Alex Wong

Last week, while traveling back home from REITworld in San Francisco, I read a Wall Street Journal article. It was regarding the FTX cryptocurrency exchange bankruptcy, which is all over the news.

I’m sure you’ve at least seen a headline or two about it by now. In the article I read, the author wrote:

“The emerging picture suggests FTX wasn’t simply felled by a rival, undone by a bad trade, or even by the relentless fall this year in the value of cryptocurrencies. Instead, it had long been a chaotic mess…

“From its earliest days, the firm was an unruly agglomeration of corporate entities, customer assets, and Mr. Bankman-Fried himself, according to court papers, company balance sheets shown to bankers, and interviews with employees and investors.”

The entire debacle begs the question of how so many folks were duped into participating in such a speculative venture. It also begs an ultimate answer of, “Regardless of the rationale, duped they were.”

The size and scale of this cratered business has drawn many comparisons to Enron and Bernie Madoff so far. Others have said it’s so much worse than that.

But speaking of those past busts, I do have to say that you’d think we as the human race would learn eventually. Instead, we keep falling for get-rich-quick schemes over and over again.

I guess we just can’t get past the desperate desire to think that “this time, it’s different.” Not collectively speaking, that is.

On an individual level, though, there’s much more hope to hold onto.

Too Much Speculation for Anyone’s Good

In late January 2022, FTX announced it had raised $400 million from investors such as Softbank, Temasek, and Tiger Global. The funding boosted its valuation to $32 billion from around $7 billion in 2021.

That was on top of its profitable ties to a long list of well-known names such as…

- NFL legend Tom Brady and his to-be-ex-wife supermodel Gisele Bundchen

- NBA legends Stephen Curry and Shaquille O’Neal

- Tennis star Naomi Osaka

- Entrepreneur co-star of hit TV show Shark Tank Kevin O’Leary

- Seinfeld creator Larry David.

If you’ve been reading my articles on Seeking Alpha, you know I’ve been calling out crypto for some time. Last year, for instance, I explained:

“I keep telling my son that Bitcoin is too volatile to be called an investment of any kind. Borrowing [Charlie] Munger’s words… this time from the Daily Journal’s annual shareholders’ meeting in February:

“‘It’s really kind of an artificial substitute for gold. And since I never buy any gold, I never buy any Bitcoin. Bitcoin reminds me of what Oscar Wilde said about foxhunting. He said it was the pursuit of the uneatable by the unspeakable.’”

I get why my son disagreed at the time (and might still. That’s to be determined still). Crypto and other digital assets were cool and making money with the promise of making much, much more.

He and his likeminded community were engaging in the wave of the future!

But sometimes, waves only look like they’ll last. Or sometimes they ebb and flow until they become truly substantial and substantiated.

Moreover, sometimes we get too blinded by the sun to tell the difference.

That’s why I’m writing this article today: to clearly show the difference between an investor and a speculator. It’s an exceptionally important distinction.

The Difference Between Investing and Speculating

I’ve said it before, but I can’t say it enough: there’s a major difference between investing and speculating.

And now I’m going to say it again. Because now looks like another great time for another timely reminder.

Mr. Bankman-Fried, the previous and now-disgraced CEO of FTX, was once worth an estimated $22.5 billion, according to Forbes. And just a few months ago, Fortune slapped him on its magazine cover with the clickbait title, “The Next Warren Buffett?”

Fortune

In which case, let me quote the real billionaire here (i.e., Buffett). As Fortune should know, he’s very well known for saying such things as:

- “The important thing is to know what you know and know what you don’t know.”

- “Rule No. 1 is never lose money. Rule No. 2 is never forget Rule No. 1.”

- “My wealth has come from a combination of living in America, some lucky genes, and compound interest.”

There’s a clue with that last quote especially – one I’d like to remind readers today.

If You Must Speculate, Learn the Rules

One of my favorite books is “If You Must Speculate, Learn the Rules.” Written by Frank J. Williams, it explains:

“We are all gamblers at heart. We cannot be blamed for wanting to get at the best things in life in the quickest possible way. This is the spirit of America. The stock-market seems to offer the most rapid road to fortune.”

Williams wrote the book in 1934, long before crypto was a concept. But his words are timeless, including:

“The quick profits are just froth. They arouse a fever in the blood and don’t last. The worst thing that can happen to a new spectator is to make a lot of quick money on his first trade.”

Unfortunately, that’s exactly what happened to my son. He won big through online gambling… then promptly gambled away most all of his newfound gains by speculating in crypto.

It was a tough lesson for him. But at least he’s young enough to make it over again.

As for you, I’m truly sorry if you lost out betting on crypto, too. But, to be blunt, folks – including my son – need to wake up and smell the roses.

Or, to quote the equally blunt Williams again:

“People of the dupe type are hypnotized by the glare of gold. They stare so long at glistening fortune that their minds are brought under subjection to one of nature’s strongest passions – greed. They will listen to any tip, however wild and ridiculous, and impulsively act on any suggestion.”

So… Do you fit into this box?

“The speculator is he who buys today with the hope of selling tomorrow or next month at a higher price.”

Or this one:

“An investor is one who buys sound securities where he knows his principal will be safe and he will get a fair income return on his money.”

The choice is yours.

4 REITs To Finish the Year

Year 2022 has been a rollercoaster, and we’ve been through many different events: record high inflation, Russia Ukraine war, rising interest rates, and supply chain issues.

There has been bad news following bad news, and the stock market just never got any traction. Every time we thought we had made it past some bad news, more bad news came right after.

It’s not all hopeless though.

The economy has been pretty resilient, and unemployment rate has stayed at a record low. The inflation rate has finally showed some signs of easing off, even though it is too early to say that it’s truly trending downward.

The following four real estate investment trusts (“REITs”) are great choices to finish the year strong. Solid balance sheets and great operation set them apart, and should allow investors to sleep well at night.

Global Medical REIT Inc. (GMRE)

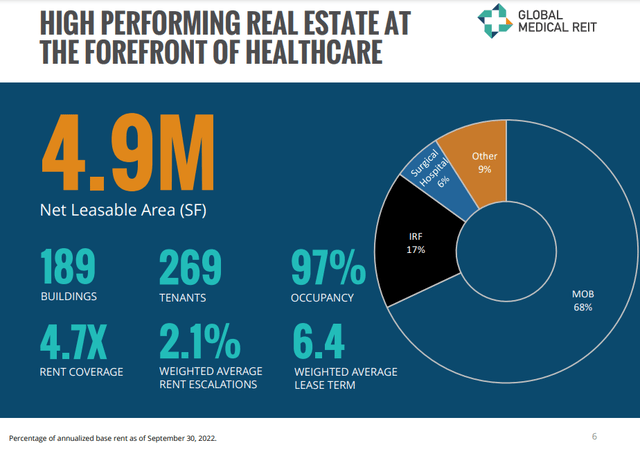

Global Medical REIT invests in healthcare properties operated by physician groups, regional healthcare systems, or the national healthcare system.

Their portfolio consists of medical office buildings, small to mid-sized healthcare facilities, acute-care hospitals, and long-term acute care facilities.

Global Medical has over 4.9M sq ft of net leasable area with 189 buildings and 269 tenants. Their properties are in high demand with 97% occupancy. The value of their assets grew substantially from $94 M at the IPO to $1.5 B in 2022.

They achieved this strong growth through disciplined market selection, stringent underwriting, rigorous tenant identification, and a resilient financial structure.

Global Medical has a favorable capital structure. Their fixed rate debt to total debt ratio is at 79%, and the weighted average interest rate is at 3.9%. The weighted average maturity is 4.2 years.

Also, they have a substantial amount of unused liquidity available, with revolver and common equity ATM capacity over $500 M.

The valuation metrics show a nice upside potential. P/AFFO of 9.58x and P/FFO of 10.10x are about 22% lower than their 5-year average. Also, iREIT’s equity rating tracker shows a 41% margin of safety for Global Medical.

It’s a great time for investors to take advantage of the favorable valuation.

Realty Income Corporation (O)

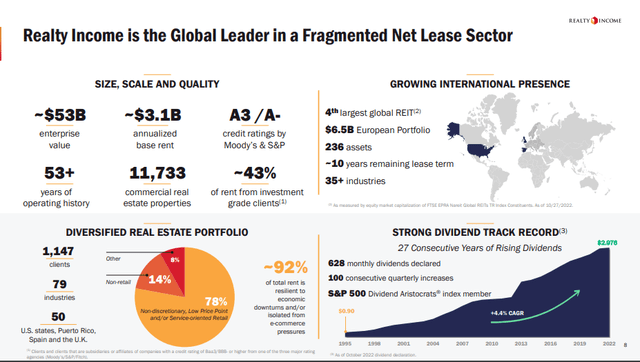

Realty Income owns a diversified portfolio with over 11,000 properties and over 1,100 clients in 79 different industries. Realty Income has achieved substantial and consistent growth since 1995, and they have raised their dividend for 27 consecutive years to make the list of S&P 500 Dividend Aristocrats.

Looking at their consistent acquisition volume, I expect their portfolio to continue its growth trajectory, and their dividend to grow consistently as well. The acquisition volume has been more than $1 B each year since 2011.

Realty Income also has a strong balance sheet. Their fixed charge coverage ratio is at 5.5x, and debt to total market cap rate is at 31%. Their debt profile is very well spread over the next several years, and the weighted average term to maturity is 6.3 years.

It’s not surprising to see Moody’s and S&P assigned the credit rating at A3 and A-, respectively. I don’t think Realty Income will suffer financial hardship anytime soon.

Realty Income’s dividend is safe at this point. The cash dividend payout ratio is at 74.99%, and FAD payout ratio is at 78.52%. With their strong balance sheet and solid operation, I expect Realty Income to continue increasing their dividend well into the future.

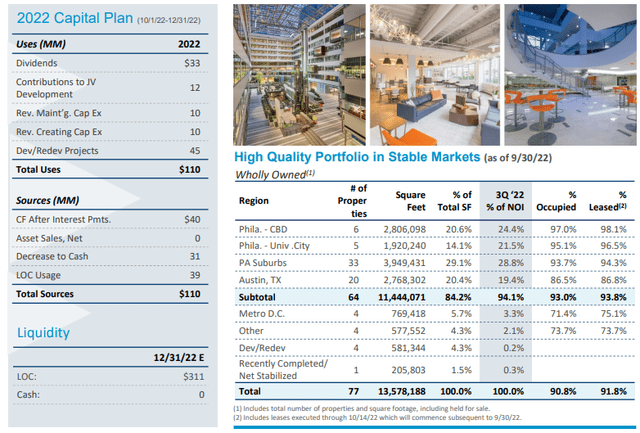

Brandywine Realty Trust (BDN)

Brandywine Realty Trust engages in the acquisition, development, redevelopment, ownership, management, and operation of office, life science, residential, and mixed-use properties.

Their properties are in the following markets – Philadelphia central business district, Pennsylvania suburbs, Austin, Metropolitan Washington, D.C., among others.

Brandywine has several exciting projects in their pipeline that will increase their portfolio value substantially. The Uptown ATX (Austin, TX) will be a mixed-use, 66-acre transit-oriented community. Currently, IBM occupies 65% of the existing buildings. After redevelopment, the properties will include office, multi-family, hotels, retail, and new Cap Metro light rail stations.

Schuylkill Yard (Philadelphia, PA) is another exciting project. The properties are next to the nation’s third busiest rail station, and this 14-acre project will include residential, life science, research and academic facilities, office, and retail.

Brandywine’s dividend is safe at this point, shown by a cash dividend payout ratio of 65.87% and funds from operations (“FFO”) payout ratio of 53.90%.

A nearly 55% drop of stock price in the past twelve months has created a great opportunity for investors to take advantage of a juicy dividend (11.73%) at a favorable valuation.

Their valuations metrics show they are undervalued, with P/AFFO of 7.52x and P/FFO of 4.75x that are far below their historic averages.

Digital Realty Trust, Inc. (DLR)

Digital Realty Trust is a leading global provider of data center, colocation, and interconnection solutions for customers around the world. Their impressive client base includes Amazon Web Services, Verizon, Adobe, LinkedIn, and Google Cloud.

As more and more companies build out big data and analysis capabilities, the data center industry is poised to keep growing at a strong pace. Digital Realty Trust is in the best position to take advantage of this trend.

Digital Realty Trust is the 8th largest publicly traded U.S. REIT, and their core FFO per share grew 10% per year (“CAGR”) since 2005.

They have also raised their dividend for 17 consecutive years.

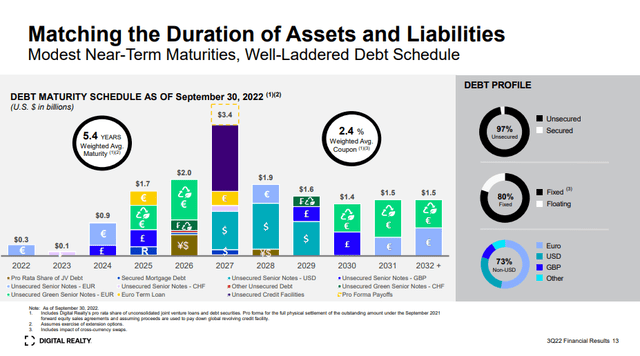

Digital Realty has a strong balance sheet and well-managed debt. Their net debt to adjusted EBITDA is 6.4x, and fixed charge coverage ratio is 5.7x. Their debt maturity schedule is very well spread over the next several years, and the weighted average maturity is at 5.4x. The weighted average coupon rate is at 2.4%, and 80% of their debt is fixed rate.

During the last earnings call, management mentioned that they will be focusing on long-term growth. With over 300 data centers around the world and a revenue base of over $4.5 B, Digital Realty is fundamentally very strong and ready to grow even further.

So far, they are on track. The last quarter’s new booking was over $176 M, and it marked the third time in the past 4 quarters that the booking exceeded $150 M.

Digital Realty’s dividend is relatively safe at this point, shown by FFO payout ratio of 72.54% and AFFO payout ratio of 78.63%. Given their continued growth and strong balance sheet, I expect shareholders of Digital Realty will be well rewarded with dividend increase and stock value appreciation in the future.

Risks…

Even though the market showed some signs of life this past week following the news of softer inflation data, it’s too early to call the end of volatility. Inflation is still at a historically high level, and one data point doesn’t constitute a “trend.”

Also, the reactions from the members of Federal Reserve were mixed. Some of them were positive and welcomed the result, while others remained skeptical. Therefore, I expect the market to remain volatile for a while.

The mortgage rate dropped last week, but it didn’t really revive the sentiment in the real estate market. Both homebuilders and buyers remained pessimistic about the real estate market’s short-term prospects.

This negative sentiment will continue to have a negative impact on REIT’s stock price, and, therefore, the stock price of REITs will remain volatile until the market sentiment turns.

Conclusion

It’s already mid-November, and Thanksgiving is just around the corner.

The stock market and overall world has been through a lot in the past couple of years. Unfortunately, I think the volatility will remain on the ticket for a little longer.

However, these are terrific options out there for savvy investors to take advantage of. Great companies are being sold at a bargain price, and the dividend yields are higher than their historical average.

The four companies in this article have strong operations, solid balance sheets, and nice growth prospects. They provide great opportunities for those who take advantage of their current favorable valuation and future strong dividend growth.

“Good ideas, carried to wretched excess, become bad ideas. Nobody’s gonna say I got some s*** that I want to sell you. They say – it’s blockchain!” Charlie Munger

Be the first to comment