PhonlamaiPhoto

Here at the Lab, we initiated to cover FormFactor (NASDAQ:FORM) with a comps analysis and two follow-up articles both called “FormFactor Vs Technoprobe“. Since then, the American company has lost more than half of its market cap while the Italian company is up by more than 22%. For a recap, you can have a look at our previous publications:

Following our Q2 results comment, today we are back to analyze FormFactor Q3 numbers (and the reason why the company declined by almost a quarter of its entire capitalization on the reporting day).

Q3 results

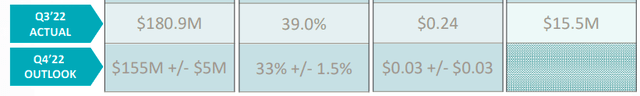

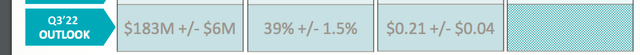

Cross-checking Wall Street estimates, FormFactor managed to slightly beat EPS expectations (by 1.2%) and insignificantly missed its top-line sales (by 4%). In addition, on a quarterly basis, the company usually projects its guidance for the following three-month expectation. Looking at its Q2 presentation, we can conclude that Q3 results were pretty much in line with the internal management outlook.

Source: FormFactor Q2 results presentation

FormFactor Q3 actual and Q4 outlook

Source: FormFactor Q3 results presentation

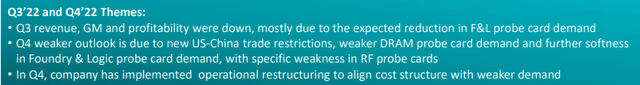

However, as we can see from the above snap, the company lowered its Q4 sales expectation by more than 15% while reducing significantly the company’s gross margin guidance from 39% to 33%. Looking at the Wall Street average numbers, they were forecasting a turnover of more than $180 million and now the company expects to reach a number between $150 and 155 million. Checking the presentation, FormFactor pointed out a cyclical weakness in the DRAM probe cards and F&L demand (especially in RF) as well as a pessimistic expectation of new US-China trade restrictions. Logic and foundry probe cards lower sales development were partially offset by FormFactor’s systems business thanks to the support of the company’s Lab to Fab diversification plan.

Source: FormFactor Q3 results presentation

Conclusion and Valuation

We were already not positive about the company and we now believe that management estimates for 2023 will be delayed. We believe that the company is losing market share and R&D capabilities to offset Technoprobe’s higher competition. However, we should also note that FormFactor might face pressure on the cost side to obtain shipment permission to support its Chinese sales. Following the new US restrictions announced on the 7th of October, FormFactor’s DRAM sale projections were further cut (and competition might increase and we should also note that Technoprobe has a footprint in China). Therefore, the company’s upside is more limited and navigating this highly complex demand environment makes us fear that the company might miss its goals for the years ahead. During the Q3 Q&A call, this was also announced by the CEO: “based on the clientele, sector and macroeconomic data we have at the moment, we forecast this reduced demand to extend well into next year”. For the above reason, FormFactor will initiate an operational restructuring in Q4 to counteract the impact of the sluggish demand, which is anticipated to last well into next year. According to CFO Shai Shahar, this entails laying off 13% of its personnel, primarily in the probe card business with a cost structure predicted to be reduced by $25–$30 million annually as a result of the restructuring. Regarding FormFactor valuation and based on the latest company’s guidance, we derive a 2023 EPS of $1.25 and based on a P/E ratio of 20x, we arrive at a valuation of $25 per share. Even if an extreme risk has been considerably priced in, we still prefer Technoprobe’s investment proposition. Therefore, our FormFactor neutral rating is confirmed.

Be the first to comment