VioletaStoimenova

While screening for companies near their 52-week highs, I came across FTI Consulting, Inc. (NYSE:FCN). I believe FCN’s strong price momentum is driven by expectations on its countercyclical bankruptcy and restructuring consulting practice. Momentum traders may wish to participate in the current strong uptrend, as revenues and earnings are likely to beat estimates into 2023. However, valuations may already be pricing in a ‘Bull Case’ scenario, so I think any shortfall could see swift selling.

Company Overview

FTI Consulting is one of the largest management consulting firms in the world. The company specializes in restructuring, corporate finance, economic consulting, forensic and litigation consulting, technology consulting and strategic communications management.

Forensic Technologies International was founded in 1982 to provide expert witnesses for litigation and to explain technical issues for juries. The company went public in 1996 and rebranded itself as FTI Consulting in 1998.

In 2002, FTI Consulting acquired the U.S. Business Recovery Services Division of PricewaterhouseCoopers, which at the time was the largest provider of bankruptcy, restructuring, and turnaround consulting services in the U.S.

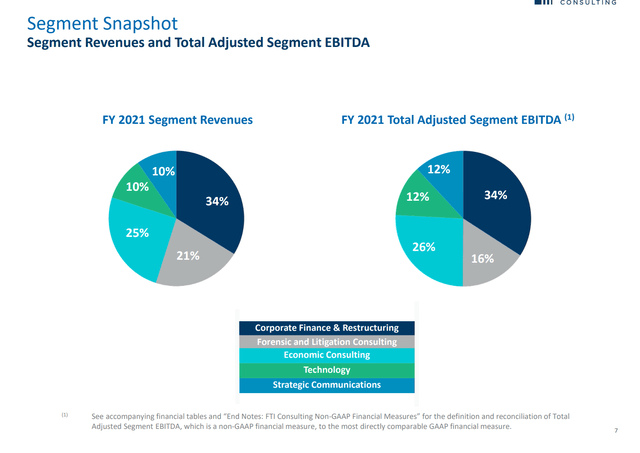

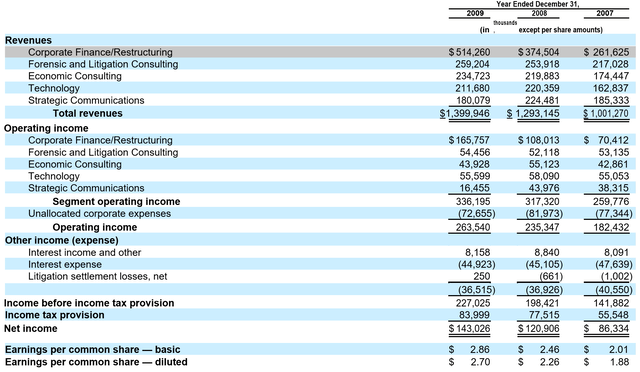

Today, FCN’s consultants bring in $2.8 billion in revenues per year, with approximately 1/3 of revenues coming from Corporate Finance & Restructuring, 20% from Forensic and Litigation Consulting, 25% from Economic Consulting, and 20% from Technology and Strategic Communications (Figure 1).

Figure 1 – FCN Business Mix (FCN Investor Presentation)

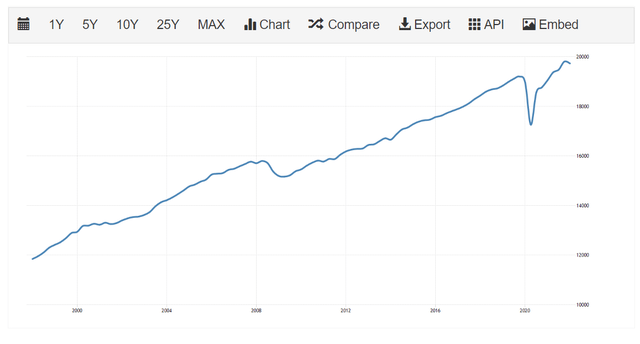

Strong Technical Momentum

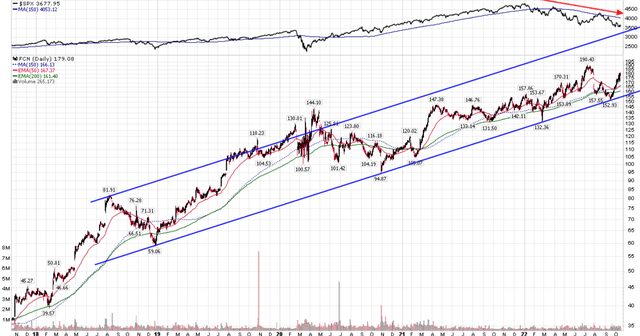

FCN’s stock has been showing strong relative momentum. Despite the S&P 500 Index declining ~25% YTD, FCN is up over 20% and had been making new all-time highs.

Figure 2 – FCN stock is showing strong relative momentum (Author created with price chart from stockcharts.com)

What could be the reason behind FCN’s strong performance?

Bankruptcy / Restructuring Is The Right Business For The Current Environment

I believe the main reason behind the company’s strong stock performance is the bankruptcy and restructuring business that makes up a third of revenues. As the economy slows and companies get into financial trouble, they are likely to require the services of bankruptcy and restructuring experts like FCN.

Corporate Bankruptcies Expected To Increase In Coming Quarters

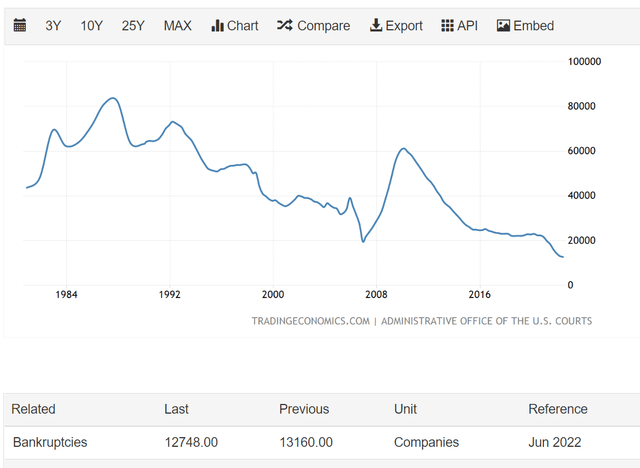

A little under the radar, but FCN’s restructuring and bankruptcy business has actually faced macro headwinds in the past few quarters. Corporate bankruptcies were at the lowest level ever in Q2/2022, with only 12,748 cases in the quarter according to data from the Administrative Office of the U.S. Courts (Figure 3).

Figure 3 – Corporate bankruptcies at multi-decade lows (tradingeconomics.com)

In fact, the 2020 COVID-recession was unusual in that it did not lead to any noticeable spike in bankruptcy filings, as the U.S. government effectively bailed out everyone with stimulus checks (individuals) and PPP loans (companies).

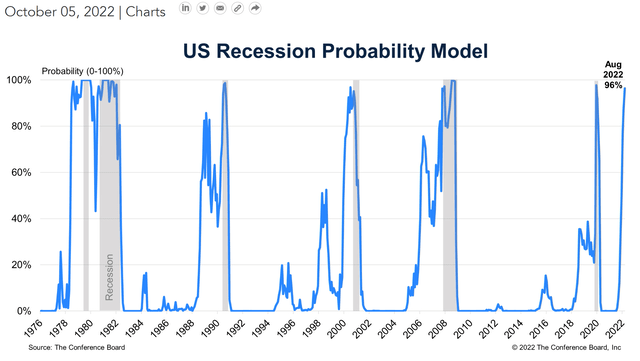

However, as the U.S. economy is looking at a 96% probability of a recession in the next 12 months, as predicted by the Conference Board, we may see bankruptcy and restructuring activity increase in the coming quarters (Figure 4). Historically, once the recession probability gets this high, a recession is virtually a lock (6 out of 6 previous times the probability surpassed 90%, a recession shortly followed).

Figure 4 – Recession probability at 96% (Conference Board)

One counter-argument against a 2023 recession is that the U.S. government or the Federal Reserve can shield companies with further stimulus. However, investors should be reminded that one of the primary reasons we are in our current high inflation predicament is due to the tremendous fiscal and monetary stimulus unleashed to combat the COVID pandemic. While one should never rule out further government largesse (see recent student loan cancellation policy), the economy will probably have to see a lot more pain before the Fed stops with their monetary tightening policies.

Already, we are starting to see FCN’s U.S. restructuring business pick up. As per the CFO, Ajay Sabherwal, during the Q2 conference call: (highlight by the author)

Third, large M&A activity is down year-over-year which impacts our Economic Consulting and Technology segments. As a reminder, last year, we benefited from large M&A-related engagements that have since concluded. There are also pockets within our Forensic and Litigation Consulting business where work involving our litigation-related services has been slower to get started than we expected. Conversely though, we had better-than-expected performance in our Corporate Finance & Restructuring segment.

Over the last two quarters, we have seen sequential increases in restructuring activity without any letup in our transactions and business transformation businesses. As Steve mentioned, we are reiterating our guidance for the full year despite the lower-than-expected second quarter performance.

Great Financial Crisis As A Model Implies Boom Times Ahead For FCN

The last time the U.S. economy saw a prolonged downturn was during the 2008 Great Financial Crisis (“GFC”). As we can see from Figure 3 above, corporate bankruptcies almost tripled to 60k cases a quarter by the end of 2009.

For FCN, its bankruptcy and restructuring business almost doubled from $262 million in revenues in 2007 to $514 million in revenues in 2009 (Figure 5). Overall revenues for FCN increased 40% during GFC, from $1 billion in 2007 to $1.4 billion in 2009. Operating income likewise saw a large jump, from $182 million to $264 million (45% increase).

Figure 5 – FCN’s business boomed during GFC (FCN 2009 10K report)

Importantly, while the rest of the economy was under immense pressure from the 2008 recession (U.S. real GDP fell 4%, see Figure 6), FCN’s business was ‘booming’ with 4 out of 5 business segments recording gains in revenues from 2007 to 2009. The only segment that saw revenues decline was Strategic Communications, which help companies handle their public communications and is pro-cyclical.

Figure 6 – U.S. Real GDP (tradingeconomics.com)

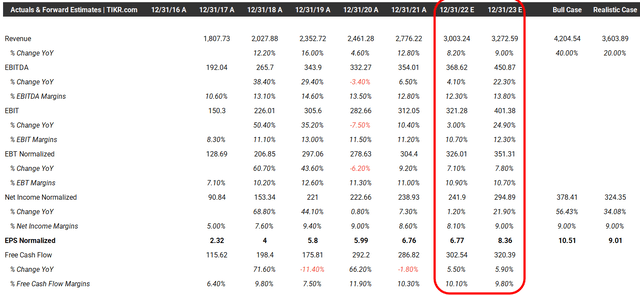

Financial Estimates Could Be Conservative

Looking at current consensus estimates, Wall Street analysts expect top-line growth of 8% in 2022 and 9% in 2023. Non-GAAP EPS is expected to grow modestly in 2022 to $6.77 and $8.36 in 2023 (Figure 7).

Figure 7 – Analyst estimates for FCN (Author created Bull and Realistic Case based on estimates data from tikr.com)

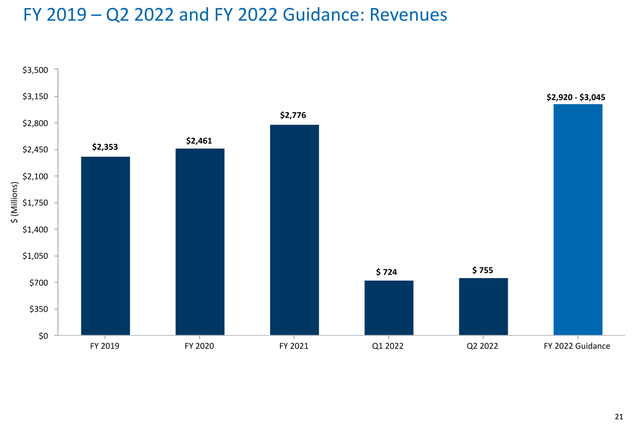

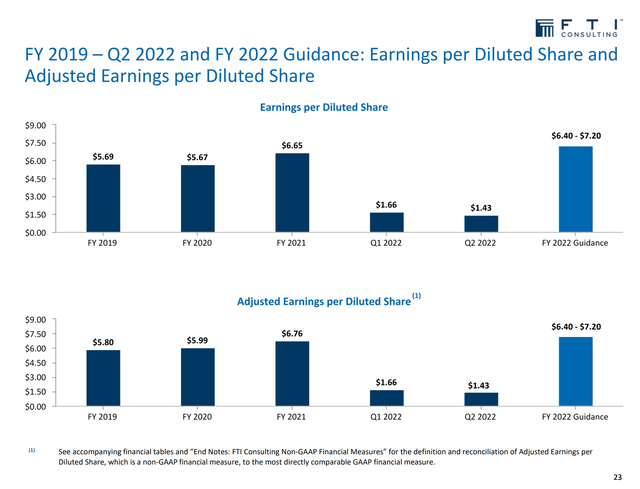

Analyst estimates are basically in line with the Company’s guidance for 2022, as reaffirmed in the latest quarterly earnings (Figure 8 and 9).

Figure 8 – FCN reaffirmed 2022 revenue guidance (FCN Q2 earnings slides) Figure 9 – FCN reaffirmed 2022 EPS guidance (FCN Q2 earnings slides)

However, given my expectation for the U.S. economy to enter a recession in 2023, I believe many companies will need bankruptcy and restructuring advice and analyst estimates could be too conservative. Every 5% in incremental revenue growth for 2023 should equate to ~$150 million in revenues and $13.5 million in earnings (9% net margin) or $0.38 in EPS.

If we assume a Bull Case scenario where FCN’s revenues increase by 40% using 2022 as the baseline (like the 2008 recession where FCN’s revenues increased 40% from 2007), then we may see 2023 revenues of $4.2 billion and $10.51 in EPS.

Valuations Already Factoring In Bull Case

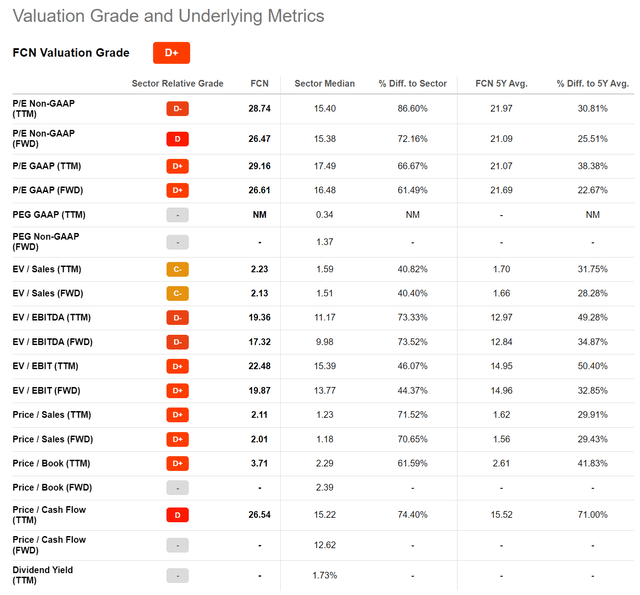

However, looking at FCN’s valuation, the company screens expensive, as it is trading at a 26.5x non-GAAP Forward P/E vs. Industrial peers at 15.4x (Figure 10). Even on my Bull Case EPS estimate of $10.51 for 2023, FCN is trading at 17.1x, a premium to the market P/E of 16.4x.

Figure 10 – FCN trading at a premium valuation (Seeking Alpha)

Risks To Owning FCN

The Great Financial Crisis was one of the worst recessions in modern history, so the Bull Case as I wrote above could be very optimistic for FCN. If revenues only grow at half the rate of the Bull Case, say at 20% YoY in 2023, then we may see only $3.6 billion in 2023 revenues and $9.01 in EPS. Although this would still be excellent growth for FCN (the company has not seen above 20% revenue growth since 2008), this would leave valuations at over 20x 2023 P/E.

Furthermore, reviewing the latest quarterly earnings call transcript, FCN has oddly not seen material pick-up in the restructuring business outside of North America (note: Ajay Sabherwal is FCN’s CFO while Andrew Nicholas is an analyst from William Blair Securities)

Andrew Nicholas

Maybe to start following up on the last thing you said, Ajay, about kind of not having seen a pickup in restructuring outside of North America. What’s your sense for kind of what’s driving that? Is it — and what kind of visibility do you have, if any, to that eventually sighing outside the U.S.? Just kind of curious about the different dynamics impacting that end market?

Ajay Sabherwal

Andrew, the U.S. is more marked. We can see it in the number of matters coming in and the number of pitches and so on and so forth. I think it’s a matter of time but I can’t predict that time. And we certainly have all the visibility in the world. We are the leading practice. So I just didn’t want us to get ahead of ourselves.

This is surprising, as Europe is arguably in more need of restructuring and bankruptcy services. So, the risk is that ‘this time is different’ and FCN may not see the anticipated pickup in business.

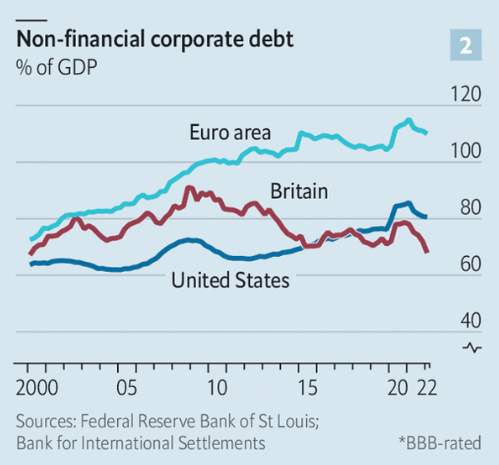

On the upside, perhaps a 40% revenue growth rate in 2023 is too conservative, as the level of non-financial corporate debt as a % of GDP is above 2008 levels (Figure 10). This actually argues for more restructuring and bankruptcies in the coming recession.

Figure 11 – Corporate Debt as % of GDP (Economist.com)

Conclusion

In conclusion, FTI Consulting has shown strong technical momentum, trading near all-time highs while the S&P 500 is down 25% YTD. I believe this is driven by expectations for FCN’s countercyclical bankruptcy and restructuring consulting practice. Momentum traders may wish to participate in the current strong uptrend, given revenues and earnings are likely to beat estimates into 2023 in my opinion. However, it appears valuations are already pricing in a ‘Bull Case‘ scenario, so any shortfall could see swift selling.

Be the first to comment