baranozdemir

Fortress Transportation and Infrastructure Investors LLC (NASDAQ:FTAI) was formed in 2015 as one part aviation leasing and one part infrastructure. It is a subsidiary of Fortress Investment Group, which itself is owned by SoftBank Group (OTCPK:SFTBY). Below is the share price since IPO.

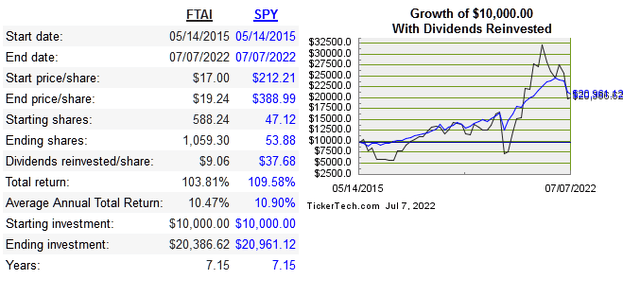

Shares have matched market returns but with greater volatility. Being in an unfortunate industry during COVID (air travel) certainly added volatility that otherwise wouldn’t be there.

The major news with FTAI is a spin-off of their infrastructure assets, already approved by the board. The spin-off makes sense as there isn’t any inherent benefit to these very different assets being under the same roof.

So once the company splits off the aviation leasing will be a separate business. This analysis is for the aviation side of FTAI, going forward from that point. This business is undoubtedly capital intensive and the air travel industry as a whole is still in recovery mode. Global air travel is still well below pre-COVID levels, obviously the industry still faces an uphill battle. Assuming that those levels never actually return and sustain, any business in the industry should ideally be able to adapt and still produce meaningful cash flows.

The company had both planes and engines in Ukraine and Russia before the invasion. The assets in these locations were damaged/destroyed in the Ukraine/Russia conflict, leading to a $122.8 million impairment charge, but expects to recoup this via insurance on these assets. The company won’t continue to do any business in Russia following US sanctions. The insured value of those assets is about $294 million, but exactly how much will be paid out is still uncertain.

|

Company |

10 Year Median ROE |

10-Year Median ROIC |

10-Year EPS CAGR |

10-Year FCF CAGR |

|

FTAI |

-291 |

-5.5% |

n/a |

n/a |

|

9.2% |

2.6% |

19.7% |

-0.24% |

|

|

10% |

3.7% |

22.9% |

n/a |

Source: QuickFS

Risk

The main risk comes from the industry as a whole being slow to recover. I have no specific call for when the industry will strengthen. At this point though, even an undervalued company in such a tough time for the industry is not a good risk-adjusted bet. FTAI’s aviation business didn’t suffer nearly as much as airlines did though. Below are some numbers isolated from the aviation business:

|

Year |

2019 |

2020 |

2021 |

|

Revenue |

336.67 mil |

281.21 mil |

321.42 mil |

|

Net Income |

258.77 mil |

88.64 mil |

157.22 mil |

|

ROC |

15% |

5% |

7% |

Sales didn’t decline very much during the pandemic and they still managed to turn a profit despite the turmoil in global air travel.

Valuation

The table below shows how FTAI is priced compared to its closest peers. This includes all segments of FTAI since the spin-off has yet to happen.

|

Company |

EV/Sales |

EV/EBITDA |

EV/FCF |

P/B |

|

FTAI |

9.4 |

18.8 |

-7.8 |

-6.5 |

|

AL |

9 |

12.5 |

-10.5 |

0.6 |

|

ATSG |

1.8 |

4.9 |

28.8 |

1.6 |

Source: QuickFS

The multiples are still high for a company still in a recovering industry. They have fared better than airlines, but the recent returns on capital aren’t at levels that entice me to invest. It is worth watching the company after the spin-off, but right now I would hold and wait to see what happens next. The almost 7% dividend is appealing in the meantime, and I don’t see this as being a dividend trap.

Conclusion

The key event in the short term for FTAI is the spin-off of the infrastructure side of the business, which should be happening this year. The aviation business definitely didn’t struggle as much as airlines did, but the air travel industry as a whole still has a lot of recovering to do, and this should bring some growth to the business as this happens.

I don’t think there is a ton of upside post spin-off, but the current dividend yield of almost 7% is appealing for those who want to make a bet on the stock of the aviation business performing better than the current configuration. I would like to see how the company performs afterwards considering the recovery of the whole industry.

Be the first to comment