TexBr/iStock via Getty Images

Volatile crude oil prices and rising regional geopolitical risk have seen investors largely ignore upstream drillers focused on South America. Recent developments in Colombia have sparked considerable concern over the future of the Andean country’s economically crucial oil industry while weighing on the market value of those drillers operating there. One intermediate upstream oil producer operating in Colombia which appears particularly attractively valued is Frontera Energy Corporation (OTCPK:FECCF)(TSX:FEC:CA).

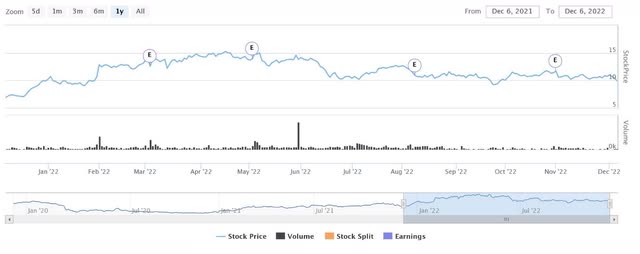

Price Chart (Frontera Energy)

Frontera is Colombia’s third largest oil producer behind state controlled Ecopetrol (EC) and fellow Canadian driller Parex Resources (PXT:CA). While that makes Frontera especially exposed to sharply rising Colombia specific geopolitical risks, notably a deteriorating security environment and the government’s plans to ban hydraulic fracturing and end contracting for oil exploration, it does appear undervalued. When it is considered that I last wrote on Frontera in an article published in July 2020, those latest developments coupled with now heightened oil price volatility make an appropriate time to review the driller’s potential as an investment.

Company overview

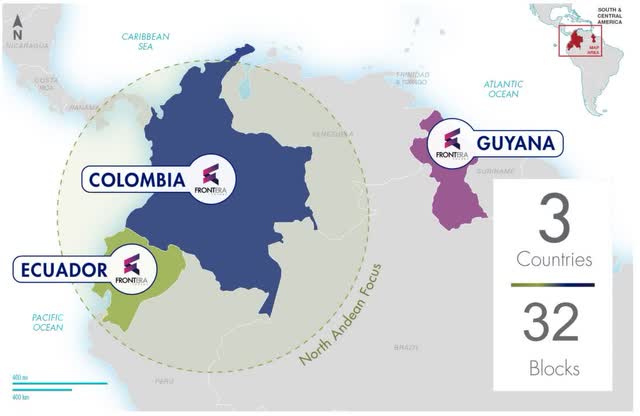

Frontera emerged from the 2015 bankruptcy of Pacific Rubiales which had been Colombia’s largest privately owned oil producer. The company owns a diverse portfolio of assets with oil acreage, comprised of 32 blocks, centered on Colombia but also including assets in Ecuador and Guyana.

Asset Map (Frontera Energy)

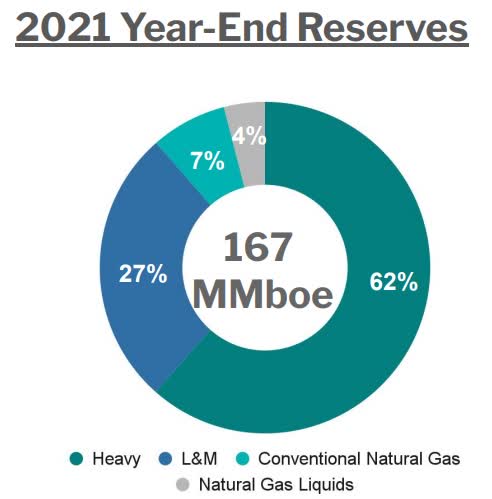

That oil acreage endows Frontera with proven oil reserves (1P) of 109 million barrels, proven and probable reserves (2P) totaling 167 million barrels and proven, probable and possible reserves (3P) of 217 million barrels. Of the driller’s 2P reserves of 167 million barrels 67% is weighted to light and medium crude oil, 27% is heavy oil, 7% is natural gas and 4% natural gas liquids.

2021 Oil Reserves (Frontera Energy)

That solid reserve base is one of the key reasons Frontera is an attractive investment in the current environment where an energy crisis is bolstering oil and natural gas prices.

Key assets

The company’s operations are focused on the strife-torn Latin American nation of Colombia, where geopolitical risk has ratcheted significantly higher in recent months. To offset that rising risk Frontera is diversifying its portfolio of energy assets away from Colombia having acquired blocks in Ecuador and offshore Guyana.

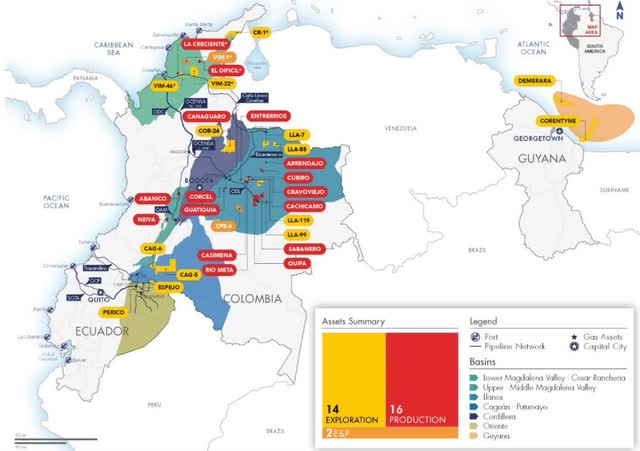

Colombia Block Map (Frontera Energy)

Core Colombia operations

Frontera’s key Colombian asset is the Quifa Block in the Llanos Basin borders the Rubiales Block which contains Colombia’s most prolific oilfield. The company holds a 60% working interest in Quifa with the other 40% held by Ecopetrol. The block contains the Quifa SW, Cajua and Quifa Norte fields and is Frontera’s key asset pumping a total of 16,150 barrels per day during the third quarter 2022, which amounts to 39% of total production for the period. Frontera owns a 100% working interest in CPE 6, also in the Llanos Basin, which for the third quarter 2022 pumped 4,916 barrels per day of heavy crude, accounting for 12% of the company’s total output for that period. The final core Colombian operation is the Guatiquia Block, again in the prolific Llanos Basin which is Colombia’s number hydrocarbon producing sedimentary basin. During the third quarter 2022 the block pumped 8,949 barrels daily of light to medium oil, accounting for 22% of the quarter’s total output.

In total, Frontera’s three key Colombian assets produced an average of 30,015 barrels per day during the third quarter making them responsible for nearly threequarters of the driller’s total oil production. Combined Colombian operations were responsible for 97% of Frontera’s total third quarter 2022 hydrocarbon output. That considerable dependence on Colombia is a primary driver of the risks that Frontera is facing since leftist President hiked taxes payable by the oil industry and announced plans to end contracting for hydrocarbon exploration as well as ban hydraulic fracturing. I discuss those risks at length in the appropriate section below.

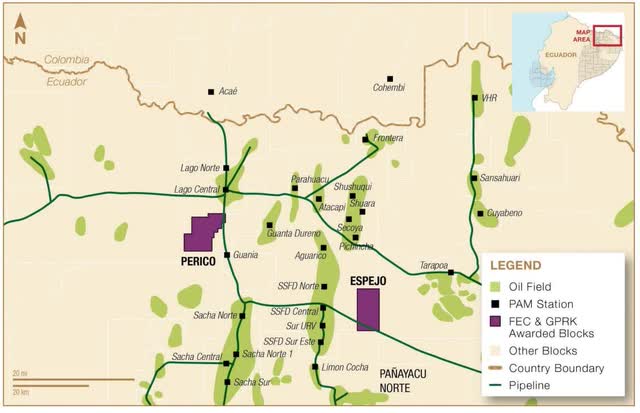

Ecuador blocks

Frontera holds a 50% working interest in two exploration blocks in Ecuador; Perico where it is also the operator and Espejo where GeoPark (GPRK) is the operator.

Ecuador Block Map (Frontera Energy)

Source: Frontera Corporate Presentation November 2022.

In February 2022, Frontera announced the discovery of oil with the Jandaya-1 exploration well on the Perico Block. That discovery is being evaluated with the driller compiling a field development plan. For the third quarter 2022, Frontera’s share of production from those assets totaled 1,204 barrels per day, which represents 3% of the period’s total oil output. As those two blocks are developed, they will boost Frontera’s medium to heavy grade crude oil production while lowering the driller’s dependence on Colombia which is becoming a riskier less profitable area for energy companies.

Offshore Guyana

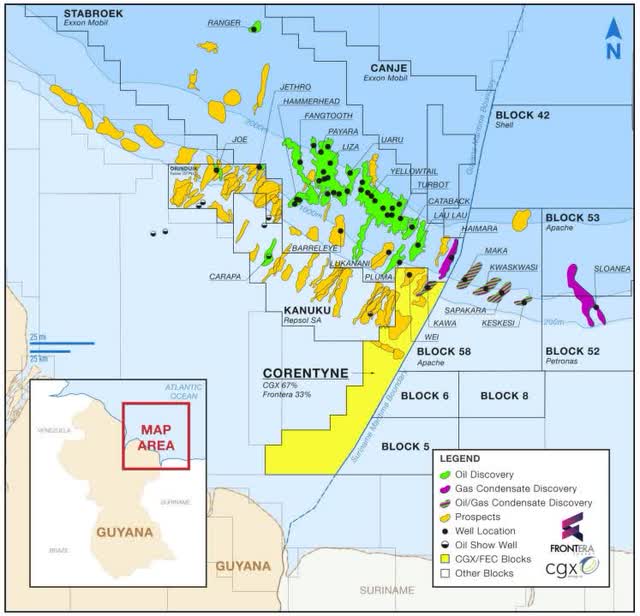

The jewel in Frontera’s crown is the Corentyne Block in offshore Guyana, where an Exxon (XOM) led consortium has made over 30 world-class discoveries, with over 11 billion barrels of recoverable oil resources, in the neighboring Stabroek Block. Frontera has a 33% working interest in the block with the remainder held by partner CGX Energy (OTCPK:CGXEF) (CA:OYL) a subsidiary of which it owns 77% giving the driller a consolidated interest of nearly 93% in the Corentyne Block. The northern end of the block is believed to contain the same petroleum fairway that runs through the adjacent Stabroek Block.

Offshore Guyana Block Map (Frontera Energy)

That along with Exxon’s considerable and ongoing success in the Stabroek Block as well as the discoveries made by APA Corp. (APA) and 50% partner TotalEnergies (TTE) in neighboring offshore Suriname Block 58 points to the Corentyne Block’s considerable oil potential. Frontera was planning to drill a second well in the Corentyne Block but was forced to suspend that operation because the operator did not release the rig. The spudding of the Wei-1 exploration well which will be located 8.7 miles northwest of the Kawa well is expected to commence between December 2022 and the end of January 2023. Frontera has confirmed that its Corentyne licenses is unaffected by the delay and remains in good standing.

A massive oil boom, which is being characterized by energy analysts as the world’s last greater frontier offshore oil boom, is emerging in the Guyana-Suriname Basin. Exxon has identified at least 11 billion barrels of recoverable oil resources in the Stabroek Block with most discoveries occurring in the southeast segment near the Corentyne Block. It is estimated that Block 58 offshore Suriname, adjacent to the southeast of Corentyne, where Apache and TotalEnergies have made four commercial discoveries could contain 6.5 billion barrels of recoverable oil resources. The considerable promise held by the northern segment of the Corentyne Block could see Frontera positioned to cash in on the offshore oil boom underway in Guyana. This helps to offset the risk posed by recent political, regulatory and security events in Colombia as well as the potential for further civil unrest in Ecuador impacting its two blocks in the Andean country.

Operational update

Frontera reported a solid third quarter 2022. Overall hydrocarbon production shot-up 13% year over year to 41,033 barrels per day which was 73% weighted to crude oil. It was Colombia and Ecuador which were the key drivers of that growth. Colombian output soared by 9% to 39,829 barrels per day, while Frontera’s Ecuadorean asset pumped 1,204 barrels daily compared to zero a year earlier. Significantly higher oil prices coupled with stronger year over year production delivered a financial windfall for Frontera. During the third quarter 2022 the international Brent refence price averaged $97.70 per barrel compared to $73.23 for the same period a year earlier, that gave Frontera’s realized price per barrel a healthy lift. The driller reported a net sale realized price of $81.93 for the period which was 38% greater than the $59.47 per barrel realized for the third quarter 2021. As a result, Frontera saw a healthy increase in its operating netback per barrel which was $59.78 for the third quarter 2022 compared to $37.79 a year earlier. Strong control of costs will ensure that Frontera maintains an impressive netback and its operations are profitable.

Those numbers translated into a solid financial performance for the third quarter 2022. Cash from operating activities was $120.8 million compared to $79.1 million a year earlier. Operating EBITDA of $173 million or 124% higher than the $77 million reported for the same period a year earlier. Nonetheless, the company’s bottom line fell sharply to a net loss of $26.9 million compared to a profit of $38.5 for the third quarter 2021. That can be attributed to a large, nearly $94 million, deferred tax expense compared to a $14 million recovery a year earlier. While total cash by the end of the third quarter 2022 was $309 million or 26% less than the $419 million reported a year earlier, Frontera is still highly liquid and has a solid balance sheet. The decline in total cash occurred because of a $61 million investment in exploration and development activities for Frontera’s operations in Colombia and Ecuador. The company also spent $11.8 million on drilling activities in offshore Guyana for the Wei-1 well. Finally, Frontera returned $57.9 million to shareholders through its share buyback.

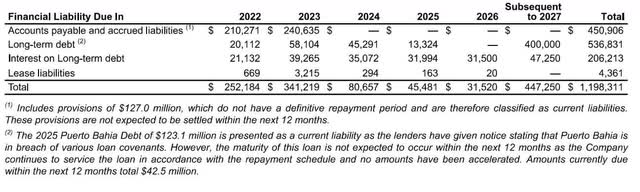

Frontera possesses a solid balance sheet with a well-laddered debt profile. The company finished the third quarter 2022 with $533 million in debt which was 5% lower than a year earlier. There are no significant debt repayments due until after 2027 giving Frontera ample time to profit from higher oil prices, bolster its cash position and pay down outstanding debt.

Debt Schedule (Frontera Energy)

Frontera’s solid balance sheet and credible cash position will improve for as long as oil prices are high, which will be for some time with a global energy crisis buoying oil and natural gas prices.

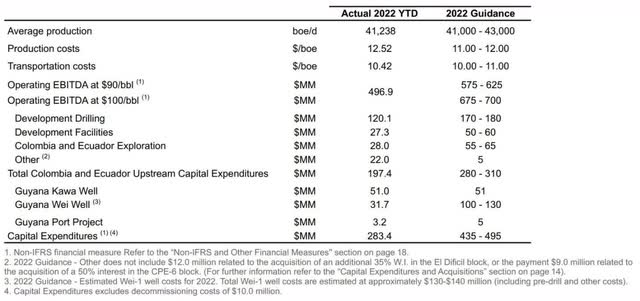

At a forecast average annual price of $90 per barrel Brent Frontera expects to generate $575 million in EBITDA, at the bottom-end of its 2022 forecast budget, which jumps to $700 million at the top end of the international benchmark averages $100 per barrel. This is as per Frontera’s revised forecast 2022 budget set out below.

Financial Table (Frontera Energy)

Source: Frontera Management Discussion and Analysis for three and nine months ended September 30 2022.

Frontera is on-track to achieve its 2022 guidance with average year to date production of 41,238 barrels per day within the forecast 41,000 to 43,000 barrels per day range. That will see the driller deliver strong full-year results further indicating that Frontera is, indeed, undervalued even after accounting for the significant risks that it is exposed to by virtue of its Colombian operations.

Company specific risks

Aside from the usual risks for an upstream oil producer that can negatively affect its financial performance such as commodity prices there are specific hazards that have the potential to sharply impact Frontera’s operations. The key risks that could have an oversized material impact on Frontera are heightened geopolitical risks in Colombia. The Latin American country’s 34th President Gustavo Petro, who is incidentally Colombia’s first leftwing president, recently hiked taxes for extractive industries notably oil and coal. He also plans to end hydrocarbon exploration in the Andean country, although there are signs that stance maybe softening.

Colombia’s tax reform

Tax reforms approved by Colombia’s congress being written into law during early November 2022 have removed royalty payments as a deduction against taxable income and implemented a scalable surcharge payable when oil is above a certain price. A 5% surcharge is applied when Brent is selling for $67.30 to $75 per barrel, which then increases to 10% when the price is between $75 to $82.20 a barrel and then rises to 15% if Brent is trading at higher than the final threshold. Royalties payable by drillers operating in Colombia, which were once classified as an expense that could be offset against tax payable on income, can now no longer be claimed as a tax deduction. Energy companies are obligated to pay 8% to 25% of the value of the oil produced to Colombia’s government. The percentage of the royalty appointed depends upon the costs of extracting and transporting the oil as well as its grade with the API gravity and sulfur content being considered. This means lower grade petroleum deposits which are costly to exploit have a lower royalty rate assigned.

Deteriorating security

Rising insecurity in Colombia, notably in remote regions where the petroleum industry predominantly operates, is impacting operations. There have been a series of attacks upon petroleum infrastructure by the last remaining leftist guerilla group the National Liberation Army, known by its Spanish initials ELN, and FARC dissidents. Those groups are also ambushing, killing and kidnapping elements of Colombia’s security forces while also being locked in conflict among themselves. The ELN kidnapped and then released two Colombian soldiers in the department of Arauca, which contains the Caño Limon oilfield, during November 2022. A savage clash between two dissident FARC bands, those elements of the Revolutionary Armed Forces of Colombia (known by Spanish initials FARC) who did not accept the 2016 peace agreement, left 18 dead in the southern department of Putumayo. That department contains Colombia’s third most prolific sedimentary basin, the Putumayo Basin, where the oil industry has regularly been impacted by pipeline bombings, road blockades and oilfield invasions. Another dissident FARC group ambushed a National Army patrol in the Cauca Department during early December 2022 killing six.

This significant increase in violence is occurring despite Petro recommencing peace negotiations with the ELN leadership in Cuba and opening a dialogue with key leaders of FARC dissident groups. That conflict is being fueled by ever-higher cocaine production in Colombia, which hit a new record during 2021. This is driving an ever-growing rate of petroleum theft with various criminal bands and illegal armed groups tapping Colombia’s oil pipelines. The oil, which is syphoned-off from illegal valves applied to pipelines, is then converted into a crude gasoline in primitive clandestine jungle refineries for use in the manufacture of cocaine or smuggled across the border for sale in Venezuela. The demand for gasoline for use in manufacturing cocaine is soaring not only because of record production of the narcotic but also because of higher fuel prices and a crackdown by Colombian authorities on gasoline smuggling.

Colombia’s petroleum industry is also feeling the impact of a disintegrating social license with many local communities opposed to it operating in their municipalities. This community dissent is ratcheting upward because of the approval of hydraulic fracturing pilots, ongoing environmental concerns and pollution. It has in the past sparked protests, road blockades and even oilfield invasions. There is no sign of that easing any time soon, with potential for it to worsen if the Petro administration fails to keep the promise to ban hydrocarbon exploration and hydraulic fracturing. That may lead to further community protests which will impede operations and potentially cause production to fall.

Finding Frontera’s indicative fair value

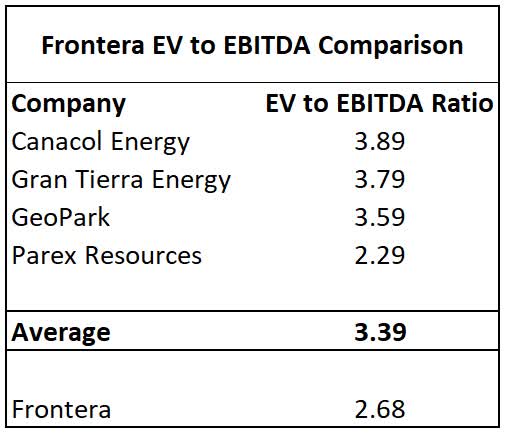

Frontera in comparison to its upstream peers operating in Colombia appears cheap because of its Enterprise Value to EBITDA as the chart below shows. Only Parex is cheaper on that basis with an EV to EBITDA ratio of 2.29, but it does not offer investors exposure to offshore Guyana, which is shaping up to be what industry analysts are calling the world’s last greater oil frontier

EV to EBITDA Comparison (Wall Street journal)

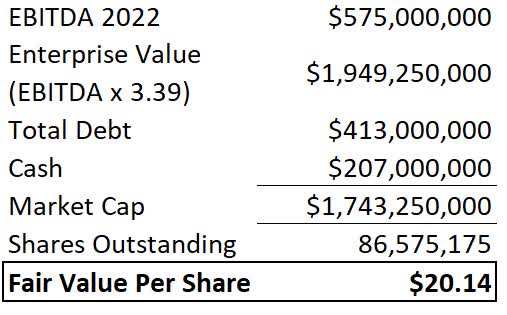

Using the average EBITDA for Frontera’s peers of 3.39 the driller has an indicative fair value of $20.14 per share when using the lower end of the forecast annual 2022 EBITDA of $575 million, as the table below shows.

EBITDA Calculations for fair value per share (Author’s own work)

That value is almost three-times greater than the $7.32 per share that Frontera is trading at, in U.S. dollars on the pink sheets, at the time of writing. This confirms that for as long as Brent is trading at or above $90 per barrel Frontera is heavily undervalued. Even with Brent having plunged sharply in recent weeks as fears of an economic hard-landing grow to be trading at around $76 per barrel Frontera is still significantly undervalued with a substantial margin of error.

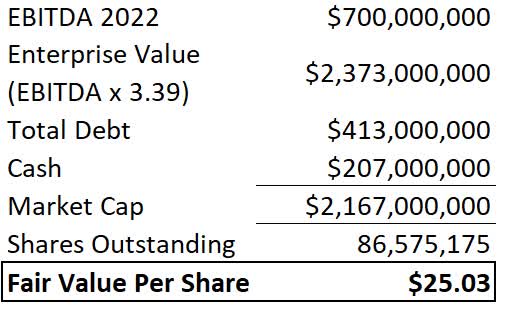

If the upper end of Frontera’s 2022 forecast EBITDA is used, which is expected to be $700 million for the full year if Brent averages $100 per barrel, the driller’s indictive fair value jumps to $25.03 per share, as the table below shows.

EBITDA to Calculate Value Per Share (Author’s own work)

That is more than three-times higher than the value of Frontera’s U.S. pink sheets listing at the time of writing further underscoring the company is heavily undervalued with considerable upside available, especially if Brent returns to over $100 per barrel.

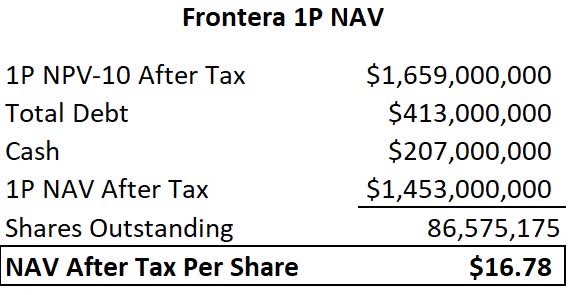

Another way to determine Frontera’s indicative fair value per share, using the industry accepted standard, is to calculate the net asset value (NAV) of its oil reserves per share. Using Frontera’s proven oil reserves, otherwise known as 1P reserves, the company has an indicative fair-value of $16.78 per share as per the chart below.

NAV Calculations Per Share (Author’s own work)

This is more than double Frontera’s share price at the time of writing for its U.S. pink sheets listing indicating that it is heavily undervalued and that there is a substantial margin of error. That calculation was made using the after-tax net present value (NPV) of the driller’s 1P reserves. Importantly, the after-tax NPV of the driller’s oil reserves, for 1P, 2P and 3P reserves, was calculated using a 13-year average Brent price of $76.46 per barrel. This is roughly the same as the Brent price at the time of writing and significantly less than the average Brent price of $102 per barrel since the start of 2022. Crucially, the NPV of Frontera’s oil reserves also incorporates a 4% discount from Brent for the sale price of the heavy oil that the company producers, which is benchmarked to Colombia’s Vasconia oil grade.

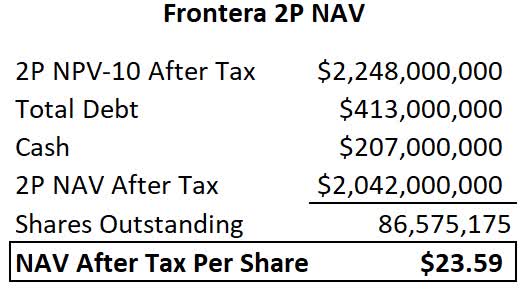

Frontera’s indicative fair-value increases when the after-tax NPV for its proven and possible oil reserves, known as 2P reserves, is used. This is the most widely used methodology within the energy industry which is used to determine the value of upstream oil producers like Frontera, because 2P reserves are their primary income generating asset. As the table below shows, Frontera’s indicative fair-value per share jumps to $23.59 when using the after-tax net-present value of its 2P oil reserves.

NPV-10 Calculations Per Share (Authors own work)

This is more than triple Frontera’s current market value, as per the U.S. pink sheets listing. That further affirms that the driller is heavily undervalued and that there is considerable upside ahead for investors with a considerable margin of safety. Based on those calculations, Frontera has an indicative fair-value of somewhere between $16.78 to $25.03 per share or 132% to 246% higher than the company’s market price at the time of writing.

Conclusion

Erring on the side of caution the company’s indicative fair-value is the NAV of its proven and probable oil reserves which comes to $23.59 per share, giving potential upside of 226% and a substantial margin of safety. That margin of safety is further enhanced when it is considered that the indicative fair-value was calculated using Frontera’s 2P after-tax NPV that was calculated using a 13-year forecast Brent price of $76.46 per barrel which is less than the current spot price.

It may take time for Frontera’s true value to be realized because of significantly higher geopolitical risk in Colombia causing the market to overbake the perception of risk associated with the company. Then there is Frontera’s offshore Guyana Corentyne Block which is still in early exploration stages as are its 2 blocks on Ecuador, making the driller highly dependent on its core Colombian operations.

*Important note: While Frontera is not listed on a U.S. exchange, the company’s stock is highly liquid with it being listed on the Toronto Stock Exchange with a market cap of C$873 million and an average daily trading volume of 79,396.

Be the first to comment