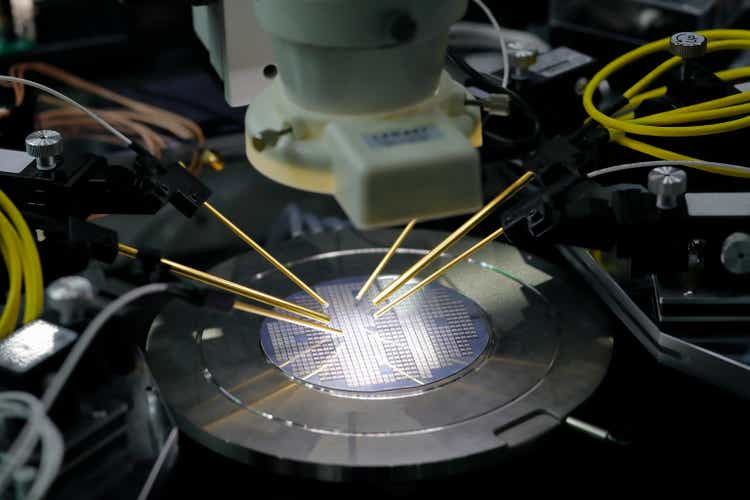

genkur

FormFactor (NASDAQ:FORM) has never been an especially easy company to model, as it has relatively few competitors that report detailed information, its customer base is quite concentrated, and short lead-times make for sometimes seemingly countercyclical behavior relative to the semiconductor industry. To that end, while chip companies are still reporting rather healthy growth, FormFactor has warned investors about emerging weakness in leading-edge chip demand from broad verticals like compute and mobile.

FormFactor shares are down about 6% since my last update, with the shares chopping lower throughout 2022 on growing concerns about the imminent end of this unusually strong chip cycle. Relative to the broader SOX index and leading customers like Intel (INTC) and TSMC (TSM), that decline hasn’t been so bad.

I do believe that FormFactor will be fine over the long term, even with increased competition from Italy’s Technoprobe (TPRO.MI), as leading-edge nodes requiring increasingly sophisticated probe cards that will further narrow the market to the top suppliers and support both healthy revenue growth and margins.

An Okay Quarter, But Guidance Will Keep Sentiment On Ice

FormFactor’s second quarter (reported late July) was fine insofar as reported versus expected results, but management’s guidance for the third quarter calls for a significant sequential weakening in revenue (down about 10% qoq) and gross margin (down around eight points), with management calling out a weakening demand environment for leading-edge logic chips in compute and mobile applications.

Revenue rose 8% year over year in the second quarter, with card revenue up 9% on 18% growth in foundry and logic, 8% growth in flash, and a 13% decline in DRAM. System revenue rose 5%. By way of comparison, the chip industry saw a 5% increase in wafer shipments during the quarter, so FormFactor has continued to grow ahead of underlying industry volumes.

GAAP gross profit rose 270bp yoy to 46.3% (non-GAAP fell 160bp to 47.4), with probe card gross margin improving 350bp to 46.8% and system gross margin improving 140bp to 50.5%. Non-GAAP operating income rose 20% yoy and fell 6% qoq, with margin up 200bp yoy (and down 200bp qoq) to 20.7%.

For the quarter, Intel remained the lead customer at around 21% of revenue, while both Samsung (OTCPK:SSNLF) and TSMC were sub-10% customers (it’s quite common for TSMC in particular to hover around the 10% disclosure line from quarter to quarter).

Micronics (6871.T), a large Japanese rival more focused on probe cards for memory chips, recently reported June quarter results that included 8% year-over-year revenue growth in its probe card business and modest margin contraction (28.5% versus 30.1% segment operating margin). Micronics also reported a sharp increase in probe card orders, up almost 52%, with backlog up about 18%. The company also modestly revised its probe card forecast lower, but given how memory makes up about 85% of probe card revenue, comparability is limited.

Likewise with Technoprobe, which has yet to post second quarter results as of this writing. Technoprobe has been trouncing FormFactor of late in terms of probe card revenue growth (up 59% in Q1’22 versus almost flat growth at FormFactor), and it will be interesting to see what this company has to say with respect to its outlook.

Demand Has Often Been Volatile In The Short Run, But Dependable Over The Longer Term

I don’t wave off concerns about this surprisingly weak guidance, nor the recent underperformance relative to Technoprobe, but I will note that volatile near-term demand has been more typical than not over the life of this company. It’s a short lead-time business and very sensitive to demand at the most advanced nodes, and with some signs of cracks emerging (including weaker handset demand), this could well be the start of a reset.

I also wouldn’t ignore the possibility that customer and application-specific exposure is playing a role here. While the data center market has remained healthy in general, with AMD (AMD) and Nvidia (NVDA) posting mid-teens sequential growth, Intel posted a 23% qoq decline on macro challenges and customer inventory reductions. There has likewise been growing evidence of softening demand for PCs, smartphones, and consumer devices – all of which hits FormFactor’s above-average exposure to SoCs (system-on-a-chip) and mobile processors.

Longer term, I don’t dismiss the risk of some share loss to Technoprobe, but I would note that FormFactor continues to out-invest its Italian rival in terms of R&D spending. This is relevant as increasingly sophisticated chip/packaging architectures are placing much higher demands on probe card developers to develop cards that can accurately and quickly test these leading-edge chips. Outspending on R&D doesn’t guarantee superior technology (R&D spending and R&D productivity are two very different things), but I’d note FormFactor has a strong track record of first-to-market innovation.

With increasingly demanding test requirements for leading-edge nodes, I still expect FormFactor to outgrow the broader chip market over time. While I expect overall chip volume growth to continue somewhere in the 4% to 6% range over the longer term, I expect around 200bp-300bp of outgrowth for FormFactor as it leverages higher-value leading-edge testing opportunities.

Margins will be interesting to monitor. Management is still targeting long-term non-GAAP gross margins of 47% (versus 45% in FY’21, 45.4% in FY’20, and 47.4% in Q2’22), but chip companies have their own margins to preserve and many chip company representatives have talked at trade shows of needing probe companies to maintain both R&D progress and affordability.

The Outlook

I don’t pretend to know how long this correction in compute and mobile-driven logic probe card demand will last, nor how deep it will be – the semiconductor industry has a long history of hard-to-call peaks and troughs. I don’t believe this will be a particularly severe correction, but again I note the risk of some idiosyncratic exposure – end-markets like data center and auto will probably outperform mobile in the near term and that could lead to weaker near-term results from FormFactor.

Over the longer term, though, I’m confident that the growth in high-end chip demand will continue to support mid-to-high single-digit revenue growth for FormFactor. Moreover, while I’m more conservative on margin improvements relative to FormFactor’s stated gross margin, SG&A, and R&D targets, I believe operating margins (GAAP) will improve to the mid-teens over the next five years and toward 20% over the next decade, with FCF margins heading into the high teens and supporting low-to-mid-teens growth.

The Bottom Line

Using discounted cash flow, I believe FormFactor is priced for a low double-digit long-term total annualized return. I do have some concerns that there is another shoe to drop with respect to guidance and near-term demand from logic customers, but that risk is part and parcel of investing in FormFactor. Investors less willing to take on the risk of buying in too early should at least keep this on a watch list, though, as I continue to believe that FormFactor is a good way to play ongoing growth in leading-edge semiconductor production across the next 10 years.

Be the first to comment