We Are

San Francisco-based Forge Global (NYSE:FRGE) is a stock exchange for private companies. The company was founded in 2014 and went public in 2021 on the back of the now largely dead blank check boom. The company helps facilitate liquidity for pre-IPO companies which form the growing number of private enterprises staying private for longer than they have. The success of exchanges, large highly liquid and digital marketplaces, is built on scale. Investors will want to go to where the companies are and vice versa, hence it quickly becomes a winner takes all scenario. From a public perspective, this has meant only NASDAQ (NDAQ) and the NYSE (ICE) have remained the premier stock exchanges for the United States against a plethora of competing ideas. This most recently has come from the 2019 launch of the Long-Term Stock Exchange.

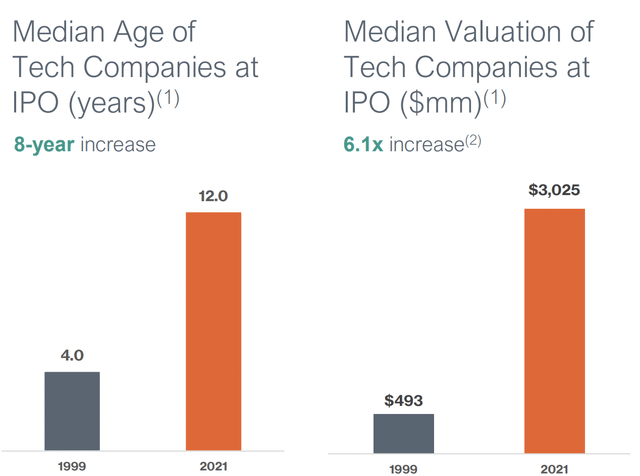

So why should stock market investors care about the newly listed Forge? The bullish argument centres on vibrant private companies and their growing importance to the US economy. Private companies really are staying private longer than they have. This essentially encapsulates more value away from the hands of public investors.

Hamilton Lane

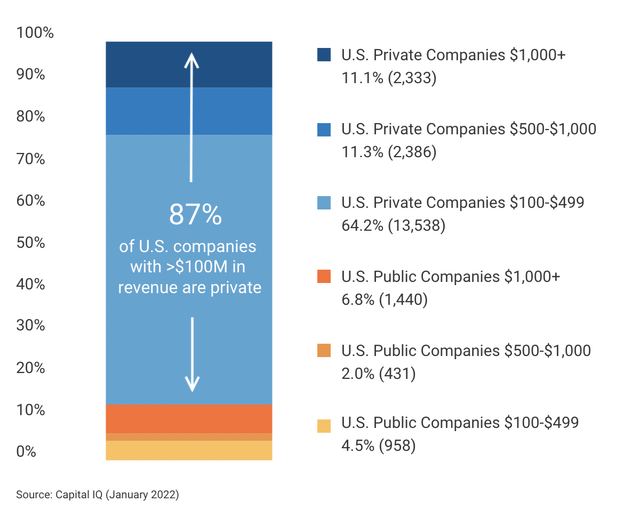

Indeed, there are only 2,800 public companies with annual revenues greater than $100 million compared to 18,000 private businesses of that size. Forge has mainly focused on venture capital-backed private companies to act as a conduit for liquidity. This allows executives and employees to crystalize stock-based compensation.

Forge Global

With companies accruing more value whilst private, investors have been clamouring for ways to access this asset class outside of the traditionally exclusive venture capital funds. Forge aims to solve this and other problems with its exchange. The lack of liquidity has stemmed from a lack of effective exchanges, volume, and standardized processes and documentation. This has historically led to inefficient and broadly illiquid markets.

Providing Liquidity For Private Markets Is Growing

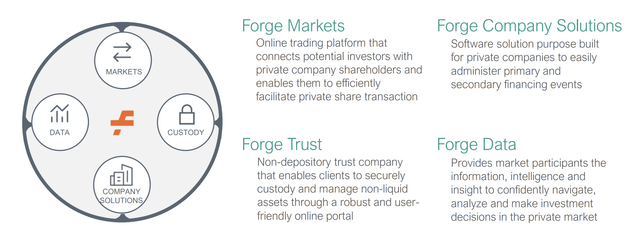

The Forge trading ecosystem is broadly made up of Markets, Trust, Solutions, and Data. All of which feed into each other to drive revenue growth.

Forge Global

For example, buyers of XYZ stock on the Forge platform may become Trust customers. As their transaction with sellers of XYZ generates new data, Forge is able to monetize this through its Data offering. It also helps enable the development of new products like stock option lending. Overall, this contributes to the creation of a flywheel that allows Forge to create scale, drive more value for its customers, and generate incremental fees at lower costs.

Forge Global

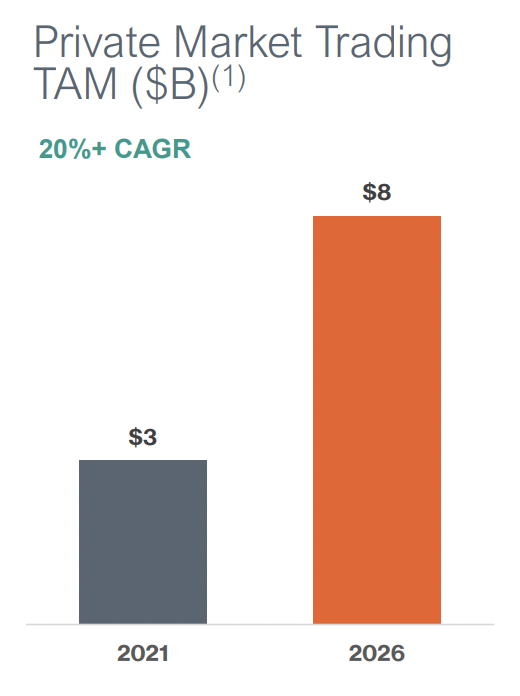

This is set against a total addressable market that is set to grow to reach $8 billion in 2026, a just over 20% compound annual growth rate over last year. Hence, against such a large TAM why have Forge’s common shares pulled back by 84% year-to-date?

Firstly, at the $10 SPAC reference price the company was going public at a $2 billion pro-forma valuation. That’s two-thirds of the total TAM for the same year. This is even more jarring when you consider the shares ran up to over $32 on the back of a post-redemption short squeeze. Forge’s go-public valuation was far too excessive against its TAM. The company’s financials have also worsened as the stock market crashed and private valuations followed. Forge’s last reported earnings for its fiscal 2022 second quarter saw revenue come in at $16.6 million, a 57% decline from its year-ago quarter. The decline was led by a fall in activity from the previous year with trading volume during the quarter at $331.8 million, a 64% year-over-year fall. Total placement fee at $11 million was down 67% from the year-ago quarter.

The company’s net take rate for the quarter was 3.2%, down 6% from its year-ago quarter due to a change in the mix of individual versus institutional block trades. This came as total custodial accounts decreased by 7% from 1.88 million to 1.74 million. Total assets under custody was the only bright spot, it grew by 5% to $15.3 billion from the year-ago quarter.

To be fair to Forge, its year-ago comps were an aberration. Last year saw what can only be retrospectively described as the dual euphoric impact of low-interest rates and large pandemic-era government spending.

Forge Needs Scale In Its Mission To Make It Easy To Trade Private Shares

Cheap money expanded asset bubbles and led to a trading boom in everything from SPACs to meme stocks. This would see the pipeline for companies going public expand as SPAC activity reached stratospheric levels and IPOs blossomed. Again, this drove private market activity and valuations.

The market for trading private shares is somewhat competitive with a number of VC-funded companies like Carta also vying for market share. Forge will have to attain scale quickly to be able to capture a lot of the $8 billion TAM from 2026. I’d wait for the company’s finances to stabilize before making an investment.

Be the first to comment