Jessie Casson/DigitalVision via Getty Images

The Commerce Department reported that newly built homes rose to a seasonally adjusted annual rate of 632,000 in October; up 7.5% from September. Economists’ consensus had anticipated a 5.5% month-over-month decline, so the uptick in sales warrants an examination of which parts are moving the most in the home building vertical. Specifically, we will look at how Forestar Group Inc. (NYSE:FOR) is navigating in the slowing home construction business.

On November 29th, the S&P CoreLogic Case-Shiller National Home Price Index described that home prices fell 1% in September from August. Over the past three months, the index is down 2.6%, so, if that trend has continued, we might extrapolate that the number of new home sales rose in October as a result of reduced sale prices. Builders may have chosen to take a reduced price to facilitate inventory turnover and the recycling of capital.

Price reductions might be a prudent move for builders in that the dynamics of input costs can help facilitate delivery of more affordable homes. On American Homes 4 Rent’s (AMH) 3Q22 earnings call, in response to a question about returns on new development in a higher interest rate environment, CEO David Singelyn replied:

“What we are seeing in development is significant reductions in the cost to build homes…A couple of cases in point, lumber has come down from $1,600 a 1,000 board feet to $500. That’s a 2/3 decline. That’s more than a $20,000 savings in building a home. We’ve also seen it in the trades, all through drywall…So we expect that we’re going to see 20% to 25% reductions in input costs.”

In the same response, he also described that they were starting to see fully developed lots, previously unavailable, become available at discounted prices. Fully developed lots are what Forestar manufactures.

Forestar 4Q Fiscal Year 2022

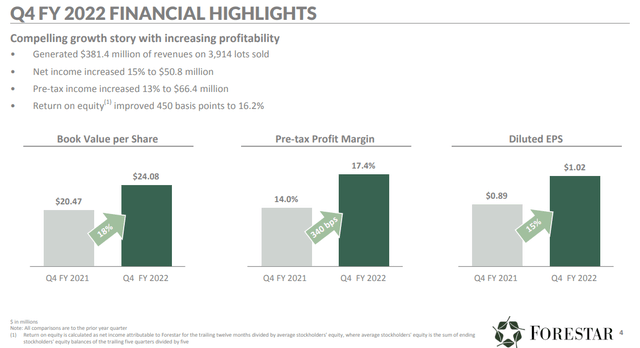

In an 11/09/22 news release, FOR highlighted its continued improvements in profit margins and earnings, and a still growing book value per share.

This was basically a continuation of trends that they described in their 3Q FY 2022 reporting.

When I reported on FOR in early October, I described that Forestar was trading at a huge discount to its stated book value. A Seeking Alpha reader was quick to point out that the market for land had gotten pretty frenzied and toppy over the last couple of years and that it was likely that FOR’s book value would face impairment charges in the rapidly slowing markets. As it turns out, the reader wasn’t alone in this concern and an analyst posed the question directly to FOR on their 11/09 earnings call.

Anthony James Pettinari

Citigroup Inc., Research Division

You continue to trade well below book and I’m just wondering, is there you know a threshold on margins or home prices or volumes or whatever metric, you choose, where you would have to start thinking about potential impairments. But just wondering you know if you can directionally talk about risk of impairments? And maybe help how far you are away from that as we think about ‘23 and potentially softer market?

James D. Allen

Executive VP, CFO, Treasurer & Principal Accounting Officer

Well, our margins are still strong. I mean I think we’re still a long, long way from any kind of widespread impairments you know if we see some margin compression during the year there may be isolated projects maybe that might have impairments. But at this point, we just — we’re not seeing it. The only impairments we have or we have had in the year, we had one during the year that was just kind of an isolated incident, but it was really more around earnest money and you know maybe writing off due diligence costs for deals that we decide not to pursue, that’s really more likely.

Daniel C. Bartok

Chief Executive Officer

Again, over half of the lots we own today, we contracted to purchase before 2021. So we really have pretty low land bases relative to the current you know the more recent market expectations. You can really see our purchasing of new land really fell significantly this past year. So I feel like we’re in pretty good shape to kind of weather the storm.

In prepared remarks, CEO Daniel Bartok described that 31% of their owned lots are currently under contract to sell, secured by $136 million of hard earnest money, and representing more than $1.5 billion of future revenue. Those sold lots certainly will not face impairment.

Difficult Markets

Inflation on all fronts, a doubling of mortgage interest rates, and inverted yield curves signaling potential recession have combined to make this a tense and concerning time for individuals and companies navigating the housing markets. While this economy will continue to present challenges, Forestar’s conservative, disciplined pace and its strong balance sheet should see them through the storm and let them capitalize on emerging opportunities.

I remain long Forestar Group Inc.

Be the first to comment