RiverRockPhotos

The last few months have been tough for commodities, yet Freeport-McMoRan (NYSE:FCX) is still producing strong cash flows. The copper miner is poised to ride the huge copper demand boost from the global shift to clean energy. My investment thesis remains ultra Bullish on the stock around $30.

Tough Quarter

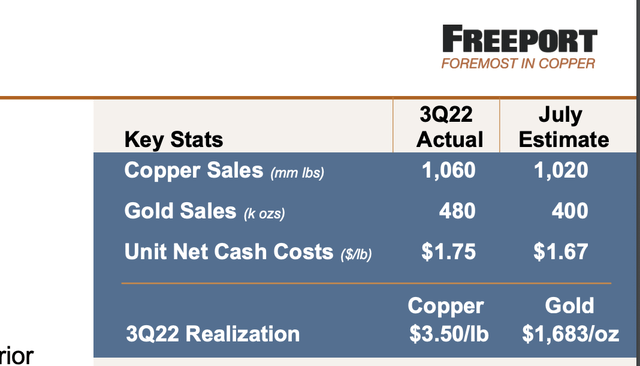

Freeport-McMoRan faced a tough quarter in Q3 with average realized copper prices dipping to $3.50/lb. While this is historically a higher price, the market is structurally tight supporting higher copper prices in the future.

For Q3’22, Freeport-McMoRan reported operating cash flows of $0.8 billion with adjusted EBITDA of $1.7 billion when excluding prior period pricing adjustments. The cash flows were enough to cover ramped up spending on new capital projects to meet the strong demand for copper in the future.

For the quarter, Freeport hit all production targets with copper sales reaching 1,060 million pounds of copper, up from a July goal of 1,020 million pounds of copper. Gold sales soared past the 400 thousand ounces goal.

Source: Freeport-McMoRan Q3’22 presentation

Of course, copper is structurally tight to where any missed mining targets only helps buoy copper prices via lower supply on the market. CEO Richard Adkerson was adamant that copper inventories remain tight and market fundamentals are strong with the global shift to decarbonization:

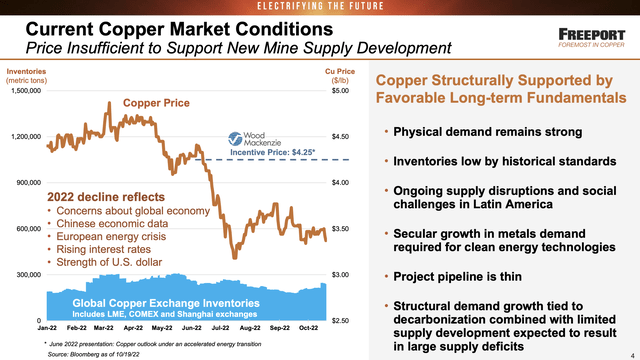

Current prices for copper are insufficient to support new mine supply development, which is expected to add to future supply deficits.

Copper inventories remain low while Wood Mackenzie still reports the incentive copper price for new mines is up at $4.25/lb. The market appears to view such a price as a peak level, but the structural situation with market demand could easily turn $4+/lb into the new base.

Source: Freeport-McMoRan Q3’22 presentation

As highlighted in prior research, S&P Global is forecasting for copper demand to double from 25 million MMt to 50 million MMt in 2035. Even Freeport-McMoRan isn’t aggressively building out mines to meet this demand despite a strong balance sheet.

The copper miner ended the quarter with net debt of only $2.1 billion after returning $2.7 billion to shareholders since June 2021. Management has the company in a far better financial position this time heading into a potential global recession.

Freeport-McMoRan doesn’t have to worry about cutting capital spending this cycle due to a strong focus on maintaining a strong balance sheet. The company hasn’t ramped up spending until after getting net debt levels to near zero while also maintaining discretionary spending in the capital spending plan. The company forecasts spending $3.3 billion on capex in 2023 with $1.0 billion falling into the discretionary category allowing for easy scaling back of spending.

A big part of the discretionary capital projects is the long-term mine development at Kucing Liar and low capital intensive projects at Lone Star, Grasberg and copper recycling at Atlantic Copper CirCular. Freeport-McMoRan isn’t in a hurry to spend on these projects, but the company will support the additional copper mining and recycling on these projects with supportive copper prices.

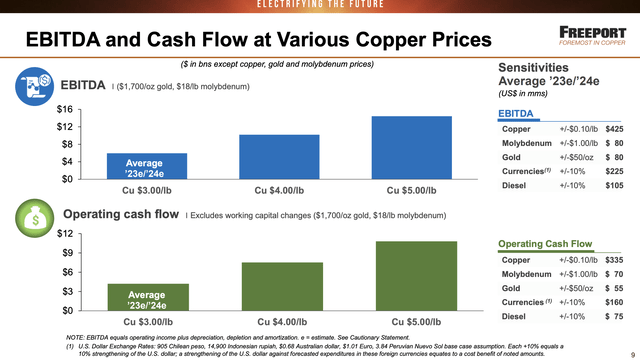

Huge Earnings Power

The stock has a market cap of $40 billion and the copper miner can easily generate $10 billion in annual adjusted EBITDA at $4/lb for copper. Freeport-McMoRan has a $425 million sensitivity to each $0.10 move in copper prices leading to $2.1 billion in additional EBITDA from the realized price returning to prior levels.

Source: Freeport-McMoRan Q3’22 presentation

The base case here is Freeport-McMoRan trading around 4x adjusted EBITDA targets. Copper could easily top $5/lb where the copper miner would produce nearly $10 billion in operating cash flows and free cash flows would amount to at least $6 billion annually.

Takeaway

The key investor takeaway is that Freeport-McMoRan is incredibly attractive here with the stock trading at 4x based adjusted EBITDA targets. Copper remains in a structural deficit without new supply to meet the rush into green energy projects and EVs.

Investors should use weakness to load up on the copper miner at an exceptional price in comparison to the long-term opportunity for copper.

Be the first to comment