Drs Producoes

“The ballot is stronger than the bullet.” – Abraham Lincoln

Those who’ve followed my work over the years would note that mean-reversion is a concept that I have a lot of time for. I recently put out a tweet on The Lead-Lag Report highlighting how emerging markets look well-poised to begin a fresh cycle of outperformance relative to domestic stocks, and this may linger for a few years.

If you’re fishing for opportunities to play this potential secular shift, you may want to cover the Franklin FTSE Brazil ETF (NYSEARCA:FLBR), which offers investors the most cost-efficient route toward Brazilian stocks (FLBR’s expense ratio is 0.19% vs competing alternatives that have corresponding figures ranging from 0.57%-0.9%).

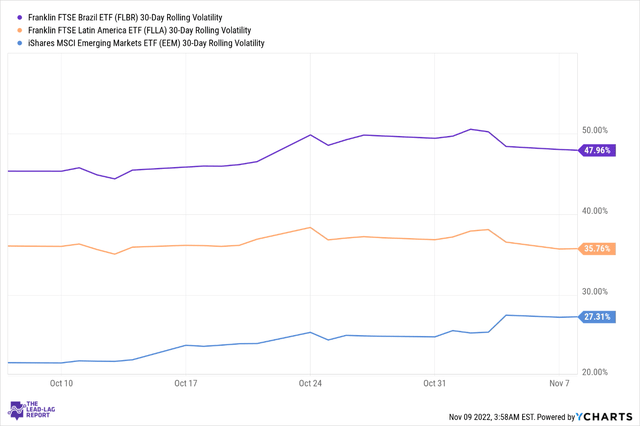

I also think it could be a good time to get on board with FLBR, as its volatility quotient may likely dip, and one may see some stability ahead, now that the 2022 elections are out of the way. The chart below highlights how FLBR’s 30-day rolling volatility had spiked recently to levels not far from 50%, even as the broader Latam ETF (FLLA), and the emerging markets ETF (EEM) saw much lower levels of volatility.

It’s not difficult to see why the volatility of Brazil stocks has been so heightened off late when you consider the result of the ballot; the eventual winner- Luiz Inacio Lula da Silva, only managed to secure 50.9% of the run-out vote (as against Jair Bolsonaro’s 49.1%).

So what can investors expect from the Lula regime?

Firstly, it needs to be noted that Lula’s win will further tilt the landscape of Latin America as a growing left-wing cauldron; his win comes after the nations of Peru, Colombia, and Chile all saw left-wing candidates take charge. It’s worth noting that Lula had the backing of a large chunk of economically-weak voters who had previously benefitted from his old Presidential regime when commodity exports were quite resplendent.

In his election manifesto. Lula has promised to re-industrialize Brazil and attract even more foreign capital. Nonetheless, his quest to implement some structural reforms could be challenged, as he still has to deal with a fractured congress. Besides note that his coalition only has 123 votes in the 513- seat Chamber of Deputies, and 27 votes in the 81-seat senate. Getting bills passed in the legislature will be no easy feat and this may call for more alliances.

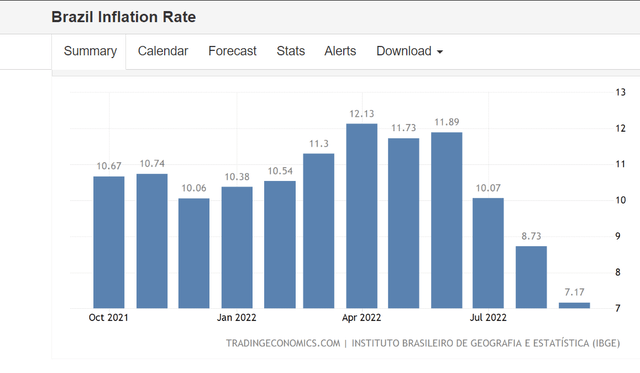

Recent reports suggest that he is pushing for a mammoth increase of BRL 200bn ($39bn), in fiscal spending for 2023, but this could likely upset the inflation applecart. If you’ve read some of the macro commentaries on Brazil in The Lead-Lag Report, you’d note that I’ve praised the Brazilian central bank’s efforts in managing inflation, which is in stark contrast to the shenanigans in the US. Rather than dilly-dally like the central bankers here, Brazil was quick to get started with an aggressive rate hiking spree (12 successive increases) which saw the Selic hit levels of 13.75% from levels of 2% in March last year. You can see what a profound impact this has had on inflation where the latest reading dropped to a little over 7%; considering the strong double-digit base effects in the months ahead,

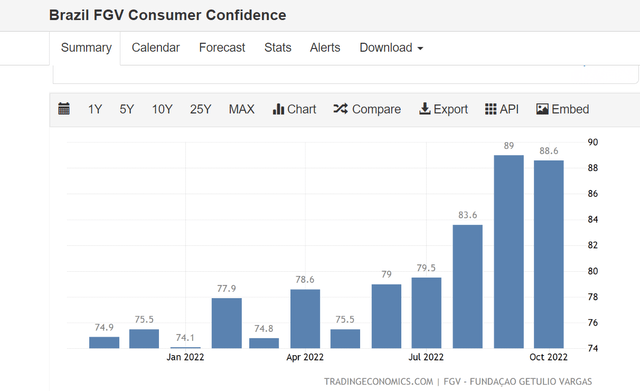

It isn’t just inflation, unemployment has been skidding for a while now, whilst consumer confidence to looks rather resilient highlighting how Brazilians feel about discretionary spending under a new political regime.

Then of course there’s also the tailwind of the dollar to consider which could aid FLBR; if you managed to catch the Lead-Lag Live discussion with Ashraf Laidi last week, you’d note that we broke down various catalysts that could impact the greenback.

Technically-minded market participants would notice that after hitting some tremendous highs, the dollar is currently going through a bout of distribution which does not bode too well for its prospects. It’s also quite worrying that despite the markets being party to an ultra-hawkish Fed last week, the dollar index remained virtually unchanged.

Conclusion

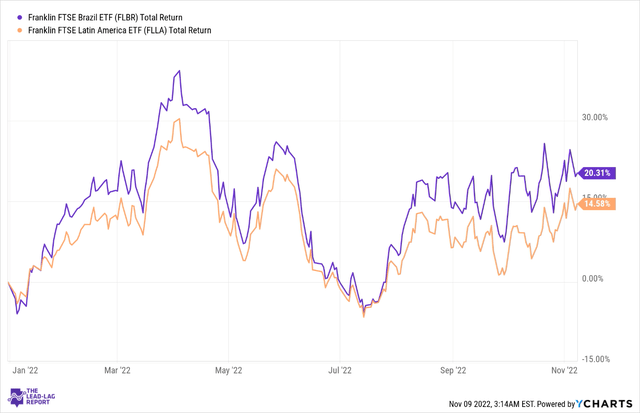

Admittedly, FLBR has already enjoyed a solid 2022, delivering 20% returns and outperforming its Latam peers by 1.4x. Interestingly enough, despite the superior performance this year, FLBR can still be picked up at a valuation discount; FLBR trades at 6.9x P/E whereas the Franklin FTSE LATAM ETF (FLLA) trades at 7.5x P/E. This valuation discount even extends to a broader basket of EM securities, where the iShares MSCI Emerging Markets ETF (EEM) trades at a 48% premium.

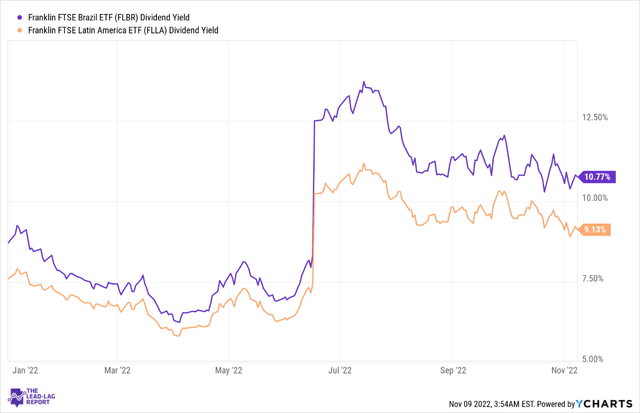

In addition to that, also note that FLBR’s current yield is very lucrative at close to 11%, which is more than 2x higher than the historical average (5%). This is also over 250bps higher than what you get from a diversified portfolio of Latam stocks.

Anticipate Crashes, Corrections, and Bear Markets

Anticipate Crashes, Corrections, and Bear Markets

Sometimes, you might not realize your biggest portfolio risks until it’s too late.

That’s why it’s important to pay attention to the right market data, analysis, and insights on a daily basis. Being a passive investor puts you at unnecessary risk. When you stay informed on key signals and indicators, you’ll take control of your financial future.

My award-winning market research gives you everything you need to know each day, so you can be ready to act when it matters most.

Click here to gain access and try the Lead-Lag Report FREE for 14 days.

Be the first to comment