FG Trade/E+ via Getty Images

A Quick Take On Freshworks

Freshworks (NASDAQ:FRSH) went public in September 2021, raising approximately $1.03 billion in gross proceeds from an IPO that priced at $36.00 per share.

The firm provides companies of all sizes with a variety of online software to manage aspects of their business operations.

Despite evidence of an economic slowdown and slower uptake by the middle and lower segments of the company’s customer base, management doesn’t appear to be reducing expected operating losses for the period ahead.

I believe this could be a mistake; until I see a meaningful move to reduce operating losses, either through improved efficiencies or a reduction in costs, I’m on hold for FRSH.

Freshworks Overview

San Mateo, California-based Freshworks was founded to provide a customer experience service and then expanded its offerings to include IT service management and other related customer relationship management capabilities.

Management is headed by co-founder, Chairman and CEO Rathna Girish Mathrubootham, who has been with the firm since inception and previously held senior roles at Zoho Corporation.

The company’s primary offerings include:

-

Freshdesk – Customer Experience

-

Freshservice – IT Service Management

-

Freshsales – Sales CRM

- Freshmarketer – Marketing CRM

The firm pursues relationships with clients from small to large firms.

Small firms are encouraged to use the self-serve portal, while mid-sized firms are contacted directly or via channel partners. Large enterprises receive outreach from the firm’s direct sales organization.

As of June 30, 2022, the company counted 59,900 customers.

Freshworks’ Market & Competition

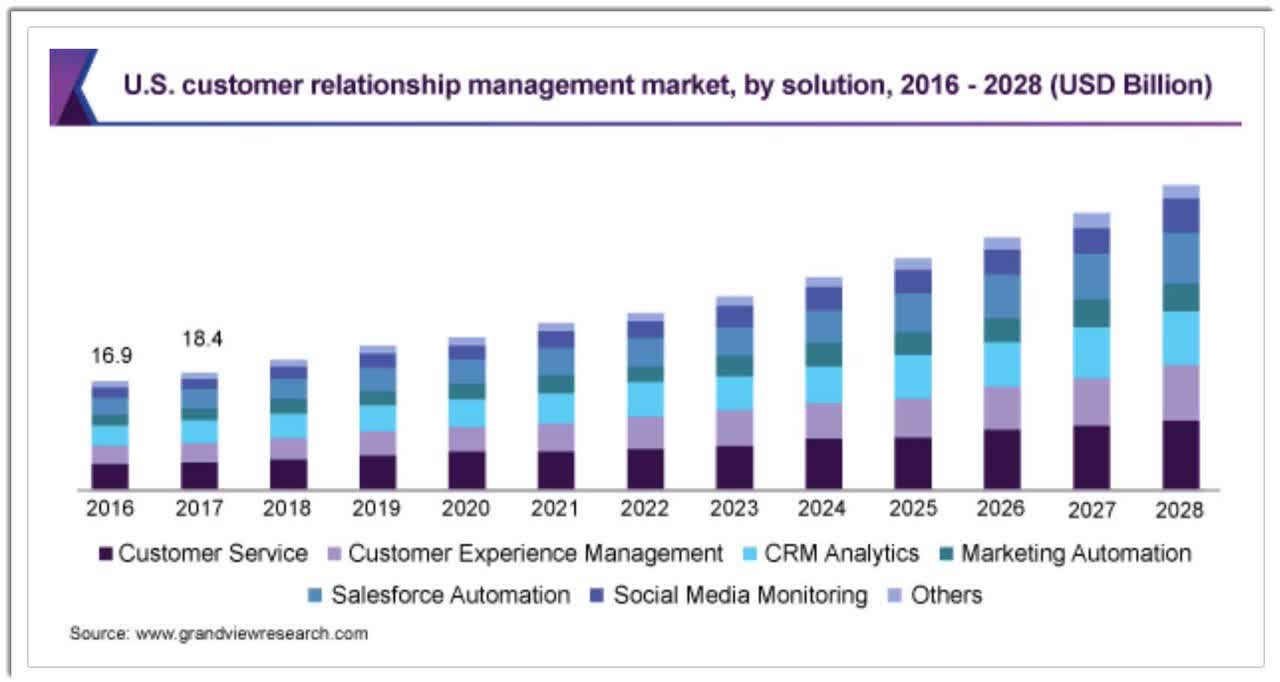

According to a 2021 market research report by Grand View Research, the global market for customer relationship management was an estimated $43.7 billion in 2020 and is expected to reach $98 billion by 2028.

This represents a forecast CAGR of 10.6% from 2021 to 2028.

The main drivers for this expected growth are a growing demand for integrated software suites to automate engagement with customers and prospective clients.

Also, below is a historical and projected future growth trajectory for the CRM industry in the US, from 2016 to 2028 by solution type:

U.S. CRM Market (Grand View Research)

Major competitive or other industry participants include:

-

Salesforce (CRM)

-

Zoho

-

Microsoft (MSFT)

-

SAP (SAP)

-

Oracle (ORCL)

-

Adobe Systems (ADBE)

-

Zendesk (ZEN)

-

ServiceNow (NOW)

-

BMC

-

Ivanti

-

Atlassian (TEAM)

-

HubSpot (HUBS)

-

Sage (OTCPK:SGGEF)

-

Others

Freshworks’ Recent Financial Performance

-

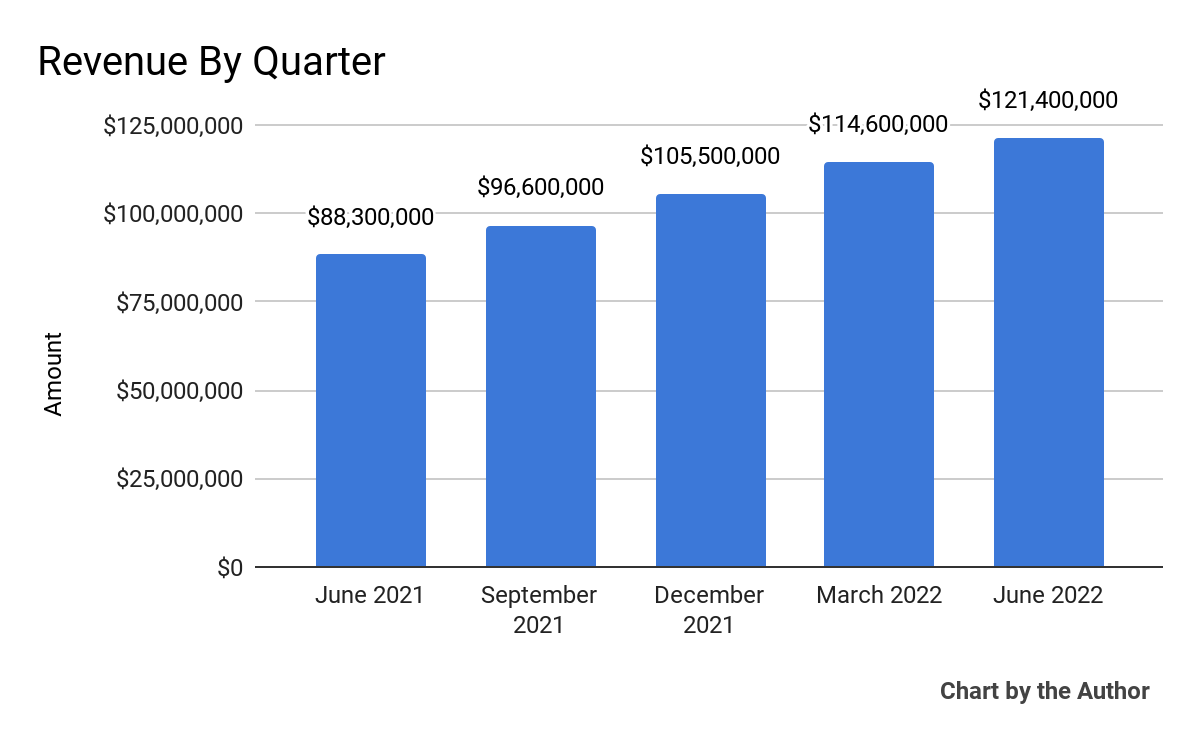

Total revenue by quarter has risen steadily in recent quarters:

5 Quarter Total Revenue (Seeking Alpha)

-

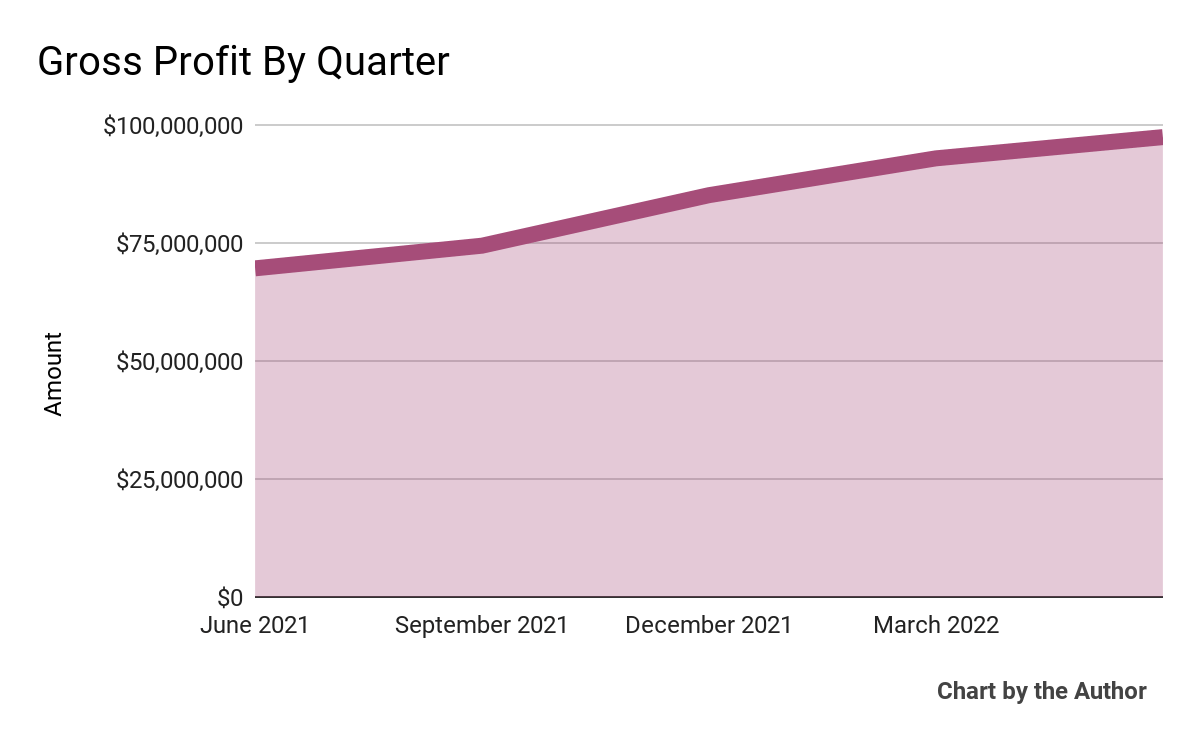

Gross profit by quarter has grown in similar fashion:

5 Quarter Gross Profit (Seeking Alpha)

-

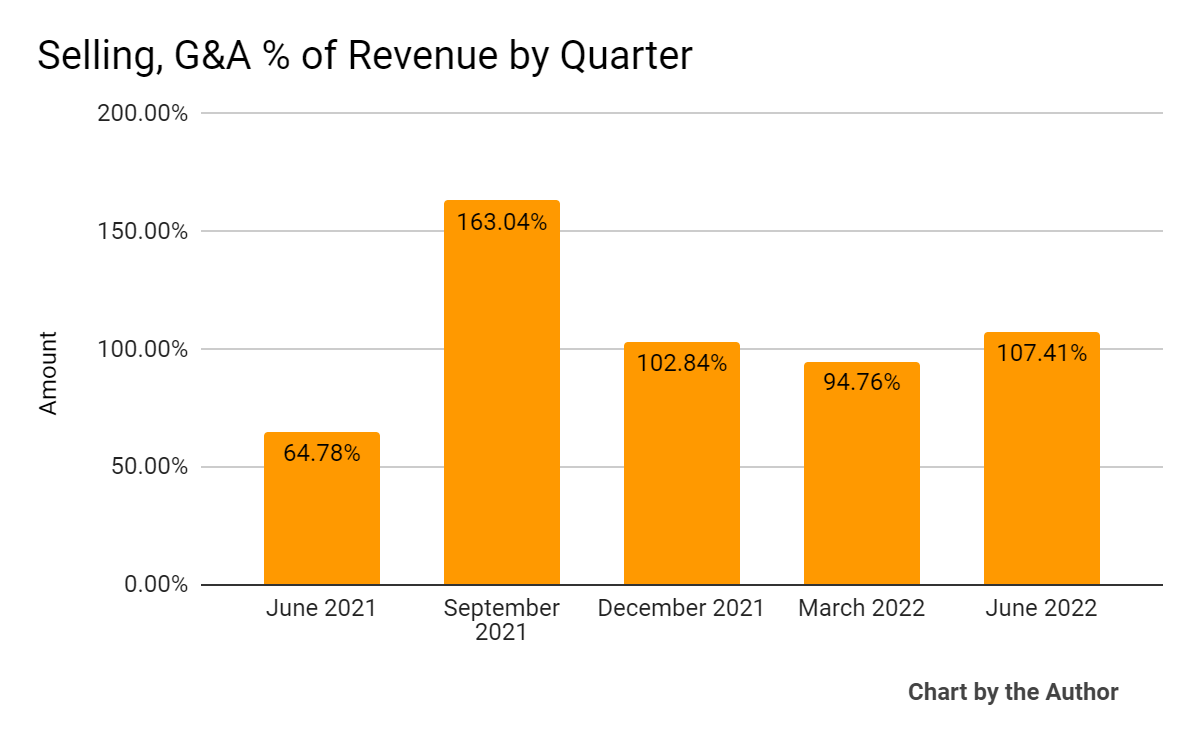

Selling, G&A expenses as a percentage of total revenue by quarter have trended higher and remained high:

5 Quarter Selling, G&A % Of Revenue (Seeking Alpha)

-

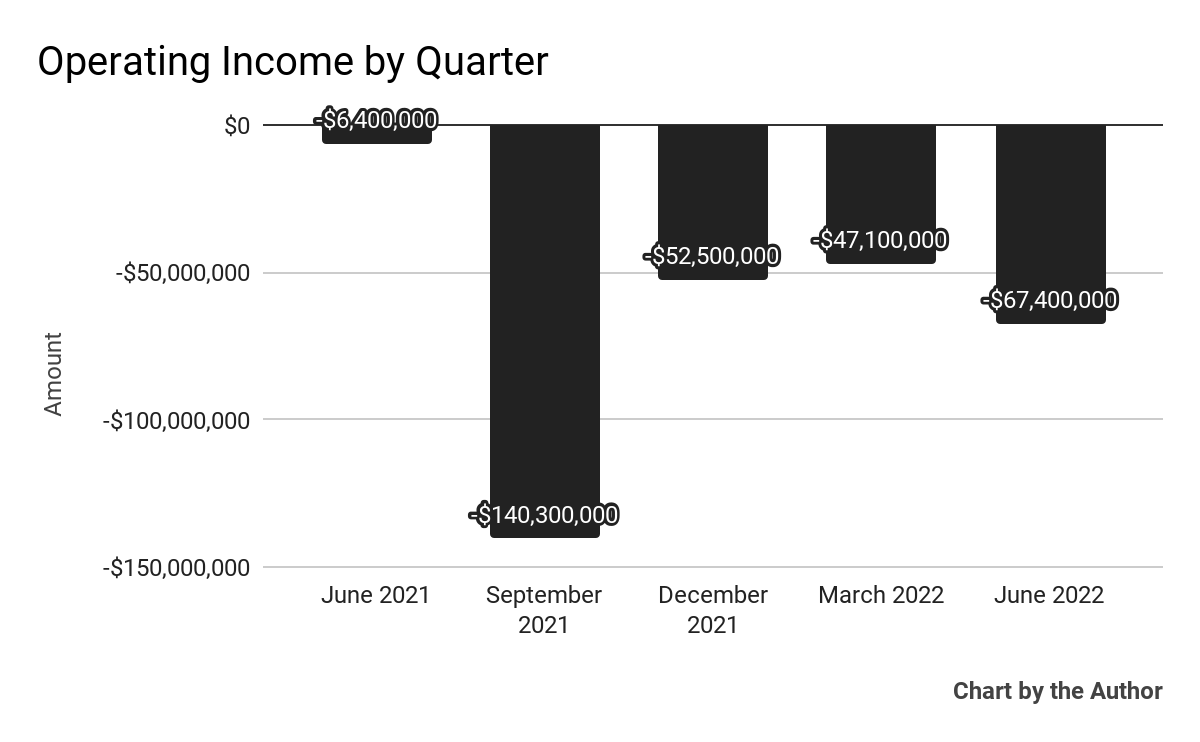

Operating losses by quarter have worsened in Q2 2022:

5 Quarter Operating Income (Seeking Alpha)

-

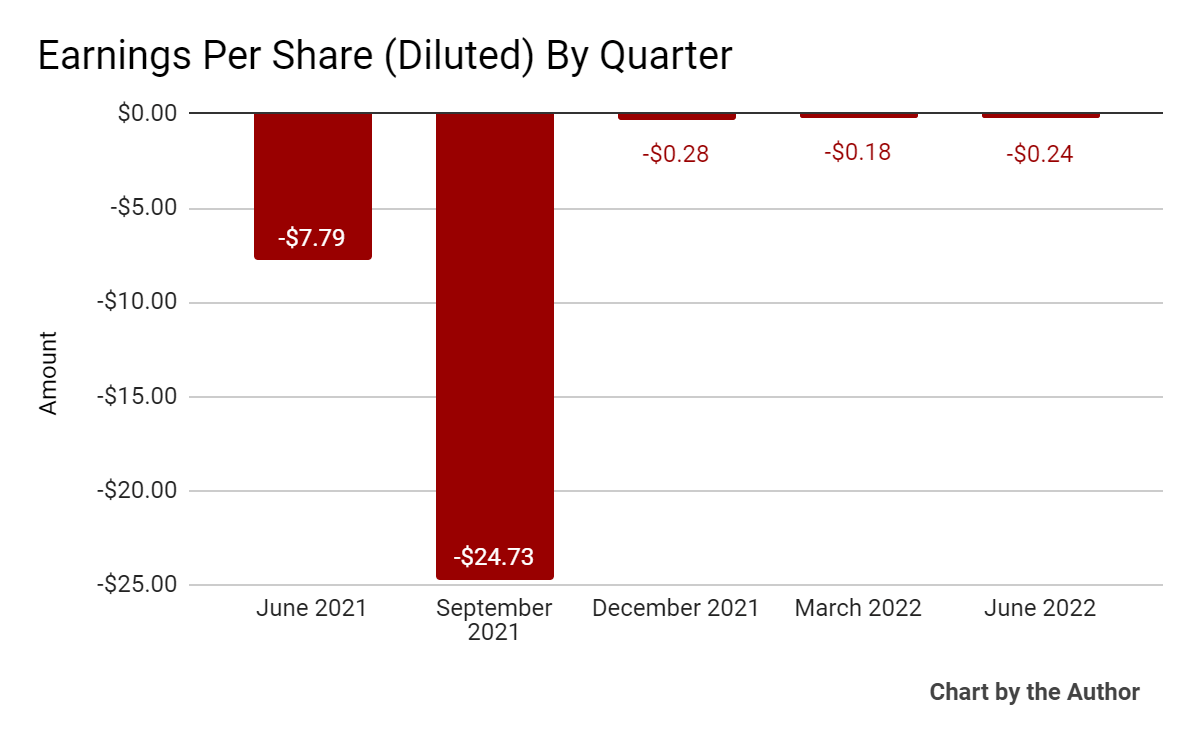

Earnings per share (Diluted) have remained negative:

5 Quarter Earnings Per Share (Seeking Alpha)

(All data in above charts is GAAP)

Since its IPO, FRSH’s stock price has dropped 72.6% vs. the U.S. S&P 500 index’s drop of around 12.7%, as the chart below indicates:

Stock Price Since IPO (Seeking Alpha)

Valuation And Other Metrics For Freshworks

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure [TTM] |

Amount |

|

Enterprise Value / Sales |

6.15 |

|

Revenue Growth Rate |

42.2% |

|

Net Income Margin |

-68.7% |

|

GAAP EBITDA % |

-68.1% |

|

Market Capitalization |

$3,840,000,000 |

|

Enterprise Value |

$2,690,000,000 |

|

Operating Cash Flow |

-$2,670,000 |

|

Earnings Per Share (Fully Diluted) |

-$25.43 |

(Source – Seeking Alpha)

As a reference, a relevant partial public comparable would be Zendesk, which is currently in the process of being acquired; shown below is a comparison of their primary valuation metrics:

|

Metric |

Zendesk |

Freshworks |

Variance |

|

Enterprise Value / Sales |

6.05 |

6.15 |

1.7% |

|

Revenue Growth Rate |

30.7% |

42.2% |

37.7% |

|

Net Income Margin |

-18.3% |

-68.7% |

274.7% |

|

Operating Cash Flow |

$169,530,000 |

-$2,670,000 |

-101.6% |

(Source – Seeking Alpha)

A full comparison of the two companies’ performance metrics may be viewed here.

The Rule of 40 is a software industry rule of thumb that says that as long as the combined revenue growth rate and EBITDA percentage rate equal or exceed 40%, the firm is on an acceptable growth/EBITDA trajectory.

FRSH’s most recent GAAP Rule of 40 calculation was negative (25.9%) as of Q2 2022, so the firm is in need of significant improvement in this regard, per the table below:

|

Rule of 40 – GAAP |

Calculation |

|

Recent Rev. Growth % |

42.2% |

|

GAAP EBITDA % |

-68.1% |

|

Total |

-25.9% |

(Source – Seeking Alpha)

Commentary On Freshworks

In its last earnings call (Source – Seeking Alpha), covering Q2 2022’s results, management highlighted the addition of almost 1,800 net new customers and a ‘healthy expansion rate among existing users,’ with 23% of its customer base using more than one product.

The company also expanded capabilities for its Q1-launched CRM for e-commerce product by redesigning its messaging offering so that brands can respond instantly to customer support or other issues across various channels.

Notably, management is seeing increased churn among its SMB customer base, ‘especially at the lower end of SMB in companies with fewer than 50 employees.’

On the plus side, the company’s larger size customer base has shown greater ‘resilience and they continue to grow their investment with us.’

Larger customers now contribute 57% of the company’s ARR, and Freshworks’ net dollar retention rate was steady at 115%, indicating good product/market fit and relatively efficient sales & marketing efforts.

As to its financial results, total revenue rose 40% year-over-year on a constant currency basis, although the negative impact from a stronger US dollar grew as the quarter advanced and likely is continuing to grow into Q3.

Non-GAAP gross margin was 82%, similar to the prior quarter while Selling, G&A as a percentage of total revenue rose as did GAAP operating losses and negative earnings per share.

For the balance sheet, the company ended the quarter with cash and marketable securities of $1.2 billion, but used free cash of $10.2 million, so FRSH has plenty of liquidity for its future growth initiatives.

However, one reason for this liquidity is that the firm pays significant compensation benefits to employees in the form of stock, which serves to dilute equity shareholders.

In the past four quarters, it has paid over $270 million in stock-based compensation.

Looking ahead, full year 2022 revenue guidance was $495 million, a growth rate of around 33.5% versus 2021. Management is maintaining its operating loss estimates for 2022.

Regarding valuation, the market is valuing FRSH at an EV/Sales multiple of around 6.15x.

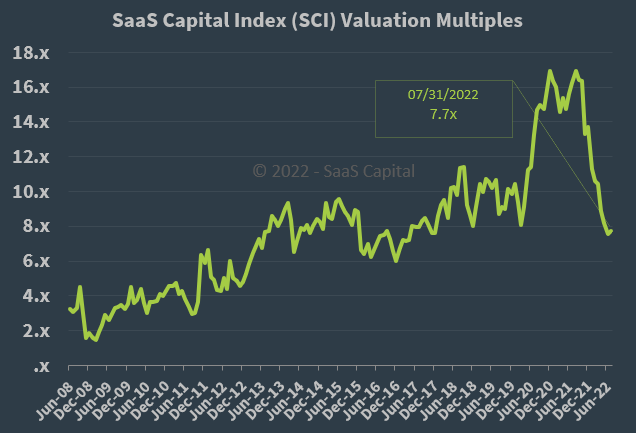

The SaaS Capital Index of publicly held SaaS software companies showed an average forward EV/Revenue multiple of around 7.7x at July 31, 2022, as the chart shows here:

SaaS Capital Index (SaaS Capital)

So, by comparison, FRSH is currently valued by the market at a slight discount to the broader SaaS Capital Index, at least as of July 31, 2022.

The primary risk to the company’s outlook is an increasingly likely macroeconomic slowdown or recession, which may slow sales cycles and flatten its revenue growth trajectory.

A potential upside catalyst to the stock could include a pause or slowdown in U.S. interest rate hikes, which would improve its valuation multiple.

Despite evidence of an economic slowdown, management doesn’t appear to be reducing expected operating losses for the period ahead.

I believe this is likely a mistake; until I see a meaningful move to reduce operating losses, either through improved efficiencies or a reduction in costs, I’m on Hold for FRSH.

Be the first to comment