mikkelwilliam

They are going to write a book about the moves Formula One Group (NASDAQ:FWONK) has made over the past few years.

This wasn’t a mainstream sport.

The company has really struggled to gain success in the United States.

Until 2016 when an American media giant, Liberty Media Group, bought Formula One and took it public.

The Formula One made their best move yet – created a Netflix (NFLX) series.

The show was a hit and has finally got Americans hooked on the sport.

I had never watched a race or really cared at all about F1 until I started binge-watching the Netflix series, “Drive to Survive,” in 2020. I was excited to hear they were holding a race down here in Miami. I was signed up to get the advance notice for tickets and even added them to the cart.

Then I realized it was held on Mother’s Day and I already had plans to spoil my wife.

So I’ll have to wait for the next one before I see the race in person, for now.

But it shows how much of an impact that show had on so many people.

Formula One went from struggling to attract younger viewers in their main markets, to attracting younger viewers in brand-new markets in just a few short years.

It is a massive turnaround and one that positions the company for success.

Let’s break down the company’s fundamentals, sentiment and technical today to see if Formula One is a buy or sell…

About Formula One Group

Formula One Group is in the motorsports business in the U.S. and internationally. It holds the commercial rights for the FIA Formula One World Championship, a nine-month long race-based competition in which teams compete for the constructors’ championship and drivers compete for the drivers’ championship.

I told you a bit about recent changes already, but this is not some new hot-shot company. Formula One racing began in 1950.

Today, it is the world’s most prestigious motor racing championship and most popular annual sporting series.

And thanks to the Netflix series, “Drive to Survive,” it was the fastest growing major sports league on the planet in 2021.

Throughout the first half of 2022, F1 has experienced record attendance at their races pointing to the growth in popularity.

The majority of revenue that F1 generates is through race promotion, media rights and sponsorships.

Let’s take a look at the fundamentals to see how those have been holding up.

Fundamental Analysis

For the fundamental take, I like to look at two main metrics – top-of-the-line numbers with revenues and bottom-of-the-line numbers with earnings per share.

These two numbers tell us the most about the company without getting into the weeds of their accounting processes.

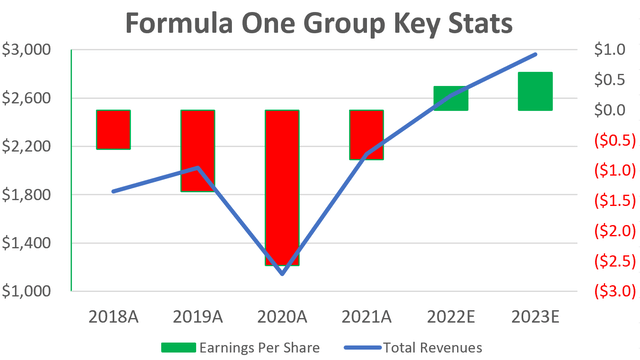

Below, you can see the revenues represented as the blue line on the chart (prices on the left in millions) and earnings per share as the red and green bars on the chart (prices on the right).

The pandemic decline is clear as day here, as they have a sharp drop in 2020, followed by an immediate recovery in 2021.

From there, it looks like revenue growth will continue through 2022 and is expected to carry into 2023 as well, along with pushing earnings per share into the green.

Earnings per share will have swung from a loss of $2.57 per share in 2020 to a gain of $0.39 per share in 2022.

Not a bad turnaround at all.

And this growth has continued in the second quarter of the year, as revenues jumped 49% YoY while operating income turned a profit at $65 million in the second quarter of 2022, compared to a loss of $36 million last year.

All three of their revenue segments saw increased sales and income, due to higher fees, growth in F1 TV subscriptions, and new sponsors.

So far, this is looking pretty good.

I may have been a little biased at first, but the good news keeps on coming.

Next up, we’ll look at a few sentiment indicators to see how investors feel about the stock.

Sentiment Readings

Short interest is a great one to start with.

In general, the higher the short interest, the weaker the sentiment. It’s not every day you get to see a short squeeze play out.

So, I like to stay on the low end of short interest if I’m looking to go long a stock. Typically, anything under 5% is not meaningful. And Formula One Group is right around there, with a 4.57% short interest as a percent of the float.

That tells us investors are not willing to leverage up and go bearish on the stock right now.

On the analyst side, the stock has an average price target of $66.33 with an average rating of a “Buy.” Six analysts are covering the stock, according to Yahoo Finance.

The price target is pretty low considering the stock hasn’t been much below $55 a share in 2022 and is currently trading at $63.80 as of September 2nd.

There is virtually no upside right now on the stock based on the analyst price target, but the price chart paints a different story that I want to talk about.

Price Patterns

In the chart below, I highlighted two key trend lines.

A horizontal resistance level in red and rising support level in green, by simply connecting the tops and bottoms.

This is creating an extremely familiar price pattern known as an ascending triangle.

They are easy to spot, with a potential double-top forming, but a rising support level closing the gap.

Take a look:

As long as that support level holds, it’s going to push the price right up to that resistance in the coming months and force a breakout for the stock.

It depicts a clear uptrend for the stock. Very broad and taking its sweet time, but higher highs and higher lows are a top feature to look for in any stock.

The question is which way will it break out.

You simply don’t know ahead of time, that’s part of the game.

But, these patterns are typically continuation patterns that follow the same direction the stock was trading in before the pattern formed.

In this case, it is pointing to an upside breakout.

Conclusion

With some very strong fundamentals and a neutral stance from the sentiment readings, this price analysis puts me over the top on labeling Formula One Group as a buy in this volatile market.

I’ll add the stock to my Bank It list today.

Be the first to comment