Uwe Krejci

If you get lucky in the market, sometimes you can benefit from extreme volatility by buying at a low price, selling at a high price, and being able to buy before too much longer at a low price again. One company where this strategy would have worked out well is Fox Factory Holding Corp. (NASDAQ:FOXF), a firm that produces products and systems that are used in equipment like bikes, on-road vehicles, trucks, snowmobiles, commercial trucks, and other related devices. Driven by severe market pessimism and due to the market’s decision to ignore certain fundamental data, shares of the company have been rather volatile lately. That can be rather unnerving. But at present, it also means that those interested in the firm could benefit nicely moving forward by buying shares of the business at current prices.

Déjà vu

Back in August of this year, I wrote an article about Fox Factory in which I concluded that shares had run their course. You see, that article was a follow-up article to another published in May of this year, wherein I rated the enterprise a “buy.” Between the publication of the first article and the publication of the second, strong fundamental performance achieved by Fox Factory sent shares up by 35.7% compared to the 8.1% decline seen by the S&P 500 (SP500). But after seeing such a significant move higher, I felt as though the stock had thoroughly run its course, leading me to rate the business a “hold” in my second article.

Unfortunately, even that was more optimistic than it should have been. Because, since the publication of that article, shares have fallen by 21.9% compared to the 10.8% drop seen by the S&P 500.

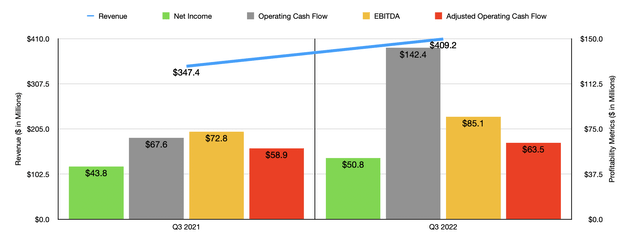

Normally, when you see such a large return disparity, the primary driver is a weakening of the firm’s fundamental performance. But from what I can see, that has been largely absent. To see what I mean, we need only look at financial data covering the third quarter of the company’s 2022 fiscal year. This is the only quarter for which new data is available that was not available when I last wrote about it. During that quarter, sales for the company came in strong at $409.2 million. That’s 17.8% higher than the $347.4 million the company generated the same quarter one year earlier.

Most of this increase came from the Powered Vehicle products the company sells, with revenue surging by 25.1%, from $188 million to $235.2 million. This increase, management said, was driven by strong performance in the upfitting product lines and increased demand in the company’s OEM channel. Meanwhile, the Specialty Sports products category of the company grew by 9.1%, with that increase attributed to strong demand in the OEM channel only.

Although the current environment has been problematic for a number of companies because of inflationary pressures, Fox Factory has managed quite well. Net income in the latest quarter totaled $50.8 million. That’s a nice improvement over the $43.8 million reported the same time one year earlier. Shockingly, the company actually saw its gross profit margin improve, climbing from 33.4% last year to 33.5% this year.

There were other factors in the mix as well, leading to the company’s net profit margin alternately contracting by 200 basis points. But on the whole, investors should see this as a win considering how difficult the economy is. Naturally, other profitability metrics followed suit. Operating cash flow surged from $67.6 million to $142.4 million. On an adjusted basis, the metric increased from $58.9 million to $63.5 million. Meanwhile, EBITDA for the business also improved, rising from $72.8 million to $85.1 million.

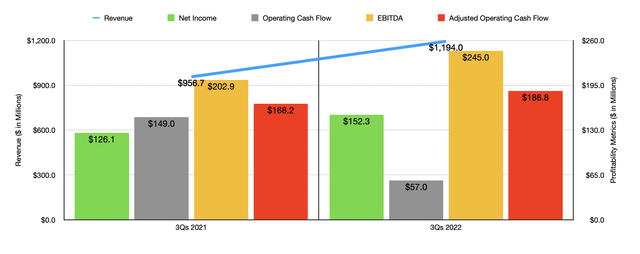

Even though the latest quarter was really strong, results for the first three quarters of 2022 relative to the same time last year are a bit more mixed. Yes, revenue has risen from $956.7 million last year to $1.19 billion this year, and net income has increased from $126.1 million to $152.3 million. But on the other hand, operating cash flow dropped, plunging from $149 million to $57 million. While this is painful to see, the adjusted figure for this still managed to increase, climbing from $168.2 million to $186.8 million. And, over that same window of time, we also saw improvement in EBITDA, climbing from $202.9 million to $245 million.

When it comes to the 2022 fiscal year as a whole, management expects revenue to come in at between $1.565 billion and $1.585 billion. At the midpoint, that would translate to a year-over-year increase of 21.2%. Earnings per share, meanwhile, should come in at between $5.15 and $5.35. At the midpoint, that would translate to net profits of $222.5 million. By comparison, that same metric in 2021 was just $163.8 million. Sadly, we didn’t receive any guidance when it came to other profitability metrics. But if we assume similar growth rates for those, we should anticipate adjusted operating cash flow of $253.7 million and EBITDA of $332.8 million.

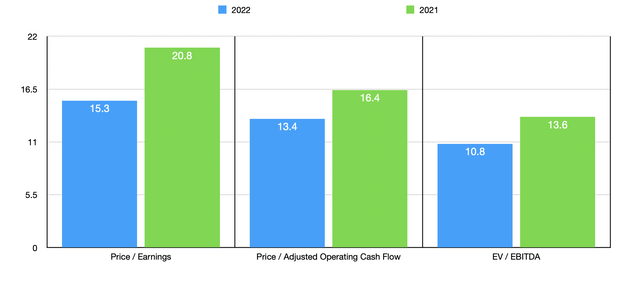

Assuming these figures come to fruition, the company is trading at a forward price-to-earnings multiple of 15.3. The forward price to adjusted operating cash flow multiple should be 13.4, while the EV to EBITDA multiple with the company should come in at 10.8. By comparison, using the data from the 2021 fiscal year, these multiples would be 20.8, 16.4, and 13.6, respectively. As part of my analysis, I also compared the firm to five similar businesses. On a price-to-earnings basis, these ranged from a low of 4.6 to a high of 32.2. Using the EV to EBITDA approach, the range was between 3.5 and 14. In both of these cases, three of the five companies are cheaper than Fox Factory. Meanwhile, using the price to operating cash flow approach, the range is between 6.5 and 54.2. In this case, two of the five were cheaper than our target.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| Fox Factory Holding Corp | 15.3 | 13.4 | 10.8 |

| Modine Manufacturing (MOD) | 9.1 | 12.7 | 6.6 |

| Dorman Products (DORM) | 18.2 | 48.1 | 11.9 |

| LCI Industries (LCII) | 4.8 | 6.5 | 4.1 |

| Adient (ADNT) | 4.6 | 22.2 | 3.5 |

| Visteon Corporation (VC) | 32.2 | 54.2 | 14.0 |

Takeaway

I understand why the market might be skittish about Fox Factory right now. In the short term, we could be due for a great deal of pain and economic uncertainty. But fundamentally, Fox Factory remains robust and is posting results that are encouraging for the future. So long as nothing changes this outlook materially, I cannot help but be somewhat bullish on the firm. I don’t believe it’s the best prospect on the market by any means. It may not even be the best prospect in its space. But considering how shares are priced and how management expects the future to look, I cannot help but rate Fox Factory Holding Corp. a soft “buy.”

Be the first to comment