Vladimir Zakharov

Introduction

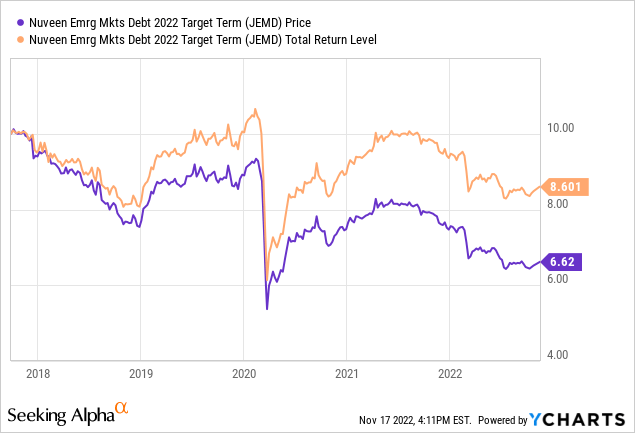

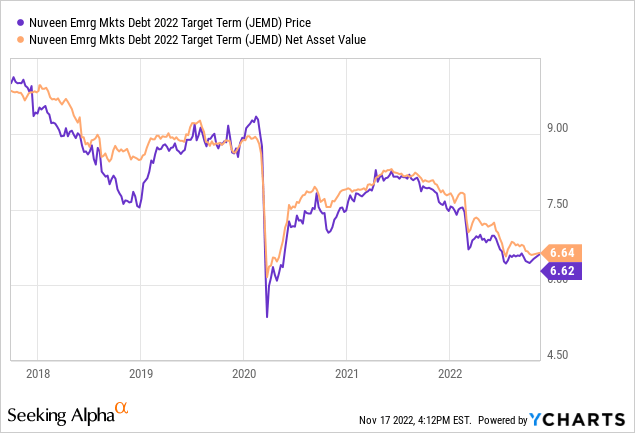

One important goal of any CEF that has a termination date is returning to its initial investors what they paid in, net of fees. Like the Nuveen Emerging Markets Debt 2022 Target Term Fund (NYSE:JEMD), that meant $9.85. In my June’20 article, JEMD EM Debt CEF – One Year Later Update, my optimistic value was a $8 termination value, the pessimistic one $6; which is closer to what investors are going to see. That said, JEMD did rally from $7.12 at publication to brief period over $8 in the spring of 2021. Based on my analysis, at that point, I sold most, but not all, of my JEMD. The rest will be sold when the fund liquidates, banking on the recent rally to continue and to capture the current NAV discount, about -.3%.

Termination news

The following was condensed from the October 21st news release from Nuveen.

- The common shares will continue trading on the New York Stock Exchange through November 25, 2022 and will be suspended from trading before the open of trading on November 28, 2022.

- The fund will not declare its regular monthly distribution in November 2022 and expects that all accumulated earnings will be included in the final liquidating distribution. The fund anticipates making its final liquidating distribution on or about December 1, 2022.

- Leading up to the final liquidating distribution date, as the fund’s portfolio securities continue to mature and are sold, the fund may further deviate from its investment objectives and policies, and its portfolio will continue to transition into high quality, short-term securities or cash and cash equivalents.

- As previously announced, due to market conditions, JEMD does not anticipate returning the Original NAV at its termination.

JEMD’s last review

Seeking Alpha describes this CEF as:

The Fund’s investment objectives are to provide a high level of current income and to return the original $9.85 NAV (“Original NAV”) per common share on or about December 1, 2022 (“Termination Date”). The Fund seeks to achieve its investment objectives by investing at least 80% of its Managed Assets (as defined below) in emerging market debt securities. Such securities include a broad range of sovereign, quasi-sovereign and corporate debt securities. Benchmark: ICE BofA US High Yield TR USD

Source: seekingalpha.com JEMD

As of 11/11/22, JEMD list $94m in common assets, plus $26m in preferred assets. They showed a yield of 3.36% but as noted in the Termination documents, no further monthly payouts will occur. Fees currently are 157bps.

Final holdings report

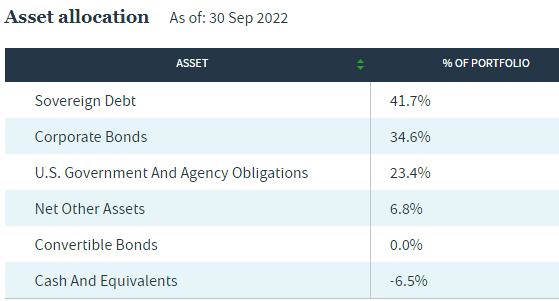

With the CEF liquidating over the next weeks, some of these bonds probably have been sold as this data is from the end of the 3rd quarter; others have matured. This was the sector allocation at that time.

nuveen.com JEMD

JEMD was already 23.4% in “cash assets” by 9/30/22. The top issuers, comprising over 50% of the remaining assets, are shown next.

nuveen.com JEMD

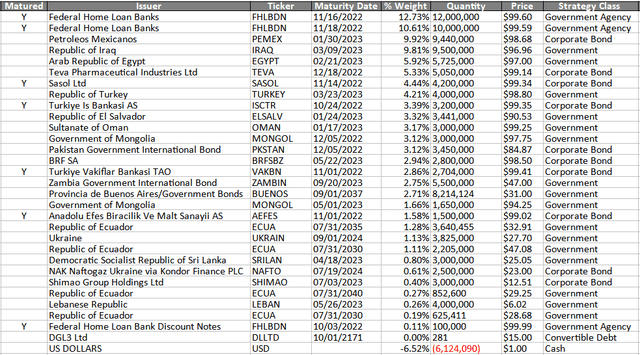

Complete holdings as of 9/30/22

nuveen.com; compiled by Author

I marked “matured” if that asset will be by the 12/1/22 termination payment. These assets account for 36% of the portfolio. There are several bonds selling at or below $30; hopefully the market is deep enough for JEMD to sell these bonds without taking a big hit. That might be tricky for the one Ukrainian, Lebanese and Sri Lankan holdings, about 2% of the portfolio.

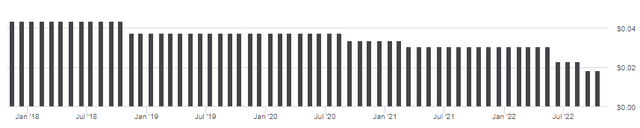

Distribution review

I included this even though no more payments are coming to give readers an idea of how payouts are effected as a liquidating fund moves to cash as it approaches termination.

seekingalpha.com JEMD DVDs

Price and NAV review

JEMD, like most US fixed income funds, started its last downtrend when US and other countries entered the current period of high inflation and the fear, then reality, of rising interest rates. Initial investors who never sold will see an annualized loss of about 2.8%. About the only investors who might have exited at a gain were those who bought when the price bottom in late 2019; those in the month following the COVID crash; and those who invested after early July of 2022.

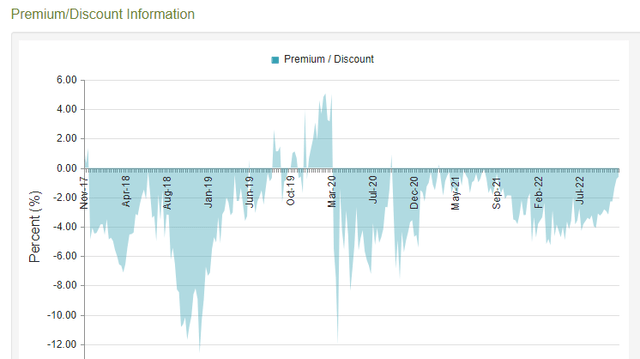

CEFConnect.com

The most recent shrinking of the discount, as one might expect, was due to the NAV approaching the price, not the other way around, as the price has only climbed $.10 since the second closing announcement.

Portfolio strategy

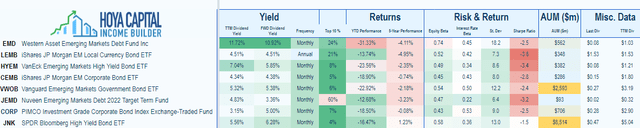

Emerging Market debt became more visible as interest rates in the Developed world drop to and even below zero. Using the Seeking Alpha Peers function, I came across numerous examples. With JEMD shutting down, investors still interested in this segment of the fixed income market have plenty of choices, though most of what I found were in the ETF space. Beyond that, there are at least five divisions in the EM debt arena, with some overlap potentially.

- USD only funds

- Local currency funds

- High Yield funds

- Corporate funds

- Sovereign funds

I found one example for each to include here. I also include JEMD and two US-focused bond ETFs for comparison purposes.

Hoya Capital Income Builder

As the table shows, the EM yield advantage is mostly gone and all underperformed the two US-only funds over the past five years.

I ‘m proud to have asked to be one of the original Seeking Alpha Contributors to the 11/21 launch of the Hoya Capital Income Builder Market Place.

This is how HCIB sees its place in the investment universe:

Whether your focus is high yield or dividend growth, we’ve got you covered with high-quality, actionable investment research and an all-encompassing suite of tools and models to help build portfolios that fit your unique investment objectives. Subscribers receive complete access to our investment research – including reports that are never published elsewhere – across our areas of expertise including Equity REITs, Mortgage REITs, Homebuilders, ETFs, Closed-End-Funds, and Preferreds.

Be the first to comment