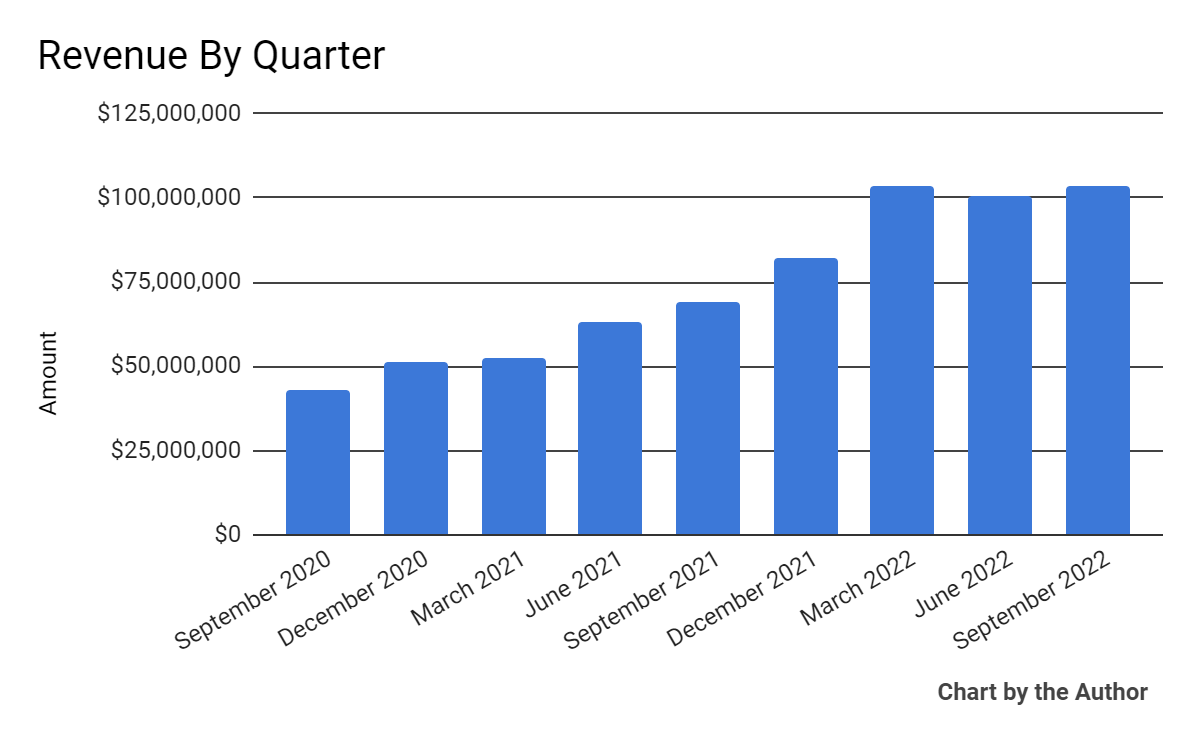

Total revenue by quarter has plateaued in recent quarters:

9 Quarter Total Revenue (Seeking Alpha)

-

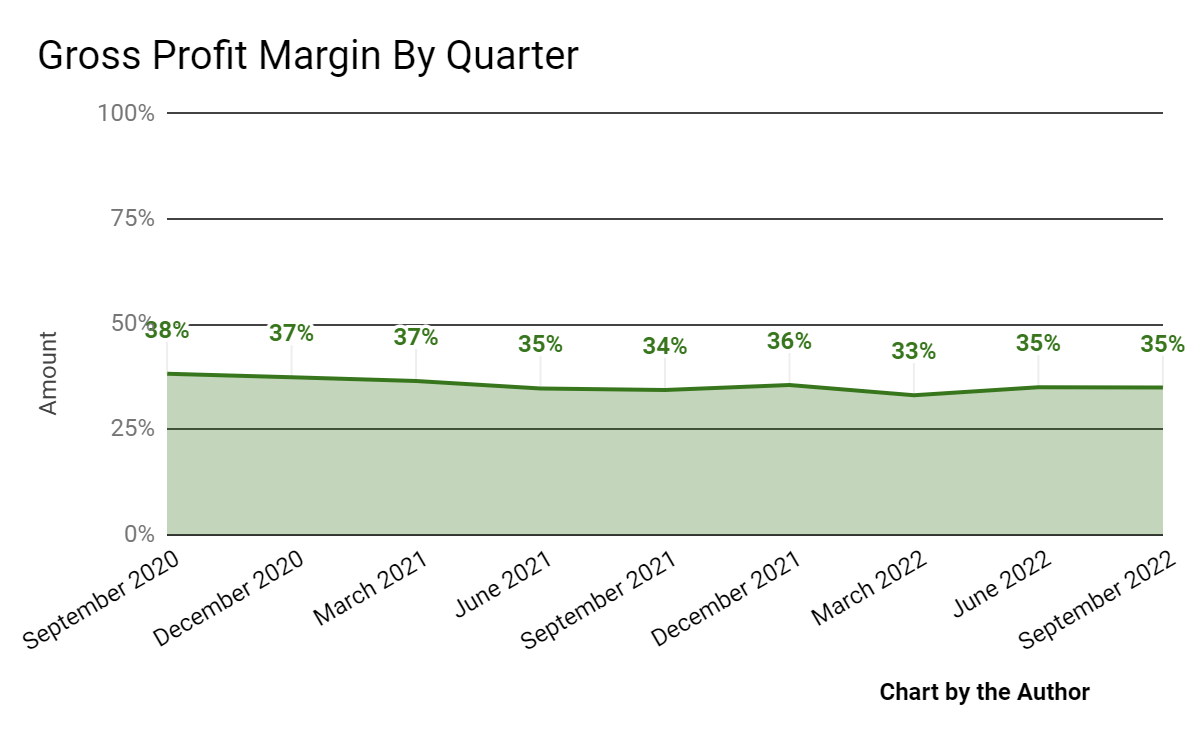

Gross profit margin by quarter has remained flat as revenue has increased:

9 Quarter Gross Profit (Seeking Alpha)

-

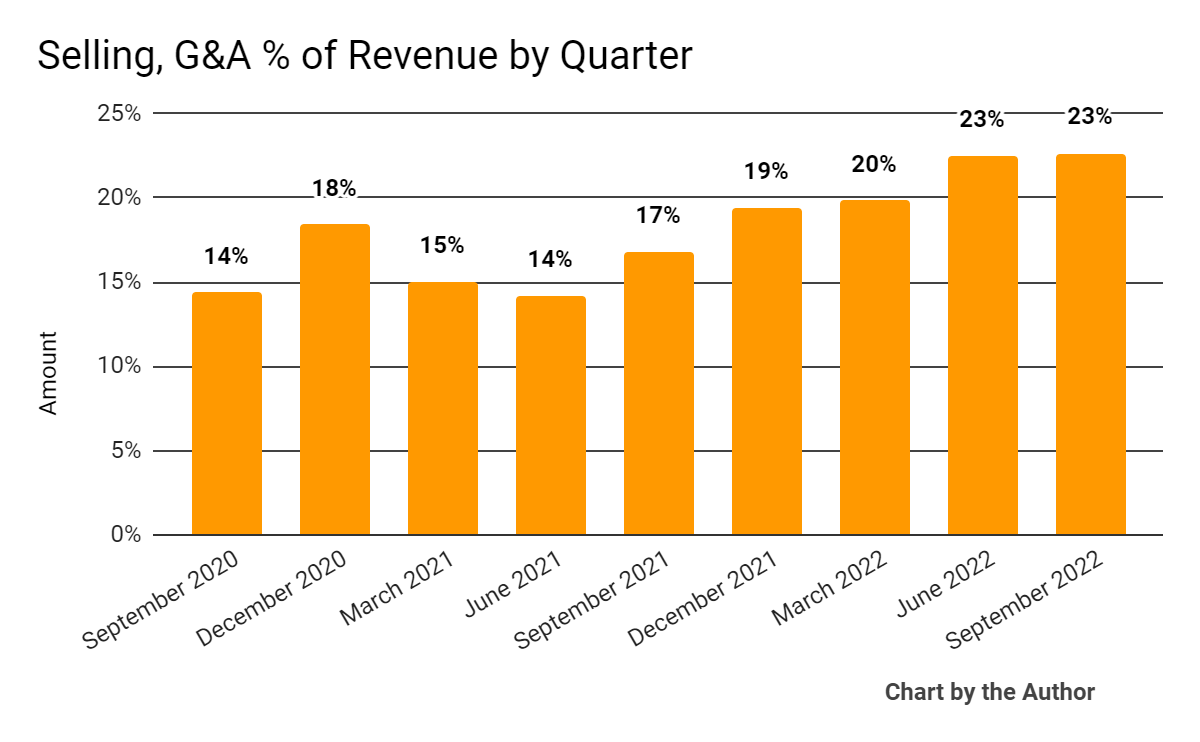

Selling, G&A expenses as a percentage of total revenue by quarter have increased as revenue has grown:

9 Quarter Selling, G&A % Of Revenue (Seeking Alpha)

-

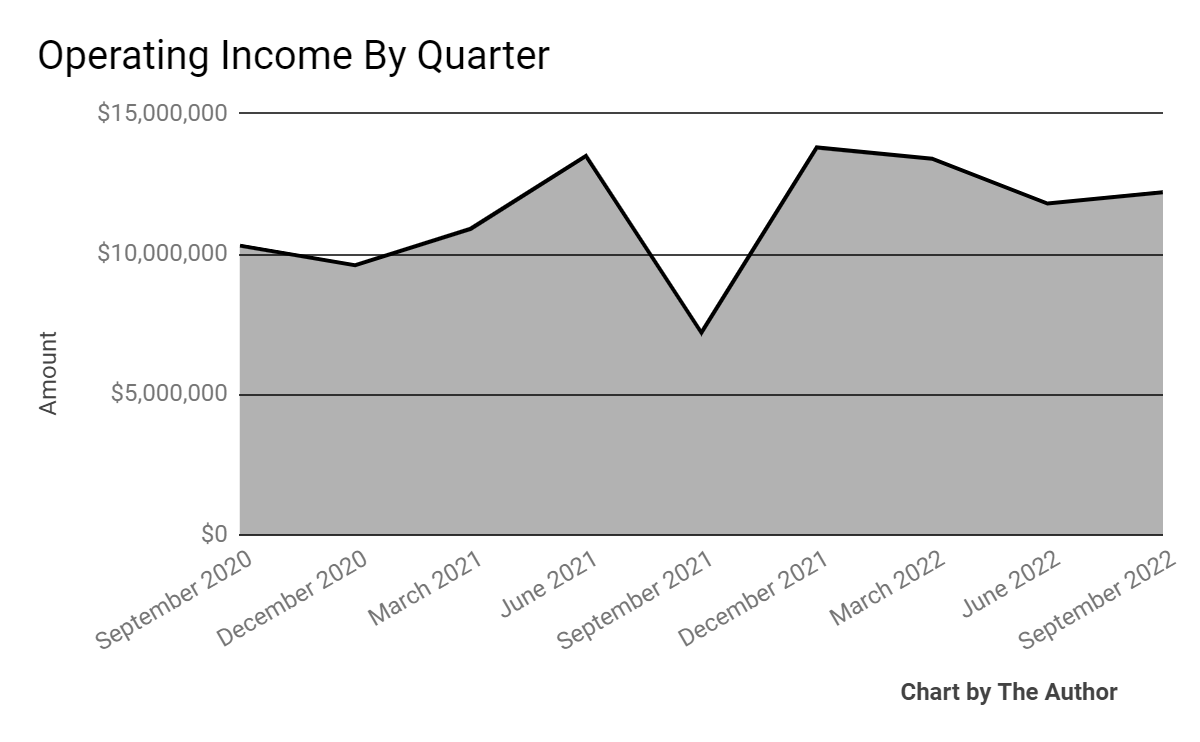

Operating income by quarter has not increased despite revenue growth:

9 Quarter Operating Income (Seeking Alpha)

-

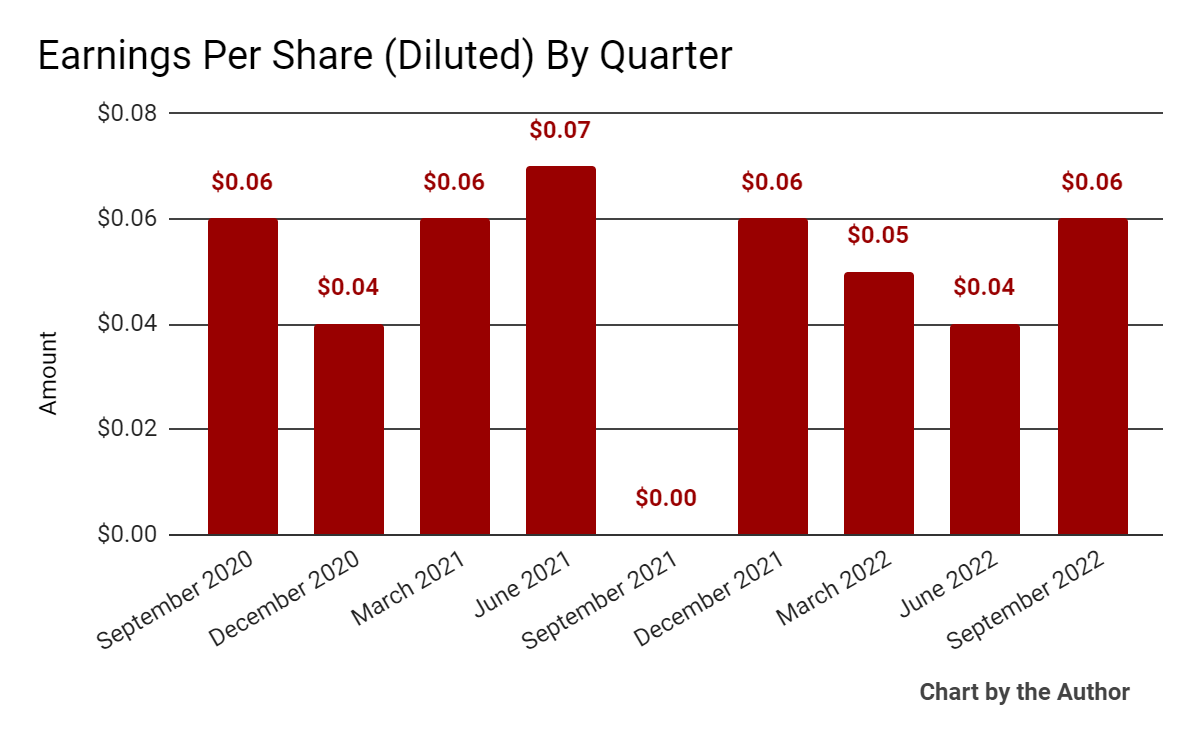

Earnings per share (Diluted) have also not increased as revenue has grown:

9 Quarter Earnings Per Share (Seeking Alpha)

(All data in above charts is GAAP.)

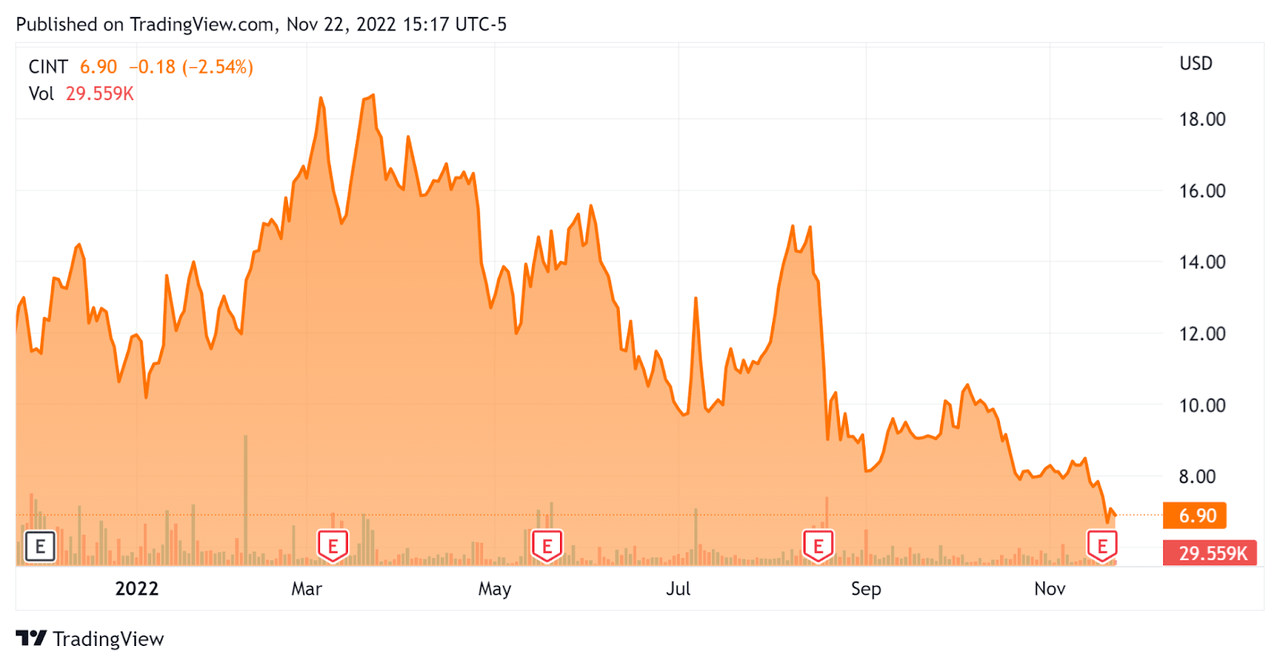

Since its IPO, CINT’s stock price has fallen 41.3% vs. the U.S. S&P 500 Index’s drop of around 14.6%, as the chart below indicates:

52 Week Stock Price (Seeking Alpha)

Valuation And Other Metrics For CI&T

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure (TTM) |

Amount |

|

Enterprise Value/Sales |

2.6 |

|

Enterprise Value/EBITDA |

15.2 |

|

Revenue Growth Rate |

62.2% |

|

Net Income Margin |

6.9% |

|

GAAP EBITDA % |

17.1% |

|

Market Capitalization |

$892,520,000 |

|

Enterprise Value |

$976,140,000 |

|

Operating Cash Flow |

$5,970,000 |

|

Earnings Per Share (Fully Diluted) |

$0.21 |

(Source – Seeking Alpha)

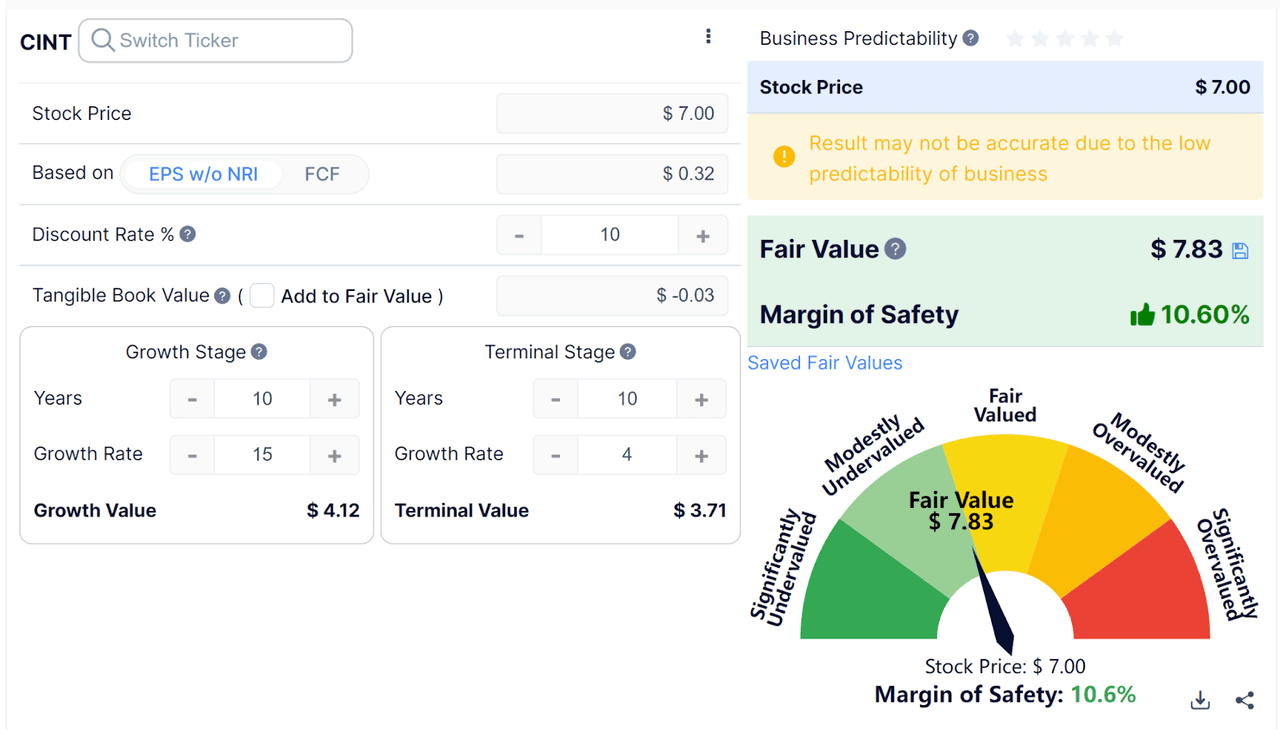

Below is an estimated DCF (Discounted Cash Flow) analysis of the firm’s projected growth and earnings:

CINT Discounted Cash Flow (GuruFocus)

Assuming generous DCF parameters, the firm’s shares would be valued at approximately $7.83 versus the current price of $7.00, indicating they are potentially currently modestly undervalued, with the given earnings, growth, and discount rate assumptions of the DCF.

Commentary On CI&T

In its last earnings call (Source – Seeking Alpha), covering Q3 2022’s results, management highlighted its expansion through acquisitions, opening new markets and verticals serves and growing its headcount.

On the acquisition front, the company recently announced a deal to acquire NTERSOL, which will give it added capabilities in the fast-growing U.S. market with the addition of 170 new specialists, doubling its team and furthering the company’s pursuit of financial services clients in the U.S.

Management believes this and other deals have ‘amplified (its) footprint for robust organic growth in (its) 4 operating regions: North America, Latin America, Europe, and Asia Pacific.’

As to its financial results, revenue rose 49% year-over-year, of which 35% was organic and 14% due to acquisitions.

Adjusted EBITDA margin was 19.2% as the firm finished the quarter with 6,900 employees. This included 1,500 net new employees added in the past year alone.

However, the firm’s SG&A as a percentage of total revenue has risen in recent quarters, likely due in part to inflationary effects on its primary cost: talent

Notably, operating income has generally remained flat despite management’s positive statements about its business prospects.

For the balance sheet, the company finished the quarter with $61.9 million in cash, equivalents and short-term investments, and $96 million in total debt.

Over the trailing twelve months, free cash flow was a paltry $800,000, with $5.2 million in capital expenditures.

Looking ahead, for the full year of 2022, management increased its net revenue guidance to an expected as-reported growth rate of 51%, which includes a negative foreign exchange impact of 7%.

Leadership reaffirmed its adjusted EBITDA guidance of 19%.

Regarding valuation, my discounted cash flow analysis indicates the stock may be slightly undervalued at its current price of around $7.00.

However, the primary risk to the company’s outlook is a slowing global economy and a U.S. economy entering a Federal Reserve-induced recession.

So, CI&T Inc is producing strong revenue growth but operating income isn’t really improving, indicating to me that the growth story isn’t translating to operating income growth.

Perhaps as the strong U.S. dollar begins to wane, CINT will face slower ForEx headwinds, but for the time-being, I’m on Hold for CINT in the near term.

Be the first to comment