J. Michael Jones/iStock Editorial via Getty Images

At the end of February, Fresenius SE & Co. KGaA (OTCPK:FSNUF) (OTCPK:FSNUY) reported its Q4 and FY 21 results. The results were not great but not terrible either. Nevertheless, the company’s stock still dropped by almost €9, from €36.6 to €27.65. Since the low on the 8th of March, the company has recovered and now trades in the €34 range. In this article, I will examine if the stock is attractive to add to your portfolio.

The Company

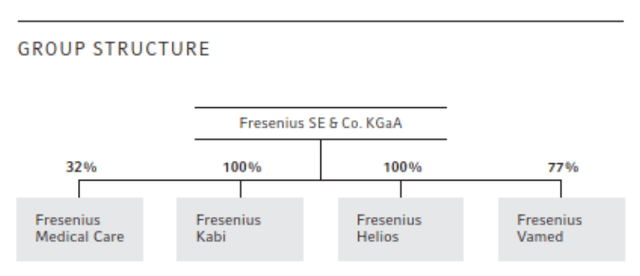

Fresenius is a diversified healthcare company that is divided into 4 segments.

Fresenius Group structure (Annual report 2021)

Fresenius Medical Care

Fresenius Medical Care (FMS) focuses on patients with kidney diseases. It is the company’s largest segment in terms of revenue but has been trading as a separate entity since the early 2000s. Fresenius SE has a controlling stake in FMS even though it only owns around 1/3rd of the shares outstanding. FMS has been struggling over the past few years and the company has had its fair share of controversy, with bribery being one of the lows in 2019. The company remains committed to FMS and still is taking steps to make the company more diversified and more efficient. The company identified 3 main themes which include: realignment of the operating model, training patients in-home dialysis with VR technology, and continuous digital quality improvement.

Fresenius Kabi

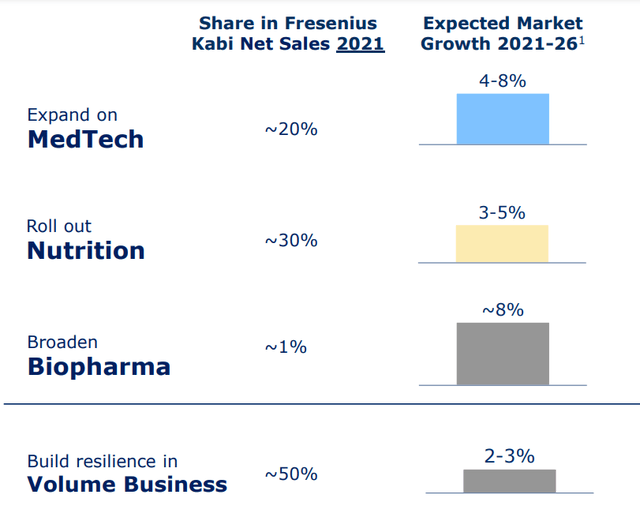

Fresenius Kabi focuses on the production of medicine and medical technology. Kabi’s product portfolio consists of I.V. generic drugs, infusion therapies, clinical nutrition, and the devices that are used to administer them. The majority of Kabi’s revenue (approximately 50%) comes from the volume business, which mainly consists of the company’s IV Drugs and Infusion therapy. Fresenius Kabi is currently the company’s 3rd largest segment and is set to be management’s main focus going forward (more on that later). Recently the company acquired Ivenix and a majority stake in mAbxience. mAbxience focuses on biosimilars and has a biologic CDMO (contract development and manufacturing organization) business, while Ivenix adds more infusion therapy software and hardware to Kabi’s offering. I expect the acquisitions to enhance Kabi’s offering, and thus increase revenue in the coming years.

Revenue per segment Fresenius Kabi (FY 2021 presentation)

Fresenius Helios

Fresenius Helios consists of multiple brands that operate worldwide and is the largest operator of private hospitals in Europe. It focuses on inpatient and outpatient care, telemedicine, and fertility treatments. The main focus is in Germany, where it earns over 60% of its revenue. During the past few years, the segment has been impacted by the Covid pandemic as surgeries were postponed due to the treatment of Covid-19 patients (for which it received compensation from the German government). Nevertheless, it has been able to grow revenue and EBIT during the pandemic and remains the 2nd largest segment by revenue.

Fresenius Vamed

Fresenius Vamed is the real estate development and hospital services arm of the company. It focuses on things such as project development, planning, turnkey construction, maintenance, technical management, and medical technology management. The company had a backlog of €3 billion at the end of Q4 2021, and this should drive revenue growth in the coming quarters. The segment was impacted by the pandemic as its project business and rehabilitation centers suffered from the impact of Covid, this was mainly due to travel restrictions and client hesitation. Nevertheless, Vamed was the segment that grew the most during 2019 and 2021 (it was down in 2020), but is the smallest in terms of revenue.

Performance

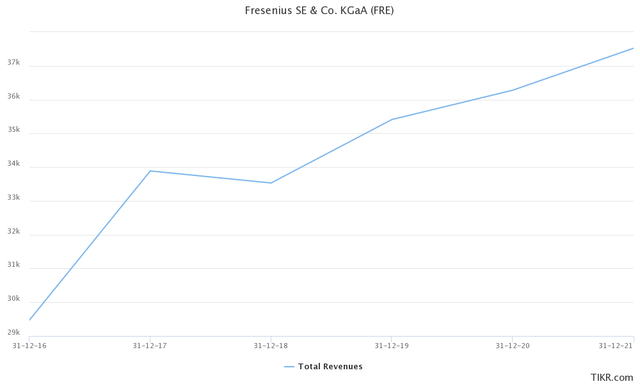

As I mentioned before, the company’s results weren’t great this year, however, they did manage to increase revenue. Over the past few years, the company only had one year in which revenues were down, that was in 2018. This gives the company a revenue CAGR of 5.2% over the past 5 years.

Fresenius revenue past 5 years (Tikr.com)

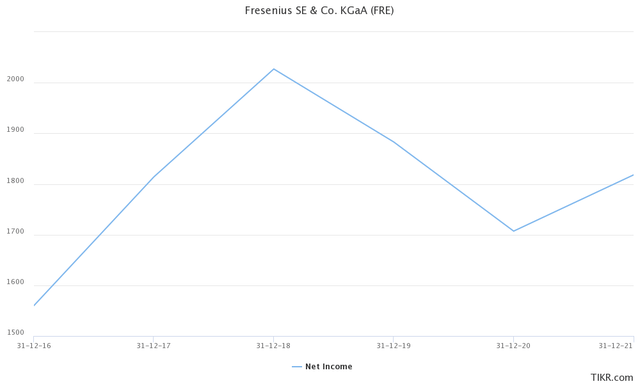

From a net income perspective, the story is slightly different. Net income actually topped in 2018, which was due to the fact that FMS sold its care coordination business. This led to a one-time gain of €809 million. If we don’t take into account the one-time gain, 2019 becomes the year with the highest net income. This isn’t that strange, as the company’s business has been impacted by Covid-19 in both 2020 and 2021.

Fresenius’ Net Income past 5 years (Tikr.com)

If we look at the company’s ROE over the past 5 years it looks quite decent, with every year being above 10. It is hard to compare Fresenius’ data to its industry average as the company is active in multiple healthcare sectors. Nevertheless, as the majority of its revenue comes from its dialysis and Kabi business, we will compare Fresenius with the pharmaceutical sector.

|

2017 |

2018 |

2019 |

2020 |

2021 |

|

|

Fresenius |

14.2 |

15.9 |

11.7 |

10.7 |

10.2 |

|

Industry |

9.11 |

8.84 |

8.02 |

8.26 |

11.04 |

Source: Tikr.com, NYU Stern

As can be seen in the table above, Fresenius outperforms its industry almost every year in terms of ROE. However, please note that the comparison is skewed given how diversified the company is.

The last thing I like to take a look at is the debt levels of the company. I prefer to look at the debt/equity ratio and net debt to EBITDA as these two combined give a clear picture of the amount of debt that is being used versus the company’s performance and stockholder’s equity. Fresenius’ debt to equity was 0.93 compared to 1 in the year before. In my opinion, this ratio should be below 1 as this gives the company more room to finance things such as M&A and new projects. This means that Fresenius is below my threshold.

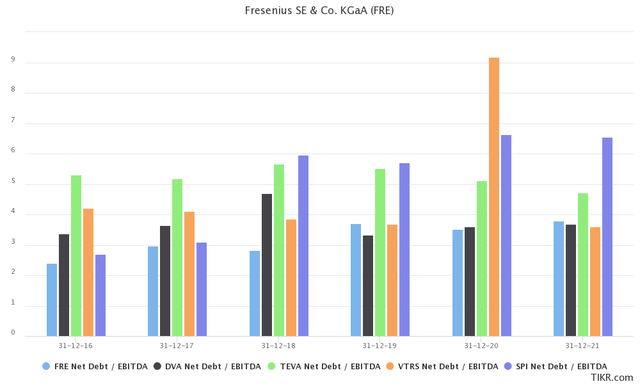

For net debt to EBITDA, I like to compare the company to peers. Even though there aren’t any peers that are active in all of Fresenius’ segments, we can compare the company to peers that are active in one or more of the company’s segments. In this case, we compare the company with Teva, Viatris (Biogenerics for Kabi), Davita (Fresenius medical care), and Spire Healthcare (for Helios). Compared to these companies Fresenius is about average with a net debt to EBITDA of 3.78, which is lower than Teva and Spire, but slightly higher than Davita and Viatris. Given that it is closer to the lower range of its peers, I don’t think that investors should worry about the company’s debt.

Fresenius’ net debt to EBITDA vs Competitors (Tikr.com)

Dividends

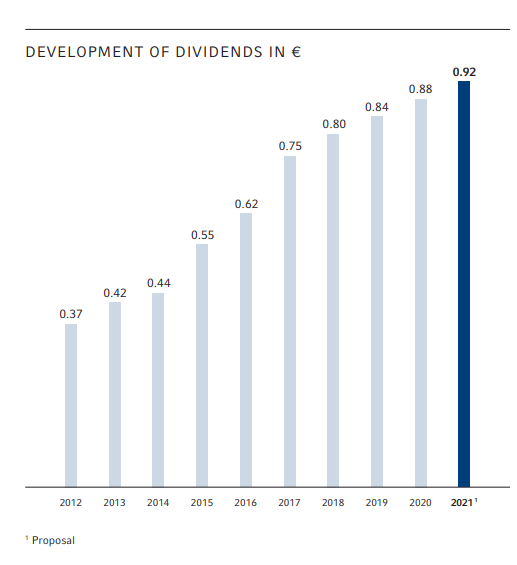

My main focus of investing is to create a passive income stream. This makes dividend stocks more interesting as they pay out a part of their profit. Fresenius is a company that has raised its dividend for 29 consecutive years, which makes it a dividend aristocrat (albeit this status doesn’t carry the same weight in Europe as it does in the US).

Fresenius dividend development (Annual report 2021)

If a company increases its dividend, I also like to look at its chowder number. The chowder number is calculated by adding a company’s 5-year dividend growth rate and dividend yield together. Fresenius’ dividend growth rate over the past 5 years was 8.2%, while its yield at the moment of writing was approximately 2.7%. This gives the company a chowder number of 10.9. I prefer stocks that have a chowder number above 12, as this means that they either have a significant yield or are growing the dividend at a rapid pace. Nevertheless, as the chowder number is above 10, it is still above the minimum where I’d consider buying a stake in a company.

Valuation

To value the company, I like to use multiple methods. First of all, I like to use a DCF and forward EV/EBITDA calculation. As a DCF requires a lot of assumptions I like to combine this with using some of the company’s average multiples over the past 5 years. I personally like to use the PE ratio and dividend yield.

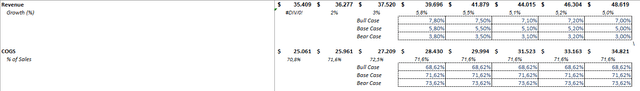

Let’s start with the DCF and forward EV/EBITDA. In my assumptions, I always use 3 scenarios, a base case, a bull case, and a bear case. For Fresenius I used the following estimations.

Assumptions used in DCF model (Author)

The revenue growth assumptions are based on management guidance and analyst estimations and the COGS are based on the average over the past 3 years. I think that these are relatively conservative estimates, especially for COGS as the company’s COGS was partially impacted by Covid.

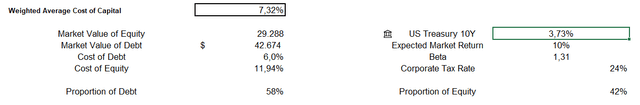

The WACC was based on the company’s beta, my minimum required rate of return, the treasury rate +1% (as I expect this to rise), and the company’s tax rate and looks like this.

The estimated growth rate in perpetuity is put at 0 as I like to err on the conservative side. We assume no stock buybacks and a dividend payout ratio of 30%. This gives a price target of approximately €66.14 based on the DCF. If we assume an EV/EBITDA multiple of 7, which is at the lower end of the company’s 5-year range, we get a price target of €89.19.

The other valuation methods which I use, the company’s P/E ratio and dividend yield, are based on reversion to the mean. The company’s 5-year average P/E was 15.5 and its EPS during 2021 was 3.26, which gives a price target of €50.53. The company’s 5-year dividend yield was 1.33% and its current dividend is €0.92. If we divide 0.92 by 1.33 and multiply it by 100 we get a price target of €69.17. Combining all of the price targets gives us a price of €68.76, which would make the shares undervalued by over 100%.

Potential Catalysts

Potential Break-Up

During the company’s latest conference call, it mentioned that it would be open for an IPO or for external investors to buy a stake in Helios and/or Vamed. More specifically the company said:

Helios and Vamed can continue to rely on Fresenius Group funds to finance smaller growth projects. For larger growth opportunities, though, Fresenius is now open to external equity investments at the level of that respective business segment, whether via a contribution in kind or a cash injection in any case, we want to broaden and strengthen those businesses and create synergies at a much more appropriate valuation relative to the discounted level currently implied in the FSE share price and also to increase the debt financing potential for the group as a whole and the enhanced value transparency potentially reducing the discount at the FSE level. Ultimately, this may, but will not necessarily lead to an IPO. We’d obviously prefer to preserve some exclusivity for Fresenius Group as a listed entity.

Breaking up conglomerates is something that we have seen more often in the last couple of years. For example, Siemens (OTCPK:SIEGY) has spun off its Healthineers, Gamesa, while in the US General Electric (GE) did a similar thing. In my opinion, this could be advantageous for shareholders as management of the respective divisions are not limited by management of the group and the cash that comes in can be used to fund growth of their respective divisions. Thus, I would assume that a potential break-up would be appreciated by the market.

Covid Recovery

Fresenius was impacted by Covid, as the company had to spend additional money for cleaning. People that were using the company’s dialysis products died faster than anticipated, and Vamed’s project business was limited by travel restrictions, among other things. The company expects that Covid had a negative 1 to 5 percent effect on its net income and a 0 to negative 1 percent effect on revenue. With the number of severe Covid cases reduced and traveling slowly recovering, the effect of Covid on the company’s results should decrease. Better results should in theory lead to a higher share price and could be a tailwind for the company.

To Take Into Account

FX Risk

Fresenius is listed on the German stock exchange and is traded in Euros. A depreciating Euro could have a significant impact on your stock portfolio. At the moment, the dollar is back near its 2019 high but below its 2016 high. If an investor is interested in buying Fresenius, it is important to look at the FX rate and, if deemed necessary, hedge against the depreciation of the Euro against the USD.

EURUSD exchange rate (Yahoo Finance)

Dividend Withholding

Another thing that investors should take into account is the dividend withholding rate in Germany. The withholding rate in Germany is 26.375% but in the tax treaty between Germany and the U.S., they specify a tax rate of 15% for dividends. However, investors might need to request the difference back from the German government or ask their broker to do this. If you are interested in buying foreign stocks, it would be advisable to contact a tax professional, as they will be able to provide you with more information regarding foreign withholding tax.

Conclusion

Fresenius is a diversified healthcare company that has been underperforming over the past few years. The company’s business has been impacted by Covid, and this effect should decrease during 2022. The company also pays out a growing dividend and is one of the few European Dividend Aristocrats. I estimate the company to be undervalued by over 100% based on a DCF, forward EV/EBITDA, PE ratio, and dividend yield. To reach this valuation I currently see two catalysts: a potential break-up of its business and/or the aforementioned effect of Covid.

Be the first to comment